Total enrollment up 11.6% YoY

Revenue up 13.9% YoY

Diluted earnings per share $1.98; Adjusted EPS

$1.81, growth of 47.2% YoY

Second quarter highlights

- Total student enrollment 91,264, up 11.6% year-over-year

- Revenue $447.7 million, up 13.9% year-over-year

- Chamberlain University achieved eighth straight quarter of

total enrollment growth, up 11.5% year-over-year, highest total

enrollment in university history

- Walden University achieved sixth straight quarter of total

enrollment growth, up 13.2% year-over-year

- Strong momentum, GAAP net income $75.9 million and adjusted

EBITDA $125.0 million, up 35.1% year-over-year

- Growth with Purpose strategy generating significant and

sustainable returns

Capital allocation

- Repurchased $38 million of shares, $140 million remaining under

$300 million Board authorized share repurchase program through

January 2027

- Repaid $100 million of outstanding Term Loan B balance on Jan.

17, 2025

- Net leverage 1.1x as of Dec. 31, 2024

Fiscal year 2025 guidance

- Revenue $1,730 million to $1,760 million

- Adjusted earnings per share $6.10 to $6.30

Adtalem Global Education Inc. (NYSE: ATGE), the leading

healthcare educator in the United States, today reported second

quarter fiscal year 2025 results (ended Dec. 31, 2024), expanding

the Company’s societal and healthcare impact at an industry-leading

pace.

"Growth with Purpose, our operational excellence strategy, has

delivered exceptional results—marked by six straight quarters of

enrollment growth—while advancing our mission to develop skilled

healthcare professionals," said Steve Beard, chairman and chief

executive officer, Adtalem Global Education. "By optimizing the

student experience and with a commitment to student outcomes, we're

successfully scaling critical care education. These consistent and

sustainable results give us confidence to raise our expectations

for fiscal 2025."

Financial Highlights

Selected financial data for the three months ended Dec. 31,

2024:

- Revenue of $447.7 million increased 13.9% compared with the

prior year

- Operating income of $103.9 million, compared with $58.6 million

in the prior year; adjusted operating income of $101.4 million,

compared with $75.6 million in the prior year

- Net income of $75.9 million, compared with $39.9 million in the

prior year; adjusted net income of $69.4 million, compared with

$50.3 million in the prior year

- Diluted earnings per share of $1.98, compared with $0.98 in the

prior year; adjusted earnings per share of $1.81, compared with

$1.23 in the prior year

- Adjusted EBITDA of $125.0 million, compared with $92.6 million

in the prior year; adjusted EBITDA margin of 27.9%, compared with

23.5% in the prior year

Business Highlights

- Adtalem produced more graduates with Psychiatric-Mental Health

Nurse Practitioner (MSN-PMHNP) degrees than the top 20 programs

combined, according to the most recently published 2023 data from

the American Association of Colleges of Nursing. Adtalem is

addressing critical U.S. healthcare issues, as The National

Institute for Health Care Management estimates that approximately

49% of Americans live in a mental health workforce shortage area.

As of Dec. 31, 2024, Chamberlain University enrolled over 3,000

MSN-PMHNP students, with Walden University enrolling over 6,600.

Further, Walden University currently has over 21,000 students

enrolled in Social and Behavioral Sciences programs.

- Chamberlain University continues to build a robust pipeline of

nurses through programs including its Bachelor of Science in

Nursing (BSN) Online Option, which offers flexibility and

experiential learning opportunities to students in 36 states. The

program boasts over 2,500 current enrollees since launching four

years ago and operates 44 clinical hub locations at partner

healthcare sites.

- Walden University launched "Get the W," a new brand campaign

that celebrates the wins that drive our students and graduates to

make a meaningful impact in healthcare and beyond.

- Ross University School of Veterinary Medicine (RUSVM) hosted

the West Indies Veterinary Conference 2024, a prominent event in

the global veterinary community that brings together hundreds of

veterinary professionals, including over 300 RUSVM alumni. The

event featured continuing education, including lectures and master

classes on topics ranging from wound care to business

management.

Segment Highlights

Chamberlain

$ in millions

Three Months Ended

December 31,

2024

2023

% Change

Revenue

$181.0

$153.6

17.9%

Operating Income

$42.2

$29.6

42.5%

Adj. Operating Income

$42.3

$29.6

42.7%

Adj. EBITDA

$52.6

$36.9

42.5%

Total Students (1)

39,691

35,592

11.5%

- Total student enrollment increased 11.5% compared with the

prior year, driven by continued growth in pre-licensure and

post-licensure nursing programs.

Walden

$ in millions

Three Months Ended

December 31,

2024

2023

% Change

Revenue

$171.3

$146.8

16.7%

Operating Income

$48.9

$21.6

126.4%

Adj. Operating Income

$46.2

$30.2

53.1%

Adj. EBITDA

$52.1

$34.6

50.2%

Total Students (1)

46,399

40,971

13.2%

- Total student enrollment increased 13.2% compared with the

prior year, driven by growth in healthcare and non-healthcare

programs.

Medical and Veterinary

$ in millions

Three Months Ended

December 31,

2024

2023

% Change

Revenue

$95.4

$92.9

2.8%

Operating Income

$21.5

$22.0

(2.5)%

Adj. Operating Income

$21.5

$22.1

(2.6)%

Adj. EBITDA

$26.7

$26.4

1.3%

Total Students (1)

5,174

5,209

(0.7)%

- Medical and Veterinary schools do not have a new enrollment

period starting in the second quarter fiscal year 2025. Second

quarter fiscal year 2025 enrollment period is the same as first

quarter fiscal year 2025 enrollment period and corresponding

reported enrollment data.

Fiscal Year 2025 Outlook

Adtalem raises guidance for fiscal year 2025, with revenue in

the range of $1,730 million to $1,760 million, approximately 9.0%

to 11.0% growth year-over-year. Adjusted earnings per share to be

in the range of $6.10 to $6.30, approximately 21.5% to 25.5% growth

year-over-year.

Conference Call and Webcast Information

Adtalem will hold a conference call to discuss its second

quarter fiscal year 2025 results today at 4:00 p.m. CT (5:00 p.m.

ET).

The call can be accessed by dialing +1 877-407-6184 (U.S.

participants) or +1 201-389-0877 (international participants) and

stating “Adtalem earnings call” or by using conference ID:

13750710. The call will be simulcast through the Adtalem investor

relations website at: https://investors.adtalem.com.

Adtalem will archive a replay of the call for 30 days. To access

the replay, dial +1 877-660-6853 (U.S.) or +1 201-612-7415

(international), conference ID: 13750710, or visit the Adtalem

investor relations website.

About Adtalem Global Education

Adtalem Global Education is the leading provider of healthcare

education in the U.S., shaping the future of healthcare by

preparing a diverse workforce with high-quality academic programs.

We innovate education pathways, align with industry needs and

empower individuals to reach their full potential. Our commitment

to excellence and inclusivity is reflected in our expansive network

of institutions, serving over 90,000 students and supported by a

strong community of approximately 350,000 alumni and nearly 10,000

dedicated employees. Visit Adtalem.com for more information and

follow us on LinkedIn, Instagram and Facebook.

Cautionary Disclosure Regarding Forward-Looking

Statements

Certain statements contained in this release are forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995. Forward-looking statements provide current

expectations of future events based on certain assumptions and

include any statement that does not directly relate to any

historical or current fact, which includes statements regarding

Adtalem’s future growth. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“future,” “believe,” “expect,” “anticipate,” “estimate,” “plan,”

“intend,” “may,” “will,” “would,” “could,” “can,” “continue,”

“preliminary,” “range,” and similar terms. These forward-looking

statements are subject to risk and uncertainties that could cause

actual results to differ materially from those described in the

statements. These risks and uncertainties include the risk factors

described in Item 1A. “Risk Factors” of our most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (SEC) and our other filings with the SEC. These

forward-looking statements are based on information available to us

as of the date any such statements are made, and Adtalem assumes no

obligation to publicly update or revise its forward-looking

statements even if experience or future changes make it clear that

any projected results expressed or implied therein will not be

realized, except as required by law.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty of special items that

may be incurred in the future, although these special items could

be material to Adtalem's results in accordance with GAAP.

1 Represents total students attending sessions during each

institution’s most recent enrollment period in Q2 FY 2025 and Q2 FY

2024.

Adtalem Global Education

Inc.

Consolidated Balance

Sheets

(unaudited)

(in thousands)

December 31,

June 30,

2024

2024

Assets:

Current assets:

Cash and cash equivalents

$

193,958

$

219,306

Restricted cash

1,461

1,896

Accounts and financing receivables,

net

146,973

126,833

Prepaid expenses and other current

assets

64,693

70,050

Total current assets

407,085

418,085

Noncurrent assets:

Property and equipment, net

245,878

248,524

Operating lease assets

188,800

176,755

Deferred income taxes

28,413

49,088

Intangible assets, net

771,084

776,694

Goodwill

961,262

961,262

Other assets, net

112,608

103,184

Assets held for sale

7,825

7,825

Total noncurrent assets

2,315,870

2,323,332

Total assets

$

2,722,955

$

2,741,417

Liabilities and shareholders'

equity:

Current liabilities:

Accounts payable

$

66,920

$

102,626

Accrued payroll and benefits

50,999

71,373

Accrued liabilities

62,479

96,957

Deferred revenue

171,523

185,272

Current operating lease liabilities

32,633

31,429

Total current liabilities

384,554

487,657

Noncurrent liabilities:

Long-term debt

649,924

648,712

Long-term operating lease liabilities

182,051

167,712

Deferred income taxes

32,367

29,526

Other liabilities

35,149

38,675

Total noncurrent liabilities

899,491

884,625

Total liabilities

1,284,045

1,372,282

Commitments and contingencies

Total shareholders' equity

1,438,910

1,369,135

Total liabilities and shareholders'

equity

$

2,722,955

$

2,741,417

Adtalem Global Education

Inc.

Consolidated Statements of

Income

(unaudited)

(in thousands, except per

share data)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Revenue

$

447,729

$

393,242

$

865,129

$

762,087

Operating cost and expense:

Cost of educational services

186,636

172,069

372,631

340,687

Student services and administrative

expense

156,901

155,584

315,974

321,679

Restructuring expense

322

68

2,416

744

Business integration expense

—

6,909

—

12,171

Total operating cost and expense

343,859

334,630

691,021

675,281

Operating income

103,870

58,612

174,108

86,806

Interest expense

(13,909

)

(16,693

)

(28,391

)

(32,350

)

Other income, net

2,235

3,563

4,881

5,777

Income from continuing operations before

income taxes

92,196

45,482

150,598

60,233

Provision for income taxes

(21,020

)

(7,769

)

(33,177

)

(10,561

)

Income from continuing operations

71,176

37,713

117,421

49,672

Discontinued operations:

Income from discontinued operations before

income taxes

6,271

2,926

6,164

1,161

Provision for income taxes

(1,591

)

(748

)

(1,564

)

(296

)

Income from discontinued operations

4,680

2,178

4,600

865

Net income and comprehensive income

$

75,856

$

39,891

$

122,021

$

50,537

Earnings per share:

Basic:

Continuing operations

$

1.90

$

0.95

$

3.12

$

1.22

Discontinued operations

$

0.13

$

0.05

$

0.12

$

0.02

Total basic earnings per share

$

2.03

$

1.00

$

3.25

$

1.24

Diluted:

Continuing operations

$

1.85

$

0.92

$

3.03

$

1.20

Discontinued operations

$

0.12

$

0.05

$

0.12

$

0.02

Total diluted earnings per share

$

1.98

$

0.98

$

3.15

$

1.22

Weighted-average shares outstanding:

Basic shares

37,435

39,872

37,578

40,636

Diluted shares

38,401

40,787

38,755

41,486

Adtalem Global Education

Inc.

Consolidated Statements of

Cash Flows

(unaudited)

(in thousands)

Six Months Ended

December 31,

2024

2023

Operating activities:

Net income

$

122,021

$

50,537

Income from discontinued operations

(4,600

)

(865

)

Income from continuing operations

117,421

49,672

Adjustments to reconcile net income to net

cash provided by operating activities:

Stock-based compensation

20,918

13,505

Amortization and impairments to operating

lease assets

14,092

17,340

Depreciation

19,993

19,381

Amortization of acquired intangible

assets

5,610

20,010

Amortization of debt discount and issuance

costs

2,226

2,310

Provision for bad debts

28,719

23,024

Deferred income taxes

23,516

(343

)

Loss on disposals of property and

equipment

114

38

Gain on investments

(442

)

(575

)

Unrealized loss on assets held for

sale

—

647

Changes in assets and liabilities:

Accounts and financing receivables

(46,493

)

(52,716

)

Prepaid expenses and other current

assets

6,829

(2,143

)

Cloud computing implementation assets

(14,071

)

(11,314

)

Accounts payable

(34,588

)

9,755

Accrued payroll and benefits

(20,311

)

(6,073

)

Accrued liabilities

(29,066

)

25,130

Deferred revenue

(12,028

)

(13,540

)

Operating lease liabilities

(10,594

)

(20,441

)

Other assets and liabilities

(5,888

)

(1,314

)

Net cash provided by operating

activities-continuing operations

65,957

72,353

Net cash provided by operating

activities-discontinued operations

4,340

9,515

Net cash provided by operating

activities

70,297

81,868

Investing activities:

Capital expenditures

(21,094

)

(19,612

)

Proceeds from sales of marketable

securities

2,426

626

Purchases of marketable securities

(1,548

)

(498

)

Net cash used in investing activities

(20,216

)

(19,484

)

Financing activities:

Proceeds from exercise of stock

options

9,833

15,313

Employee taxes paid on withholding

shares

(12,198

)

(6,505

)

Proceeds from stock issued under Colleague

Stock Purchase Plan

567

359

Repurchases of common stock for

treasury

(74,066

)

(160,549

)

Proceeds from issuance of long-term

debt

9,873

—

Repayments of long-term debt

(9,873

)

—

Net cash used in financing activities

(75,864

)

(151,382

)

Net decrease in cash, cash equivalents and

restricted cash

(25,783

)

(88,998

)

Cash, cash equivalents and restricted cash

at beginning of period

221,202

275,075

Cash, cash equivalents and restricted cash

at end of period

$

195,419

$

186,077

Non-cash investing and financing

activities:

Accrued capital expenditures

$

5,085

$

4,053

Accrued liability for repurchases of

common stock

$

400

$

2,400

Accrued excise tax on share

repurchases

$

301

$

2,358

Adtalem Global Education

Inc.

Segment Information

(unaudited)

(in thousands)

Three Months Ended

Six Months Ended

December 31,

December 31,

Increase/(Decrease)

Increase/(Decrease)

2024

2023

$

%

2024

2023

$

%

Revenue:

Chamberlain

$

180,986

$

153,553

$

27,433

17.9

%

$

348,916

$

296,149

$

52,767

17.8

%

Walden

171,306

146,808

24,498

16.7

%

332,819

288,416

44,403

15.4

%

Medical and Veterinary

95,437

92,881

2,556

2.8

%

183,394

177,522

5,872

3.3

%

Total consolidated revenue

$

447,729

$

393,242

$

54,487

13.9

%

$

865,129

$

762,087

$

103,042

13.5

%

Operating income (loss):

Chamberlain

$

42,226

$

29,640

$

12,586

42.5

%

$

68,200

$

53,964

$

14,236

26.4

%

Walden

48,898

21,598

27,300

126.4

%

88,735

23,536

65,199

277.0

%

Medical and Veterinary

21,463

22,020

(557

)

(2.5

)%

36,134

36,383

(249

)

(0.7

)%

Home Office

(8,717

)

(14,646

)

5,929

40.5

%

(18,961

)

(27,077

)

8,116

30.0

%

Total consolidated operating income

$

103,870

$

58,612

$

45,258

77.2

%

$

174,108

$

86,806

$

87,302

100.6

%

Non-GAAP Financial Measures and Reconciliations

We believe that certain non-GAAP financial measures provide

investors with useful supplemental information regarding the

underlying business trends and performance of Adtalem’s ongoing

operations as seen through the eyes of management and are useful

for period-over-period comparisons. We use these supplemental

non-GAAP financial measures internally in our assessment of

performance and budgeting process. However, these non-GAAP

financial measures should not be considered as a substitute for, or

superior to, measures of financial performance prepared in

accordance with GAAP. The following are non-GAAP financial measures

used in the subsequent GAAP to non-GAAP reconciliation tables:

Adjusted net income (most comparable GAAP measure: net income) –

Measure of Adtalem’s net income adjusted for restructuring expense,

business integration expense, amortization of acquired intangible

assets, litigation reserve, debt modification costs, loss on assets

held for sale, and income from discontinued operations.

Adjusted earnings per share (most comparable GAAP measure:

diluted earnings per share) – Measure of Adtalem’s diluted earnings

per share adjusted for restructuring expense, business integration

expense, amortization of acquired intangible assets, litigation

reserve, debt modification costs, loss on assets held for sale, and

income from discontinued operations.

Adjusted operating income (most comparable GAAP measure:

operating income) – Measure of Adtalem’s operating income adjusted

for restructuring expense, business integration expense,

amortization of acquired intangible assets, litigation reserve,

debt modification costs, and loss on assets held for sale. This

measure is applied on a consolidated and segment basis, depending

on the context of the discussion.

Adjusted EBITDA (most comparable GAAP measure: net income) –

Measure of Adtalem’s net income adjusted for income from

discontinued operations, interest expense, other income, net,

provision for income taxes, depreciation, amortization of acquired

intangible assets, amortization of cloud computing implementation

assets, stock-based compensation, restructuring expense, business

integration expense, litigation reserve, loss on assets held for

sale, and debt modification costs. This measure is applied on a

consolidated and segment basis, depending on the context of the

discussion. Provision for income taxes, interest expense, and other

income, net is not recorded at the reportable segments, and

therefore, the segment adjusted EBITDA reconciliations begin with

operating income.

Free cash flow (most comparable GAAP measure: net cash provided

by operating activities-continuing operations) – Defined as net

cash provided by operating activities-continuing operations less

capital expenditures.

Net debt – Defined as long-term debt less cash and cash

equivalents.

Net leverage – Defined as net debt divided by adjusted

EBITDA.

A description of special items in our non-GAAP financial

measures described above are as follows:

- Restructuring expense primarily related to workforce

reductions, costs to exit certain course offerings, and prior real

estate consolidations at Adtalem’s home office. We do not include

normal, recurring, cash operating expenses in our restructuring

expense.

- Business integration expense include expenses related to the

Walden acquisition and certain costs related to growth

transformation initiatives. We do not include normal, recurring,

cash operating expenses in our business integration expense.

- Amortization of acquired intangible assets.

- Amortization of cloud computing implementation assets.

- Reserves related to significant litigation, debt modification

costs related to refinancing our Term Loan B loan, and loss on

assets held for sale related to a fair value write-down on

assets.

- Income from discontinued operations includes expense from

ongoing litigation costs and settlements related to the DeVry

University divestiture and the earn-outs we received.

Adtalem Global Education

Inc.

Non-GAAP Operating Income by

Segment

(unaudited)

(in thousands)

Three Months Ended

Six Months Ended

December 31,

December 31,

Increase/(Decrease)

Increase/(Decrease)

2024

2023

$

%

2024

2023

$

%

Chamberlain:

Operating income (GAAP)

$

42,226

$

29,640

$

12,586

42.5

%

$

68,200

$

53,964

$

14,236

26.4

%

Restructuring expense

77

—

77

1,935

—

1,935

Adjusted operating income (non-GAAP)

$

42,303

$

29,640

$

12,663

42.7

%

$

70,135

$

53,964

$

16,171

30.0

%

Operating margin (GAAP)

23.3

%

19.3

%

19.5

%

18.2

%

Operating margin (non-GAAP)

23.4

%

19.3

%

20.1

%

18.2

%

Walden:

Operating income (GAAP)

$

48,898

$

21,598

$

27,300

126.4

%

$

88,735

$

23,536

$

65,199

277.0

%

Restructuring expense

—

(776

)

776

—

(776

)

776

Amortization of acquired intangible

assets

2,805

9,333

(6,528

)

5,610

20,010

(14,400

)

Litigation reserve

(5,550

)

—

(5,550

)

(5,550

)

18,500

(24,050

)

Adjusted operating income (non-GAAP)

$

46,153

$

30,155

$

15,998

53.1

%

$

88,795

$

61,270

$

27,525

44.9

%

Operating margin (GAAP)

28.5

%

14.7

%

26.7

%

8.2

%

Operating margin (non-GAAP)

26.9

%

20.5

%

26.7

%

21.2

%

Medical and Veterinary:

Operating income (GAAP)

$

21,463

$

22,020

$

(557

)

(2.5

)%

$

36,134

$

36,383

$

(249

)

(0.7

)%

Restructuring expense

56

71

(15

)

115

185

(70

)

Adjusted operating income (non-GAAP)

$

21,519

$

22,091

$

(572

)

(2.6

)%

$

36,249

$

36,568

$

(319

)

(0.9

)%

Operating margin (GAAP)

22.5

%

23.7

%

19.7

%

20.5

%

Operating margin (non-GAAP)

22.5

%

23.8

%

19.8

%

20.6

%

Home Office:

Operating loss (GAAP)

$

(8,717

)

$

(14,646

)

$

5,929

40.5

%

$

(18,961

)

$

(27,077

)

$

8,116

30.0

%

Restructuring expense

189

773

(584

)

366

1,335

(969

)

Business integration expense

—

6,909

(6,909

)

—

12,171

(12,171

)

Loss on assets held for sale

—

647

(647

)

—

647

(647

)

Debt modification costs

—

—

—

712

—

712

Adjusted operating loss (non-GAAP)

$

(8,528

)

$

(6,317

)

$

(2,211

)

(35.0

)%

$

(17,883

)

$

(12,924

)

$

(4,959

)

(38.4

)%

Adtalem Global Education:

Operating income (GAAP)

$

103,870

$

58,612

$

45,258

77.2

%

$

174,108

$

86,806

$

87,302

100.6

%

Restructuring expense

322

68

254

2,416

744

1,672

Business integration expense

—

6,909

(6,909

)

—

12,171

(12,171

)

Amortization of acquired intangible

assets

2,805

9,333

(6,528

)

5,610

20,010

(14,400

)

Litigation reserve

(5,550

)

—

(5,550

)

(5,550

)

18,500

(24,050

)

Loss on assets held for sale

—

647

(647

)

—

647

(647

)

Debt modification costs

—

—

—

712

—

712

Adjusted operating income (non-GAAP)

$

101,447

$

75,569

$

25,878

34.2

%

$

177,296

$

138,878

$

38,418

27.7

%

Operating margin (GAAP)

23.2

%

14.9

%

20.1

%

11.4

%

Operating margin (non-GAAP)

22.7

%

19.2

%

20.5

%

18.2

%

Adtalem Global Education

Inc.

Non-GAAP Adjusted EBITDA by

Segment

(unaudited)

(in thousands)

Three Months Ended

Six Months Ended

December 31,

December 31,

Increase/(Decrease)

Increase/(Decrease)

2024

2023

$

%

2024

2023

$

%

Chamberlain:

Operating income (GAAP)

$

42,226

$

29,640

$

12,586

42.5

%

$

68,200

$

53,964

$

14,236

26.4

%

Restructuring expense

77

—

77

1,935

—

1,935

Depreciation

5,466

4,786

680

10,834

8,902

1,932

Amortization of cloud computing

implementation assets

815

376

439

1,467

576

891

Stock-based compensation

3,993

2,089

1,904

7,112

4,996

2,116

Adjusted EBITDA (non-GAAP)

$

52,577

$

36,891

$

15,686

42.5

%

$

89,548

$

68,438

$

21,110

30.8

%

Adjusted EBITDA margin (non-GAAP)

29.1

%

24.0

%

25.7

%

23.1

%

Walden:

Operating income (GAAP)

$

48,898

$

21,598

$

27,300

126.4

%

$

88,735

$

23,536

$

65,199

277.0

%

Restructuring expense

—

(776

)

776

—

(776

)

776

Amortization of acquired intangible

assets

2,805

9,333

(6,528

)

5,610

20,010

(14,400

)

Litigation reserve

(5,550

)

—

(5,550

)

(5,550

)

18,500

(24,050

)

Depreciation

1,795

1,926

(131

)

3,477

3,900

(423

)

Amortization of cloud computing

implementation assets

778

379

399

1,479

567

912

Stock-based compensation

3,326

2,188

1,138

6,066

4,052

2,014

Adjusted EBITDA (non-GAAP)

$

52,052

$

34,648

$

17,404

50.2

%

$

99,817

$

69,789

$

30,028

43.0

%

Adjusted EBITDA margin (non-GAAP)

30.4

%

23.6

%

30.0

%

24.2

%

Medical and Veterinary:

Operating income (GAAP)

$

21,463

$

22,020

$

(557

)

(2.5

)%

$

36,134

$

36,383

$

(249

)

(0.7

)%

Restructuring expense

56

71

(15

)

115

185

(70

)

Depreciation

2,744

2,972

(228

)

5,313

5,864

(551

)

Amortization of cloud computing

implementation assets

315

138

177

598

190

408

Stock-based compensation

2,158

1,196

962

3,765

2,836

929

Adjusted EBITDA (non-GAAP)

$

26,736

$

26,397

$

339

1.3

%

$

45,925

$

45,458

$

467

1.0

%

Adjusted EBITDA margin (non-GAAP)

28.0

%

28.4

%

25.0

%

25.6

%

Home Office:

Operating loss (GAAP)

$

(8,717

)

$

(14,646

)

$

5,929

40.5

%

$

(18,961

)

$

(27,077

)

$

8,116

30.0

%

Restructuring expense

189

773

(584

)

366

1,335

(969

)

Business integration expense

—

6,909

(6,909

)

—

12,171

(12,171

)

Loss on assets held for sale

—

647

(647

)

—

647

(647

)

Debt modification costs

—

—

—

712

—

712

Depreciation

185

359

(174

)

369

715

(346

)

Stock-based compensation

1,990

577

1,413

3,975

1,621

2,354

Adjusted EBITDA (non-GAAP)

$

(6,353

)

$

(5,381

)

$

(972

)

(18.1

)%

$

(13,539

)

$

(10,588

)

$

(2,951

)

(27.9

)%

Adtalem Global Education:

Net income (GAAP)

$

75,856

$

39,891

$

35,965

90.2

%

$

122,021

$

50,537

$

71,484

141.4

%

Income from discontinued operations

(4,680

)

(2,178

)

(2,502

)

(4,600

)

(865

)

(3,735

)

Interest expense

13,909

16,693

(2,784

)

28,391

32,350

(3,959

)

Other income, net

(2,235

)

(3,563

)

1,328

(4,881

)

(5,777

)

896

Provision for income taxes

21,020

7,769

13,251

33,177

10,561

22,616

Operating income (GAAP)

103,870

58,612

45,258

174,108

86,806

87,302

Depreciation and amortization

14,903

20,269

(5,366

)

29,147

40,724

(11,577

)

Stock-based compensation

11,467

6,050

5,417

20,918

13,505

7,413

Restructuring expense

322

68

254

2,416

744

1,672

Business integration expense

—

6,909

(6,909

)

—

12,171

(12,171

)

Litigation reserve

(5,550

)

—

(5,550

)

(5,550

)

18,500

(24,050

)

Loss on assets held for sale

—

647

(647

)

—

647

(647

)

Debt modification costs

—

—

—

712

—

712

Adjusted EBITDA (non-GAAP)

$

125,012

$

92,555

$

32,457

35.1

%

$

221,751

$

173,097

$

48,654

28.1

%

Adjusted EBITDA margin (non-GAAP)

27.9

%

23.5

%

25.6

%

22.7

%

Adtalem Global Education

Inc.

Non-GAAP Earnings

Disclosure

(unaudited)

(in thousands, except per

share data)

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net income (GAAP)

$

75,856

$

39,891

$

122,021

$

50,537

Restructuring expense

322

68

2,416

744

Business integration expense

—

6,909

—

12,171

Amortization of acquired intangible

assets

2,805

9,333

5,610

20,010

Litigation reserve, debt modification

costs, and loss on assets held for sale

(5,550

)

647

(4,838

)

19,147

Income tax impact on non-GAAP adjustments

(1)

645

(4,402

)

(687

)

(12,095

)

Income from discontinued operations

(4,680

)

(2,178

)

(4,600

)

(865

)

Adjusted net income (non-GAAP)

$

69,398

$

50,268

$

119,922

$

89,649

(1)

Represents the income tax impact of

non-GAAP continuing operations adjustments that is recognized in

our GAAP financial statements.

Three Months Ended

Six Months Ended

December 31,

December 31,

2024

2023

2024

2023

Diluted earnings per share (GAAP)

$

1.98

$

0.98

$

3.15

$

1.22

Effect on diluted earnings per share:

Restructuring expense

0.01

0.00

0.06

0.02

Business integration expense

-

0.17

-

0.29

Amortization of acquired intangible

assets

0.07

0.23

0.14

0.48

Litigation reserve, debt modification

costs, and loss on assets held for sale

(0.14

)

0.02

(0.12

)

0.46

Income tax impact on non-GAAP adjustments

(1)

0.02

(0.11

)

(0.02

)

(0.29

)

Income from discontinued operations

(0.12

)

(0.05

)

(0.12

)

(0.02

)

Adjusted earnings per share (non-GAAP)

$

1.81

$

1.23

$

3.09

$

2.16

Diluted shares used in non-GAAP EPS

calculation

38,401

40,787

38,755

41,486

Note: May not sum due to rounding.

(1)

Represents the income tax impact of

non-GAAP continuing operations adjustments that is recognized in

our GAAP financial statements.

Adtalem Global Education

Inc.

Non-GAAP Free Cash Flow

Disclosure

(unaudited)

(in thousands)

Twelve Months Ended

FY24

FY24

FY24

FY25

FY25

Q2

Q3

Q4

Q1

Q2

Net cash provided by (used in) operating

activities-continuing operations (GAAP)

$

227,600

$

276,843

$

288,367

$

291,820

$

281,971

Capital expenditures

(38,713

)

(44,137

)

(48,893

)

(48,873

)

(50,375

)

Free cash flow (non-GAAP)

$

188,887

$

232,706

$

239,474

$

242,947

$

231,596

Adtalem Global Education

Inc.

Non-GAAP Net Leverage

Disclosure

(unaudited)

(in thousands)

Twelve Months Ended

December 31, 2024

Adtalem Global Education:

Net income (GAAP)

$

208,261

Income from discontinued operations

(2,799

)

Interest expense

59,700

Other income, net

(9,646

)

Provision for income taxes

48,840

Depreciation and amortization

66,875

Stock-based compensation

33,360

Restructuring expense

3,542

Business integration expense

22,044

Litigation reserve

(5,550

)

Debt modification costs

1,560

Adjusted EBITDA (non-GAAP)

$

426,187

December 31, 2024

Long-term debt

$

658,283

Less: Cash and cash equivalents

(193,958

)

Net debt (non-GAAP)

$

464,325

Net leverage (non-GAAP)

1.1 x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130322578/en/

Investor Contact Jay Spitzer

Investor.Relations@Adtalem.com +1 312-906-6600

Media Contact Britt Mitchell AdtalemMedia@Adtalem.com +1

872-270-0301

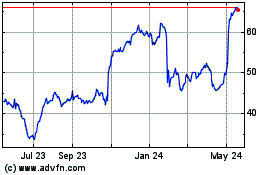

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Dec 2024 to Jan 2025

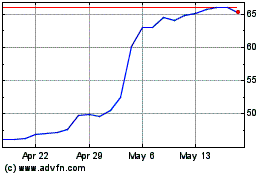

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Jan 2024 to Jan 2025