false

0001600438

0001600438

2025-03-06

2025-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): March 6, 2025

GMS INC.

(Exact name of

registrant as specified in charter)

| Delaware |

|

001-37784 |

|

46-2931287 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

100 Crescent Centre Parkway, Suite 800

Tucker, Georgia |

|

30084 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (800) 392-4619

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

GMS |

|

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Item 2.02. Results of Operations and Financial Condition.

On March 6,

2025, GMS Inc. (the “Company” or “GMS”) issued a press release, a copy of which is furnished as Exhibit 99.1 hereto

and incorporated herein by reference, announcing the Company’s financial results for the three and nine months ended January

31, 2025.

In accordance with General Instruction B.2 of Form 8-K, the information

in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such

a filing.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

*Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GMS INC. |

| |

|

|

|

| Date: March 6, 2025 |

By: |

/s/

Scott M. Deakin |

| |

|

Name: |

Scott M. Deakin |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

GMS REPORTS THIRD QUARTER FISCAL 2025 RESULTS

Pricing Resilience Despite Declining End Market

Demand

Tucker,

Georgia, March 6, 2025. GMS Inc. (NYSE: GMS), a leading North American specialty building products distributor, today

reported financial results for the fiscal third quarter ended January 31, 2025.

Third

Quarter Fiscal 2025 Highlights

(Comparisons are to the third quarter of fiscal 2024)

| · | Net sales of $1.3 billion increased 0.2%; organic net sales decreased 6.7%. |

| · | Net loss of $21.4 million, or $0.55 per diluted share, including a $42.5 million non-cash goodwill impairment charge, decreased from

net income of $51.9 million, or $1.28 per diluted share. |

| · | Adjusted net income of $36.2 million, or $0.92 per diluted share, decreased from $68.8 million, or $1.70 per diluted share. |

| · | Adjusted EBITDA of $93.0 million decreased $35.0 million, or 27.3%. |

| · | Cash provided by operating activities and free cash flow were $94.1 million and $83.1 million, respectively, compared to cash provided

by operating activities and free cash flow of $104.3 million and $94.1 million, respectively, in the prior year period; Net debt leverage

was 2.4 times at the end of the quarter, up from 1.5 times a year ago. |

“Our results in the quarter reflect the impact of soft end market

demand and steel pricing, both of which deteriorated meaningfully during the last half of the quarter, ultimately driving both lower than

expected sales and gross margin compression, despite experiencing price and mix improvement in Wallboard and Ceilings,” said John

C. Turner, Jr., President and CEO of GMS. “Economic uncertainty, general affordability and tight lending conditions, combined with

adverse winter weather disruptions, all contributed to reduced levels of activity in each of our end markets.”

“During the quarter, we delivered a net reduction in organic

SG&A primarily as a result of the cost reduction efforts we took earlier this fiscal year. Moreover, given that we expect the macro-level

conditions to continue at least into the back half of calendar 2025, we are taking additional actions to further rationalize our operations

and align the business with the now lower expected volumes in our end markets. As such, leveraging our investments in technology and efficiency

optimization, we are implementing an additional estimated $20 million in annualized cost reductions, which will bring our total annualized

run rate of reductions to $50 million since the start of our fiscal year.”

“While the broader construction environment in our industry remains

challenged, continuing year-over-year price resilience in Wallboard and Ceilings was a bright spot during the quarter, and we expect this

to continue during our fourth quarter. In addition, we are demonstrating the strength of our business model through our ability to generate

significant levels of cash flow and maintain our solid balance sheet. We are confident that GMS is positioned to navigate the evolving

backdrop and benefit from our scale, wide breadth of product offerings and balanced mix of end markets served, to capitalize on opportunities

when demand trends improve.”

Third

Quarter Fiscal 2025 Results

(Comparisons are to the third quarter of fiscal 2024 unless otherwise

noted)

Net sales for the third quarter of fiscal 2025 of $1.3 billion increased

0.2%, while organic net sales declined 6.7%. Benefits to total net sales from recent acquisitions and favorable Ceilings mix were offset

by demand contraction across multi-family, commercial and single-family markets amid broader economic uncertainty. Unfavorable winter

weather conditions were also a factor.

Year-over-year quarterly sales changes by product category were as

follows:

| · | Wallboard sales of $501.7 million decreased 3.6% (down 7.4%

on an organic basis). |

| · | Ceilings sales of $180.7 million increased 16.0% (up 4.4% on

an organic basis). |

| · | Steel Framing sales of $179.7 million decreased 11.6% (down

17.9% on an organic basis). |

| · | Complementary Product sales of $398.6 million increased 5.3%

(down 4.3% on an organic basis). |

Gross profit of $393.1 million decreased $21.6 million from the prior

year quarter. Gross margin was 31.2%, down 180 basis points as compared to 33.0% a year ago. Gross margins contracted year-over-year across

all major product lines driven by weak demand and continued negative price and cost dynamics. Additionally, vendor incentive income was

challenged by reduced volumes. Absent the lower incentive income, we were pleased to experience generally resilient pricing and margins

sequentially, consistent with our expectations, despite the current competitive market pressures. Steel pricing, however, once again was

a headwind, declining both sequentially and year-over-year.

Selling, general and administrative (“SG&A”) expenses

were $310.8 million for the quarter, up from $295.7 million. Of the $15.1 million year-over-year increase, approximately $24 million related

to recent acquisitions, $4 million related to higher than usual insurance claim development, and $1.2 million related to an increase in

severance costs primarily associated with the previously disclosed cost containment actions. Despite the headwind of unfavorable weather-related

inefficiencies, these increases were offset by lower overall operating costs, reflective of the realized savings from the previously disclosed

cost reduction actions and reduced activity given the changes in demand.

SG&A expense as a percentage of net sales increased 120 basis points

to 24.7% for the quarter, compared to 23.5%. In what is typically our seasonally slowest quarter, our results were further impacted by

several unusual items, including greater than normal disruptions from winter weather and higher than usual insurance claims development,

which together contributed 70 basis points of deleverage. General operating cost inflation, principally from higher rent expense, contributed

70 basis points of deleverage, 50 basis points of which was offset by structural cost improvements from our previously announced restructuring

actions. One-time costs, primarily severance, related to the cost containment efforts, negatively impacted SG&A leverage by 20 basis

points. Net product price deflation, led by Steel, was also unfavorable to SG&A leverage, by 10 basis points. Adjusted SG&A expense

as a percentage of net sales of 23.9% increased 100 basis points from 22.9%.

Inclusive of a $42.5 million impairment of goodwill, a $7.4 million

gain from the sale of the Company’s non-core installed insulation contracting business, and a $4.3 million, or 22.8%, increase in

interest expense, the Company recorded a net loss of $21.4 million, or $0.55 per diluted share. This compared to net income of $51.9 million,

or $1.28 per diluted share in the prior year period. Due to the net loss in the quarter, net income margin is not a meaningful measure.

Adjusted net income was $36.2 million, or $0.92 per diluted share, for the third quarter of fiscal 2025, compared to $68.8 million, or

$1.70 per diluted share.

Adjusted EBITDA decreased $35.0 million, or 27.3%, to $93.0 million

compared to the prior year quarter. Adjusted EBITDA margin was 7.4%, compared with 10.2% for the third quarter of fiscal 2024.

Impairment of Goodwill

During the quarter, the Company recognized a $42.5 million non-cash

impairment charge to write off goodwill related to its Ames business. The primary factor contributing to the impairment was a decrease

in the expected future cash flows and an increase in the associated discount rate for the business, primarily due to softness stemming

from high interest rates and other economic factors in the markets that business operates in.

Balance Sheet, Liquidity and Cash Flow

As of January 31, 2025, the Company had cash on hand of $59.0

million, total debt of $1.4 billion and $469.7 million of available liquidity under its revolving credit facilities. Net debt leverage

was 2.4 times as of the end of the quarter, up from 1.5 times at the end of the third quarter of fiscal 2024.

For the third quarter of fiscal 2025, cash provided by operating activities

was $94.1 million, compared to $104.3 million in the prior year period. Free cash flow was $83.1 million for the quarter ended January 31,

2025, compared to $94.1 million for the quarter ended January 31, 2024. The Company also generated, on a non-operating basis, an

additional $12.5 million in cash flow from the sale of a non-core, installed insulation business.

Share Repurchase Activity and Renewed Share Repurchase Authorization

During the Company’s fiscal third quarter, the Company repurchased

445,163 shares of common stock for $39.3 million. As of January 31, 2025, the Company had $218.4 million of share repurchase authorization

remaining.

Conference Call and Webcast

GMS will host a conference call and webcast to discuss its results

for the third quarter of fiscal 2025 ended January 31, 2025 and other information related to its business at 8:30 a.m. Eastern Time

on Thursday, March 6, 2025. Investors who wish to participate in the call should dial 877-407-3982 (domestic) or 201-493-6780 (international)

at least 5 minutes prior to the start of the call. The live webcast will be available on the Investors section of the Company’s

website at www.gms.com. There will be a slide presentation of the results available on that page of the website as well. Replays of the

call will be available through April 6, 2025 and can be accessed at 844-512-2921 (domestic) or 412-317-6671 (international) and entering

the pass code 13751602.

About GMS Inc.

Founded in 1971, GMS operates a network of more than 300 distribution

centers with extensive product offerings of Wallboard, Ceilings, Steel Framing and Complementary Products. In addition, GMS operates nearly

100 tool sales, rental and service centers, providing a comprehensive selection of building products and solutions for its residential

and commercial contractor customer base across the United States and Canada. The Company’s unique operating model combines the benefits

of a national platform and strategy with a local go-to-market focus, enabling GMS to generate significant economies of scale while maintaining

high levels of customer service.

Use of Non-GAAP Financial Measures

GMS reports its financial results in accordance with GAAP. However,

it presents Adjusted net income, free cash flow, Adjusted SG&A, Adjusted EBITDA, and Adjusted EBITDA margin, which are not recognized

financial measures under GAAP. GMS believes that Adjusted net income, free cash flow, Adjusted SG&A, Adjusted EBITDA, and Adjusted

EBITDA margin assist investors and analysts in comparing its operating performance across reporting periods on a consistent basis by excluding

items that the Company does not believe are indicative of its core operating performance. The Company’s management believes Adjusted

net income, Adjusted SG&A, free cash flow, Adjusted EBITDA and Adjusted EBITDA margin are helpful in highlighting trends in its operating

results, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax

jurisdictions in which the Company operates and capital investments. In addition, the Company utilizes Adjusted EBITDA in certain calculations

in its debt agreements.

You are encouraged to evaluate each adjustment and the reasons GMS

considers it appropriate for supplemental analysis. In addition, in evaluating Adjusted net income, Adjusted SG&A and Adjusted EBITDA,

you should be aware that in the future, the Company may incur expenses similar to the adjustments in the presentation of Adjusted net

income, Adjusted SG&A and Adjusted EBITDA. The Company’s presentation of Adjusted net income, Adjusted SG&A, Adjusted SG&A

margin, Adjusted EBITDA, and Adjusted EBITDA margin should not be construed as an inference that its future results will be unaffected

by unusual or non-recurring items. In addition, Adjusted net income, free cash flow, Adjusted SG&A and Adjusted EBITDA may not be

comparable to similarly titled measures used by other companies in GMS’s industry or across different industries. Please see the

tables at the end of this release for a reconciliation of Adjusted EBITDA, free cash flow, Adjusted SG&A and Adjusted net income to

the most directly comparable GAAP financial measures.

When calculating organic net sales growth, the Company excludes from

the calculation (i) net sales of acquired businesses until the first anniversary of the acquisition date, and (ii) the impact of foreign

currency translation.

Forward-Looking Statements and Information

This press release includes “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by the

Company’s use of forward-looking terminology such as “anticipate,” “believe,” “confident,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “predict,” “seek,” or “should,” or the negative thereof or other variations

thereon or comparable terminology. In particular, statements about the markets in which GMS operates, including in particular residential

and commercial construction, and the economy generally, end market mix, pricing, volumes, the demand for the Company’s products,

including Complementary Products, free cash flow, mortgage and lending rates, the Company’s strategic priorities and the results

thereof, stockholder value, performance, growth, and results thereof, and expected future cost containment measures, future share repurchases

contained in this press release may be considered forward-looking statements. The Company has based forward-looking statements on its

current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates, and

projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties,

many of which are beyond its control, including current and future public health issues that may affect the Company’s business.

Forward-looking statements involve risks and uncertainties, including, but not limited to, those described in the “Risk Factors”

section in the Company’s most recent Annual Report on Form 10-K, and in its other periodic reports filed with the SEC. In addition,

the statements in this release are made as of March 6, 2025. The Company undertakes no obligation to update any of the forward-looking

statements made herein, whether as a result of new information, future events, changes in expectation or otherwise. These forward-looking

statements should not be relied upon as representing the Company’s views as of any date subsequent to March 6, 2025.

Contact Information:

Investors:

Carey Phelps

ir@gms.com

770-723-3369

GMS Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

January 31, | | |

January 31, | |

| | |

2025 | | |

2024 | | |

2025 | | |

2024 | |

| Net sales | |

$ | 1,260,710 | | |

$ | 1,258,348 | | |

$ | 4,179,942 | | |

$ | 4,088,878 | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | |

| 867,620 | | |

| 843,628 | | |

| 2,874,162 | | |

| 2,764,975 | |

| Gross profit | |

| 393,090 | | |

| 414,720 | | |

| 1,305,780 | | |

| 1,323,903 | |

| Operating expenses (income): | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 310,815 | | |

| 295,691 | | |

| 950,192 | | |

| 883,381 | |

| Depreciation and amortization | |

| 42,430 | | |

| 32,804 | | |

| 122,540 | | |

| 97,759 | |

| Impairment of goodwill | |

| 42,454 | | |

| — | | |

| 42,454 | | |

| — | |

| Gain on sale of business | |

| (7,393 | ) | |

| — | | |

| (7,393 | ) | |

| — | |

| Total operating expenses | |

| 388,306 | | |

| 328,495 | | |

| 1,107,793 | | |

| 981,140 | |

| Operating income | |

| 4,784 | | |

| 86,225 | | |

| 197,987 | | |

| 342,763 | |

| Other (expense) income: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (23,069 | ) | |

| (18,784 | ) | |

| (68,979 | ) | |

| (56,440 | ) |

| Write-off of debt discount and deferred financing fees | |

| — | | |

| — | | |

| — | | |

| (1,401 | ) |

| Other income, net | |

| 1,053 | | |

| 1,932 | | |

| 4,380 | | |

| 6,177 | |

| Total other expense, net | |

| (22,016 | ) | |

| (16,852 | ) | |

| (64,599 | ) | |

| (51,664 | ) |

| Income (loss) before taxes | |

| (17,232 | ) | |

| 69,373 | | |

| 133,388 | | |

| 291,099 | |

| Provision for income taxes | |

| 4,177 | | |

| 17,468 | | |

| 44,013 | | |

| 71,407 | |

| Net income (loss) | |

$ | (21,409 | ) | |

$ | 51,905 | | |

$ | 89,375 | | |

$ | 219,692 | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 38,708 | | |

| 39,864 | | |

| 39,125 | | |

| 40,360 | |

| Diluted | |

| 38,708 | | |

| 40,512 | | |

| 39,727 | | |

| 41,026 | |

| Net income (loss) per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.55 | ) | |

$ | 1.30 | | |

$ | 2.28 | | |

$ | 5.44 | |

| Diluted | |

$ | (0.55 | ) | |

$ | 1.28 | | |

$ | 2.25 | | |

$ | 5.35 | |

GMS Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except per share data)

| | |

January 31,

2025 | | |

April 30,

2024 | |

| | |

| | |

| |

| Assets |

|

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 59,029 | | |

$ | 166,148 | |

| Trade accounts and notes receivable, net of allowances of $15,046 and $16,930, respectively | |

| 783,116 | | |

| 849,993 | |

| Inventories, net | |

| 599,284 | | |

| 580,830 | |

| Prepaid expenses and other current assets | |

| 50,104 | | |

| 42,352 | |

| Total current assets | |

| 1,491,533 | | |

| 1,639,323 | |

| Property and equipment, net of accumulated depreciation of $348,669 and $309,850, respectively | |

| 515,452 | | |

| 472,257 | |

| Operating lease right-of-use assets | |

| 318,240 | | |

| 251,207 | |

| Goodwill | |

| 870,027 | | |

| 853,767 | |

| Intangible assets, net | |

| 548,443 | | |

| 502,688 | |

| Deferred income taxes | |

| 27,621 | | |

| 21,890 | |

| Other assets | |

| 21,720 | | |

| 18,708 | |

| Total assets | |

$ | 3,793,036 | | |

$ | 3,759,840 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 330,125 | | |

$ | 420,237 | |

| Accrued compensation and employee benefits | |

| 96,430 | | |

| 125,610 | |

| Other accrued expenses and current liabilities | |

| 109,580 | | |

| 111,204 | |

| Current portion of long-term debt | |

| 57,104 | | |

| 50,849 | |

| Current portion of operating lease liabilities | |

| 54,968 | | |

| 49,150 | |

| Total current liabilities | |

| 648,207 | | |

| 757,050 | |

| Non-current liabilities: | |

| | | |

| | |

| Long-term debt, less current portion | |

| 1,352,873 | | |

| 1,229,726 | |

| Long-term operating lease liabilities | |

| 270,732 | | |

| 204,865 | |

| Deferred income taxes, net | |

| 76,961 | | |

| 62,698 | |

| Other liabilities | |

| 50,655 | | |

| 44,980 | |

| Total liabilities | |

| 2,399,428 | | |

| 2,299,319 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

Common stock, par value $0.01 per share, 500,000 shares authorized; 38,487

and 39,754 shares issued and outstanding as of January 31, 2025 and April 30, 2024, respectively | |

| 385 | | |

| 397 | |

| Preferred stock, par value $0.01 per share, 50,000 shares authorized; 0 shares issued and outstanding as of January 31, 2025 and April 30, 2024 | |

| — | | |

| — | |

| Additional paid-in capital | |

| 211,814 | | |

| 334,596 | |

| Retained earnings | |

| 1,246,422 | | |

| 1,157,047 | |

| Accumulated other comprehensive loss | |

| (65,013 | ) | |

| (31,519 | ) |

| Total stockholders' equity | |

| 1,393,608 | | |

| 1,460,521 | |

| Total liabilities and stockholders' equity | |

$ | 3,793,036 | | |

$ | 3,759,840 | |

GMS Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| |

|

Nine Months Ended

January 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

89,375 |

|

|

$ |

219,692 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

122,540 |

|

|

|

97,759 |

|

| Impairment of goodwill |

|

|

42,454 |

|

|

|

— |

|

| Write-off and amortization of debt discount and debt issuance costs |

|

|

1,342 |

|

|

|

3,374 |

|

| Equity-based compensation |

|

|

14,505 |

|

|

|

16,507 |

|

| Gain on sale of business and disposal of assets, net |

|

|

(4,826 |

) |

|

|

(663 |

) |

| Deferred income taxes |

|

|

(6,862 |

) |

|

|

(6,410 |

) |

| Other items, net |

|

|

6,013 |

|

|

|

3,876 |

|

| Changes in assets and liabilities net of effects of acquisitions: |

|

|

|

|

|

|

|

|

| Trade accounts and notes receivable |

|

|

100,815 |

|

|

|

2,691 |

|

| Inventories |

|

|

(13,623 |

) |

|

|

7 |

|

| Prepaid expenses and other assets |

|

|

(16,024 |

) |

|

|

(19,184 |

) |

| Accounts payable |

|

|

(101,678 |

) |

|

|

(56,803 |

) |

| Accrued compensation and employee benefits |

|

|

(28,874 |

) |

|

|

(21,505 |

) |

| Other accrued expenses and liabilities |

|

|

(18,351 |

) |

|

|

(10,315 |

) |

| Cash provided by operating activities |

|

|

186,806 |

|

|

|

229,026 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(34,093 |

) |

|

|

(39,728 |

) |

| Proceeds from sale of business and sale of assets |

|

|

15,888 |

|

|

|

1,948 |

|

| Acquisition of businesses, net of cash acquired |

|

|

(204,333 |

) |

|

|

(55,402 |

) |

| Other investing activities |

|

|

(5,200 |

) |

|

|

— |

|

| Cash used in investing activities |

|

|

(227,738 |

) |

|

|

(93,182 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Repayments on revolving credit facility |

|

|

(1,265,165 |

) |

|

|

(525,009 |

) |

| Borrowings from revolving credit facility |

|

|

1,371,909 |

|

|

|

443,973 |

|

| Payments of principal on long-term debt |

|

|

(3,741 |

) |

|

|

(1,250 |

) |

| Borrowings from term loan amendment |

|

|

— |

|

|

|

288,266 |

|

| Repayments from term loan amendment |

|

|

— |

|

|

|

(287,769 |

) |

| Payments of principal on finance lease obligations |

|

|

(34,114 |

) |

|

|

(30,381 |

) |

| Repurchases of common stock |

|

|

(138,902 |

) |

|

|

(100,292 |

) |

| Payment for debt issuance costs |

|

|

— |

|

|

|

(5,825 |

) |

| Proceeds from exercises of stock options |

|

|

3,118 |

|

|

|

5,053 |

|

| Payments for taxes related to net share settlement of equity awards |

|

|

(5,002 |

) |

|

|

(4,023 |

) |

| Proceeds from issuance of stock pursuant to employee stock purchase plan |

|

|

5,967 |

|

|

|

4,586 |

|

| Cash used in financing activities |

|

|

(65,930 |

) |

|

|

(212,671 |

) |

| Effect of exchange rates on cash and cash equivalents |

|

|

(257 |

) |

|

|

423 |

|

| Decrease in cash and cash equivalents |

|

|

(107,119 |

) |

|

|

(76,404 |

) |

| Cash and cash equivalents, beginning of period |

|

|

166,148 |

|

|

|

164,745 |

|

| Cash and cash equivalents, end of period |

|

$ |

59,029 |

|

|

$ |

88,341 |

|

| Supplemental cash flow disclosures: |

|

|

|

|

|

|

|

|

| Cash paid for income taxes |

|

$ |

58,295 |

|

|

$ |

93,661 |

|

| Cash paid for interest |

|

|

72,490 |

|

|

|

57,300 |

|

GMS Inc.

Net Sales by Product Group (Unaudited)

(dollars in thousands)

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

January

31,

2025 | | |

%

of

Total | | |

January

31,

2024 | | |

%

of

Total | | |

January

31,

2025 | | |

%

of

Total | | |

January

31,

2024 | | |

%

of

Total | |

| Wallboard | |

$ | 501,703 | | |

| 39.8 | % | |

$ | 520,686 | | |

| 41.4 | % | |

$ | 1,671,751 | | |

| 40.0 | % | |

$ | 1,677,285 | | |

| 41.0 | % |

| Ceilings | |

| 180,678 | | |

| 14.3 | % | |

| 155,744 | | |

| 12.4 | % | |

| 592,275 | | |

| 14.2 | % | |

| 506,278 | | |

| 12.4 | % |

| Steel framing | |

| 179,682 | | |

| 14.3 | % | |

| 203,363 | | |

| 16.2 | % | |

| 606,928 | | |

| 14.5 | % | |

| 672,231 | | |

| 16.4 | % |

| Complementary

products | |

| 398,647 | | |

| 31.6 | % | |

| 378,555 | | |

| 30.1 | % | |

| 1,308,988 | | |

| 31.3 | % | |

| 1,233,084 | | |

| 30.2 | % |

| Total

net sales | |

$ | 1,260,710 | | |

| | | |

$ | 1,258,348 | | |

| | | |

$ | 4,179,942 | | |

| | | |

$ | 4,088,878 | | |

| | |

GMS Inc.

Net Sales and Organic Sales by Product Group

(Unaudited)

(dollars in millions)

| | |

Net

Sales | | |

| | |

Organic

Sales | | |

| |

| | |

Three

Months Ended January 31, | | |

| | |

Three

Months Ended January 31, | | |

| |

| | |

2025 | | |

2024 | | |

Change | | |

2025 | | |

2024 | | |

Change | |

| Wallboard | |

$ | 501.7 | | |

$ | 520.7 | | |

| (3.6 | )% | |

$ | 482.1 | | |

$ | 520.7 | | |

| (7.4 | )% |

| Ceilings | |

| 180.7 | | |

| 155.7 | | |

| 16.0 | % | |

| 162.5 | | |

| 155.7 | | |

| 4.4 | % |

| Steel framing | |

| 179.7 | | |

| 203.4 | | |

| (11.6 | )% | |

| 167.0 | | |

| 203.4 | | |

| (17.9 | )% |

| Complementary

products | |

| 398.6 | | |

| 378.5 | | |

| 5.3 | % | |

| 362.4 | | |

| 378.5 | | |

| (4.3 | )% |

| Total

net sales | |

$ | 1,260.7 | | |

$ | 1,258.3 | | |

| 0.2 | % | |

$ | 1,174.0 | | |

$ | 1,258.3 | | |

| (6.7 | )% |

GMS Inc.

Per Day Net Sales and Per Day Organic Sales

by Product Group (Unaudited)

(dollars in millions)

| | |

Per Day Net Sales | | |

| | |

Per Day Organic Sales | | |

| |

| | |

Three Months Ended January 31, | | |

| | |

Three Months Ended January 31, | | |

| |

| | |

2025 | | |

2024 | | |

Change | | |

2025 | | |

2024 | | |

Change | |

| Wallboard | |

$ | 8.1 | | |

$ | 8.4 | | |

| (3.6 | )% | |

$ | 7.8 | | |

$ | 8.4 | | |

| (7.4 | )% |

| Ceilings | |

| 2.9 | | |

| 2.5 | | |

| 16.0 | % | |

| 2.6 | | |

| 2.5 | | |

| 4.4 | % |

| Steel framing | |

| 2.9 | | |

| 3.3 | | |

| (11.6 | )% | |

| 2.7 | | |

| 3.3 | | |

| (17.9 | )% |

| Complementary products | |

| 6.4 | | |

| 6.1 | | |

| 5.3 | % | |

| 5.8 | | |

| 6.1 | | |

| (4.3 | )% |

| Total net sales | |

$ | 20.3 | | |

$ | 20.3 | | |

| 0.2 | % | |

$ | 18.9 | | |

$ | 20.3 | | |

| (6.7 | )% |

| | |

Per Day Growth(a) | | |

Per Day Organic Growth(a) | |

| | |

Three Months Ended January 31, 2025 | | |

Three Months Ended January 31, 2025 | |

| | |

Volume | | |

Price/Mix/Fx | | |

Volume | | |

Price/Mix/Fx | |

| Wallboard | |

| (4.9 | )% | |

| 1.3 | % | |

| (8.8 | )% | |

| 1.4 | % |

| Ceilings | |

| 8.2 | % | |

| 7.8 | % | |

| (6.7 | )% | |

| 11.1 | % |

| Steel framing | |

| (5.6 | )% | |

| (6.0 | )% | |

| (15.1 | )% | |

| (2.8 | )% |

| (a) | Given the wide breadth of offerings and units of measure in

Complementary Products, detailed price vs volume reporting is not available at a consolidated level. |

GMS Inc.

Reconciliation of Net Income (Loss) to Adjusted

EBITDA (Unaudited)

(in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

January 31, | | |

January 31, | |

| | |

2025 | | |

2024 | | |

2025 | | |

2024 | |

| Net income (loss) | |

$ | (21,409 | ) | |

$ | 51,905 | | |

$ | 89,375 | | |

$ | 219,692 | |

| Interest expense | |

| 23,069 | | |

| 18,784 | | |

| 68,979 | | |

| 56,440 | |

| Write-off of debt discount and deferred financing fees | |

| — | | |

| — | | |

| — | | |

| 1,401 | |

| Interest income | |

| (189 | ) | |

| (378 | ) | |

| (752 | ) | |

| (1,144 | ) |

| Provision for income taxes | |

| 4,177 | | |

| 17,468 | | |

| 44,013 | | |

| 71,407 | |

| Depreciation expense | |

| 21,271 | | |

| 17,276 | | |

| 61,028 | | |

| 50,566 | |

| Amortization expense | |

| 21,159 | | |

| 15,528 | | |

| 61,512 | | |

| 47,193 | |

| EBITDA | |

$ | 48,078 | | |

$ | 120,583 | | |

$ | 324,155 | | |

$ | 445,555 | |

| Impairment of goodwill | |

| 42,454 | | |

| — | | |

| 42,454 | | |

| — | |

| Stock appreciation expense(a) | |

| 691 | | |

| 1,789 | | |

| 1,331 | | |

| 3,408 | |

| Redeemable noncontrolling interests and deferred compensation(b) | |

| 34 | | |

| 461 | | |

| 1,149 | | |

| 1,125 | |

| Equity-based compensation(c) | |

| 3,422 | | |

| 3,559 | | |

| 12,025 | | |

| 11,974 | |

| Severance and other permitted costs(d) | |

| 2,282 | | |

| 1,033 | | |

| 9,698 | | |

| 2,321 | |

| Transaction costs (acquisitions and other)(e) | |

| 789 | | |

| 765 | | |

| 3,262 | | |

| 3,373 | |

| Gain on disposal of assets(f) | |

| (5,333 | ) | |

| (222 | ) | |

| (4,826 | ) | |

| (663 | ) |

| Effects of fair value adjustments to inventory(g) | |

| 3 | | |

| 8 | | |

| 484 | | |

| 450 | |

| Change in fair value of contingent consideration(h) | |

| 621 | | |

| — | | |

| 1,414 | | |

| — | |

| Debt transaction costs(i) | |

| — | | |

| 44 | | |

| — | | |

| 1,333 | |

| EBITDA adjustments | |

| 44,963 | | |

| 7,437 | | |

| 66,991 | | |

| 23,321 | |

| Adjusted EBITDA | |

$ | 93,041 | | |

$ | 128,020 | | |

$ | 391,146 | | |

$ | 468,876 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

$ | 1,260,710 | | |

$ | 1,258,348 | | |

$ | 4,179,942 | | |

$ | 4,088,878 | |

| Adjusted EBITDA Margin | |

| 7.4 | % | |

| 10.2 | % | |

| 9.4 | % | |

| 11.5 | % |

| (a) | Represents changes in the fair value of stock appreciation rights. |

| (b) | Represents changes in the fair values of noncontrolling interests and deferred compensation agreements. |

| (c) | Represents non-cash equity-based compensation expense related to the issuance of share-based awards. |

| (d) | Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility. |

| (e) | Represents costs related to acquisitions paid to third parties. |

| (f) | Includes gains from the sale of assets and the sale of the Company’s Michigan-based installed insulation contracting business,

net of losses and impairments. |

| (g) | Represents the non-cash cost of sales impact of acquisition accounting adjustments to increase inventory to its estimated fair value. |

| (h) | Represents the change in fair value of contingent consideration arrangements. |

| (i) | Represents costs paid to third-party advisors related to debt refinancing activities. |

GMS Inc.

Reconciliation of Cash Provided By Operating

Activities to Free Cash Flow (Unaudited)

(in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

January 31, | | |

January 31, | |

| | |

2025 | | |

2024 | | |

2025 | | |

2024 | |

| Cash provided by operating activities | |

$ | 94,144 | | |

$ | 104,279 | | |

$ | 186,806 | | |

$ | 229,026 | |

| Purchases of property and equipment | |

| (11,041 | ) | |

| (10,182 | ) | |

| (34,093 | ) | |

| (39,728 | ) |

| Free cash flow (a) | |

$ | 83,103 | | |

$ | 94,097 | | |

$ | 152,713 | | |

$ | 189,298 | |

(a) Free cash flow is a non-GAAP financial measure that we define as

net cash provided by (used in) operations less capital expenditures.

GMS Inc.

Reconciliation of Selling, General and Administrative

Expense to Adjusted SG&A (Unaudited)

(in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

January 31, | | |

January 31, | |

| | |

2025 | | |

2024 | | |

2025 | | |

2024 | |

| Selling, general and administrative expense | |

$ | 310,815 | | |

$ | 295,691 | | |

$ | 950,192 | | |

$ | 883,381 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustments | |

| | | |

| | | |

| | | |

| | |

| Stock appreciation expense(a) | |

| (691 | ) | |

| (1,789 | ) | |

| (1,331 | ) | |

| (3,408 | ) |

| Redeemable noncontrolling interests and deferred compensation(b) | |

| (34 | ) | |

| (461 | ) | |

| (1,149 | ) | |

| (1,125 | ) |

| Equity-based compensation(c) | |

| (3,422 | ) | |

| (3,559 | ) | |

| (12,025 | ) | |

| (11,974 | ) |

| Severance and other permitted costs(d) | |

| (2,282 | ) | |

| (1,033 | ) | |

| (9,698 | ) | |

| (2,321 | ) |

| Transaction costs (acquisitions and other)(e) | |

| (789 | ) | |

| (765 | ) | |

| (3,262 | ) | |

| (3,373 | ) |

| (Loss) gain on disposal of assets(f) | |

| (2,060 | ) | |

| 222 | | |

| (2,567 | ) | |

| 663 | |

| Debt transaction costs(g) | |

| — | | |

| (44 | ) | |

| — | | |

| (1,333 | ) |

| Adjusted SG&A | |

$ | 301,537 | | |

$ | 288,262 | | |

$ | 920,160 | | |

$ | 860,510 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

$ | 1,260,710 | | |

$ | 1,258,348 | | |

$ | 4,179,942 | | |

$ | 4,088,878 | |

| Adjusted SG&A margin | |

| 23.9 | % | |

| 22.9 | % | |

| 22.0 | % | |

| 21.0 | % |

| (a) | Represents changes in the fair value of stock appreciation rights. |

| (b) | Represents changes in the fair values of noncontrolling interests and deferred compensation agreements. |

| (c) | Represents non-cash equity-based compensation expense related to the issuance of share-based awards. |

| (d) | Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility. |

| (e) | Represents costs related to acquisitions paid to third parties. |

| (f) | Includes gains and losses from the sale and disposal of assets. |

| (g) | Represents costs paid to third-party advisors related to debt refinancing activities. |

GMS Inc.

Reconciliation of Income (Loss) Before Taxes

to Adjusted Net Income (Unaudited)

(in thousands, except per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

January 31, | | |

January 31, | |

| | |

2025 | | |

2024 | | |

2025 | | |

2024 | |

| Income (loss) before taxes | |

$ | (17,232 | ) | |

$ | 69,373 | | |

$ | 133,388 | | |

$ | 291,099 | |

| EBITDA adjustments | |

| 44,963 | | |

| 7,437 | | |

| 66,991 | | |

| 23,321 | |

| Write-off of debt discount and deferred financing fees | |

| — | | |

| — | | |

| — | | |

| 1,401 | |

| Amortization expense (1) | |

| 21,159 | | |

| 15,528 | | |

| 61,512 | | |

| 47,193 | |

| Adjusted pre-tax income | |

| 48,890 | | |

| 92,338 | | |

| 261,891 | | |

| 363,014 | |

| Adjusted income tax expense | |

| 12,711 | | |

| 23,546 | | |

| 68,092 | | |

| 92,569 | |

| Adjusted net income | |

$ | 36,179 | | |

$ | 68,792 | | |

$ | 193,799 | | |

$ | 270,445 | |

| Effective tax rate (2) | |

| 26.0 | % | |

| 25.5 | % | |

| 26.0 | % | |

| 25.5 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 38,708 | | |

| 39,864 | | |

| 39,125 | | |

| 40,360 | |

| Diluted | |

| 39,252 | | |

| 40,512 | | |

| 39,727 | | |

| 41,026 | |

| Adjusted net income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.93 | | |

$ | 1.73 | | |

$ | 4.95 | | |

$ | 6.70 | |

| Diluted | |

$ | 0.92 | | |

$ | 1.70 | | |

$ | 4.88 | | |

$ | 6.59 | |

| (1) | Represents all non-cash amortization resulting from business

combinations. To make the financial presentation more consistent with other public building products companies, beginning in the first

quarter 2025 we are now including an adjustment for all non-cash amortization expense related to acquisitions, as opposed to non-cash

amortization and depreciation for select acquisitions. |

| (2) | Normalized cash tax rate excluding the impact of acquisition

accounting and certain other deferred tax amounts. |

GMS Inc.

Reconciliation of Net Income to Pro Forma Adjusted

EBITDA (Unaudited)

(in thousands)

| | |

Last Twelve Months Ended | |

| | |

January 31, | |

| | |

2025 | | |

2024 | |

| Net income | |

$ | 145,762 | | |

$ | 295,285 | |

| Interest expense | |

| 88,000 | | |

| 74,624 | |

| Write-off of debt discount and deferred financing fees | |

| 674 | | |

| 1,401 | |

| Interest income | |

| (1,362 | ) | |

| (2,041 | ) |

| Provision for income taxes | |

| 70,693 | | |

| 94,197 | |

| Depreciation expense | |

| 79,668 | | |

| 66,530 | |

| Amortization expense | |

| 78,475 | | |

| 62,051 | |

| EBITDA | |

$ | 461,910 | | |

$ | 592,047 | |

| Impairment of goodwill | |

| 42,454 | | |

| — | |

| Stock appreciation expense(a) | |

| 3,314 | | |

| 5,223 | |

| Redeemable noncontrolling interests and deferred compensation(b) | |

| 1,451 | | |

| 1,100 | |

| Equity-based compensation(c) | |

| 15,669 | | |

| 14,993 | |

| Severance and other permitted costs(d) | |

| 10,005 | | |

| 4,693 | |

| Transaction costs (acquisitions and other)(e) | |

| 4,745 | | |

| 4,180 | |

| Gain on disposal of assets(f) | |

| (4,892 | ) | |

| (1,462 | ) |

| Effects of fair value adjustments to inventory(g) | |

| 1,667 | | |

| 937 | |

| Change in fair value of contingent consideration(h) | |

| 1,414 | | |

| — | |

| Debt transaction costs(i) | |

| (13 | ) | |

| 1,506 | |

| EBITDA adjustments | |

| 75,814 | | |

| 31,170 | |

| Adjusted EBITDA | |

| 537,724 | | |

| 623,217 | |

| Contributions from acquisitions(j) | |

| 16,572 | | |

| 6,276 | |

| Pro Forma Adjusted EBITDA | |

$ | 554,296 | | |

$ | 629,493 | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 59,029 | | |

$ | 88,341 | |

| Total debt | |

| 1,409,977 | | |

| 1,030,761 | |

| Net debt | |

$ | 1,350,948 | | |

$ | 942,420 | |

| Net debt / Pro Forma Adjusted EBITDA | |

| 2.4 | x | |

| 1.5 | x |

| (a) | Represents changes in the fair value of stock appreciation rights. |

| (b) | Represents changes in the fair values of noncontrolling interests and deferred compensation agreements. |

| (c) | Represents non-cash equity-based compensation expense related to the issuance of share-based awards. |

| (d) | Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility. |

| (e) | Represents costs related to acquisitions paid to third parties. |

| (f) | Includes gains from the sale of assets and the sale of the Company’s Michigan-based installed insulation contracting business,

net of losses and impairments. |

| (g) | Represents the non-cash cost of sales impact of acquisition accounting adjustments to increase inventory to its estimated fair value. |

| (h) | Represents the change in fair value of contingent consideration arrangements. |

| (i) | Represents costs paid to third-party advisors related to debt refinancing activities. |

| (j) | Represents the pro forma impact of earnings from acquisitions from the beginning of the last twelve month period to the date of acquisition,

including synergies. |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

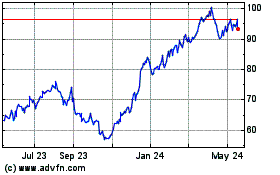

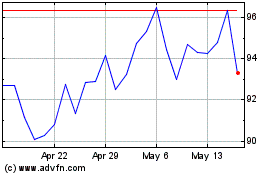

GMS (NYSE:GMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

GMS (NYSE:GMS)

Historical Stock Chart

From Mar 2024 to Mar 2025