false

0001600438

0001600438

2025-03-06

2025-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): March 6, 2025

GMS INC.

(Exact name of

registrant as specified in charter)

| Delaware |

|

001-37784 |

|

46-2931287 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

100 Crescent Centre Parkway, Suite 800

Tucker, Georgia |

|

30084 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (800) 392-4619

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

GMS |

|

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Item 7.01. Regulation FD Disclosure.

The slide presentation furnished as Exhibit 99.1 hereto, and incorporated

herein by reference, will be presented to certain investors of GMS on March 6, 2025, and may be used by GMS in various other presentations

to investors on or after March 6, 2025.

In accordance with General Instruction B.2 of Form 8-K, the information

in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

*Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GMS INC. |

| |

|

|

|

| Date: March 6, 2025 |

By: |

/s/

Scott M. Deakin |

| |

|

Name: |

Scott M. Deakin |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

Q3 FY2025 Earnings Call March 6, 2025

2 Safe Harbor and B asis of Presentation Forward - Looking Statement Safe Harbor — This presentation includes “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify forward - looking statements by the Company’s use of forward - looking terminology such as “anticipate,” “bel ieve,” “confident,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “seek,” or “should,” or the negative thereof or other variations th ere on or comparable terminology. In particular, statements about the markets in which GMS operates and our products, including potential or expected growth in those markets and products, the eco nom y generally, our ability to navigate the evolving operating environment and execute our business, strategic initiatives and priorities and growth potential, ability to achieve an ticipated cost reduction goals, closing of acquisitions and integration of such acquisitions, future M&A and greenfields, inflation, mortgage and lending rates, capital structure, prici ng (including but not limited to, fluctuations in commodity pricing), volumes, net sales, organic sales, gross margins, incremental EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, capital expend itu res, free cash flow, future financial performance and liquidity, the Company’s cost reduction initiatives and results thereof, and the ability of the Company to grow stronger con tained in this presentation may be considered forward - looking statements. Statements about our expectations, beliefs, plans, strategies, objectives, prospects, assumptions or futu re events or performance may be considered forward - looking statements. The Company has based forward - looking statements on its current expectations, assumptions, estimates and projections . While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward - looking statements are only predictions and involve known an d unknown risks and uncertainties, many of which are beyond its control. Forward - looking statements involve risks and uncertainties, including, but not limited to, those described i n the “Risk Factors” section in the Company’s most recent Annual Report on Form 10 - K, and in its other periodic reports filed with the SEC. In addition, the statements in this presentati on are made as of March 6, 2025. The Company undertakes no obligation to update any of the forward - looking statements made herein, whether as a result of new information, future events , changes in expectation or otherwise. These forward - looking statements should not be relied upon as representing the Company’s views as of any date subsequent to March 6, 2025. Use of Non - GAAP and Adjusted Financial Information — To supplement GAAP financial information, we use adjusted measures of operating results which are non - GAAP measures. This non - GAAP adjusted financial information is provided as additional information for investors. These adjusted results exclude certain costs, expenses, gains and losses, and we believe their exclusion can enhance an overall understanding of our past financial performance and also our prospects for the fu ture. These adjustments to our GAAP results are made with the intent of providing both management and investors a more complete understanding of our operating performance by excl udi ng non - recurring, infrequent or other non - cash charges that are not believed to be material to the ongoing performance of our business. The presentation of this additional inf ormation is not meant to be considered in isolation or as a substitute for GAAP measures of net income, diluted earnings per share or net cash provided by (used in) operating activities pr epared in accordance with generally accepted accounting principles in the United States. Please see the Appendix to this presentation for a further discussion on these non - GAAP measure s and a reconciliation of these non - GAAP measures to the most directly comparable GAAP measures.

3 Q3 Fiscal 2025 At a Glance Comparisons are to Q 3 FY2 4 unless noted otherwise • Results in the quarter reflect the impact of soft end market demand and steel pricing, both of which deteriorated meaningfully during the last half of the quarter • Economic uncertainty, general affordability concerns and tight lending conditions, combined with adverse winter weather disruptions, all contributed to reduced sales in each of our end markets • Continued price resilience in Wallboard, Ceilings and Complementary Products • Net Sales of $1.3 billion, up 0.2% 1 For a reconciliation of Adjusted EBITDA to the most directly comparable GAAP metrics, see Appendix. • Gross margin of 31.2%, down 20 bps from Q2 FY25 and down 180 bps YOY • Net loss of $21.4 million, including a $42.5 million non - cash goodwill impairment, compared to net income of $51.9 million • Adjusted EBITDA 1 of $93.0 million, compared to $128.0 million • Implementing an additional estimated $20 million in annualized cost reductions, bringing our total annualized run rate of reductions to $50 million since the start of Fiscal 2025 • Generated significant levels of cash Q3 FY25 Net Sales Wallboard 40% Ceilings 14% Steel Framing 14% Complementary Products 32%

4 Continued Focus on the Execution of Our Strategy Strategic Pillars • Taking near - term actions to further align and rationalize our operations with today’s market realities • Solid balance sheet with no near - term maturities • Significant levels of free cash flow generation • Disciplined capital allocation strategy Plus,

5 Sales Highlights – Q3 FY25 U.S. Per Day Residential Sales Q325 Net Sales $ 1.3 B Per Day Net Sales 2.1% U.S. Per Day Commercial Sales 7.8% 2.7% 0.2% • Demand deteriorated during the last half of the quarter across all end markets • Adverse winter weather and holiday timing negatively impacted sales by an estimated $20 million • Other than Ceilings, which benefited from project mix and the Kamco acquisition, volumes declined across the other major product categories U.S. Multi Family per day sales U.S. Single Family per day sales 1.9% 27.0% 6.4% Note: G iven the wide breadth of offerings and units of measure in Complementary Products, detailed price vs volume reporting is not ava ilable at a consolidated level. Also, end market metrics are organic sales. 1 1

6 Weak Demand & Price/Cost Dynamics Impact Profitability 1 For a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP metrics, see Appendix . 2 The most comparable GAAP metric for Adjusted EBITDA margin is Net Income Margin. However, due to the fact that the Company r eco rded a net loss during the quarter, this is not a meaningful measure. $128.0 $93.0 10.2% 7.4% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 11.5% 12.0% 12.5% 13.0% 13.5% $0 $50 $100 $150 Fiscal Q3 2024 Fiscal Q3 2025 Adj. EBITDA Adj. EBITDA Margin ($ mm) Net Loss & Adj. EBITDA 1 Net loss of $21.4 million including a $42.5 million non - cash goodwill impairment charge and a $7.4 million gain on the sale of a non - core business Adjusted EBITDA 1 was $93.0 million Adjusted EBITDA margin 2 was 7.4%. Gross Margin Bridge SG&A % Bridge - 0.50% - 0.10% +0.70% +0.40% +0.30% +0.20% +0.20% 23.5% 24.7 % FY24 Q3 SG&A% General Operating Cost Inflation + Rent Expense Higher Accident Claim Activity Logistics Inefficiencies (Weather/Holidays) Restructuring Costs Steel Price Deflation Cost-out Actions Wallboard Price Inflation FY25 Q3 SG&A% - 0.70% - 0.40% - 0.30% - 0.20% - 0.10% - 0.10% 33.0% 31.2% FY24 Q3 GM% Wallboard Price/Cost Complementary Price/Cost Lower Volume-Based Incentives Ceilings Price/Cost One-Time Operational Impacts Sales Mix Impact FY25 Q3 GM% 1 1

7 Attractive Capital Structure Supports Strategic Priorities • Repurchased 445K shares for $39.3 million during Q325 • $218.4 million repurchase authorization remaining at January 31, 2025 1.5x 1.7x 2.1x 2.3x 2.4x 1/31/2024 04/30/2024 7/31/2024 10/31/2024 1/31/2025 $14 $56 $50 $417 $35 $847 FY25 FY26 FY27 FY28 FY29 Thereafter LTM Net Debt / PF Adjusted EBITDA 4 Debt 5 Maturity Schedule $ in millions 1. For a reconciliation of free cash flow to cash provided or used by operating activities, the most directly comparable GAAP me tri c, see Appendix. 2. Balance sheet, capital structure and share repurchase authorization references are as of 1/31/2025. 3. Includes cash used for Capital Expenditures, Acquisitions, Share Repurchases, Payments on Principal on Long - Term Debt and Paymen ts on Principal on Finance Lease Obligations for fiscal years 2022, 2023 and 2024. 4. For detail, including a reconciliation of Pro Forma Adjusted EBITDA to net income, the most directly comparable GAAP metric, see Appendix. 5. Debt includes First Lien Term Loan, ABL Facility, Senior Notes, Finance Leases & Installment Notes. Share Repurchases 2 Substantial Liquidity 2 • $59.0 million of cash on hand • $469.7 million available under our revolving credit facility 3 - Year Historical Use of Cash 3 For Fiscal Years 2022, 2023 and 2024 Acquisitions 60% Capital Expenditures 11% Share Repurchases 20% Debt/Lease Payments 9% Q325 Cash Flow 1 • Cash generated by operating activities was $94.1 million • Free cash flow was $83.1 million • Cash provided by investing activities included $12.5 million in cash generated from the sale of a non - core business

8 End Market & Product - Level Expectations Q4 FY25 YOY Per Day Price/Mix Expectations Q4 FY25 YOY Per Day Volume Expectations Product Category Total (Incl. acquisitions) Organic Down high single digits •Single - family: Down ~35% •Multi - family: Down ~20% •Commercial: Flat to up slightly Down low - to - mid teens Down mid teens Total Wallboard: Up low single digits Roughly flat Ceilings: Down low double digits Down low double digits Steel Framing: Sales growth roughly flat YOY Complementary Products:

9 Consolidated Expectations Q4 FY25 Expectation Metric for Q4 FY25 Down high single digits YOY in total, Down low double digits organically Net Sales ~31.2% Gross Margin $20 million - $22 million GAAP Net Income $100 million - $110 million Adjusted EBITDA 1 ~8.0% Adjusted EBITDA Margin 1 Full Year FY25 Expectation Metric for Full Year FY25 ~ $91 million - $93 million Interest Expense ~ $45 million to $50 million Capital Expenditures ~ 60% to 65% of FY25 Adj. EBITDA 1 Free Cash Flow 1 ~ 26.5% - 27% Tax Rate 2 1 For a reconciliation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income or Free Cash Flow to the most directly c omp arable GAAP metrics, see Appendix. 2 Tax rate refers to the normalized cash tax rate excluding the impact of acquisition accounting and certain other deferred tax am ounts.

10 Appendix

11 Summary Quarterly Financials Commentary A. Net reduction in branches is a result of the divestiture of Leading Edge Insulation (LEI) and branch closures in the Northeast, offset by two additional Greenfield openings (In millions) 1Q24 2Q24 3Q24 4Q24 FY24 1Q25 2Q25 3Q25 (Unaudited) Wallboard Volume (MSF) 1,204 1,231 1,101 1,234 4,769 1,233 1,211 1,047 Wallboard Price ($ / '000 Sq. Ft.) 475$ 476$ 473$ 475$ 475$ 477$ 481$ 479$ Wallboard 571$ 585$ 521$ 586$ 2,263$ 588$ 582$ 502$ Ceilings 175 175 156 189 695 207 204 181 Steel framing 237 232 203 220 893 210 217 180 Complementary products 426 428 379 418 1,651 444 467 399 Net sales 1,410 1,421 1,258 1,413 5,502 1,448 1,471 1,261 Cost of sales 959 962 844 962 3,726 997 1,010 868 Gross profit 451 459 415 451 1,775 452 461 393 Gross margin 32.0% 32.3% 33.0% 31.9% 32.3% 31.2% 31.4% 31.2% Operating expenses (income): Selling, general and administrative expenses 287 301 296 316 1,199 315 324 311 Depreciation and amortization 32 33 33 36 133 38 42 42 Impairment of goodwill - - - - - - - 42 Gain on sale of business (7) Total operating expenses 319 334 328 351 1,332 353 366 388 Operating income 132 125 86 100 443 98 95 5 Other (expense) income: Interest expense (19) (19) (19) (19) (75) (22) (24) (23) Write-off of discount and deferred financing costs (1) - - (1) (2) - - - Other income, net 2 2 2 3 9 2 1 1 Total other expense, net (18) (17) (17) (17) (69) (20) (22) (22) Income (loss) before taxes 114 108 69 83 375 78 72 (17) Income tax expense 27 27 17 27 98 21 18 4 Net income (loss) 87$ 81$ 52$ 56$ 276$ 57$ 54$ (21)$ Business Days 64 65 62 64 255 64 65 62 Net Sales by Business Day 22.0$ 21.9$ 20.3$ 22.1$ 21.6$ 22.6$ 22.6$ 20.3$ Beginning Branch Count 304 305 308 311 304 316 325 331 Added (Reduced) Branches (A) 1 3 3 5 12 9 6 (9) Ending Branch Count 305 308 311 316 316 325 331 322

12 Quarterly Cash Flows (1) Free cash flow is a non - GAAP financial measure defined as net cash provided by (used in) operations less capital expenditures. D ifferences may occur due to rounding. ($ in millions) (Unaudited) 1Q24 2Q24 3Q24 4Q24 FY24 1Q25 2Q25 3Q25 Net income (loss) $ 86.8 $ 81.0 $ 51.9 $ 56.4 $ 276.1 $ 57.2 $ 53.5 $ (21.4) Non-cash changes & other changes (12.3) 48.2 27.5 81.1 144.5 (12.5) 64.7 59.8 Changes in primary working capital components: Trade accounts and notes receivable (38.2) (51.1) 92.1 (29.3) (26.5) (36.4) (11.8) 149.0 Inventories (1.4) 21.6 (20.3) 17.1 17.0 (20.6) 16.4 (9.4) Accounts payable (28.3) 18.4 (47.0) 79.0 22.2 (10.6) (7.2) (83.8) Cash provided by (used in) operating activities 6.6 118.1 104.3 204.2 433.2 (22.9) 115.6 94.1 Purchases of property and equipment (13.5) (16.0) (10.2) (17.5) (57.2) (9.0) (14.1) (11.0) Proceeds from sale of assets 1.0 0.7 0.2 0.7 2.7 1.2 1.1 13.6 Acquisitions of businesses, net of cash acquired (39.0) (17.0) 0.6 (320.8) (376.2) (118.5) (88.8) 2.9 Other investing activities - - - - - - (5.2) - Cash (used in) provided by investing activities (51.5) (32.3) (9.4) (337.6) (430.8) (126.2) (107.0) 5.5 Cash provided by (used in) financing activities (39.1) (89.7) (83.9) 212.2 (0.4) 35.3 22.4 (123.6) Effect of exchange rates 0.7 (1.1) 0.8 (1.1) (0.6) 0.9 (0.3) (0.9) Increase (decrease) in cash and cash equivalents (83.3) (4.9) 11.8 77.8 1.4 (113.0) 30.8 (24.9) Balance, beginning of period 164.7 81.4 76.5 88.3 164.7 166.1 53.2 83.9 Balance, end of period $ 81.4 $ 76.5 $ 88.3 $ 166.1 $ 166.1 $ 53.2 $ 83.9 $ 59.0 Supplemental cash flow disclosures: Cash paid for income taxes $ 3.2 $ 66.1 $ 24.4 $ 26.7 $ 120.4 $ 2.9 $ 43.1 $ 12.3 Cash paid for interest $ 21.9 $ 13.5 $ 22.0 $ 13.5 $ 70.8 $ 26.7 $ 19.2 $ 26.6 Cash provided by (used in) operating activities $ 6.6 $ 118.1 $ 104.3 $ 204.2 $ 433.2 $ (22.9) $ 115.6 $ 94.1 Purchases of property and equipment (13.5) (16.0) (10.2) (17.5) (57.2) (9.0) (14.1) (11.0) Free cash flow (1) $ (6.9) $ 102.1 $ 94.1 $ 186.7 $ 376.0 $ (31.9) $ 101.5 $ 83.1

13 Q3 2025 Net Sales 1. Organic net sales growth calculation excludes net sales of acquired businesses until first anniversary of acquisition date an d i mpact of foreign currency translation. ($ in millions) (Unaudited) FY25 FY24 Reported Organic (1) Organic (1) 1,174.0$ 1,258.3$ Acquisitions 95.8 - Fx Impact (9.1) - Total Net Sales 1,260.7$ 1,258.3$ 0.2% (6.7%) Wallboard 501.7$ 520.7$ (3.6%) (7.4%) Ceilings 180.7 155.7 16.0% 4.4% Steel Framing 179.7 203.4 (11.6%) (17.9%) Complementary Products 398.6 378.6 5.3% (4.3%) Total Net Sales 1,260.7$ 1,258.3$ 0.2% (6.7%) Fiscal Q3 Variance

14 Quarterly Net Income (Loss) to Adjusted EBITDA Reconciliation Commentary A. Represents changes in the fair value of stock appreciation rights B. Represents changes in the fair value of noncontrolling interests C. Represents non - cash equity - based compensation expense related to the issuance of share - based awards D. Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility E. Represents one - time costs related to acquisitions paid to third parties F. Includes gains and losses from the sale and disposal of assets G. Represents the non - cash cost of sales impact of purchase accounting adjustments to increase inventory to its estimated fair value H. Represents the change in fair value of contingent consideration arrangements I. Represents expenses paid to third party advisors related to debt refinancing activities ( $ in 000s) 1Q24 2Q24 3Q24 4Q24 FY24 1Q25 2Q25 3Q25 (Unaudited) Net Income (Loss) 86,830$ 80,957$ 51,905$ 56,387$ 276,079$ 57,248$ 53,536$ (21,409)$ Add: Interest Expense 18,914 18,742 18,784 19,021 75,461 22,213 23,697 23,069 Add: Write off of debt discount and deferred financing fees 1,401 - - 674 2,075 - - - Less: Interest Income (474) (292) (378) (610) (1,754) (370) (193) (189) Add: Income Tax Expense 26,734 27,205 17,468 26,680 98,087 20,946 18,890 4,177 Add: Depreciation Expense 16,327 16,963 17,276 18,640 69,206 19,228 20,529 21,271 Add: Amortization Expense 15,691 15,974 15,528 16,963 64,156 18,804 21,549 21,159 EBITDA 165,423$ 159,549$ 120,583$ 137,755$ 583,310$ 138,069$ 138,008$ 48,078$ Adjustments Impairment of goodwill - - - - - - - 42,454 Stock appreciation rights (A) 1,218 401 1,789 1,983 5,391 243 397 691 Redeemable noncontrolling interests (B) 480 184 461 302 1,427 422 693 34 Equity-based compensation (C) 3,304 5,111 3,559 3,644 15,618 3,678 4,925 3,422 Severance and other permitted costs (D) 406 882 1,033 307 2,628 956 6,460 2,282 Transaction costs (acquisition and other) (E) 1,385 1,223 765 1,483 4,856 1,299 1,193 789 (Gain) loss on disposal of assets (F) (131) (310) (222) (66) (729) 858 (351) (5,333) Effects of fair value adjustments to inventory (G) 302 140 8 1,183 1,633 375 106 3 Change in fair value of contingent consideration (H) - - - - - - 793 621 Debt transaction costs (I) 911 378 44 (13) 1,320 (20) - - Total Adjustments 7,875$ 8,009$ 7,437$ 8,823$ 32,144$ 7,812$ 14,216$ 44,963$ Adjusted EBITDA (as reported) 173,298$ 167,558$ 128,020$ 146,578$ 615,454$ 145,881$ 152,224$ 93,041$ Net Sales $1,409,600 $1,420,930 $1,258,348 $1,413,029 $5,501,907 $1,448,456 $1,470,776 $1,260,710 Adjusted EBITDA Margin 12.3% 11.8% 10.2% 10.4% 11.2% 10.1% 10.3% 7.4%

15 Net Income (Loss) to Pro Forma Adjusted EBITDA Reconciliation Commentary A. Represents changes in the fair value of stock appreciation rights B. Represents changes in the fair value of noncontrolling interests C. Represents non - cash equity - based compensation expense related to the issuance of share - based awards D. Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility E. Represents costs related to acquisitions paid to third parties F. Includes gains and losses from the sale and disposal of assets G. Represents the non - cash cost of sales impact of acquisition accounting adjustments to increase inventory to its estimated fair value H. Represents the change in fair value of contingent consideration arrangements I. Represents costs paid to third - party advisors related to debt refinancing activities J. Pro forma impact of earnings from acquisitions from the beginning of the LTM period to the date of acquisition, including synergies ( $ in 000s) LTM FY25 Q3 2024 2023 2022 2021(Unaudited) Net Income 145,762$ 276,079$ 332,991$ 273,442$ 105,560$ Add: Interest Expense 88,000 75,461 65,843 58,097 53,786 Add: Write off of debt discount and deferred financing fees 674 2,075 - - 4,606 Less: Interest Income (1,362) (1,754) (1,287) (163) (86) Add: Income Tax Expense 70,693 98,087 114,512 91,377 31,534 Add: Depreciation Expense 79,668 69,206 61,177 55,437 50,480 Add: Amortization Expense 78,475 64,156 65,730 63,795 57,645 EBITDA 461,910$ 583,310$ 638,966$ 541,985$ 303,525$ Adjustments Impairment of goodwill 42,454 - - - - Stock appreciation rights (A) 3,314 5,391 7,703 4,403 3,173 Redeemable noncontrolling interests (B) 1,451 1,427 1,178 1,983 1,288 Equity-based compensation (C) 15,669 15,618 13,217 10,968 8,442 Severance and other permitted costs (D) 10,005 2,628 2,788 1,132 2,948 Transaction costs (acquisition and other) (E) 4,745 4,856 1,961 3,545 1,068 (Gain) loss on disposal of assets (F) (4,892) (729) (1,413) (913) (1,011) Effects of fair value adjustments to inventory (G) 1,667 1,633 1,123 3,818 788 Change in fair value of contingent consideration (H) 1,414 - - - - Gain on legal settlement - - - - (1,382) Debt transaction costs (I) (13) 1,320 173 - 532 Total Adjustments 75,814$ 32,144$ 26,730$ 24,936$ 15,846$ Adjusted EBITDA (as reported) 537,724 615,454$ 665,696$ 566,921$ 319,371$ Contributions from acquisitions 16,572 24,213 9,535 21,348 4,948 Pro Forma Adjusted EBITDA (J) 554,296$ 639,667$ 675,231$ 588,269$ 324,319$ Net Sales $5,592,971 $5,501,907 $5,329,252 $4,634,875 $3,298,823 Adjusted EBITDA margin (as reported) 9.6% 11.2% 12.5% 12.2% 9.7%

16 Income (Loss) Before Taxes to Adjusted Net Income Reconciliation Commentary A. Represents all non - cash amortization resulting from business combinations. To make the financial presentation more consistent with other public building products companies, beginning in the first quarter 2025 we are now including an adjustment for all non - cash amortization expense related to acquisitions, as opposed to non - cash amortization and depreciation for select acquisitions B. Normalized cash tax rate excluding the impact of acquisition accounting and certain other deferred tax amounts ($ in 000s) 3Q25 3Q24 (Unaudited) Income (Loss) before taxes (17,232)$ 69,373$ EBITDA adjustments 44,963 7,437 Amortization expense (A) 21,159 15,528 Adjusted pre-tax income 48,890 92,338 Adjusted income tax expense 12,711 23,546 Adjusted net income 36,179$ 68,792$ Effective tax rate (B) 26.0% 25.5% Weighted average shares outstanding: Basic 38,708 39,864 Diluted 39,252 40,512 Adjusted net income per share: Basic 0.93$ 1.73$ Diluted 0.92$ 1.70$

17 Reported SG&A to Adjusted SG&A Reconciliation Commentary A. Represents changes in the fair value of stock appreciation rights B. Represents changes in the fair value of noncontrolling interests C. Represents non - cash equity - based compensation expense related to the issuance of share - based awards D. Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility E. Represents one - time costs related to acquisitions paid to third parties F. Includes gains and losses from the sale and disposal of assets G. Represents costs paid to third - party advisors related to debt refinancing activities (Unaudited) 1Q24 2Q24 3Q24 3Q24 FY2024 1Q25 2Q25 3Q25 ($ in millions) SG&A - Reported 286.8$ 300.9$ 295.7$ 315.5$ 1,198.9$ 315.2$ 324.2$ 310.8$ Adjustments Stock appreciation rights (A) (1.2) (0.4) (1.8) (2.0) (5.4) (0.2) (0.4) (0.7) Redeemable noncontrolling interests (B) (0.5) (0.2) (0.5) (0.3) (1.4) (0.4) (0.7) (0.0) Equity-based compensation (C) (3.3) (5.1) (3.6) (3.6) (15.6) (3.7) (4.9) (3.4) Severance and other permitted costs (D) (0.4) (0.9) (1.0) (0.3) (2.6) (1.0) (6.5) (2.3) Transaction costs (acquisition and other) (E) (1.4) (1.2) (0.8) (1.5) (4.9) (1.3) (1.2) (0.8) Gain (loss) on disposal of assets (F) 0.1 0.3 0.2 0.1 0.7 (0.9) 0.4 (2.1) Debt transaction costs (G) (0.9) (0.4) (0.0) 0.0 (1.3) 0.0 - - SG&A - Adjusted 279.2$ 293.0$ 288.3$ 307.9$ 1,168.4$ 307.7$ 310.9$ 301.5$ Net Sales 1,409.6$ 1,420.9$ 1,258.3$ 1,413.0$ 5,501.9$ 1,448.5$ 1,470.8$ 1,260.7$ Adjusted SG&A Margin 19.8% 20.6% 22.9% 21.8% 21.2% 21.2% 21.1% 23.9%

18 Leverage Summary (1) Net of unamortized discount of $2.3mm, $2.0mm, $1.9mm, $1.8mm and $1.7mm as of January 31, 2024, April 31, 2024, July 31, 202 4, October 31, 2024 and January 31, 2025, respectively. (2) Net of deferred financing costs of $3.8mm, $4.4mm, $4.3mm, $4.0mm and $3.8mm as of January 31, 2024, April 31, 2024, July 31, 20 24, October 31, 2024 and January 31, 2025, respectively. (3) Net of deferred financing costs of $3.6mm, $3.4mm, $3.2mm, $3.1mm and $2.9mm as of January 31, 2024, April 31, 2024, July 31, 20 24, October 31, 2024 and January 31, 2025, respectively. (4) For detail, including a reconciliation of Pro Forma Adjusted EBITDA to net income, the most directly comparable GAAP metric, see Appendix. ($ mm) 1/31/24 4/30/24 7/31/24 10/31/24 1/31/25 LTM LTM LTM LTM LTM Cash and cash equivalents $88 $166 $53 $84 $59 ABL Facility $29 $270 $359 $449 $373 First Lien Term Loan (1) (2) 493 491 490 489 488 Senior Notes (3) 346 347 347 347 347 Finance Lease Obligations 158 169 174 185 191 Installment Notes & Other 4 4 10 10 11 Total Debt $1,031 $1,281 $1,380 $1,480 $1,410 Total Net Debt $942 $1,114 $1,327 $1,396 $1,351 PF Adj. EBITDA (4) $629 $642 $623 $604 $554 Total Debt / PF Adj. EBITDA 1.6x 2.0x 2.2x 2.5x 2.5x Net Debt / PF Adj. EBITDA 1.5x 1.7x 2.1x 2.3x 2.4x

19 Net Income to Adjusted EBITDA Outlook Reconciliation Q4 FY25 Net Income $20 - $22 Interest expense, net 21.4 - 23.6 Provision for income taxes 6.9 - 7.6 Depreciation and amortization expense 38.3 - 42.2 Other Adjustments 13.4 - 14.7 Adjusted EBITDA $100 - $110

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

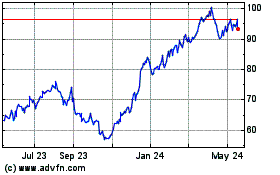

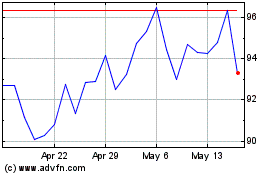

GMS (NYSE:GMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

GMS (NYSE:GMS)

Historical Stock Chart

From Mar 2024 to Mar 2025