IDACORP, Inc. (NYSE: IDA) reported fourth quarter 2024 net

income attributable to IDACORP of $37.9 million, or $0.70 per

diluted share, compared with $31.3 million, or $0.61 per diluted

share, in the fourth quarter of 2023. For the full year ended

December 31, 2024, IDACORP reported net income attributable to

IDACORP of $289.2 million, or $5.50 per diluted share, compared

with $261.2 million, or $5.14 per diluted share, in 2023.

“IDACORP's earnings in 2024 benefited from continued strong

customer growth, rate changes, spring and summer weather conditions

that contributed to higher customer usage, and the use of tax

credits under the company’s Idaho regulatory mechanism,” said

IDACORP President and Chief Executive Officer Lisa Grow. "Higher

depreciation and financing costs partially offset those benefits

during the year, as we continued to acquire resources and build

infrastructure to respond to rapidly growing customer needs."

“To support ongoing growth and energy reliability and resiliency

for all of our customers, we anticipate another year of substantial

capital investment,” Grow added.

IDACORP is initiating its full-year 2025 earnings guidance in

the range of $5.65 to $5.85 per diluted share with the expectation

that Idaho Power will use between $60 and $77 million of additional

tax credits available under the Idaho regulatory mechanism in 2025.

The earnings guidance also assumes normal weather conditions and

power supply expenses throughout the year.

Summary of Financial Results

The following is a summary of net income attributable to IDACORP

and IDACORP's earnings per diluted share for the three months and

year ended December 31, 2024 and 2023 (in thousands, except

earnings per share amounts):

Three months ended

December 31,

Year ended

December 31,

2024

2023

2024

2023

Net income attributable to IDACORP,

Inc.

$

37,876

$

31,259

$

289,174

$

261,195

Weighted average outstanding shares –

diluted

53,919

50,934

52,615

50,806

IDACORP, Inc. earnings per diluted

share

$

0.70

$

0.61

$

5.50

$

5.14

The table below provides a reconciliation of net income

attributable to IDACORP for the three months and year ended

December 31, 2024, from the same periods in 2023 (items are in

millions and are before related income tax impact unless otherwise

noted):

Three months ended

Year ended

Net income attributable to IDACORP,

Inc. - December 31, 2023

$

31.3

$

261.2

Increase (decrease) in Idaho Power net

income:

Retail revenues per megawatt-hour (MWh),

net of power cost adjustment and Idaho Fixed Cost Adjustment (FCA)

mechanisms

8.7

52.7

Customer growth, net of associated power

supply costs and power cost adjustment mechanisms

1.9

19.0

Usage per retail customer, net of

associated power supply costs and power cost adjustment

mechanisms

2.5

4.5

Transmission wheeling-related revenues,

net of Idaho jurisdiction power cost adjustment (PCA) mechanism

impacts

—

(3.0

)

Other operations and maintenance (O&M)

expenses

(13.2

)

(61.1

)

Depreciation expense

(6.3

)

(28.1

)

Other changes in operating revenues and

expenses, net

11.8

30.8

Increase in Idaho Power operating

income

5.4

14.8

Non-operating expense, net

(2.5

)

(2.2

)

Additional accumulated deferred investment

tax credits (ADITC) amortization

14.8

29.8

Income tax expense, excluding additional

ADITC amortization

(13.9

)

(18.6

)

Total increase in Idaho Power net

income

3.8

23.8

Other IDACORP changes (net of tax)

2.8

4.2

Net income attributable to IDACORP,

Inc. - December 31, 2024

$

37.9

$

289.2

Net Income - Fourth Quarter 2024

IDACORP's net income increased $6.6 million for the fourth

quarter of 2024 compared with the fourth quarter of 2023, due

primarily to higher net income at Idaho Power.

The net increase in retail revenues per MWh, net of power cost

adjustment and FCA mechanisms, increased operating income by $8.7

million in the fourth quarter of 2024 compared with the fourth

quarter of 2023. The increase is due primarily to higher Idaho base

rates, effective January 1, 2024, per the terms of the settlement

stipulation for Idaho Power's 2023 Idaho general rate case (2023

Settlement Stipulation).

Idaho Power's customer growth of 2.6% added $1.9 million to

Idaho Power's operating income in the fourth quarter of 2024

compared with the fourth quarter of 2023. Usage per retail customer

increased operating income by $2.5 million in the fourth quarter of

2024 compared with the fourth quarter of 2023.

Total other O&M expenses in the fourth quarter of 2024 were

$13.2 million higher than the fourth quarter of 2023, mainly driven

by approximately $4.7 million of increased pension-related expenses

and an approximate $7.5 million increase in wildfire mitigation

program and related insurance expenses. Both of these increases in

expenses were partially offset by increases in retail revenues, as

more costs are now recovered in base rates pursuant to the 2023

Settlement Stipulation.

Depreciation expense increased $6.3 million in the fourth

quarter of 2024 compared with the fourth quarter of 2023 due

primarily to an increase in plant-in-service.

Other changes in operating revenues and expenses, net, increased

operating income by $11.8 million in the fourth quarter of 2024

compared with the fourth quarter of 2023, due primarily from the

successful conclusion to multi-year litigation efforts challenging

Idaho and Oregon property tax valuations which resulted in refunds

of prior year taxes being finalized in the fourth quarter of 2024.

The change was also partially due to the timing of recording and

adjusting regulatory accruals and deferrals.

Non-operating expense, net, increased $2.5 million in the fourth

quarter of 2024 compared with the fourth quarter of 2023. Interest

expense on long-term debt increased in the fourth quarter of 2024

compared with the fourth quarter of 2023, due primarily to an

increase in long-term debt balances. In addition, Idaho Power's

earnings from its investment in Bridger Coal Company (BCC)

decreased $2.4 million in the fourth quarter of 2024 compared with

the fourth quarter of 2023, due to a decrease in the amount

included and recovered in base rates pursuant to the 2023

Settlement Stipulation. These increases were partially offset by an

increase in AFUDC income in the fourth quarter of 2024 compared to

fourth quarter of 2023, as the average construction work in

progress balance was higher. Additionally, interest income

increased due to higher average cash balances and interest rates

compared with 2023.

The increase in income tax expense was primarily due to fourth

quarter 2023 plant-related tax adjustments that resulted in a

benefit at Idaho Power. Idaho Power recorded $7.3 million of

additional ADITC amortization under its Idaho regulatory settlement

stipulation in the fourth quarter of 2024, but reversed $7.5

million of additional ADITC amortization during the fourth quarter

of 2023.

Net Income - Full-Year 2024

IDACORP's net income increased $28 million for 2024 compared

with 2023, due primarily to higher net income at Idaho Power.

The net increase in retail revenues per MWh, net of power cost

adjustment and FCA mechanisms, increased operating income by $52.7

million in 2024 compared with 2023. This benefit was primarily due

to an overall increase in Idaho base rates, effective January 1,

2024, per the terms of the 2023 Settlement Stipulation.

Idaho Power's customer growth of 2.6 percent added $19.0 million

to Idaho Power's operating income in 2024 compared with 2023. Usage

per retail customer increased operating income by $4.5 million in

2024 compared with 2023. Overall, usage per customer was relatively

flat for most customer classes, with irrigation customers

representing an increase, as higher temperatures during the summer

led irrigation customers to run irrigation pumps more

frequently.

Transmission wheeling-related revenues, net of PCA impacts,

decreased $3.0 million during 2024 compared with 2023. Effective

January 1, 2024, financial settlement of transmission line losses

were subject to the PCA mechanism, as approved in the 2023

Settlement Stipulation, resulting in a smaller contribution of

those revenues to net income compared with 2023 when the financial

settlement of transmission losses was not subject to the PCA

mechanism.

Other O&M expenses in 2024 were $61.1 million higher than in

2023, primarily related to approximately $17.7 million of increased

pension-related expenses and an approximate $29.5 million increase

in wildfire mitigation program and related insurance expenses. Both

of these increases were partially offset by increases in retail

revenues, as more of those costs are now recovered in base rates

pursuant to the 2023 Settlement Stipulation. Inflationary pressures

on labor-related costs also contributed to the increase in other

O&M expenses. These increases were partially offset by an $8.5

million increase in deferral of other O&M expenses related to

the conversion from coal to natural gas for two units at the Jim

Bridger plant.

Depreciation expense increased $28.1 million in 2024 compared to

2023, due primarily to an increase in plant-in-service.

Other changes in operating revenues and expenses, net, increased

operating income by $30.8 million in 2024 compared to 2023, due

partially to a decrease in net power supply expenses that were not

deferred for future recovery in rates through Idaho Power's power

cost adjustment mechanisms. More moderate wholesale natural gas and

power market prices in the western United States and increased

wholesale energy sales decreased Idaho Power's net power supply

expenses in 2024 compared with 2023. In addition, property taxes

contributed to the increase from 2023 to 2024, due primarily to the

successful conclusion of multi-year litigation efforts challenging

Idaho and Oregon property tax valuations, which resulted in refunds

of prior year taxes being finalized in 2024. The change was also

partially due to the timing of recording and adjusting regulatory

accruals and deferrals.

Non-operating expense, net, increased $2.2 million in 2024

compared with 2023. Interest expense on long-term debt increased in

2024 compared with 2023, due primarily to an increase in long-term

debt balances. In addition, Idaho Power's earnings from its

investment in BCC decreased due to a decrease in the amount

included and recovered in base rates pursuant to the 2023

Settlement Stipulation. These increases were partially offset by an

increase in AFUDC income in 2024 compared with 2023, as the average

construction work in progress balance was higher. Additionally,

interest income increased due to higher average cash balances and

interest rates compared with 2023.

Idaho Power recorded $29.8 million of additional ADITC

amortization under its Idaho regulatory settlement stipulation

during 2024, but recorded no additional ADITC amortization during

2023. The $18.6 million increase in income tax expense, excluding

additional ADITC amortization, in 2024 compared with 2023 was

primarily due to higher income before income taxes and variances in

flow-through tax adjustments.

Annual Earnings Guidance and Key Operating and Financial

Metrics

IDACORP is initiating its earnings guidance estimate for 2025.

The 2025 guidance incorporates all of the key operating and

financial assumptions listed in the table that follows (in

millions, except per share amounts):

2025 Estimate(1)

2024 Actual(2)

IDACORP Earnings Guidance (per diluted

share)

$ 5.65 – $ 5.85

$ 5.50

Idaho Power Additional ADITCs

$ 60 – $ 77

$ 29.8

Idaho Power O&M Expense

$ 465 – $ 475

$ 461

Idaho Power Capital Expenditures,

Excluding AFUDC

$ 1,000 – $ 1,100

$ 943

Idaho Power Hydropower Generation

(MWh)

6.5 – 8.5

7.2

(1)

As of February 20, 2025. Assumes

normal weather conditions and power supply expenses through the end

of 2025.

(2)

On an accrual basis.

More detailed financial and operational information is provided

in IDACORP’s Annual Report on Form 10-K filed today with the U.S.

Securities and Exchange Commission, which is also available for

review on IDACORP’s website at www.idacorpinc.com.

Web Cast / Conference Call

IDACORP will hold an analyst conference call today at 2:30 p.m.

Mountain Time (4:30 p.m. Eastern Time). All parties interested in

listening may do so through a live webcast on IDACORP's website

(www.idacorpinc.com), or by calling (855) 761-5600 for listen-only

mode. The passcode for the call is 9290150. The conference call

logistics are also posted on IDACORP's website. Slides will be

included during the conference call. To access the slide deck,

please visit www.idacorpinc.com/investor-relations. A replay of the

conference call will be available on the company's website for 12

months and will be available shortly after the call.

Background Information

IDACORP, Inc. (NYSE: IDA), Boise, Idaho-based and formed in

1998, is a holding company comprised of Idaho Power, a regulated

electric utility; IDACORP Financial, an investor in affordable

housing and other real estate tax credit investments; and Ida-West

Energy, an operator of small hydroelectric generation projects that

satisfy the requirements of the Public Utility Regulatory Policies

Act of 1978. Idaho Power, headquartered in vibrant and fast-growing

Boise, Idaho, has been a locally operated energy company since

1916. Today, it serves a 24,000-square-mile service area in Idaho

and Oregon. Idaho Power’s goal to provide 100% clean energy by 2045

builds on its long history as a clean-energy leader that provides

reliable service at affordable prices. With 17 low-cost hydropower

projects at the core of its diverse energy mix, Idaho Power’s

residential, business, and agricultural customers pay among the

nation's lowest prices for electricity. Its 2,100 employees proudly

serve more than 650,000 customers with a culture of safety first,

integrity always, and respect for all. To learn more about IDACORP

or Idaho Power, visit www.idacorpinc.com or www.idahopower.com.

Forward-Looking Statements

In addition to the historical information contained in this

press release, this press release contains (and oral communications

made by IDACORP, Inc. (IDACORP) and Idaho Power Company (Idaho

Power) may contain) statements that relate to future events and

expectations, such as statements regarding projected or future

financial performance, power generation, cash flows, capital

expenditures, regulatory filings, dividends, capital structure or

ratios, load forecasts, strategic goals, challenges, objectives,

and plans for future operations. Such statements constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements that

express, or involve discussions as to, expectations, beliefs,

plans, objectives, assumptions, or future events or performance,

often, but not always, through the use of words or phrases such as

"anticipates," "believes," "could," "estimates," "expects,"

"intends," "potential," "plans," "predicts," "preliminary,"

"projects," "targets," "may," "may result," or similar expressions,

are not statements of historical facts and may be forward-looking.

Forward-looking statements are not guarantees of future

performance, involve estimates, assumptions, risks, and

uncertainties, and may differ materially from actual results,

performance, or outcomes. In addition to any assumptions and other

factors and matters referred to specifically in connection with

such forward-looking statements, factors that could cause actual

results or outcomes to differ materially from those contained in

forward-looking statements include those factors set forth in this

press release, IDACORP's and Idaho Power's most recent Annual

Report on Form 10-K, particularly Part I, Item 1A - "Risk Factors"

and Part II, Item 7 - "Management’s Discussion and Analysis of

Financial Condition and Results of Operations" of that report,

subsequent reports filed by IDACORP and Idaho Power with the U.S.

Securities and Exchange Commission (SEC), and the following

important factors: (a) decisions or actions by the Idaho and Oregon

public utilities commissions and the Federal Energy Regulatory

Commission that impact Idaho Power's ability to recover costs and

earn a return on investment; (b) changes to or the elimination of

Idaho Power's regulatory cost recovery mechanisms; (c) expenses and

risks associated with capital expenditures and contractual

obligations for, and the permitting and construction of, utility

infrastructure projects that Idaho Power may be unable to complete,

are delayed, or that may not be deemed prudent by regulators for

cost recovery or return on investment; (d) expenses and risks

associated with supplier and contractor delays and failure to

satisfy project quality and performance standards on utility

infrastructure projects, and the potential impacts of those delays

and failures on Idaho Power's ability to serve customers and

generate revenues; (e) the rapid addition of new industrial and

commercial customer load and the volatility of such new load

demand, resulting in increased risks and costs of power demand

potentially exceeding available supply; (f) the potential financial

impacts of industrial customers not meeting forecasted power usage

ramp rates or amounts; (g) impacts of economic conditions,

including an inflationary or recessionary environment and interest

rates, on items such as operations and capital investments, supply

costs and delivery delays, supply scarcity and shortages,

population growth or decline in Idaho Power's service area, changes

in customer demand for electricity, revenue from sales of excess

power, credit quality of counterparties and suppliers and their

ability to meet financial and operational commitments and on the

timing and extent of counterparties’ power usage, and collection of

receivables; (h) changes in residential, commercial, and industrial

growth and demographic patterns within Idaho Power's service area,

and the associated impacts on loads and load growth; (i) employee

workforce factors, including the operational and financial costs of

unionization or the attempt to unionize all or part of the

companies' workforce, the cost and ability to attract and retain

skilled workers and third-party contractors and suppliers, the cost

of living and the related impact on recruiting employees, and the

ability to adjust to fluctuations in labor costs; (j) changes in,

failure to comply with, and costs of compliance with laws,

regulations, policies, orders, and licenses, which may result in

penalties and fines, increase compliance and operational costs, and

impact recovery associated with increased costs through rates; (k)

abnormal or severe weather conditions, wildfires, droughts,

earthquakes, and other natural phenomena and natural disasters,

which affect customer sales, hydropower generation, repair costs,

service interruptions, public safety power shutoffs and

de-energization, liability for damage caused by utility property,

and the availability and cost of fuel for generation plants or

purchased power to serve customers; (l) advancement and adoption of

self-generation, energy storage, energy efficiency, alternative

energy sources, and other technologies that may reduce Idaho

Power's sale or delivery of electric power or introduce operational

vulnerabilities to the power grid; (m) variable hydrological

conditions and over-appropriation of surface and groundwater in the

Snake River Basin, which may impact the amount of power generated

by Idaho Power's hydropower facilities and power supply costs; (n)

ability to acquire equipment, materials, fuel, power, and

transmission capacity on reasonable terms and prices, particularly

in the event of unanticipated or abnormally high resource demands,

price volatility (including as a result of new or increased

tariffs), lack of physical availability, transportation

constraints, outages due to maintenance or repairs to generation or

transmission facilities, disruptions in the supply chain, or

reduced credit quality or lack of counterparty and supplier credit;

(o) inability to timely obtain and the cost of obtaining and

complying with required governmental permits and approvals,

licenses, rights-of-way, and siting for transmission and generation

projects and hydropower facilities; (p) disruptions or outages of

Idaho Power's generation or transmission systems or of any

interconnected transmission systems, which can result in liability

for Idaho Power, increased power supply costs and repair expenses,

and reduced revenues; (q) accidents, electrical contacts, fires

(either affecting or caused by Idaho Power facilities or

infrastructure), explosions, infrastructure failures, general

system damage or dysfunction, and other unplanned events that may

occur while operating and maintaining assets, which can cause

unplanned outages; reduce generating output; damage company assets,

operations, or reputation; subject Idaho Power to third-party

claims for property damage, personal injury, or loss of life; or

result in the imposition of fines and penalties; (r) acts or

threats of terrorism, acts of war, social unrest, cyber or physical

security attacks, and other malicious acts of individuals or groups

seeking to disrupt Idaho Power's operations or the electric power

grid or compromise data, or the disruption or damage to the

companies’ business, operations, or reputation resulting from such

events; (s) Idaho Power's concentration in one industry and one

region, and the resulting exposure to regional economic conditions

and regional legislation and regulation; (t) unaligned goals and

positions with co-owners of Idaho Power’s existing and planned

generation and transmission assets; (u) changes in tax laws or

related regulations or interpretations of applicable laws or

regulations by federal, state, or local taxing jurisdictions, and

the availability of expected tax credits or other tax benefits; (v)

ability to obtain debt and equity financing or refinance existing

debt when necessary and on satisfactory terms, which can be

affected by factors such as credit ratings, reputational harm,

volatility or disruptions in the financial markets, interest rates,

decisions by the Idaho, Oregon, or Wyoming public utility

commissions, and the companies' past or projected financial

performance; (w) ability to enter into financial and physical

commodity hedges with creditworthy counterparties to manage price

and commodity risk for fuel, power, and transmission, and the

failure of any such risk management and hedging strategies to work

as intended, and the potential losses the companies may incur on

those hedges, which can be affected by factors such as the volume

of hedging transactions and degree of price volatility; (x) changes

in actuarial assumptions, changes in interest rates, increasing

health care costs, and the actual and projected return on plan

assets for pension and other postretirement plans, which can affect

future pension and other postretirement plan funding obligations,

costs, and liabilities and the companies' cash flows; (y)

remediation costs associated with planned cessation of coal-fired

operations at Idaho Power's co-owned coal plants and conversion of

the plants to natural gas; (z) ability to continue to pay dividends

and achieve target dividend payout ratios based on financial

performance and capital requirements, and in light of credit rating

considerations, contractual covenants and restrictions, cash flows,

and regulatory limitations; (aa) adoption of or changes in

accounting policies and principles, changes in accounting

estimates, and new SEC or New York Stock Exchange requirements or

new interpretations of existing requirements; and (bb) changing

market dynamics due to the emergence of day ahead or other energy

and transmission markets in the western United States and

surrounding regions. Any forward-looking statement speaks only as

of the date on which such statement is made. New factors emerge

from time to time and it is not possible for the companies to

predict all such factors, nor can they assess the impact of any

such factor on the business or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. IDACORP and Idaho

Power disclaim any obligation to update publicly any

forward-looking information, whether in response to new

information, future events, or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220352308/en/

Investor and Analyst Contact John R. Wonderlich Investor

Relations Manager Phone: (208) 388-5413

JWonderlich@idahopower.com

Media Contact Jordan Rodriguez Corporate Communications Phone:

(208) 388-2460 JRodriguez@idahopower.com

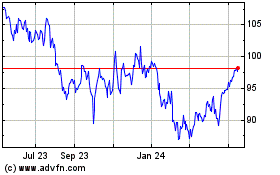

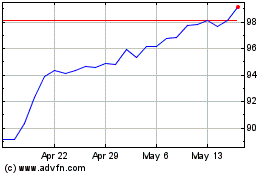

IDACORP (NYSE:IDA)

Historical Stock Chart

From Jan 2025 to Feb 2025

IDACORP (NYSE:IDA)

Historical Stock Chart

From Feb 2024 to Feb 2025