Trending: SAP Downgrades Its 2023 Operating Profit, Cloud Revenue Outlook

April 21 2023 - 10:51AM

Dow Jones News

1516 GMT- SAP SE is among the most mentioned companies across

news items over the past 12 hours, according to Factiva data, after

the company changed its 2023 outlook and reported a jump in

first-quarter revenue. The German-based software company downgraded

its non-IFRS operating profit outlook for the year, saying that it

expects it at constant currencies between EUR8.6 billion and EUR8.9

billion, compared with EUR8.8 billion to EUR9.1 billion previously.

SAP also downgraded its cloud revenue expectations at constant

currencies, saying it should come between EUR14 billion and EUR14.4

billion, down from between EUR15.3 billion to EUR15.7 billion

previously. Meanwhile, first-quarter revenue rose on a non-IFRS

basis to EUR7.44 billion, from EUR6.77 the prior year. SAP changed

its guidance to account for the divestment of its stake in

Qualtrics International, which it had announced in March for

roughly $7.7 billion, ING analyst Jan Frederik Slijkerman says in a

research note. "The results show that SAP is not impacted by

macroeconomic uncertainty. We continue to like the company because

of strong growth in the cloud segment, but also because of its

strong credit profile," the analyst says. Dow Jones & Co. owns

Factiva. (pierre.bertrand@wsj.com)

(END) Dow Jones Newswires

April 21, 2023 11:36 ET (15:36 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

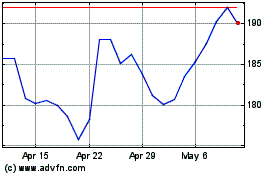

SAP (NYSE:SAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

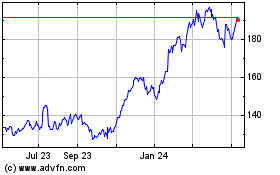

SAP (NYSE:SAP)

Historical Stock Chart

From Feb 2024 to Feb 2025