Athabasca Minerals Increases Ownership in Duvernay Frac Sand Project

May 07 2019 - 6:01AM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) is pleased to announce that it has increased its ownership in

the Duvernay Frac Sand Project (“Duvernay Project”) to 49.6%

through the acquisition of an additional 33.4% interest in

‘Privco2’, a private Alberta corporation that owns the project. To

date 55 auger holes have been drilled to assess the deposit and 395

samples have been delivered to AGAT Laboratories and 20 samples to

Stim-Lab Inc for independent analysis and testing. Privco2 has

engaged Stantec Consulting Ltd to prepare a National Instrument

43-101 resource estimate which is expected to be completed in

June-2019. The increase in ownership strengthens the Corporation’s

business position for the deployment of premium domestic in-basin

frac sand for Oil & Gas well-site operations in Western Canada.

Chief Executive Officer, Robert Beekhuizen,

states: “AMI is bullish about the potential and calibre of the

Duvernay Project to displace the market’s reliance on imported

American frac sand with a high-quality local alternative. Recent

field results from the delineation program are encouraging and

support AMI stepping-up its ownership without delay. The

Corporation’s strategic goal is to fortify AMI Silica Inc., its

wholly-owned subsidiary, with a portfolio of good quality,

strategically-located frac sand assets that can bring domestic

value improvements to customers.”

AMI has staged its increase of ownership in

Privco2, and the ensuing Duvernay Project, based on progressive

milestones in delineating and confirming the frac sand project. An

initial investment of $280,000 in cash and the issuance of 420,000

Athabasca (‘ABM’) shares was made for 16.2% interest in Privco2, as

previously announced on January 29, 2019. The additional

33.4% interest was acquired for $742,000 in cash and through the

issuance of 1,680,000 ABM shares. All cash invested into Privco2

are allocated for the purposes of exploration and development of

the Duvernay Frac Sand Project. The Corporation has the further

option to purchase the remaining 50.4% percent from Privco2

shareholders on or before January 29, 2020.

About Athabasca MineralsThe

Corporation is an integrated group of aggregates companies involved

in resource development, aggregates marketing and midstream

supply-logistics solutions. Business activities include aggregate

production, pit management services, sales from corporate-owned and

third-party pits, acquisitions of sand and gravel operations, and

new venture development. Athabasca Minerals is the parent company

of Aggregates Marketing Inc. – a midstream business providing

integrated supply and transportation solutions for industrial and

construction markets. It is also the parent company of AMI Silica

Inc. – a subsidiary positioning to become a leading supplier of

premium domestic in-basin frac sand with regional deposits in

Alberta and NE British Columbia. It is the joint venture owner of

the Montney In-Basin and Duvernay Basin Frac Sand Projects.

Additionally, the Corporation has industrial mineral leases, such

as those supporting the Richardson Quarry Project, that are

strategically positioned for future development in industrial

regions of high potential aggregates demand.

For further Information on Athabasca,

please contact:

Dean StuartT: 403-617-7609E:

dean@boardmarker.net

Robert BeekhuizenT: 587-525-9610

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

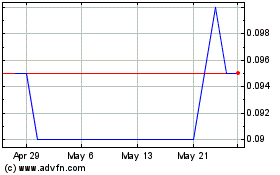

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

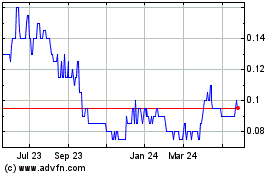

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025