Bodycote PLC Trading Update (0603A)

May 24 2019 - 1:00AM

UK Regulatory

TIDMBOY

RNS Number : 0603A

Bodycote PLC

24 May 2019

24 May 2019

Bodycote plc

Trading Update

Bodycote, the world's leading provider of heat treatment and

specialist thermal processing services, is issuing a trading update

covering the four-month period from 1 January to 30 April 2019

("the period"), ahead of the Company's 66(th) Annual General

Meeting, which will be held at 12.00pm today.

Current trading

Group revenue for the four months ended 30 April 2019 was

GBP245m, 1% higher than the same period last year (flat at constant

currency). On a divisional basis, ADE revenues were up 6% to

GBP100m (up 4% at constant currency), while AGI revenues were down

3% to GBP145m (also down 3% at constant currency).

Within the overall Group result, Specialist Technologies'

revenues grew 3% at constant currency, while Emerging Markets'

revenues grew 6%.

The following review of the Group's markets quotes all movements

based on growth against the same period in 2018, at constant

currency.

Aerospace and defence revenues grew 15%, with the strong growth

trend seen through the second half of last year continuing into

2019.

Automotive revenues fell 4%, with car & light truck revenues

negatively impacted by lower production volumes, particularly in

Western Europe. Year on year growth comparisons in car & light

truck are somewhat skewed, however, as the first half of 2018 was

particularly strong due to manufacturers accelerating deliveries

ahead of the introduction of the WLTP regulations.

General industrial revenues were 6% lower, with good growth in

the emerging markets more than offset by weakness in the developed

economies. The revenue declines in the developed markets are due to

the impact of business that was discontinued in H2 2018, as well as

what appears to be some hesitation in customers' capital investment

decisions.

Energy revenues were broadly flat, with stronger revenues from

subsea projects offsetting a decline in North American onshore oil

& gas revenues as a result of customer destocking.

Financial position

Net cash as at 30 April 2019 was GBP31m compared to GBP36m at 31

December 2018. This reflects continued strong underlying cash

generation in light of the typical working capital outflows in the

first few months of the year; the ongoing investment in the growth

of the business; and the purchase of shares for the settlement of

future long-term incentive awards. The Board will pay a final

dividend of 13.3p per share and the special dividend of 20.0p per

share on 7 June 2019, at a total cost of GBP64m.

EU State Aid Tax Case

In note 30 of its last reports and accounts, Bodycote reported

on a state aid investigation being conducted by the European

Commission. The note highlighted a maximum potential liability of

GBP20m in relation to this investigation. On April 25, the European

Commission released its decision that certain tax exemptions

offered by the UK authorities constituted State Aid and, as such,

will need to be recovered. Bodycote is working with its tax

advisers to understand the implications of this and determine what,

if any, exceptional charge may need to be booked.

Summary and Outlook

In the first four months, we have seen excellent growth in civil

aerospace revenues, offset by anticipated weakness in automotive

and general industrial revenues against strong comparatives from

the same period last year.

The full year outlook for civil aerospace remains strong, and

revenue growth for Specialist Technologies' is also expected to be

good. With easing comparatives in automotive in the second half of

the year, and provided current macroeconomic conditions do not

deteriorate, year on year growth should strengthen. The Board's

expectations for the full year remain unchanged.

Trading Update Conference Call

The Company will be hosting a conference call for analysts and

investors at 0810am today (Friday 24 May 2019).

Participant's dial in number: +44 333 300 9271

Participants will be asked for names only, no PIN required

For further information, please contact:

Bodycote plc

Stephen Harris, Group Chief Executive

Dominique Yates, Chief Financial Officer

Tel No +44(0) 1625 505300

FTI Consulting

Richard Mountain

Susanne Yule

Tel No +44 (0) 2037271340

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBCGDUBXDBGCX

(END) Dow Jones Newswires

May 24, 2019 02:00 ET (06:00 GMT)

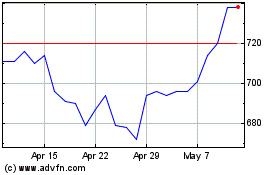

Bodycote (LSE:BOY)

Historical Stock Chart

From Feb 2025 to Mar 2025

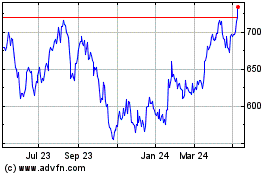

Bodycote (LSE:BOY)

Historical Stock Chart

From Mar 2024 to Mar 2025