Base Resources Limited FY23 results - Kwale continues to deliver strong financial performance

August 27 2023 - 6:01PM

UK Regulatory

TIDMBSE

AIM and Media Release

28 August 2023

Base Resources Limited

FY23 results - Kwale continues to deliver strong financial performance

African mineral sands producer and developer, Base Resources Limited (ASX & AIM:

BSE) (Base Resources or the Company) is pleased to present its results for the

year ended 30 June 2023 (FY23), with higher prices across all products

delivering an EBITDA of US$158.6 million and generating cash flows from

operations of US$117.4 million. The disciplined application of the Company's

capital management policy has supported the determination of a FY23 final

dividend of AUD 4 cents per share (unfranked).

Despite Kwale Operations' robust operational performance, a net loss of US$4.8

million was recorded, with profitability impacted by a non-cash impairment of

US$88.9 million following a reassessment of the carrying value of Kwale

Operations, reflecting the increased operating costs of mining the North Dune,

the softening outlook for mineral sands product prices over the remaining mine

life and an improved understanding of the ultimate costs of closure1.

The Toliara Project in Madagascar remains a significant growth opportunity for

the Company. Despite making sound progress in discussions with the Government

of Madagascar on the fiscal terms applicable to the project and the lifting of

the on-ground suspension, recent engagement has slowed whilst the Government

focuses on finalising its overhaul of the Malagasy Mining Code and preparations

for the upcoming presidential election. The Company remains committed to

developing the world class project and is ready to progress. However, until the

Mining Code reform is finalised, and the elections scheduled for late 2023 have

concluded, the Company does not expect to achieve material progress in securing

fiscal terms or lifting of the project's on-ground suspension. In parallel,

substantial effort is being applied to identification and progression of

attractive business development opportunities to secure optionality in the

project portfolio as well as broader funding options for ultimate Toliara

Project development.

Operational and development highlights for FY23

· Production of 68,814 tonnes of rutile, 297,861 tonnes of ilmenite, 25,954

tonnes of zircon and a combined 18,330 tonnes of low-grade rutile and zircon

products from Kwale Operations.

· Increase in average achieved prices of 18% for rutile, 3% for ilmenite and

3% for zircon compared to the prior year.

· Bumamani Project implementation completed and mining of the North Dune

orebody commenced, extending the mine life of Kwale Operations to December 2024.

· Toliara Project Rare Earths Concept Study completed, confirming the

substantial economic potential of the Toliara monazite content and advancing to

a Pre-Feasibility Study, which remains on track for completion in the March

quarter of 2024.

Financial highlights for FY23

· Revenue of US$271.4 million, with an 8% increase in average realised unit

sales price partially offsetting lower production and sales volumes when

compared to the prior year.

· EBITDA of US$158.6 million and underlying NPAT of US$84.0 million (before

the US$88.9 million impairment charge).

· Free cashflow of US$79.2 million (operating cashflows of US$117.4 million

less US$38.2 million invested to extend Kwale Operations mine life and progress

the Toliara Project).

· Net cash position of US$92.9 million at 30 June 2023.

Final dividend of AUD 4 cents per share determined

Consistent with its growth strategy, the Company seeks to provide returns to

shareholders through both long-term growth in the Company's share price and

appropriate cash distributions. Cash not required for the Company's growth and

development, or to maintain requisite balance sheet strength in light of

prevailing circumstances, can be expected to be returned to shareholders. In

the disciplined application of this capital management approach in the context

of anticipated future cashflows from Kwale Operations and the approaching

closure of the mine, the strategic opportunities being pursued and a net cash

position of US$92.9 million at the end of the period, the Board has determined a

final dividend of AUD 4.0 cents per share (unfranked), totalling A$47.1 million

in aggregate (approximately US$31.3 million).

Upon payment of the final dividend, dividends distributed to shareholders since

October 2020 will total AUD 22.5 cents per share, equal to A$265 million in

aggregate (approximately US$187 million).

The dividend will be paid wholly from conduit foreign income and have record and

payment dates of 11 September 2023 and 28 September 2023, respectively - for

further information, refer to Base Resources' accompanying announcement "FY23

Final Dividend - Key dates and information".

Managing Director of Base Resources, Tim Carstens, said:

"The 2023 financial year has been another operationally and financially

successful one. Strong operational performance, coupled with the continuation

of buoyant mineral sands markets, has delivered a record EBITDA for Kwale

Operations, even with the transition to the more challenging and lower grade ore

sources that will characterise the final years of the operation.

We continue to actively pursue additional mine life extension opportunities in

the Kwale East sector, with a second phase aircore drill program currently

underway. Given the inherent uncertainty associated with exploration,

significant effort is also going into planning for the ultimate closure of Kwale

Operations and the transition to post-mining land use, with the clear objective

of cementing a reputation for excellence in the full life cycle of mining.

The Toliara Project in Madagascar continues to represent a transformational

growth opportunity for the Company. By confirming the substantial commercial

potential of its monazite content, the Toliara Project Rare Earth concept study

has enhanced that opportunity and further reinforces our belief that the project

is the best undeveloped mineral sands asset in the world. We look forward to

sharing more as we complete the study phases and clear regulatory hurdles.

While engagement with the Government on the fiscal terms applicable to the

Toliara Project has slowed due to the Government's focus on its new mining code

and the presidential elections in late 2023, we are clear that our patient

approach is the right one to secure outcomes that will support the realisation

of optimum shareholder value and we remain fully committed to the project's

development.

Having finished the year with a significant cash balance, the Board has

determined an AUD 4 cents per share dividend. In the context of Kwale

Operations' approaching end of mine life and diminishing future cash generation

potential, we believe this strikes the right balance between delivering cash

returns to shareholders and retaining balance sheet strength to fund the

Company's strategic growth initiatives in pursuant of our 2031 vision of

multiple concurrent operations."

Documents attached and forming part of Base Resources' FY23 results reporting

suite

For further information in relation to Base Resources' FY23 operating and

financial results, refer to the PDF copies of the Company's 2023 Annual Report

and FY23 results Investor Presentation attached to this release and available

from the Company's website at:

https://baseresources.com.au/investors/announcements/.

Also attached to this release and available from the Company's website (link

above), and forming part of Base Resources' FY23 results reporting suite, is the

Company's FY23 Corporate Governance Statement.

Investor webcasts

Investor webcasts will be hosted by Tim Carstens (Managing Director) and Kevin

Balloch (Chief Financial Officer), who will both be available to answer

questions following a presentation of the Company's results.

Details for the webcasts and teleconferences are below. Participants will only

be able to ask questions via the teleconference line. Participants that propose

using the teleconference line will need to pre-register their details using the

teleconference registration URL provided below. Upon registering, participants

will receive an email with their unique PIN and dial-in details so that they can

join the call without needing to speak to an operator.

Australia webcast and teleconference

· Date: Monday, 28 August 2023

· Time: 8.30am AWST / 10.30am AEST

· Webcast URL: https://webcast.openbriefing.com/bse-fyr-2023/

· Teleconference registration URL:

https://registrations.events/direct/OCP61319

UK webcast and teleconference

· Date: Tuesday, 29 August 2023

· Time: 4.30pm AWST / 9.30am BST

· Webcast URL: https://webcast.openbriefing.com/bse-fyr-2023-uk/

· Teleconference registration URL:

https://registrations.events/direct/OCP60433

Forward looking statements

Certain statements in or in connection with this release contain or comprise

forward looking statements. Such statements may include, but are not limited

to, statements with regard to future production and grades, capital cost,

capacity, sales projections and financial performance and may be (but are not

necessarily) identified by the use of phrases such as "will", "expect",

"anticipate", "believe" and "envisage". By their nature, forward looking

statements involve risk and uncertainty because they relate to events and depend

on circumstances that will occur in the future and may be outside Base

Resources' control. Accordingly, results could differ materially from those set

out in the forward-looking statements as a result of, among other factors,

changes in economic and market conditions, success of business and operating

initiatives, changes in the regulatory environment and other government actions,

fluctuations in product prices and exchange rates and business and operational

risk management. Subject to any continuing obligations under applicable law or

relevant stock exchange listing rules, Base Resources undertakes no obligation

to update publicly or release any revisions to these forward-looking statements

to reflect events or circumstances after today's date or to reflect the

occurrence of unanticipated events.

[Note (1): Refer to note 13 to the FY23 consolidated financial statements

contained in the 2023 Annual Report for further details about the impairment.]

ENDS.

For further information contact:

+--------------------------------+-----------------------------+

|Australian Media Relations |UK Media Relations |

+--------------------------------+-----------------------------+

|Citadel Magnus |Tavistock Communications |

+--------------------------------+-----------------------------+

|Cameron Gilenko and Michael Weir|Jos Simson and Gareth Tredway|

+--------------------------------+-----------------------------+

|Tel: +61 8 6160 4900 |Tel: +44 207 920 3150 |

+--------------------------------+-----------------------------+

This release has been authorised by the Base Resources Disclosure Committee.

About Base Resources

Base Resources is an Australian based, African focused, mineral sands producer

and developer with a track record of project delivery and operational

performance. The Company operates the established Kwale Operations in Kenya and

is developing the Toliara Project in Madagascar. Base Resources is an ASX and

AIM listed company. Further details about Base Resources are available at

www.baseresources.com.au.

PRINCIPAL & REGISTERED OFFICE

Level 3, 46 Colin Street

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 8 9413 7400

Fax: +61 8 9322 8912

NOMINATED ADVISER & JOINT BROKER

Canaccord Genuity Limited

James Asensio / Raj Khatri

Phone: +44 20 7523 8000

JOINT BROKER

Berenberg

Matthew Armitt / Detlir Elezi

Phone: +44 20 3207 7800

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

https://mb.cision.com/Public/22548/3824549/b5b3327b9b47a596.pdf 2023 Corporate Governance Statement

https://mb.cision.com/Public/22548/3824549/b32eeec6590c4a57.pdf Presentation - FY23 Full Year Results

https://mb.cision.com/Public/22548/3824549/83569c8ce4fc15fa.pdf 2023 Annual Report

END

(END) Dow Jones Newswires

August 27, 2023 19:01 ET (23:01 GMT)

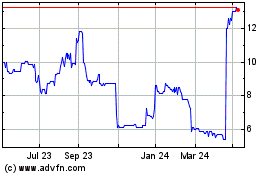

Base Resources (LSE:BSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

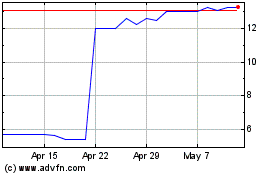

Base Resources (LSE:BSE)

Historical Stock Chart

From Apr 2023 to Apr 2024