TIDMPRD

RNS Number : 4540Z

Predator Oil & Gas Holdings PLC

12 January 2024

FOR IMMEDIATE RELEASE

12 January 2024

Predator Oil & Gas Holdings Plc / Index: LSE / Epic: PRD /

Sector: Oil & Gas

LEI 213800L7QXFURBFLDS54

Predator Oil & Gas Holdings Plc

("Predator" or the "Company" and together with its subsidiaries

the "Group")

Operations update and 2024 forward work programme

Highlights

-- Phase 1 Guercif rigless well testing scheduled to commence before 25 January

with Phase 2 using Sandjet scheduled for February/March

-- Site visit to Cory Moruga scheduled for 22 - 26 January to begin planning for well workovers

-- Cory Moruga Independent Technical Report gives P50 and P90

Contingent and Prospective gross recoverable resources of 14.31 and

21.41 million barrels respectively

-- H1 2024 well workovers forecast to generate gross net

operating profit of US$ 3.1 million in 12 months from H2 2024 to H1

2025

-- Cory Moruga Field Development Plan for P90 Contingent and

Prospective gross recoverable resources of 9.13 million barrels

gives gross US$202.12 million undiscounted net operating profit

(NPV@10% US$85.14 million with IRR 240.9%)

-- Well planning for discretionary high impact Jurassic well commenced for April/May drilling

-- Fully funded for all 2024 firm commitments

-- Potential for gas monetisation and Cory Moruga production

revenues to fund discretionary drilling

-- Low corporate and operating overhead maintained despite increase in activity

Predator Oil & Gas Holdings Plc (LSE: PRD), the Jersey based

Oil and Gas Company with near-term operations focussed on Morocco

and Trinidad, is pleased to provide an operations update.

CORY MORUGA PRODUCTION LICENCE ONSHORE TRINIDAD

Further to the announcement of 7 November 2023 in respect of the

acquisition of T-Rex Resources (Trinidad) Limited ("T-Rex"), the

Company is publishing today an Independent

Technical Report ("ITR") by Scorpion Geoscience Ltd. for the

Cory Moruga block and resource potential of the Snowcap

Discovery.

https://wp-predatoroilandgas-2020.s3.eu-west-2.amazonaws.com/media/2024/01/Cory-Moruga_ITR_20230111-final-11.01.24-13.11-hours.pdf

Oil resources

Table 1 Unrisked Gross(1) Contingent and Prospective

Oil-in-Place

and Recoverable Resources (million barrels oil)

Herrera Sand P90 P50 P10 Category

# 8 in place 4.57 5.94 7.54 Contingent

--------- -------------- ------------- ------------

# 8 recoverable 1.04 1.40 1.84 Contingent

--------- -------------- ------------- ------------

Recovery Factor

(%) 22.75 23.57 24.4

--------- -------------- ------------- ------------

# 1 to 7 in place 35.03 54.9 81.71 Prospective

--------- -------------- ------------- ------------

# 1 to 7 recoverable 8.09 12.91 19.57 Prospective

--------- -------------- ------------- ------------

Recovery Factor

(%) 23.09 23.51 23.95

--------- -------------- ------------- ------------

(1) Discussions commenced to acquire, subject to regulatory

consent, the remaining 16.2%

interest in Cory Moruga for an overriding royalty

Field size is indicated as being similar to the nearby mature

producing oil fields at Moruga West and Inniss-Trinity. Production

and reservoir data from these fields have been incorporated in

assessing the primary recovery factors used for the generation of

the resource figures shown in Table 1.

Wax suppression and pressure maintenance are seen as key aspects

of ensuring longer term productivity and improved Expected Ultimate

Recovery ("EUR"). Gas injection undertaken by BP in a single

compartment of the Moruga West Field boosted EUR recovery by an

additional 10% in 1963 but was abandoned due to a lack of gas. The

ITR notes that a 30% recovery factor may be achievable given that

Cory Moruga has a range of 5.67 to 13.8 BCF of associated gas

available for reinjection over a scoping 15-year production life of

the field modelled for the purpose of generating project

economics.

Later in field life CO2 EOR could be considered to potentially

boost EUR.

Geological risk in relation to the Prospective Resources are

summarised as the chances of not encountering reservoir;

encountering reservoir that is not saturated with oil; encountering

reservoir from which oil will not flow to surface and is not

producible.

Risks associated with the Herrera #8 Sand Contingent Resources

relate to the continuity and producibility of oil in the context of

tight borehole conditions, incomplete logging and limited well

testing.

Flow assurance relies on effective treatment for wax suppression

and the potential requirement for gravel-packed completions.

Uncertainty regarding future oil prices may also create

commercial risks from time to time during field life.

Workovers of existing Snowcap-1 and Snowcap-2ST1 discovery

wells

Management is making a site visit to Trinidad in the week of 22

January 2024 to meet with

local well services contractors and to identify workover rigs to

prepare for implementing the

Snowcap-1 and Snowcap-2ST1 well re-entries.

Subject to wireline well surveys to confirm borehole conditions,

a workover and wax treatment will be performed in H1 2024 on

Snowcap-1 for the Herrera #8 Sand. Initial Production Rate ("IPR")

is forecast to be 200 bopd declining to 130 bopd after 12

months.

A workover and wax treatment will be performed on Snowcap-2ST1

for the Herrera #7 and #8 Sands. Initial Production Rate ("IPR") is

forecast to be 200 bopd declining to 130 bopd after 12 months (with

an upside IPR potential of 300 to 400 bopd).

Wax treatment and gas management will be critical to reducing

the decline rates.

Total estimated gross costs for the workovers and for

re-establishing Cory Moruga oil production facilities are forecast

by the Company to be GBP500,000. The Company is fully funded to

execute the well workovers from discretionary cash in its 2024

working capital forecast.

Workovers will be completed as early as possible in H1 2024 with

forecast, ITR-supported, operating profits after all costs and

taxes for the 12 months from H2 2024 shown in Table 2 below.

Table 2 Unrisked post-tax net operating profit (US$)

12 months commencing June 2024 (WTI flat at US$76/barrel)

Q2/Q3 2024 Q4 2024 Q1 2025 Q2 2025

Snowcap-1 workover 623,084 420,611 374,667 220,148

----------- --------- ------------ -----------

Snowcap-2ST1 workover 557,712 372,966 334,122 201,163

----------- --------- ------------ -----------

Combined 1,180,796 793,577 708,789 421,311

----------- --------- ------------ -----------

Cory Moruga Field Development Plan ("FDP")

A Snowcap-3 appraisal well would be located to test the Herrera

#1 - 3 and #6 to 8 Sands and would be the first step in

implementing the FDP. The thickest Herrera #1 and #2 Sands were not

reached in either Snowcap-1 or Snowcap-2ST1 legacy wells within the

Snowcap structure defined by 3D seismic. Herrera #1 and #2 Sands

are the primary reservoir units in the adjoining Moruga West

Field.

Potential production from co-mingling the Herrera H#1, H#2 and

H#3 Sands is forecast to be 1,000 bopd IPR declining by 35% over 12

months .

Once H#1, H#2 and H#3 Sands are at equal pressure H#6, H#7 and

H#8 sands could be added to production for an additional 400 bopd

IPR declining by an estimated 35% over the first 12 months.

Snowcap-3 is estimated to cost a gross amount of US$3 million to

drill. Currently the appraisal well is planned for 2025 and could

be fully funded by the operating profits from the well workover

programme (Table 2 above).

A preliminary Base Case 15-year production profile and compared

with that for the adjoining former BP and Shell Moruga West field,

uses only the P90 oil resources and is presented in the ITR. It

assumes 14 new production wells and a peak scoping gross production

rate of 3,500 bopd.

Projected gross operating profits for the first 10 years of

production are shown in Table 3 below.

Table 3 Unrisked post-tax net operating profit (US$ millions)

10 years commencing 2025 (WTI flat at US$76/barrel)

2025 2026 2027 2028 2029 2030 2031 2032 2033 2034

2.989 11.899 27.168 21.541 25.600 29.228 23.890 20.132 9.609 9.587

------- ------- ------- ------- ------- ------- ------- ------ ------

Phased development drilling is expected to be funded from

post-tax operating profits to allow the Company to be fully funded

for all of its projected capital expenditures.

Project economics

At WTI US$76/barrel spot price the gross undiscounted operating

profit based on the above FDP is US$202.12 million.

NPV @10% is US$ 85.14 million.

IRR is 240.9%.

Undiscounted net-back is US$19.61 per barrel of oil.

In the case of a 100 bopd production rate and a WTI spot price

of US$50 per barrel, gross net operating revues are still strongly

positive generating US$434,870.

Future potential development upside

Potential exists to re-enter and re-perforate the RD-6 and RD-7

wells, which are located in the Cory Moruga Block but are within

the Moruga West oil field and have previously been produced.

Additionally there may also be an opportunity to re-enter Green

Hermit-1 to evaluate an untested thick interval of the Herrera #1

Sand which had oil shows whilst drilling. Low resistivity oil pays

have been shown to be productive in the Moruga West field and

potentially could be evaluated using the Sandjet perforating

technology that the Company intends to deploy in Morocco.

GUERCIF TESTING PROGRAMME ONSHORE MOROCCO

An updated Independent Technical Report ("ITR"), incorporating

the 2023 MOU-3 and MOU-4 well results is currently being prepared

by Scorpion Geoscience Ltd. for the Guercif block and resource

potential of the prospective area tested by MOU-1, MOU-2, MOU-3 and

MOU-4. The Company will use it best endeavours to publish the ITR

before the Phase 1 rigless testing commences.

Phase 1

Phase 1 is planned to commence before 25 January 2024 and is

expected to take up to 14 days to complete.

The unforeseen regulatory issue relating to Guercif Petroleum

Agreement Amendment No.3 has now been successfully resolved.

Intervals to be tested are as previously announced.

MOU-3

1,406.0 to 1,412.0 metres RKB (within Moulouya Fan interval);

and

845.0 to 849.0 metres RKB (Ma Sand)

MOU-1

1,236.5 to 1,241.1 metres RKB (TGB-2 Sand); and

844.0 to 848.0 metres RKB (Ma Sand)

Successfully perforating the Ma and TGB-2 Sands, whilst

depending on test rates and any evidence of reservoir depletion,

may justify an 10-year production profile at a plateau rate of 10

mm cfgpd based on anticipated volumes within the structures tested

by these wells.

Depending on test results and the potential to comingle

production from the two different horizons in MOU-1, a 20 mm cfgpd

profile for up to 5 years may also be achievable.

Production forecasts are dependent on a successful outcome to

the perforating programme.

The Phase 1 rigless testing of a small interval of the MOU-3

Moulouya Fan reservoir has only currently been programmed to

evaluate reservoir quality and potential gas flow rates at this

location. This may allow the Company to improve upon the design of

the Phase 2 rigless testing programme using Sandjet to further

evaluate the Moulouya Fan.

The Company is fully funded to execute the Phase 1 rigless

testing programme.

Phase 2

Phase 2 rigless testing operations using Sandjet are planned to

commence in early February to early March. The duration of

operations is forecast to be for up to 21 days.

Regulatory approval of the Guercif Petroleum Agreement Amendment

#4, which is proposing to extend the Initial Period of the Guercif

Petroleum Agreement to 5 June 2024, is a pre-requisite before Phase

2 testing operations can commence..

Depending on the results of the Phase 1 rigless testing,

Petroleum Agreement Amendment #4 would also potentially facilitate

an application by 5 March 2024 for a single Exploitation Concession

over the area tested by MOU-1 and MOU-3, providing geological

continuity of potential gas reservoirs can be demonstrated.

The Sandjet rigless testing programme is likely to target,

subject to further refinement, the following intervals:

MOU-4

Thin Jurassic dolomitic reservoirs

Moulouya Fan

Highly porous weathered volcanic interval

Multiple thin shallow sands

MOU-3

Several thin sands within TGB-6

TGB-4

Sandjet allows multiple horizons to be tested relative to

conventional perforating guns based on cost considerations. It also

potentially perforates further beyond any formation damage relative

to conventional perforating guns.

Trialling Sandjet at Guercif may also allow the Company to

evaluate its suitability for the planned Cory Moruga well workovers

and FDP implementation to assess the ability to increase initial

well deliverability.

Sandjet will be testing intervals in MOU-3 and MOU-4 where

current conventional wireline log interpretation is adversely

impacted by possible formation damage caused by the requirement to

drill over-balanced with heavy drilling mud to control the wells

through highly mobile claystones.

NuTech petrophysical log interpretation for the above intervals

interprets the presence of gas. However the integrity of the

interpretation can only be verified after the programme of Sandjet

rigless testing has been completed.

Sandjet rigless testing results will determine in the shorter

term any ability to upscale to a 50 mm cfgpd production profile

facilitated under the Collaboration Agreement for a CNG Gas Sales

Agreement with Afriquia Gaz.

The Company is fully funded to execute the Phase 2 rigless

testing programme.

Discretionary potentially high impact Jurassic

appraisal/exploration drilling

Planning is underway based on a provisional drilling window in

April/May.

Subject to the regulatory approval of Guercif Petroleum

Agreement Amendment #4 to extend the Initial Period of the Guercif

Petroleum Agreement to 5 June 2024, the Company is seeking to drill

the Jurassic target, the extreme edge of which was penetrated in

MOU-4 downdip from the crest of the large mapped seismic closure of

126km2.

There is currently in-country rig availability within the window

for which MOU-4 NE could be ready for drilling, subject to

regulatory approvals and the schedule for delivery of long-lead

well inventory items.

MOU-4 NE is forecast to take up to 12 days to drill.

This is a higher risk but potentially high reward well close to

gas infrastructure (the Maghreb gas pipeline).

A successful well may create a new potential gas market

(gas-to-power) if the scale of the opportunity for the MOU-4 NE

structure is realised.

Funding the discretionary well would depend on final well cost

estimates; the quantum of discretionary cash on the Company's

balance sheet in Q2 2024; and the ability for potential early

monetisation of gas following a successful Phase 1 rigless testing

programme.

Discretionary appraisal/development drilling

Discretionary appraisal/development drilling is provisionally

scheduled for H2 2024.

Subject to an application and the subsequent award of an

Exploitation Concession and regulatory approval of the drilling

programme, the Company may drill two appraisal/development wells to

potentially, if successful, add incremental gas resources to

support and extend the CNG production profiles.

MOU-3-NW

MOU-3NW will target the shallow sands behind casing in MOU-3 and

not available for rigless testing in that well. MOU-3 NW will

require a revision of the well design to facilitate rigless testing

of potential shallow gas at higher than normal reservoir pressure

for the shallow depth.

MOU-3-SW

MOU-3SW will target the Ma, TGB-6 and, potentially, depending on

Phase 2 rigless testing results, TGB-4 sands.

MOU-2 re-entry and deepening

Subject to an evaluation of the Phase 1 and Phase 2 rigless

testing results, the Company has an option to re-enter the MOU-2

well and deepen it to the Moulouya Fan target.

Funding and timing of the discretionary drilling programme will

be dictated by the availability and quantum of production revenues

generated by Cory Moruga and the opportunity for partial

monetisation of gas assets in Guercif, always subject to a

successful rigless testing programme.

The discretionary drilling programme may have to be aligned with

a requirement to further develop the CNG industrial gas market

above the 50 mm cfgpd cap set in the Afriquia Gaz Collaboration

Agreement.

IRELAND

The applications for successor authorisations to Licensing

Options 16/26 (Corrib South) and 16/30 (Ram Head) remain under

consideration by the Department of the Environment, Climate and

Communications.

Paul Griffiths, Executive Chairman of Predator, commented:

"I am pleased to confirm that 2024 is set to be the busiest year

for activity since the Company was incorporated.

The addition of a substantial, near virgin, field appraisal and

development asset onshore Trinidad provides the Company with the

potential to generate strongly positive cashflows in 2024 to

contribute organically towards further development of its

assets.

The milestones to be met for potential monetisation of gas in

Morocco, subject to the results of the Phase 1 rigless testing, are

now clearly defined from a regulatory, technical, marketing and

operational perspective. The objective over the last six months

since the completion of the 2023 drilling programme has always been

focussed on ensuring that all the elements for monetising gas are

put in place to support an application for an Exploitation

Concession.

Management's appetite for efficiently drilling within pre-drill

budgets moderate risk but high impact wells that potentially

generate a multiple uplift on drilling costs remains strong and

aligned with current market sentiment. For this reason we are also

focussed on accelerating the drilling of the Jurassic target in

Morocco and a high impact appraisal well in Cory Moruga at a later

date. The Company is in a position of strength where it can dictate

the timing of exercising high impact discretionary drilling

opportunities either through eventual Cory Moruga production

revenues or through an accelerated process triggered by potential

early partial monetisation of gas assets, which are subject to a

successful rigless testing programme.

The Company is however also able to fund its firm 2024

commitments whilst maintaining some discretionary cash on the

balance sheet without considering potential production revenues

from Cory Moruga in 2024.

Funding the CNG development can be achieved using discretionary

cash on the balance sheet combined with a leasing arrangement for

CNG trailers and equipment. For this reason it has been important

to develop the scale of potential CNG gas sales in Guercif, in a

success case, to provide greater leverage to negotiate leasing

agreements with greater materiality for potential service

providers..

The CNG development schedule will be updated after the Phase 1

rigless testing results.

The Company has maintained strict oversight over its operating

and commercial overheads and despite the exponential increase in

activity we will continue to practice restraint when it comes to

controlling costs."

For further information visit www.predatoroilandgas.com

Follow the Company on twitter @PredatorOilGas.

This announcement contains inside information for the purposes

of Article 7 of the Regulation (EU) No 596/2014 on market abuse

For more information please visit the Company's website at

www.predatoroilandgas.com :

Enquiries:

Predator Oil & Gas Holdings Plc Tel: +44 (0) 1534 834 600

Paul Griffiths Executive Chairman Info@predatoroilandgas.com

Lonny Baumgardner Managing Director

Novum Securities Limited Tel: +44 (0)207 399 9425

David Coffman / Jon Belliss

Flagstaff Strategic and Investor Communications Tel: +44 (0)207 129 1474

Tim Thompson predator@flagstaffcomms.com

Mark Edwards

Fergus Mellon

Notes to Editors:

Predator is operator of the Guercif Petroleum Agreement onshore

Morocco which is prospective for Tertiary and Jurassic gas. The

current focus of the exploration and appraisal drilling programme

is located less than 10 kilometres from the Maghreb gas pipeline.

The MOU-1 well drilled in 2021 and the MOU-3 and MOU-4 wells

drilled in 2023 have been completed for rigless testing in early

2024. Near-term focus is on supplying compressed natural gas

("CNG") to the Moroccan industrial market. A Collaboration

Agreement for potential CNG gas sales of up to 50 mm cfgpd has been

executed with Afriquia Gaz. Further drilling activity is

anticipated in 2024 to further evaluate the MOU-4 Jurassic

prospect.

Predator is seeking in the medium term to apply CO2 EOR

techniques onshore Trinidad which have the advantage of

sequestrating anthropogenic carbon dioxide. The acquisition of

T-Rex Resources (Trinidad) Ltd. ("T-Rex") is a first step to

realising this objective. T-Rex holds the Cory Moruga Production

Licence. Cory Moruga is a largely undeveloped near-virgin oil field

of similar potential size to the nearby Moruga West and

Inniss-Trinity mature oil fields. The Cory Moruga Production

Licence is a potentially significant asset for the Company with the

capability of generating positive operating profits in the

near-term. Capital required for staged field development can be

implemented potentially utilising operating profits generated from

an increasing level of gross production revenues.

Predator owns and operates exploration and appraisal assets in

licensing options offshore Ireland, for which successor

authorisations have been applied for, adjoining Vermilion's Corrib

gas field in the Slyne Basin on the Atlantic Margin and east of the

decommissioned Kinsale gas field in the Celtic Sea. The

applications for successor authorisations remain "under

consideration" by the DECC.

Predator has developed a Floating Storage and Regasification

Project ("FSRUP") for the import of LNG and its regassification for

Ireland and is also developing gas storage concepts to address

security of gas supply and volatility in gas prices during times of

peak gas demand.

Further progress for the Mag Mell FSRUP will be dependent on

government policy in relation to security of energy supply. A

generalised FSRUP concept has now been recognised by the government

as an option for security of energy supply.

The Company has a small but highly experienced management team

with a proven track record in successfully executing drilling

operations in the oil and gas sector and in acquiring assets where

there is a potential to generate multiple returns for relatively

low and manageable levels of investment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDZZGMMNMMGDZM

(END) Dow Jones Newswires

January 12, 2024 02:00 ET (07:00 GMT)

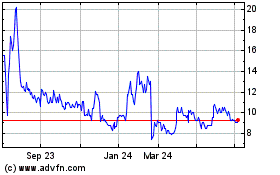

Predator Oil & Gas (LSE:PRD)

Historical Stock Chart

From Dec 2024 to Jan 2025

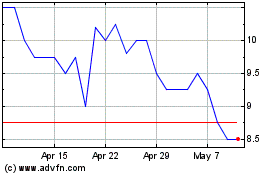

Predator Oil & Gas (LSE:PRD)

Historical Stock Chart

From Jan 2024 to Jan 2025