TIDMTAVI

RNS Number : 7050V

Tavistock Investments PLC

11 April 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

Tavistock Investments Plc

("Tavistock" or the "Company")

Acquisition of Precise Protect Limited

11 April 2023

Tavistock (AIM:TAVI) is pleased to announce that it has today

acquired the entire issued and to be issued share capital of

Precise Protect Limited, a profitable and fast growing insurance

and protection business based in Bangor, Northern Ireland (the

"Transaction"). Precise Protect is regulated by the Financial

Conduct Authority (the "FCA") and Tavistock has received change in

control consent for the Transaction from the FCA.

Background

As announced by the Company previously, the current financial

year is a period of transition for Tavistock as the Company focuses

on the continued development of its innovative commercial operating

model and replacement of the contribution from its investment

management business, which was sold to Titan Wealth Holdings

Limited in August 2021.

Key elements of Tavistock's innovative commercial operating

model include:

-- Automated adviser oversight and real-time risk management

-- Integrated technology facilitating data mining and business intelligence

-- The Tavistock Academy to augment recruitment and career development

-- Multiple sources of lead generation (including affinities,

distribution partners and client referrals)

-- A "Tell Me How" financial portal for corporate and affinity clients

-- Proven blueprint for successfully integrating acquisitions.

Acquisition of Precise Protect

Precise Protect has a network of over 200 advisers working with

more than 37,000 UK clients, with an average age of under 40.

Precise offers its clients a wide range of products (including life

and critical illness cover, private medical insurance, personal

injury and income protection), several of which were developed

in-house and are unique to the firm. In the year ended 31 October

2022, Precise Protect reported a profit before taxation of GBP1.45

million on turnover of GBP6.5 million and net assets of GBP1.23

million.

Following the Transaction, the Tavistock group will have more

than 400 advisers and other business introducers looking after over

110,000 private clients with estimated assets of over GBP5.0

billion, as well as 350 corporate and affinity clients with some

16,000 employees.

The total consideration for the Transaction (assuming the

achievement of all performance related earn-outs) will amount to up

to some GBP7.0 million. GBP250,000 of the consideration is to be

settled through the issue of 3,571,429 new ordinary shares of 1

penny each in the capital of Tavistock Investments Plc at an issue

price of 7p per share (the "Consideration Shares"), with the

balance being settled in cash from the Company's existing cash

resources and the Company drawing down from the acquisition debt

facility provided by the Bank of Ireland.

GBP2.75 million of the cash consideration is being paid now,

together with the issue of the Consideration Shares (conditional on

admission to trading on AIM). The balance of the cash

consideration, totalling up to some GBP4.0 million, is payable in

three subsequent annual instalments, the value of each being linked

to the future performance of the Precise Protect business.

Admission and total voting rights

An application has been submitted to the London Stock Exchange

for the Consideration Shares to be admitted to trading on AIM and

trading in the Consideration Shares is anticipated to commence at

7.00am on Thursday 13 April 2023 ("Admission").

Upon Admission, the Company's issued share capital will comprise

of 560,429,005 ordinary shares of 1 penny each, with one voting

right per share ("Ordinary Shares"). The Company does not hold any

ordinary shares in treasury and therefore the total number of

Ordinary Shares with voting rights in the Company is

560,429,005.

With effect from Admission, the above figure of 560,429,005 may

be used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

Key anticipated synergies

Precise Protect is the first significant acquisition in the next

phase of Tavistock's growth plan. Integration of Precise into the

Tavistock group will provide opportunities for operational cost

savings (e.g. software, systems and regulatory oversight). However,

the most significant benefit to Tavistock will be Precise Protect's

experienced and dedicated specialist team. Other key benefits

include:

-- 37,000+ clients providing financial advice leads for both

desk based and face-to-face advice teams

-- Upskilling mortgage and protection advisers to become IFAs through the Tavistock Academy.

Tony Close, Precise Protect's Managing Director, said : "Precise

Protect's revenues and EBITDA have grown rapidly and we remain

excited about its prospects. However, we are very pleased to be

joining the Tavistock group which will enable us to offer a much

wider range of services to our clients, as well as deliver a

development pathway for advisers and career development

opportunities for staff."

Brian Raven, Tavistock's Chief Executive, said ; "We are

delighted to welcome Tony and his team into the group and to add

Precise Protect's products to the wider group's service

proposition. We look forward to benefitting from numerous

synergies, including operational cost savings, increased

profitability and new business leads."

For further information:

Tavistock Investments Plc

Oliver Cooke

Brian Raven Tel: 01753 867000

Allenby Capital Limited Tel: 020 3328

(Nominated adviser and broker) 5656

Corporate Finance:

Nick Naylor, Nick Athanas, Daniel

Dearden-Williams

Sales and Corporate Broking:

Tony Quirke

Powerscourt

Gilly Lock Tel: 07711 380

007

Roxane Girard 020 7250 1446

About Tavistock Investments Plc

Tavistock Investments Plc is an AIM listed financial services

group which before the acquisition of Precise Protect had more than

200 advisers and other business introducers across the UK.

Tavistock has over 75,000 clients with more than GBP5 billon of

investments.

Tavistock's advisory business operates throughout the UK. The

Tavistock Partners network supports Registered Individuals

(self-employed IFAs), providing compliance, administration,

technology, training and accounting services. The Tavistock

Partnership is a network that does the same for Appointed

Representative firms. Tavistock Private Client provides wealth

management and financial planning to high-net-worth

individuals.

The Tavistock Platform, launched in 2020, provides a low-cost

platform service to the Group's advisory and investment

clients.

Tavistock Asset Management ("TAM") markets the Group's

centralised investment proposition, both the ACUMEN UCITS funds and

the Group's Model Portfolio Service ("MPS"). In June 2021 the

Company entered a ten-year strategic partnership with Titan Wealth

Holdings Limited ("Titan Wealth"). Tavistock acts as Titan Wealth's

retail distribution partner. TAM retains Titan Wealth as investment

manager for the MPS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUPUWACUPWGMQ

(END) Dow Jones Newswires

April 11, 2023 02:00 ET (06:00 GMT)

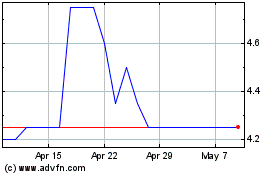

Tavistock Investments (LSE:TAVI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tavistock Investments (LSE:TAVI)

Historical Stock Chart

From Jan 2024 to Jan 2025