0001001907

ASTROTECH Corp

false

--06-30

Q1

2024

0.001

0.001

2,500,000

2,500,000

280,898

280,898

280,898

280,898

0.001

0.001

250,000,000

250,000,000

1,712,045

1,692,045

1,701,729

1,681,729

10,316

10,316

0

0

21

7

00010019072023-07-012023-09-30

xbrli:shares

00010019072023-11-09

thunderdome:item

iso4217:USD

00010019072023-09-30

00010019072023-06-30

iso4217:USDxbrli:shares

00010019072022-07-012022-09-30

0001001907us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2023-06-30

0001001907astc:CommonStockOutstandingMember2023-06-30

0001001907us-gaap:TreasuryStockCommonMember2023-06-30

0001001907us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001001907us-gaap:RetainedEarningsMember2023-06-30

0001001907us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0001001907us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2023-07-012023-09-30

0001001907astc:CommonStockOutstandingMember2023-07-012023-09-30

0001001907us-gaap:TreasuryStockCommonMember2023-07-012023-09-30

0001001907us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0001001907us-gaap:RetainedEarningsMember2023-07-012023-09-30

0001001907us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0001001907us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2023-09-30

0001001907astc:CommonStockOutstandingMember2023-09-30

0001001907us-gaap:TreasuryStockCommonMember2023-09-30

0001001907us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001001907us-gaap:RetainedEarningsMember2023-09-30

0001001907us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001001907us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2022-06-30

0001001907astc:CommonStockOutstandingMember2022-06-30

0001001907us-gaap:TreasuryStockCommonMember2022-06-30

0001001907us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001001907us-gaap:RetainedEarningsMember2022-06-30

0001001907us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

00010019072022-06-30

0001001907us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2022-07-012022-09-30

0001001907astc:CommonStockOutstandingMember2022-07-012022-09-30

0001001907us-gaap:TreasuryStockCommonMember2022-07-012022-09-30

0001001907us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0001001907us-gaap:RetainedEarningsMember2022-07-012022-09-30

0001001907us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-30

0001001907us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2022-09-30

0001001907astc:CommonStockOutstandingMember2022-09-30

0001001907us-gaap:TreasuryStockCommonMember2022-09-30

0001001907us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001001907us-gaap:RetainedEarningsMember2022-09-30

0001001907us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

00010019072022-09-30

0001001907astc:InterestbearingTimeDepositsMember2023-07-012023-09-30

0001001907astc:InterestbearingTimeDepositsMember2022-07-012022-09-30

xbrli:pure

0001001907astc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-09-30

0001001907astc:CorporateGovernmentDebtETFsSecuritiesMember2023-09-30

0001001907astc:InterestbearingTimeDepositsMember2023-09-30

0001001907astc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-06-30

0001001907astc:CorporateGovernmentDebtETFsSecuritiesMember2023-06-30

0001001907astc:InterestbearingTimeDepositsMember2023-06-30

0001001907us-gaap:BankTimeDepositsMember2023-09-30

0001001907us-gaap:BankTimeDepositsMember2023-06-30

0001001907astc:ResearchAndDevelopmentFacilityMemberastc:AustinTexasMember2021-04-27

utr:M

0001001907astc:ResearchAndDevelopmentFacilityMemberastc:AustinTexasMember2022-11-11

0001001907astc:SubleasedFacilityMemberastc:AustinTexasMember2022-11-22

0001001907astc:SubleasedFacilityMemberastc:AustinTexasMember2022-12-01

0001001907astc:PropertyAndEquipmentNetMember2023-09-30

0001001907astc:PropertyAndEquipmentNetMember2023-06-30

0001001907astc:LeaseLiabilitiesCurrentMember2023-09-30

0001001907astc:LeaseLiabilitiesCurrentMember2023-06-30

0001001907astc:LeaseLiabilitiesNoncurrentMember2023-09-30

0001001907astc:LeaseLiabilitiesNoncurrentMember2023-06-30

utr:Y

0001001907astc:FurnitureFixturesEquipmentAndLeaseholdImprovementsMember2023-09-30

0001001907astc:FurnitureFixturesEquipmentAndLeaseholdImprovementsMember2023-06-30

0001001907us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-09-30

0001001907us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-06-30

0001001907us-gaap:ConstructionInProgressMember2023-09-30

0001001907us-gaap:ConstructionInProgressMember2023-06-30

0001001907us-gaap:SeriesDPreferredStockMember2023-09-30

0001001907astc:ShareRepurchaseProgramAuthorizedNovember2022Member2022-11-09

0001001907astc:RightsPlanMember2022-12-21

00010019072022-07-012023-06-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedMarch262020Member2023-09-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedMarch262020Member2023-06-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedMarch302020Member2023-09-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedMarch302020Member2023-06-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedOctober232020Member2023-09-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedOctober232020Member2023-06-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedOctober282020Member2023-09-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedOctober282020Member2023-06-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedFebruary162021Member2023-09-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedFebruary162021Member2023-06-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedApril122021Member2023-09-30

0001001907astc:ClassOfWarrantOrRightsWarrantsIssuedApril122021Member2023-06-30

0001001907us-gaap:RestrictedStockMember2023-07-012023-09-30

0001001907us-gaap:EmployeeStockOptionMember2023-07-012023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-09-30

0001001907us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-30

0001001907us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-30

0001001907us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-30

0001001907us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-30

0001001907us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtMutualFundsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:CorporateGovernmentDebtETFsSecuritiesMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberastc:InterestbearingTimeDepositsMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:InterestbearingTimeDepositsMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:InterestbearingTimeDepositsMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:InterestbearingTimeDepositsMember2023-06-30

0001001907us-gaap:ShortTermInvestmentsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberastc:InterestbearingTimeDepositsMember2023-06-30

0001001907us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-30

0001001907us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-30

0001001907us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-30

0001001907us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-30

0001001907us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-30

0001001907astc:SecuredPromissoryNote2019NoteMember2022-09-05

0001001907astc:SecuredPromissoryNote2019NoteMember2022-09-052022-09-05

0001001907us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-07-012023-09-30

0001001907us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-07-012022-09-30

0001001907us-gaap:EmployeeStockOptionMember2023-09-30

0001001907us-gaap:EmployeeStockOptionMember2023-07-012023-09-30

0001001907astc:ExercisePriceRange1Member2023-07-012023-09-30

0001001907astc:ExercisePriceRange1Member2023-09-30

0001001907astc:ExercisePriceRange2Member2023-07-012023-09-30

0001001907astc:ExercisePriceRange2Member2023-09-30

0001001907astc:ExercisePriceRange3Member2023-07-012023-09-30

0001001907astc:ExercisePriceRange3Member2023-09-30

0001001907us-gaap:EmployeeStockOptionMember2022-07-012022-09-30

0001001907us-gaap:RestrictedStockMember2023-06-30

0001001907us-gaap:RestrictedStockMember2023-07-012023-09-30

0001001907us-gaap:RestrictedStockMember2023-09-30

0001001907us-gaap:RestrictedStockMember2022-07-012022-09-30

00010019072022-12-31

00010019072021-12-31

0001001907us-gaap:SubsequentEventMember2023-11-09

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the quarterly period ended September 30, 2023

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 001-34426

Astrotech Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware | | 91-1273737 |

| State or Other Jurisdiction of Incorporation or Organization | | I.R.S. Employer Identification No. |

| | | |

| 2105 Donley Drive, Suite 100, Austin, Texas | | 78758 |

| Address of Principal Executive Offices | | Zip Code |

(512) 485-9530

Registrant’s Telephone Number, Including Area Code

Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

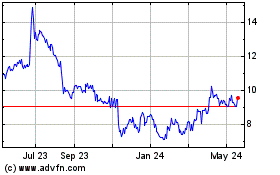

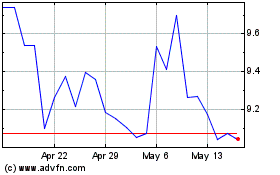

| Common Stock, $0.001 par value per share | | ASTC | | NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of November 9, 2023, the number of shares of the registrant’s common stock outstanding was: 1,701,729.

ASTROTECH CORPORATION AND SUBSIDIARIES

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

PART I: FINANCIAL INFORMATION

ITEM 1. Condensed Consolidated Financial Statements

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

| | | September 30, | | | June 30, | |

| | | 2023 | | | 2023 | |

| | | (Unaudited) | | | (Note) | |

| Assets | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | $ | 13,090 | | | $ | 14,208 | |

| Short-term investments | | | 25,863 | | | | 27,919 | |

| Accounts receivable | | | 391 | | | | 225 | |

| Inventory, net: | | | | | | | | |

| Raw materials | | | 1,560 | | | | 1,379 | |

| Work-in-process | | | 287 | | | | 243 | |

| Finished goods | | | 343 | | | | 373 | |

| Income tax receivable | | | — | | | | 1 | |

| Prepaid expenses and other current assets | | | 296 | | | | 365 | |

| Total current assets | | | 41,830 | | | | 44,713 | |

| Property and equipment, net | | | 2,545 | | | | 2,670 | |

| Operating lease right-of-use assets, net | | | 226 | | | | 262 | |

| Other assets, net | | | 31 | | | | 30 | |

| Total assets | | $ | 44,632 | | | $ | 47,675 | |

| Liabilities and stockholders’ equity | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable | | | 646 | | | | 546 | |

| Payroll related accruals | | | 567 | | | | 633 | |

| Accrued expenses and other liabilities | | | 723 | | | | 1,170 | |

| Lease liabilities, current | | | 312 | | | | 316 | |

| Total current liabilities | | | 2,248 | | | | 2,665 | |

| Accrued expenses and other liabilities, net of current portion | | | 39 | | | | — | |

| Lease liabilities, net of current portion | | | 228 | | | | 291 | |

| Total liabilities | | | 2,515 | | | | 2,956 | |

| Commitments and contingencies (Note 13) | | | | | | | | |

| Stockholders’ equity | | | | | | | | |

| Convertible preferred stock, $0.001 par value, 2,500,000 shares authorized; 280,898 shares of Series D issued and outstanding at September 30, 2023 and June 30, 2023, respectively | | | — | | | | — | |

| Common stock, $0.001 par value, 250,000,000 shares authorized at September 30, 2023 and June 30, 2023, respectively; 1,712,045 and 1,692,045 shares issued at September 30, 2023 and June 30, 2023, respectively; 1,701,729 and 1,681,729 outstanding at September 30, 2023 and June 30, 2023, respectively | | | 190,643 | | | | 190,643 | |

| Treasury shares, 10,316 at September 30, 2023 and June 30, 2023, respectively | | | (119 | ) | | | (119 | ) |

| Additional paid-in capital | | | 81,366 | | | | 81,002 | |

| Accumulated deficit | | | (228,266 | ) | | | (225,354 | ) |

| Accumulated other comprehensive loss | | | (1,507 | ) | | | (1,453 | ) |

| Total stockholders’ equity | | | 42,117 | | | | 44,719 | |

| Total liabilities and stockholders’ equity | | $ | 44,632 | | | $ | 47,675 | |

Note: The condensed consolidated balance sheet at June 30, 2023, has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by the United States generally accepted accounting principles for complete financial statements.

See accompanying notes to unaudited condensed consolidated financial statements.

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except per share data)

(Unaudited)

| |

|

Three Months Ended |

|

| |

|

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Revenue |

|

$ |

425 |

|

|

$ |

38 |

|

| Cost of revenue |

|

|

242 |

|

|

|

32 |

|

| Gross profit |

|

|

183 |

|

|

|

6 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

1,646 |

|

|

|

1,642 |

|

| Research and development |

|

|

1,872 |

|

|

|

1,129 |

|

| Total operating expenses |

|

|

3,518 |

|

|

|

2,771 |

|

| Loss from operations |

|

|

(3,335 |

) |

|

|

(2,765 |

) |

| Other income and expense, net |

|

|

423 |

|

|

|

235 |

|

| Loss from operations before income taxes |

|

|

(2,912 |

) |

|

|

(2,530 |

) |

| Net loss |

|

$ |

(2,912 |

) |

|

$ |

(2,530 |

) |

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

1,631 |

|

|

|

1,612 |

|

| Basic and diluted net loss per common share: |

|

|

|

|

|

|

|

|

| Net loss per common share |

|

$ |

(1.79 |

) |

|

$ |

(1.57 |

) |

| Other comprehensive loss, net of tax: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,912 |

) |

|

$ |

(2,530 |

) |

| Available-for-sale securities: |

|

|

|

|

|

|

|

|

| Net unrealized loss |

|

|

(54 |

) |

|

|

(368 |

) |

| Total comprehensive loss |

|

$ |

(2,966 |

) |

|

$ |

(2,898 |

) |

See accompanying notes to unaudited condensed consolidated financial statements.

ASTROTECH CORPORATION

Condensed Consolidated Statement of Changes in Stockholders’ Equity

(In thousands)

(Unaudited)

| |

|

Preferred Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Series D |

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number of Shares Outstanding |

|

|

Amount |

|

|

Number of Shares Outstanding |

|

|

Amount |

|

|

Treasury Stock Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated Deficit |

|

|

Accumulated Other Comprehensive Loss |

|

|

Total Stockholders’ Equity |

|

| Balance at June 30, 2023 |

|

|

281 |

|

|

$ |

— |

|

|

|

1,682 |

|

|

$ |

190,643 |

|

|

$ |

(119 |

) |

|

$ |

81,002 |

|

|

$ |

(225,354 |

) |

|

$ |

(1,453 |

) |

|

$ |

44,719 |

|

| Net change in available-for-sale marketable securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(54 |

) |

|

|

(54 |

) |

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

364 |

|

|

|

— |

|

|

|

— |

|

|

|

364 |

|

| Issuance of restricted stock |

|

|

— |

|

|

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,912 |

) |

|

|

— |

|

|

|

(2,912 |

) |

| Balance at September 30, 2023 |

|

|

281 |

|

|

$ |

— |

|

|

|

1,702 |

|

|

$ |

190,643 |

|

|

$ |

(119 |

) |

|

$ |

81,366 |

|

|

$ |

(228,266 |

) |

|

$ |

(1,507 |

) |

|

$ |

42,117 |

|

| |

|

Preferred Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Series D |

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number of Shares Outstanding |

|

|

Amount |

|

|

Number of Shares Outstanding |

|

|

Amount |

|

|

Treasury Stock Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated Deficit |

|

|

Accumulated Other Comprehensive Loss |

|

|

Total Stockholders’ Equity |

|

| Balance at June 30, 2022 |

|

|

281 |

|

|

$ |

— |

|

|

|

1,686 |

|

|

$ |

190,642 |

|

|

$ |

— |

|

|

$ |

79,505 |

|

|

$ |

(215,712 |

) |

|

$ |

(1,199 |

) |

|

$ |

53,236 |

|

| Net change in available-for-sale marketable securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(368 |

) |

|

|

(368 |

) |

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

387 |

|

|

|

— |

|

|

|

— |

|

|

|

387 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,530 |

) |

|

|

— |

|

|

|

(2,530 |

) |

| Balance at September 30, 2022 |

|

|

281 |

|

|

$ |

— |

|

|

|

1,688 |

|

|

$ |

190,642 |

|

|

$ |

— |

|

|

$ |

79,892 |

|

|

$ |

(218,242 |

) |

|

$ |

(1,567 |

) |

|

$ |

50,725 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| |

|

Three Months Ended |

|

| |

|

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,912 |

) |

|

$ |

(2,530 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

364 |

|

|

|

387 |

|

| Depreciation |

|

|

149 |

|

|

|

67 |

|

| Amortization of operating lease right of use assets |

|

|

36 |

|

|

|

22 |

|

| Interest on financing leases |

|

|

4 |

|

|

|

4 |

|

| Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(166 |

) |

|

|

18 |

|

| Contract asset |

|

|

— |

|

|

|

2 |

|

| Inventory, net |

|

|

(195 |

) |

|

|

52 |

|

| Income tax receivable |

|

|

1 |

|

|

|

— |

|

| Accounts payable |

|

|

100 |

|

|

|

118 |

|

| Income tax payable |

|

|

— |

|

|

|

(1 |

) |

| Other assets and liabilities |

|

|

(394 |

) |

|

|

(558 |

) |

| Operating lease liabilities |

|

|

(37 |

) |

|

|

(22 |

) |

| Net cash used in operating activities |

|

|

(3,050 |

) |

|

|

(2,441 |

) |

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(24 |

) |

|

|

(346 |

) |

| Purchases of short-term investments |

|

|

— |

|

|

|

(4,855 |

) |

| Proceeds from short-term investments |

|

|

2,001 |

|

|

|

— |

|

| Net cash provided by (used in) investing activities |

|

|

1,977 |

|

|

|

(5,201 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Repayment of related-party debt |

|

|

— |

|

|

|

(500 |

) |

| Repayments on finance lease liabilities |

|

|

(45 |

) |

|

|

(38 |

) |

| Net cash used in financing activities |

|

|

(45 |

) |

|

|

(538 |

) |

| Net change in cash and cash equivalents |

|

|

(1,118 |

) |

|

|

(8,180 |

) |

| Cash and cash equivalents at beginning of period |

|

|

14,208 |

|

|

|

26,453 |

|

| Cash and cash equivalents at end of period |

|

$ |

13,090 |

|

|

$ |

18,273 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

4 |

|

|

$ |

59 |

|

| Income taxes paid |

|

$ |

2 |

|

|

$ |

1 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

ASTROTECH CORPORATION AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

(1) General Information

Description of the Company – Astrotech Corporation (Nasdaq: ASTC) (“Astrotech,” the “Company,” “we,” “us,” or “our”), a Delaware corporation organized in 1984, is a mass spectrometry company that launches, manages, and commercializes scalable companies based on its innovative core technology.

Basis of Presentation – The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information and the rules and regulations of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results for the three months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending June 30, 2023. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023. Certain prior period amounts have been reclassified to conform to the current year presentation or adjusted due to rounding and have had no impact on net income or stockholders' equity.

Reverse Stock Split – On December 5, 2022, the Company effectuated a reverse stock split of its shares of common stock, par value $0.001 per share (the “Common Stock”), whereby every thirty (30) pre-split shares of Common Stock were exchanged for one (1) post-split share of the Company's Common Stock (the “Reverse Stock Split”). No fractional shares were issued in connection with the Reverse Stock Split. Stockholders who would otherwise have held a fractional share of the Common Stock received a cash payment in lieu thereof. Numbers presented in these condensed consolidated financial statements have been adjusted to reflect the Reverse Stock Split.

Accounting Pronouncements –In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. ASU 2016-13 requires entities to use a forward-looking approach based on current expected credit losses (“CECL”) to estimate credit losses on certain types of financial instruments, including trade receivables. The standard became effective for the Company for financial statements periods beginning after December 15, 2022. The adoption of ASU 2016-13 did not have a material impact on the Company’s consolidated financial statements.

Recently Issued Accounting Standards Not Yet Adopted - In July 2023, the FASB issued ASU No 2023-03, “Presentation of Financial Statements (Topic 205), Income Statement—Reporting Comprehensive Income (Topic 220), Distinguishing Liabilities from Equity (Topic 480), Equity (Topic 505), and Compensation— Stock Compensation (Topic 718)” pursuant to SEC Staff Accounting Bulletin No. 120, which adds interpretive guidance for public companies to consider when entering into share-based payment transactions while in possession of material non-public information. The effective date of this update is for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. The Company does not expect the adoption to have a material impact on the Company's consolidated financial statements.

In October 2023, the FASB issued ASU 2023-06, Disclosure Improvements. The amendments in this update seek to clarify or improve disclosure and presentation requirements. The Company is assessing the impact of this update on the accompanying financial statements.

Our Business Units

Astrotech Technologies, Inc.

Astrotech Technologies, Inc. (“ATI”) owns and licenses the Astrotech Mass Spectrometer Technology™ (the “AMS Technology”), the platform mass spectrometry technology originally developed by 1st Detect Corporation (“1st Detect”). The AMS Technology has been designed to be inexpensive, smaller, and easier to use when compared to traditional mass spectrometers. Unlike other technologies, the AMS Technology works under ultra-high vacuum, which eliminates competing molecules, yielding higher resolution and fewer false alarms. The intellectual property includes 18 patents granted along with extensive trade secrets. With a number of diverse market opportunities for the core technology, ATI is structured to license the intellectual property for different fields of use. ATI currently licenses the AMS Technology to three wholly-owned subsidiaries of Astrotech on an exclusive basis, including to 1st Detect for use in the security and detection market, to AgLAB Inc. (“AgLAB”) for use in the agriculture market, and to BreathTech Corporation (“BreathTech”) for use in breath analysis applications.

ATI has contracted with various vendors to assist with the further development of our mass spectrometer products including the manufacturability and reliability of our systems.

1st Detect Corporation

1st Detect, a licensee of ATI for the security and detection market, has developed the TRACER 1000™, the world’s first mass spectrometry (“MS”) based explosives trace detector (“ETD”) certified by the European Civil Aviation Conference (“ECAC”). The TRACER 1000 was designed to outperform the ETDs currently used at airports, cargo and other secured facilities, and borders worldwide. The Company believes that ETD customers are unsatisfied with the currently deployed ETD technology, which is driven by ion mobility spectrometry (“IMS”). The Company further believes that some IMS-based ETDs have issues with false positives, as they often misidentify personal care products and other common household chemicals as explosives, causing facility shutdowns, unnecessary delays, frustration, and significant wasted security resources. In addition, there are hundreds of different types of explosives, but IMS-based ETDs have a very limited threat detection library reserved only for those few explosives of largest concern. Adding additional compounds to the detection library of an IMS-based ETD fundamentally reduces the instrument’s performance, further increasing the likelihood of false alarms. In contrast, adding additional compounds to the TRACER 1000’s detection library does not degrade its detection capabilities, as it has a virtually unlimited and easily expandable threat library.

In order to sell the TRACER 1000 to airport and cargo security customers in the European Union and certain other countries, we obtained ECAC certification. The Company is currently selling the TRACER 1000 to customers who accept ECAC certification. As of September 30, 2023, the Company has deployed the TRACER 1000 in approximately 29 locations in 14 countries throughout Europe and Asia.

In the United States, the Company is working with the U.S. Transportation Security Administration (“TSA”) towards air cargo certification. On March 27, 2018, the Company announced that the TRACER 1000 was accepted into TSA’s Air Cargo Screening Technology Qualification Test (“ACSQT”) and, on April 4, 2018, the Company announced that the TRACER 1000 entered into testing with the TSA for passenger screening at airports. On November 14, 2019, the Company announced that the TRACER 1000 had been selected by the TSA’s Innovation Task Force to conduct live checkpoint screening at Miami International Airport. With similar protocols as ECAC testing, the Company has received valuable feedback from all programs. Following ECAC certification and the Company’s early traction within the cargo market, testing for cargo security continued with the TSA. With the COVID-19 pandemic, all testing within the TSA was put on hold; however, cargo testing resumed during the summer of 2020, and the Company subsequently announced on September 9, 2020 that the TRACER 1000 passed the non-detection testing portion of the TSA’s ACSQT. Due to delays caused by COVID-19, TSA cargo detection testing is ongoing, but has proceeded much more slowly than originally anticipated. As a result, efforts are primarily focused on our other opportunities. TSA cargo detection testing is the final step to be listed on the Air Cargo Screening Technology List as an “approved” device. If approved, the TRACER 1000 will be approved for cargo sales in the United States.

AgLAB Inc.

AgLAB, an exclusive licensee of ATI for the agriculture market, has developed the AgLAB 1000™ series of mass spectrometers for use in the hemp and cannabis markets with initial focus on optimizing yields in the distillation process. The AgLAB product line is a derivative of the Company’s core AMS Technology. AgLAB has continued to conduct field trials to demonstrate that the AgLAB 1000-D2™ can be used in the distillation process to significantly improve the processing yields of tetrahydrocannabinol (“THC”) and cannabidiol (“CBD”) oil during distillation. The AgLAB 1000-D2 uses the Maximum Value Process solution (“MVP”) to analyze samples in real-time and assist the equipment operator determining the ideal settings required to maximize yields. As part of our growth plan, we also plan to launch a family of “process control” methods and solutions that we believe could be valuable additions to many nutraceutical and pharmaceutical distillation processing plants.

Production and processing of hemp and cannabis is a huge, worldwide industry. In the U.S., for example, the wholesale value of the cannabis crop from just the 11 states permitting adult-use and medical cannabis exceeds $6 billion annually. Growth in the U.S. and in the worldwide market is likely fed in part by the growing acceptance of medicinal cannabis products and anticipated legislative changes in various jurisdictions worldwide. This growth is also due in part to the passage of the 2018 Farm Bill, which legalized hemp production in the United States. According to a report by BDS Analytics and Arcview Market Research, the U.S. CBD market is estimated to reach $20 billion by 2024, with a CAGR of 49% from 2019 to 2024. The market is segmented into various categories of products, including oils, tinctures, capsules, topicals, edibles, and pet products. The largest category is oils and tinctures, accounting for 44% of the market share in 2020, followed by topicals (26%) and edibles (19%). CBD-infused pet products are also growing in popularity, with sales estimated to reach $1.7 billion by 2025, despite the FDA’s current position that such products may not be lawfully sold under the federal Food, Drug & Cosmetic Act (FD&C Act).

One factor driving the growth of the market is the increasing consumer interest in natural and alternative health remedies. According to a survey conducted by the National Center for Complementary and Integrative Health, nearly one-third of Americans use natural products, including CBD, for their health and wellness needs. Another survey by Consumer Reports found that 64% of Americans who have tried CBD reported benefits in connection with various health conditions, including pain, anxiety, and sleep disorders. Despite the regulatory uncertainty surrounding the use of CBD in food and dietary supplements, as the FDA has consistently held that such products are unlawful under the FD&C Act, the market has continued to expand. A survey conducted by the Grocery Manufacturers Association found that 71% of US consumers are open to using CBD-infused food and beverage products, and the market for CBD-infused beverages is projected to reach $1.4 billion by 2023.

As the market continues to grow, there has been an influx of new companies entering the space, ranging from large corporations to small startups. The competition is fierce, with companies investing heavily in research and development to create innovative products and differentiate themselves from their competitors. However, the market remains highly fragmented, with many products of varying quality and efficacy, making it challenging for consumers to navigate. Overall, the CBD and hemp market in the US is a rapidly growing industry with significant potential for continued expansion. As more research is conducted and regulations are established, we believe it is likely that the market will become more standardized and regulated, leading to increased consumer confidence and demand. However, the industry is also likely to face challenges as it matures, including increased competition and potential regulatory hurdles.

Management believes the AgLAB 1000-D2 will deliver a compelling combination of cost and time savings while enhancing product quality and quantity for distillation processors of hemp and cannabis. The use of the AgLAB 1000-D2 should reduce waste from current distillation practices and result in a significantly improved product. Due in large part to the Company’s proprietary technology, the Company believes it is the only provider of a mass spectrometry system that gives it a distinct advantage in the industry.

Our competition consists of high performance liquid chromatography technology which analyzes THC and CBD derived from hemp. While we believe our technology has competitive advantages over the incumbent technology, there are no assurances competing in this market segment.

The hemp extraction market is a broad market and encompasses many startup companies and well-established companies. There is no assurance this industry will remain profitable, given the evolving regulatory landscape and applicable state and federal restrictions.

During the first quarter of fiscal year 2023, AgLab began the first production run of the AgLAB 1000-D2 and sales efforts are currently underway. On May 9, 2023, AgLab announced the confirmed results from field trials using the AgLAB 1000-D2 mass spectrometer and the Maximum Value ProcessTM testing method (“AgLAB MVP”). AgLAB MVP is designed to improve yields and bottom-line profits for hemp (CBD) and cannabis (THC) producers of distilled oils. While we currently market primarily to distillers within the hemp industry, our AgLAB products also have the potential to serve distillers within the broader cannabis industry in the future, in which case our risk exposure would likely increase and could have a detrimental effect on our business.

BreathTech Corporation

BreathTech, an exclusive licensee of ATI for use in breath analysis applications, is developing the BreathTest-1000™, a breath analysis tool to screen for VOC metabolites found in a person’s breath that could indicate they may have a compromised condition including but not limited to a bacterial or viral infection. The Company believes that new tools to aid in the battle against COVID-19 and other diseases remain of the utmost importance to help more quickly identify that an infection may be present.

In June 2022, the Company expanded its existing study that initially focused on COVID-19 with Cleveland Clinic to use the BreathTest-1000 to screen for a variety of diseases spanning the entire body. The project will focus on detecting bloodstream infections, respiratory infections such as influenza types A and B and respiratory syncytial virus (“RSV”), carriage of Staphylococcus aureus, and Clostridioides difficile (“C. diff”) infections.

In November 2022, BreathTech announced that, based on analysis of data from testing of breath samples procured during library development, the BreathTest-1000™ lung disease screening instrument can clearly distinguish between infected and healthy breath samples. This analysis and conclusion marks a significant milestone in the development of the BreathTest-1000™ lung disease screening instrument.

(2) Investments

The following tables summarize gains and losses related to the Company’s investments as of September 30, 2023 and June 30, 2023, respectively:

| |

|

September 30, 2023 |

|

| Available-for-Sale Investments |

|

Adjusted |

|

|

Unrealized |

|

|

Unrealized |

|

|

Fair |

|

| (In thousands) |

|

Cost |

|

|

Gain |

|

|

Loss |

|

|

Value |

|

| Mutual Funds - Corporate & Government Debt |

|

$ |

19,995 |

|

|

$ |

— |

|

|

$ |

(1,074 |

) |

|

$ |

18,921 |

|

| ETFs - Corporate & Government Debt |

|

|

7,375 |

|

|

|

— |

|

|

|

(433 |

) |

|

|

6,942 |

|

| Time Deposits |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total |

|

$ |

27,370 |

|

|

$ |

— |

|

|

$ |

(1,507 |

) |

|

$ |

25,863 |

|

| |

|

June 30, 2023 |

|

| Available-for-Sale Investments |

|

Adjusted |

|

|

Unrealized |

|

|

Unrealized |

|

|

Fair |

|

| (In thousands) |

|

Cost |

|

|

Gain |

|

|

Loss |

|

|

Value |

|

| Mutual Funds - Corporate & Government Debt |

|

$ |

19,990 |

|

|

$ |

— |

|

|

$ |

(1,025 |

) |

|

$ |

18,965 |

|

| ETFs - Corporate & Government Debt |

|

|

7,376 |

|

|

|

— |

|

|

|

(418 |

) |

|

|

6,958 |

|

| Time Deposits |

|

|

2,006 |

|

|

|

— |

|

|

|

(10 |

) |

|

|

1,996 |

|

| Total |

|

$ |

29,372 |

|

|

$ |

— |

|

|

$ |

(1,453 |

) |

|

$ |

27,919 |

|

We have certain financial instruments on our condensed consolidated balance sheets related to interest-bearing time deposits. Time deposits with maturities of less than 90 days, if any, from the purchase date are included in “Cash and Cash Equivalents.” Time deposits with maturities from 91-360 days, if any, are included in “Short-term investments.” Time deposits with maturities of more than 360 days, if any, are included in “Long-term investments.” As of September 30, 2023 and June 30, 2023, the Company had no long-term investments. For more information about the fair value of the Company’s financial instruments, see footnote 8.

The following table presents the carrying amounts of certain financial instruments as of September 30, 2023 and June 30, 2023, respectively:

| |

|

Carrying Value |

|

| |

|

Short-Term Investments |

|

| (In thousands) |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

| Money Market Funds |

|

|

|

|

|

|

|

|

| Mutual Funds - Corporate & Government Debt |

|

$ |

18,921 |

|

|

$ |

18,965 |

|

| ETFs - Corporate & Government Debt |

|

|

6,942 |

|

|

|

6,958 |

|

| Time Deposits |

|

|

|

|

|

|

|

|

| Maturities from 1-90 days |

|

|

— |

|

|

|

— |

|

| Maturities from 91-360 days |

|

|

— |

|

|

|

1,996 |

|

| Total |

|

$ |

25,863 |

|

|

$ |

27,919 |

|

(3) Leases

On April 27, 2021, Astrotech entered into a new lease for a research and development facility of approximately 5,960 square feet in Austin, Texas (the “R&D facility”) that includes a laboratory, a small production shop, and offices for staff, although many of the Company’s employees continue to work remotely. The lease commenced on June 1, 2021 and had a lease term of 36 months. On November 11, 2022, the Company signed a lease extension agreement for the R&D facility, extending the term of the lease through April 30, 2025. The Company’s total contractual base rent obligation for the eleven-month extension is approximately $95 thousand.

On November 22, 2022, Astrotech entered into a sublease agreement for an additional facility directly adjacent to the R&D facility (the “Subleased Facility”). The Subleased Facility consists of approximately 3,900 square feet and will provide the space needed as the Company launches its AgLAB products and continues its R&D efforts at ATI & BreathTech. The sublease commenced on December 1, 2022, and has a lease term of 29 months. The Company’s total contractual base rent obligation for the Subleased Facility is approximately $156 thousand.

Operating lease assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent its obligation to make lease payments arising from the lease. Operating lease assets and liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. As the Company’s leases do not provide an implicit rate, the Company uses its incremental borrowing rate in determining the present value of lease payments. Significant judgement is required when determining the Company’s incremental borrowing rate. Lease expense for lease payments is recognized on a straight-line basis over the lease term. The amortization expense for financed lease assets for the years ended September 30, 2023 and 2022 totaled $31 thousand and $26 thousand, respectively.

Upon the adoption of Topic 842, the Company’s accounting for financing leases, previously referred to as capital leases, remains substantially unchanged from prior guidance.

The balance sheet presentation of the Company’s operating and finance leases is as follows:

| (In thousands) | | Classification on the Condensed Consolidated Balance Sheet | | September 30, 2023 | | | June 30, 2023 | |

| Assets: | | | | | | | | | | |

| Operating lease assets | | Operating leases, right-of-use assets, net | | $ | 226 | | | $ | 262 | |

| Financing lease assets | | Property and equipment, net | | | 453 | | | | 484 | |

| Total lease assets | | $ | 679 | | | $ | 746 | |

| | | | | | | | | | | |

| Liabilities: | | | | | | | | | | |

| Current: | | | | | | | | | | |

| Operating lease obligations | | Lease liabilities, current | | $ | 155 | | | $ | 148 | |

| Financing lease obligations | | Lease liabilities, current | | | 157 | | | | 168 | |

| Non-current: | | | | | | | | | | |

| Operating lease obligations | | Lease liabilities, non-current | | | 97 | | | | 130 | |

| Financing lease obligations | | Lease liabilities, non-current | | | 131 | | | | 161 | |

| Total lease liabilities | | $ | 540 | | | $ | 607 | |

Future minimum lease payments as of September 30, 2023 under non-cancellable leases are as follows (in thousands):

| (In thousands) | | | | | | | | | | | | |

| For the Year Ended June 30, | | Operating Leases | | | Financing Leases | | | Total | |

| 2024 | | $ | 124 | | | $ | 136 | | | $ | 260 | |

| 2025 | | | 141 | | | | 94 | | | | 235 | |

| 2026 | | | — | | | | 27 | | | | 27 | |

| 2027 | | | — | | | | 27 | | | | 27 | |

| 2028 | | | — | | | | 24 | | | | 24 | |

| Thereafter | | | — | | | | — | | | | — | |

| Total lease obligations | | | 265 | | | | 308 | | | | 573 | |

| Less: imputed interest | | | (13 | ) | | | (20 | ) | | | (33 | ) |

| Present value of net minimum lease obligations | | | 252 | | | | 288 | | | | 540 | |

| Less: lease liabilities - current | | | (155 | ) | | | (157 | ) | | | (312 | ) |

| Lease liabilities - non-current | | $ | 97 | | | $ | 131 | | | $ | 228 | |

Other information as of September 30, 2023, is as follows:

| Weighted-average remaining lease term (years): | | | | |

| Operating leases | | | 1.6 | |

| Financing leases | | | 2.0 | |

| Weighted-average discount rate: | | | | |

| Operating leases | | | 6.1 | % |

| Financing leases | | | 5.2 | % |

Cash payments for operating leases for the three months ended September 30, 2023, and 2022 totaled $41 thousand and $26 thousand, respectively. Cash payments for financing leases for the three months ended September 30, 2023, and 2022 totaled $45 thousand and $38 thousand, respectively.

(4) Property and Equipment, net

As of September 30, 2023, and June 30, 2023, property and equipment, net consisted of the following, respectively:

| (In thousands) | | September 30, 2023 | | | June 30, 2023 | |

| Furniture, fixtures, equipment & leasehold improvements | | $ | 3,158 | | | $ | 2,805 | |

| Software | | | 241 | | | | 217 | |

| Capital improvements in progress | | | 295 | | | | 649 | |

| Gross property and equipment | | | 3,694 | | | | 3,671 | |

| Accumulated depreciation and amortization | | | (1,149 | ) | | | (1,001 | ) |

| Property and equipment, net | | $ | 2,545 | | | $ | 2,670 | |

Depreciation and amortization expense of property and equipment was $149 thousand and $67 thousand for the three months ended September 30, 2023 and 2022, respectively. Total depreciation and amortization expense includes finance lease right-of-use asset amortization of $31 thousand and $26 thousand for the three months ended September 30, 2023 and 2022, respectively.

(5) Stockholders’ Equity

Common Stock

On November 22, 2022, the Company filed a third amendment (the “Amendment”) to the Company’s Certificate of Incorporation (as amended, the “Certificate of Incorporation”) with the Secretary of State of the State of Delaware to effect a 1-for-30 reverse stock split of all of the Company’s issued and outstanding shares of Common Stock. The Amendment provided that, at the effective time of the Reverse Stock Split, every 30 shares of the Company’s issued and outstanding Common Stock were automatically combined into one validly issued, fully paid and non-assessable share of Common Stock, without effecting a change to the par value per share. The Reverse Stock Split affected all shares of the Company’s Common Stock outstanding immediately prior to the effective time of the Reverse Stock Split, as well as the number of shares of Common Stock available for issuance under the Company’s equity incentive plans. In addition, the Reverse Stock Split effected a reduction in the number of shares of Common Stock issuable upon the exercise of stock options and warrants outstanding immediately prior to the effectiveness of the Reverse Stock Split with a corresponding increase in exercise price per share. The Reverse Stock Split also triggered a proportionate adjustment to the number of shares of Common Stock issuable upon the conversion of our Series D convertible preferred stock, par value of $0.001 per share (“Series D Preferred Shares”). All historical per share data, number of shares outstanding, and other common stock equivalents for the periods presented in the accompanying condensed consolidated financial statements and notes thereto have been adjusted retroactively, where applicable, to reflect the Reverse Stock Split.

Preferred Stock

The Company has issued 280,898 shares of Series D Preferred shares, all of which are issued and outstanding. Series D Preferred Shares are convertible to common stock on a one-to-thirty basis. Series D Preferred Shares are not callable by the Company. The holder of the preferred stock is entitled to receive, and we shall pay, dividends on shares equal to and in the same form as dividends actually paid on shares of common stock when, and if, such dividends are paid on shares of common stock. No other dividends are paid on the preferred shares. Preferred shares have no voting rights. Upon liquidation, dissolution, or winding-up of the Company, whether voluntary or involuntary, the preferred shares have preference over common stock. The holder of the Series D preferred shares has the option to convert at a ratio of 30 shares to one of common stock at the holder's discretion.

Share Repurchase Program

On November 9, 2022, the Company’s Board of Directors authorized a share repurchase program that allows the Company to repurchase up to $1.0 million of the Company’s common stock beginning November 17, 2022, and continuing through and including November 17, 2023. As previously disclosed, on June 16, 2023, the Company terminated its existing share repurchase program, effective immediately, in order to comply with Regulation M under the Exchange Act. The shares could have been repurchased from time to time in the open market or privately negotiated transactions or by other means in accordance with applicable state and federal securities laws. The timing, as well as the number and value of shares repurchased under the program, could have been determined by the Company at its discretion and would have depended on a variety of factors, including management’s assessment of the intrinsic value of the Company’s common stock, the market price of the Company’s common stock, general market and economic conditions, available liquidity, compliance with the Company’s debt and other agreements, applicable legal requirements, and other considerations.

Rights Plan

On December 21, 2022, the Company’s Board of Directors adopted a limited duration stockholder rights plan (the “Rights Plan”) expiring December 20, 2023 and declared a dividend of one preferred share purchase right for each outstanding share of common stock to stockholders of record on January 5, 2023 to purchase from the Company one one-thousandth of a share of Series A Junior Participating Preferred Stock, par value $0.001 per share, of the Company for an exercise price of $58.00 once the rights become exercisable, subject to the terms of and adjustment as provided in the related rights agreement.

Warrants

A summary of the common stock warrant activity for the three months ended September 30, 2023, is presented below:

| | | Number of Shares Underlying Warrants (In thousands) | | | Weighted Average Exercise Price | | | Aggregate Fair Market Value at Issuance (In thousands) | | | Weighted Average Remaining Contractual Term (Years) | |

| Outstanding June 30, 2023 | | | 80 | | | $ | 72.10 | | | $ | 3,747 | | | | 2.60 | |

| Warrants issued | | | — | | | | — | | | | — | | | | — | |

| Warrants exercised | | | — | | | | — | | | | — | | | | — | |

| Warrants expired | | | — | | | | — | | | | — | | | | — | |

| Outstanding September 30, 2023 | | | 80 | | | $ | 72.10 | | | $ | 3,747 | | | | 2.35 | |

The following represents a summary of the warrants outstanding at each of the dates identified:

| | | | | | | | | | Number of Shares Underlying Warrants (In thousands) | |

| Issue Date | | Classification | | Exercise Price | | Expiration Date | | September 30, 2023 | | | June 30, 2023 | |

| March 26, 2020 | | Equity | | $ | 187.50 | | March 25, 2025 | | | 1 | | | | 1 | |

| March 30, 2020 | | Equity | | $ | 140.63 | | March 27, 2025 | | | 2 | | | | 2 | |

| October 23, 2020 | | Equity | | $ | 86.25 | | October 21, 2025 | | | 15 | | | | 15 | |

| October 28, 2020 | | Equity | | $ | 80.63 | | October 28, 2025 | | | 6 | | | | 6 | |

| February 16, 2021 | | Equity | | $ | 121.88 | | February 11, 2026 | | | 6 | | | | 6 | |

| April 12, 2021 | | Equity | | $ | 56.25 | | April 7, 2026 | | | 50 | | | | 50 | |

| Total Outstanding | | | | | | | | 80 | | | | 80 | |

(6) Net Loss per Share

Basic net loss per share is computed on the basis of the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed based on the weighted average number of common shares outstanding plus the effect of potentially dilutive common shares outstanding during the period using the treasury stock method and the if-converted method. Potentially dilutive common shares include outstanding stock options and share-based awards.

The following table reconciles the numerators and denominators used in the computations of both basic and diluted net loss per share:

| | | Three Months Ended | |

| | | September 30, | |

| (In thousands, except per share data) | | 2023 | | | 2022 | |

| Numerator: | | | | | | | | |

| Net loss | | $ | (2,912 | ) | | $ | (2,530 | ) |

| Denominator: | | | | | | | | |

| Denominator for basic and diluted net loss per share — weighted average common stock outstanding | | | 1,631 | | | | 1,612 | |

| Basic and diluted net loss per common share: | | | | | | | | |

| Net loss per common share | | $ | (1.79 | ) | | $ | (1.57 | ) |

All unvested restricted stock awards and convertible Series D preferred share for the three months ended September 30, 2023 are not included in diluted net loss per share, as the impact to net loss per share would be anti-dilutive. Options to purchase 154,910 shares of common stock at exercise prices ranging from $10.10 to $175.50 per share outstanding as of September 30, 2023 were not included in diluted net loss per share, as the impact to net loss per share would be anti-dilutive.

(7) Revenue Recognition

Astrotech recognizes revenue employing the generally accepted revenue recognition methodologies described under the provisions of Accounting Standards Codification (“ASC”) Topic 606 “Revenue from Contracts with Customers” (“Topic 606”), which was adopted by the Company in fiscal year 2019. The methodology used is based on contract type and how products and services are provided. The guidelines of Topic 606 establish a five-step process to govern the recognition and reporting of revenue from contracts with customers. The five steps are: (i) identify the contract with a customer, (ii) identify the performance obligations within the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations within the contract, and (v) recognize revenue when or as the performance obligations are satisfied.

An additional factor is reasonable assurance of collectability. This necessitates deferral of all or a portion of revenue recognition until collection. During the three months ended September 30, 2023, the Company had two revenue sources that comprised materially all of its revenue. During the three months ended September 30, 2022, the Company had three revenue sources that comprised all of its revenue. Revenue was recognized at a point in time consistent with the guidelines in Topic 606.

Contract Assets and Liabilities. The Company enters into contracts to sell products and provide services, and it recognizes contract assets and liabilities that arise from these transactions. The Company recognizes revenue and corresponding accounts receivable according to Topic 606 and, at times, recognizes revenue in advance of the time when contracts give us the right to invoice a customer. The Company may also receive consideration, per the terms of a contract, from customers prior to transferring goods to the customer. The Company records customer deposits as deferred revenue. Additionally, the Company may receive payments, most typically for service and warranty contracts, at the onset of the contract and before services have been performed. In such instances, the Company records a deferred revenue liability. The Company recognizes these contract liabilities as sales after all revenue recognition criteria are met.

Practical Expedients. In cases where the Company is responsible for shipping after the customer has obtained control of the goods, the Company has elected to treat the shipping activities as fulfillment activities rather than as a separate performance obligation. Additionally, the Company has elected to capitalize the cost to obtain a contract only if the period of amortization would be longer than one year. The Company only gives consideration to whether a customer agreement has a financing component if the period of time between transfer of goods and services and customer payment is greater than one year.

Product Sales. The Company recognizes revenue from sales of products upon shipment or delivery when control of the product transfers to the customer, depending on the terms of each sale, and when collection is probable. In the circumstance where terms of a product sale include subjective customer acceptance criteria, revenue is deferred until the Company has achieved the acceptance criteria unless the customer acceptance criteria are perfunctory or inconsequential. The Company generally offers customers payment terms of 60 days or less.

Freight. The Company records shipping and handling fees that it charges to its customers as revenue and related costs as cost of revenue.

Multiple Performance Obligations. Certain agreements with customers include the sale of equipment involving multiple elements in cases where obligations in a contract are distinct and thus require separation into multiple performance obligations, revenue recognition guidance requires that contract consideration be allocated to each distinct performance obligation based on its relative standalone selling price. The value allocated to each performance obligation is then recognized as revenue when the revenue recognition criteria for each distinct promise or bundle of promises has been met.

The standalone selling price for each performance obligation is an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for transferring the good or service. When there is only one performance obligation associated with a contract, the entire amount of consideration is attributed to that obligation. When a contract contains multiple performance obligations, the standalone selling price is first estimated using the observable price, which is generally a list price net of applicable discount or the price used to sell the good or service in similar circumstances. In circumstances when a selling price is not directly observable, the Company will estimate the standalone selling price using information available to it including its market assessment and expected cost, plus margin.

The timetable for fulfilment of each of the distinct performance obligations can range from completion in a short amount of time and entirely within a single reporting period to completion over several reporting periods. The timing of revenue recognition for each performance obligation may be dependent upon several milestones, including physical delivery of equipment, completion of site acceptance test, and in the case of after-market consumables and service deliverables, the passage of time.

(8) Fair Value Measurement

ASC Topic 820 “Fair Value Measurement” (“Topic 820”) defines fair value, establishes a market-based framework or hierarchy for measuring fair value, and expands disclosures about fair value measurements. Topic 820 is applicable whenever assets and liabilities are measured and included in the financial statements at fair value. The fair value hierarchy established in Topic 820 prioritizes the inputs used in valuation techniques into three levels as follows:

Level 1 - Quoted prices in active markets for identical assets or liabilities.

Level 2 - Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 - Unobservable inputs that are supported by little or no market activity and are significant to the fair value of the assets or liabilities.

The following tables present the carrying amounts, estimated fair values, and valuation input levels of certain financial instruments as of September 30, 2023 and June 30, 2023:

| |

|

September 30, 2023 |

|

| |

|

Carrying |

|

|

Fair Value Measured Using |

|

|

Fair |

|

| (In thousands) |

|

Amount |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Value |

|

| Available-for-Sale Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mutual Funds - Corporate & Government Debt |

|

|

18,921 |

|

|

|

18,921 |

|

|

|

— |

|

|

|

— |

|

|

|

18,921 |

|

| ETFs - Corporate & Government Debt |

|

|

6,942 |

|

|

|

6,942 |

|

|

|

— |

|

|

|

— |

|

|

|

6,942 |

|

| Total Available-for-Sale Investments |

|

$ |

25,863 |

|

|

$ |

25,863 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

25,863 |

|

| |

|

June 30, 2023 |

|

| |

|

Carrying |

|

|

Fair Value Measured Using |

|

|

Fair |

|

| (In thousands) |

|

Amount |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Value |

|

| Available-for-Sale Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mutual Funds - Corporate & Government Debt |

|

|

18,965 |

|

|

|

18,965 |

|

|

|

— |

|

|

|

— |

|

|

|

18,965 |

|

| ETFs - Corporate & Government Debt |

|

|

6,958 |

|

|

|

6,958 |

|

|

|

— |

|

|

|

— |

|

|

|

6,958 |

|

| Time deposits: 91-360 days |

|

|

1,996 |

|

|

|

— |

|

|

|

1,996 |

|

|

|

— |

|

|

|

1,996 |

|

| Total Available-for-Sale Investments |

|

$ |

27,919 |

|

|

$ |

25,923 |

|

|

$ |

1,996 |

|

|

$ |

— |

|

|

$ |

27,919 |

|

The value of available-for-sale securities with Level 1 inputs is based on pricing from third-party pricing vendors, who use quoted prices in active markets for identical assets. The fair value measurements used for time deposits are considered Level 2 and use pricing from third-party pricing vendors who use quoted prices for identical or similar securities in both active and inactive markets.

(9) Related-party Debt

On September 5, 2022, the secured promissory issued by the Company on September 5, 2019 (the “2019 Note”) to Thomas B. Pickens III, the Chief Executive Officer and Chairman of the Board of Directors of the Company, matured. On the maturity date, the remaining outstanding principal amount of $500 thousand and accrued interest of $55 thousand on the 2019 Note was paid in full and the 2019 Note was canceled. With the cancelation of the 2019 Note, the Amended Subsidiary Guarantee was terminated and the Subsidiaries’ Collateral was released. Refer to Note 7 of our Annual Report on Form 10-K for 2023 for more detailed information on the 2019 Note.

(10) Business Risk and Credit Risk Concentration Involving Cash

For the three months ended September 30, 2023, the Company had two customers that materially comprised of all of the Company’s revenue. For the three months ended September 30, 2022, the Company had three customers that comprised all of the Company's revenue.

The Company maintains funds in bank accounts that may exceed the limit insured by the Federal Deposit Insurance Corporation (the "FDIC"). The risk of loss attributable to these uninsured balances is mitigated by depositing funds in what the Company believes to be high credit quality financial institutions. The Company has not experienced any losses in such accounts.

(11) Stock-Based Compensation

Stock Option Activity Summary