via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the

“Company”), an electric vehicle (“EV”) manufacturer, today

announces financial results for the twelve months ended Sept. 30,

2024, and a current business update.

Commenting on fiscal year 2024 ("FY2024"),

and recent Company developments, CEO and chairman David Michery

stated:

“2024 was a challenging year for the electric

vehicle industry, including Mullen. In the retail market, the

previous projections for EV growth rates have not materialized and

the conclusion by many has been EVs are ‘not selling.’ It is true

that the large OEMs have slowed their aggressive EV plans, but have

certainly not stopped. However, I want to make it clear that Mullen

is not in the retail market. We are in the commercial market with

different market conditions, adoption criteria and customers. In

the commercial market, it has only really been the last few years

that OEMs have brought vehicles to customers and in some vehicle

classes, there are still no entries. Consequently, adoption is

still at the very early stages and is now growing.

“For all new commercial EV manufacturers, there

has been a continued slowdown in available capital, high interest

rates, supply chain issues, regulatory hurdles to deal with as well

as the unknown impact of the new administration’s potential

regulatory and incentives and tax changes. Many new OEMs have not

weathered the storm and, unfortunately, were forced to close.

Mullen however, managed successfully to face these challenges head

on and has made significant progress in many areas.

“While I am proud of the Company’s

accomplishments, I share investor disappointment with the

performance of Mullen stock. There are many reasons I have

previously expressed to shareholders why I believe the price of the

Company stock does not closely reflect the value of the Company. I

believe the Company’s real estate assets, manufacturing

capabilities and intellectual property portfolio value exceeds the

current market capitalization. The Company was able to successfully

achieve full certification to sell its Class 1 EV cargo van and 3

EV truck, as well as Bollinger Class 4 trucks. Our Tunica,

Mississippi, facility is fully equipped and has produced hundreds

of commercial EVs. I do recognize a slow start of sales and as a

result, we are revising our sales forecast to reflect slower growth

than previously anticipated. Commercial customers require longer

lead time to evaluate our new Company, brand and product offerings,

including fleet managers, who often require vehicle pilots to gain

the confidence they need in confirming our EVs perform and meet

their specific requirements. We are gaining meaningful traction now

on the sales front, and the Company is laser focused on the sale of

its commercial vehicles where we believe we have a clear

competitive advantage at this time.

“Being fully aware of the extremely difficult

capital-raising environment, the Company has recently initiated

further significant cost-cutting measures to minimize our operating

expenses for 2025. These reductions are a result of a singular

focus on our commercial business and include continued elimination

of operating expenses where it is not critical for the sales and

growth of our Company.

“As you will note from the updates below, there

are many reasons I remain positive, including the fact that we now

have three vehicle lines that are currently in U.S. production,

generating cash from sales and building demand for our EVs from

several different customer verticals. We believe no other recently

established EV company in the U.S. can say this.”

Recent Company Highlights

Mullen Commercial – Troy,

MichiganClass 1 and 3 Commercial Vehicles

- Recent sale and order activity for Mullen commercial EVs

include:

- Mullen ONE All-Electric Cargo Van to Mr. Appliance® of Owings

Mills, Maryland, marking the Company’s first venture into the home

service vertical.

- 10 Class 3 EV cab chassis trucks order from Associated Coffee,

a San Francisco Bay Area coffee and snack distributor.

- Two Mullen THREE, Class 3 EV trucks with vehicle upfits

performed by Phenix Truck Bodies & Van Equipment (“Phenix”)

order from Westland Floral.

- The Company continues commercial EV adoption across college

campuses with two new EV Class 1 orders from leading California

universities in Los Angeles and the San Francisco Bay Area.

- The Company has conducted many recent ride-and-drive events to

increase awareness in many verticals, including Work Truck

Exchange, AltWheels Fleet Day, Zeem SeaTac EV Fleet Ride &

Drive, ZEV Tour – Clean Fleet Experience, NTEA Commercial Upfitting

Summit, Fleet Forward Conference and Zero Emissions Showcase.

- In November 2024, Mullen announced that Emerald Transportation

Solutions, a premier commercial refrigeration (“reefer”) vehicle

upfitter, is working with the Papé Group (“Papé”) to develop an

advanced reefer upfit for the Mullen THREE, a Class 3 all-electric

truck.

Bollinger Motors – Oak Park, Michigan

Class 4 Commercial Truck

- Bollinger Motors started production and delivered its first

five B4 trucks to customers in September 2024, recognizing its

first revenues of $703K in FY24. Since September, the company has

delivered an additional 26 B4 trucks recognizing additional

revenues of $3.6M in FY25. To date, the company has delivered a

total of 31 B4 trucks and recognized revenues of $4.2M.

- Bollinger has expanded its national sales and service network

to include over 50 sales and service locations including TEC

Equipment, Affinity Truck Center, Anderson Motors, Bergey’s Truck

Centers, Broadway Ford Truck Center, Nacarato Truck Centers, and

Nuss Truck and Equipment.

- As of November 2024, the Bollinger B4 Class 4 electric trucks

are available for government fleets through its partnership with

National Auto Fleet Group under the Sourcewell contract agreement

#032824-NAF.

- In November 2024, the 2025 Bollinger B4 became eligible for New

York State’s New York Truck Voucher Incentive Program, an incentive

for commercial electric vehicles from the New York State Energy and

Research Development Authority providing up to a $100,000 cash

voucher incentive on the all-electric B4 truck.

- Robert Bollinger, founder of Bollinger Motors, provided

Bollinger with $10 million in non-dilutive long-term debt financing

to support Bollinger’s production ramp-up and sale of the B4, Class

4 EV truck.

Battery Technology – Fullerton,

California

- In November 2024, the Company announced continued progress for

battery production in Fullerton, California, with the addition of

three battery lines installed in support of U.S.-made battery

components and manufacturing. Lines include:

- High volume standard battery chemistry line.

- High precision, low volume standard chemistry R&D

line.

- A high precision, low volume solid-state polymer R&D

line.

- On Dec. 17, 2024, Mullen Automotive submitted a modified plan

to the U.S. Department of Energy (“DOE”) that incorporates its

facilities in Mishawaka, Indiana, and Fullerton, California, for

U.S.-based battery and pack production. In total, Mullen is seeking

$55 million in matching DOE funds to support the U.S. manufacturing

capabilities.

FY2024 Highlights

During the fiscal year ended Sept. 30, 2024, the Company

successfully transitioned from pre-revenue product development to

revenue generation for Mullen Commercial EVs and Bollinger Motors

began revenue generation with the launch of the Class 4 electric

truck in September of 2024.Mullen Commercial – Troy,

Michigan

Class 1 and 3 Commercial Vehicles

- Growth of vehicles invoiced grew

substantially from fiscal years 2023 to 2024:

- 443 vehicles invoiced in 2024

compared to 35 vehicles invoiced in 2023.

- The Company invoiced $21 million

for vehicles in 2024 compared to $1 million for vehicles invoiced

in 2023.

- In 2024, Mullen Automotive made

significant strides in expanding its dealer network across the U.S.

The Company expanded dealer distribution from one dealer to seven

new dealer partners, strengthening its retail presence and making

Mullen vehicles more accessible to a wider commercial

audience.

- In September 2024, Papé Truck

placed an initial order for 43 Class 3 EV trucks and 7 Class 1 EV

cargo vans. The total purchase for the 50 units had a retail sales

value of $3.1 million.

- In September 2024, Mullen announced

the addition of premier full-service dealer, Papé Kenworth, to its

commercial EV dealer network. Based in Eugene, Oregon, Papé

Kenworth became Mullen’s seventh franchise dealer partner expanding

fleet opportunities for the Company’s full line of commercial

electric vehicles. Papé Group, which includes Papé Kenworth,

consists of five operating companies with over 150 locations in

nine states, with 815 service bays and more than 1,500

technicians.

- In 2024, the Company continued

sales momentum with leading higher education colleges and

universities across the U.S. Orders include Princeton University in

Princeton, New Jersey, University of Virginia in Charlottesville,

Virginia, and University of North Carolina in Charlotte, North

Carolina, and public California universities in Los Angeles and the

San Francisco Bay Area.

- The State of Massachusetts issued

MOR-EV approval, granting Mullen’s Class 3 EV truck a $15,000 cash

voucher per vehicle sold.

- In July 2024, Mullen’s Class 1 EV cargo van received approval

for the MOR-EV Program, granting a $3,500 rebate in Massachusetts.

When combined with the available $7,500 federal tax credit, the net

effective cost of the Mullen ONE would be approximately

$23,500.

- In May 2024, Mullen announced

continued Commercial EV dealer expansion in the Midwest with

Ziegler Truck Group and in the Pacific Northwest with Range Truck

Group.

- In May 2024, Mullen added a California-based and HVIP-approved

dealer, National Auto Fleet Group with locations in Watsonville and

Alhambra, California.

- In May 2024, Mullen added one of the largest U.S. commercial

dealers, Pritchard EV, to its dealer network.

- In April 2024, California issued Hybrid and Zero-Emission Truck

and Bus Voucher Incentive Project (“HVIP”) approval, granting

Mullen’s Class 3 EV trucks a $45,000 cash voucher per vehicle

sold.

- In April 2024, Mullen announced new California Air Resources

Board (“CARB”) approval for the 2025 model year Class 3 EV cab

chassis truck.

- In January 2024, Mullen announced the completion of a new

light-weight service truck body for the all-electric Mullen THREE,

targeted for utility and municipality customers. The vehicles are

available now and were developed in collaboration with Phenix Truck

Bodies & Van Equipment and Knapheide Manufacturing.

Bollinger Motors – Oak Park,

MichiganClass 4 Commercial Vehicle

- Bollinger Motors launched production of the Bollinger B4 Class

4 electric truck on Sept. 16 at Roush Industries in Livonia,

Michigan

- First deliveries of Bollinger B4 electric trucks went to

Nacarato Truck Centers with a retail sales value of nearly

$800,000.

- In September 2024, Bollinger achieved CARB certification, and

in November, CARB approved the 2025 Bollinger B4 for HVIP. Under

HVIP, the Bollinger B4 electric truck now qualifies for a rebate of

up to $60,000. When combined with the available $40,000 federal tax

credit, the net effective cost of the Bollinger B4 would be less

than $59,000. The B4 also qualifies for substantial state-based

incentives, including New York, New Jersey and Massachusetts.

- In July 2024, Bollinger Motors named former GM executive James

Taylor as CEO taking over from company founder Robert Bollinger. In

addition, Bollinger promoted Bryan Chambers to president and chief

operating officer.

- In June 2024, Bollinger received EPA certification for Class 4

EV Commercial Trucks, which is a critical step to selling vehicles

in the U.S.

- In May and June 2024, Momentum Group and Envirocharge placed B4

orders intended for Class 4 mobile EV charging truck

solutions.

Battery Technology – Fullerton,

California

- Mullen has made substantial investments and strategic decisions

that underscore the Company’s commitment to advancing U.S.

manufacturing of batteries and battery systems as well as reducing

supply chain risks by manufacturing packs in house for their

vehicles. Investments include:

- Strategic acquisitions, including assets from Romeo Power and

Nikola for battery pack production, and key infrastructure

investments designed to increase speed to market.

- Investments and startup costs totaling $12 million to date to

further battery and pack development and manufacturing.

- The Company is advancing its solid-state polymer pack program

and is continuing to conduct battery and vehicle testing, which

began road testing in February 2024.

- Mullen is transitioning to manufacturing and assembly of

battery systems in the United States and the Company’s first

production units are planned to be released in late 2025.

- In November 2023, Mullen originally announced the opening of

the facility in Fullerton, with the goal of scaling U.S.-made EV

battery module and pack production. The Company is focused on

reducing reliance on foreign battery components.

Financial Results for the Twelve Months Ended Sept.

30, 2024

Net loss and loss per share

The net loss attributable to common shareholders

after preferred dividends and other capital transactions with

preferred stock owners was $471.0 million, or

$1,425.6 net loss per share, for the twelve months ended Sept.

30, 2024, as compared to a net loss attributable to common

shareholders after preferred dividends of $964.9 million, or

$157,405 loss per share, for the twelve months ended Sept. 30,

2023, (giving effect to reverse stock split made effective

on Sept. 17, 2024, at a ratio of 1-for-100 shares).

The net loss for the twelve months ended

Sept. 30, 2024, included non-cash impairment charges

totaling $119.2 million (in the previous year -

$84.6 million), recognized primarily due to future funding

uncertainties and a decrease in the Company's market

capitalization.

Revenue

For the twelve months ended Sept. 30, 2024, we recorded $1.1

million in revenues compared to $0.4 million for the twelve months

ended Sept. 30, 2023.

For the twelve months ended Sept. 30, 2024, we invoiced

for 443 commercial vehicles valued at $21 million compared to

the twelve months ended Sept. 30, 2023, where we invoiced for 35

vehicles with a value of $1 million.

The difference between invoiced amounts and revenues is the

Company continues to defer the revenue and accounts

receivable recognition on most of Mullen commercial vehicles

invoiced until invoices are paid and the return provision on

the vehicles is nullified by the dealer’s sale of the vehicle to

the end user.

In September 2024, our Bollinger segment achieved a major

milestone, launching production of the B4 commercial truck.

Additionally, Bollinger completed the sale of its first five units

and recognized its first revenues of $0.7M. The B4 is generating

strong traction in the market, and we expect significant sales

growth from Bollinger in the coming year.

| Invoiced

during the year ended September 30, 2024 (dollars in

thousands) |

|

| Vehicle type |

|

Units invoiced |

|

|

Amount invoiced |

|

|

Revenue recognized |

|

|

Mullen 3 (UU) |

|

|

180 |

|

|

$ |

11,658 |

|

|

$ |

163 |

|

| Mullen Urban Delivery

(UD1) |

|

|

258 |

|

|

|

8,568 |

|

|

|

228 |

|

| Bollinger B4 |

|

|

5 |

|

|

|

703 |

|

|

|

703 |

|

| Total |

|

|

443 |

|

|

$ |

20,929 |

|

|

$ |

1,094 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Invoiced

during the year ended September 30, 2023 (dollars in

thousands) |

|

| Vehicle type |

|

Units Invoiced |

|

|

Amount invoiced |

|

|

Revenue recognized |

|

|

Mullen Urban Delivery (UD0) |

|

|

25 |

|

|

|

366 |

|

|

|

366 |

|

| Mullen 3 (UU) |

|

|

10 |

|

|

|

652 |

|

|

|

— |

|

| Total |

|

|

35 |

|

|

$ |

1,018 |

|

|

$ |

366 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Revenues

The cost of revenues for the year ended Sept.

30, 2024, totaled $16.9 million and included $1.3 million for the

cost of vehicles sold and $15.6 million in non-cash, inventory

adjustments to net realizable value. Included in the $1.3 million

of cost of vehicles sold was $0.2 million from the Mullen

Commercial segment and $1.1 million from the Bollinger segment.

Bollinger expects excess cost until target production capacity is

reached sometime in FY25.In addition to the cost of vehicles sold,

we recognized a non-cash, inventory adjustment to net realizable

value of $15.6 million from the Mullen Commercial segment,

primarily due to slow moving inventory where there are excess parts

and systems.

Liquidity

We had total cash (including cash equivalents

and restricted cash) of $10.7 million on Sept. 30,

2024, versus $155.7 million on Sept. 30, 2023. The Company has

determined that its available liquidity of approximately $10.7

million is not sufficient to meet its current obligations for at

least the next twelve months. The working capital as of Sept.

30, 2024, was negative and amounted to $120.0 million,

or $38.5 million if adding back derivative liabilities and

other liabilities settled in common stock. This compares to a

positive $58.5 million of working capital or $133.3

million of working capital on Sept. 30, 2023, if adding back

derivative liabilities and other liabilities settled in common

stock.

During the twelve months ended Sept. 30, 2024,

we paid off a $4.9 million current note payable that was secured by

a mortgage on our Tunica, Mississippi, facility. We also issued new

senior secured convertible notes with warrants for cash

totaling $61.7 million. Current notes payable as of Sept. 30,

2024, was $5.4 million compared to $7.5

million as of Sept. 30, 2023, (balances include debt

discounts). As of today, almost all of these notes and accumulated

interest have been converted into shares of the Company's common

stock.

After Sept. 30, 2024, investors purchased an

additional aggregate principal amount of $17.9 million, for $17.0

million in cash after deducting the 5% original issue discount.

The total cash spent (Operating and

Investing cash flows) for the twelve months ended Sept. 30,

2024 and 2023 was $201.7 million and $287.1 million,

respectively.

| |

|

Year Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Net loss |

|

|

(505,826,551 |

) |

|

|

(1,006,658,828 |

) |

| Non-cash adjustments |

|

|

313,054,243 |

|

|

|

821,435,469 |

|

| Working capital |

|

|

7,216,827 |

|

|

|

6,051,168 |

|

| Net cash used in operating

activities |

|

|

(185,555,481 |

) |

|

|

(179,172,191 |

) |

| Net cash used in investing

activities |

|

|

(16,148,055 |

) |

|

|

(107,923,309 |

) |

| Total cash

spent |

|

$ |

(201,703,536 |

) |

|

$ |

(287,095,500 |

) |

| |

|

|

|

|

|

|

|

|

Shareholders’ equity/(deficit)

Shareholders’ equity/(deficit) was ($16.6)

million as of Sept. 30, 2024, versus $272.8 million as

of Sept. 30, 2023. The decrease in stockholders’ equity

for the twelve months ended Sept. 30, 2024, reflects the impairment

charges of $119.2 million and other net losses

of $386.6 million offset by equity issuances.

Financial statements

Following are the Consolidated Balance Sheets,

Consolidated Statements of Operations and Consolidated Statements

of Cash Flows for the twelve months ended Sept. 30, 2024 and

2023.

MULLEN

AUTOMOTIVE INC.CONSOLIDATED BALANCE

SHEETS

| |

|

|

|

|

|

|

| |

|

September 30, 2024 |

|

September 30, 2023 |

|

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

10,321,827 |

|

|

$ |

155,267,098 |

|

|

Restricted cash |

|

|

426,851 |

|

|

|

429,372 |

|

|

Inventory |

|

|

37,503,112 |

|

|

|

16,807,013 |

|

|

Prepaid expenses and prepaid inventories |

|

|

14,798,553 |

|

|

|

24,955,223 |

|

|

Accounts receivable |

|

|

124,295 |

|

|

|

671,750 |

|

|

TOTAL CURRENT ASSETS |

|

|

63,174,638 |

|

|

|

198,130,456 |

|

|

|

|

|

|

|

|

|

|

Property, plant, and equipment, net |

|

|

82,180,266 |

|

|

|

82,032,785 |

|

|

Intangible assets, net |

|

|

27,056,030 |

|

|

|

104,235,249 |

|

|

Right-of-use assets |

|

|

3,041,485 |

|

|

|

5,249,417 |

|

|

Related party receivable |

|

|

— |

|

|

|

2,250,489 |

|

|

Goodwill, net |

|

|

— |

|

|

|

28,846,832 |

|

|

Other noncurrent assets |

|

|

3,178,870 |

|

|

|

960,502 |

|

|

TOTAL ASSETS |

|

$ |

178,631,289 |

|

|

$ |

421,705,730 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

(DEFICIT) |

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

41,335,509 |

|

|

$ |

13,175,504 |

|

|

Accrued expenses and other current liabilities |

|

|

51,612,166 |

|

|

|

41,610,788 |

|

|

Derivative liabilities |

|

|

79,742,180 |

|

|

|

64,863,309 |

|

|

Liability to issue shares |

|

|

1,771,025 |

|

|

|

9,935,950 |

|

|

Lease liabilities, current portion |

|

|

2,893,967 |

|

|

|

2,134,494 |

|

|

Notes payable |

|

|

5,399,777 |

|

|

|

7,461,492 |

|

|

Refundable deposits |

|

|

417,674 |

|

|

|

429,372 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

183,172,298 |

|

|

|

139,610,909 |

|

|

Liability to issue shares, net of current portion |

|

|

356,206 |

|

|

|

1,827,889 |

|

|

Lease liabilities, net of current portion |

|

|

11,648,662 |

|

|

|

3,566,922 |

|

|

Deferred tax liability |

|

|

— |

|

|

|

3,891,900 |

|

|

TOTAL LIABILITIES |

|

$ |

195,177,166 |

|

|

$ |

148,897,620 |

|

|

Contingencies and claims (Note 19) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

|

|

|

|

Preferred stock; $0.001 par value; 126,263,159 and 127,474,458

shares authorized at September 30, 2024 and 2023,

respectively; |

|

|

|

|

|

|

|

Preferred Series D; 84,572,538 shares authorized, 363,097 shares

issued and outstanding at September 30, 2024 and 2023, respectively

(preference in liquidation of $159,000 at September 30, 2024 and

2023) |

|

|

363 |

|

|

|

363 |

|

|

Preferred Series C; 24,874,079 and 26,085,378 shares authorized at

September 30, 2024 and 2023, respectively; 458 and 1,211,757 shares

issued and outstanding at September 30, 2024 and 2023, respectively

(preference in liquidation of $4,049 and $10,696,895 at September

30, 2024 and 2023, respectively) |

|

|

— |

|

|

|

1,212 |

|

|

Preferred Series A; 83,859 shares authorized; 648 shares issued and

outstanding at September 30, 2024 and 2023 (preference in

liquidation of $836 at September 30, 2024 and 2023) |

|

|

1 |

|

|

|

1 |

|

|

Common stock; $0.001 par value; 5,000,000,000 shares authorized;

4,577,306 and 28,718 shares issued and outstanding at September 30,

2024 and 2023 respectively |

|

|

4,577 |

|

|

|

29 |

|

|

Additional paid-in capital |

|

|

2,290,659,971 |

|

|

|

2,071,112,969 |

|

|

Accumulated deficit |

|

|

(2,319,220,938 |

) |

|

|

(1,862,162,037 |

) |

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) ATTRIBUTABLE TO THE

COMPANY'S STOCKHOLDERS |

|

|

(28,556,026 |

) |

|

|

208,952,537 |

|

|

Noncontrolling interest |

|

|

12,010,149 |

|

|

|

63,855,573 |

|

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

(16,545,877 |

) |

|

|

272,808,110 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

(DEFICIT) |

|

$ |

178,631,289 |

|

|

$ |

421,705,730 |

|

| |

|

|

|

|

|

|

MULLEN

AUTOMOTIVE INC.CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

|

|

|

|

|

| |

|

Year Ended September 30, |

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

Revenue from sale of vehicles |

|

$ |

1,094,322 |

|

|

$ |

366,000 |

|

| Cost of

revenues |

|

|

16,894,100 |

|

|

|

273,882 |

|

|

Gross profit / (loss) |

|

|

(15,799,778 |

) |

|

|

92,118 |

|

| |

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

| General and

administrative |

|

$ |

181,947,541 |

|

|

$ |

215,846,132 |

|

| Research and

development |

|

|

74,889,400 |

|

|

|

77,387,336 |

|

| Impairment

of goodwill |

|

|

30,062,727 |

|

|

|

63,988,000 |

|

| Impairment

of intangible assets |

|

|

73,447,067 |

|

|

|

5,873,000 |

|

| Impairment

of right-of-use assets |

|

|

11,505,001 |

|

|

|

— |

|

| Impairment

of property, plant, and equipment, and other noncurrent assets |

|

|

4,174,935 |

|

|

|

14,770,000 |

|

| Loss

from operations |

|

|

(391,826,449 |

) |

|

|

(377,772,350 |

) |

| |

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

| Other

financing costs - initial recognition of derivative

liabilities |

|

|

(54,653,033 |

) |

|

|

(506,238,038 |

) |

| Other

financing costs - initial recognition of warrants |

|

|

(13,652,762 |

) |

|

|

— |

|

| Other

financing costs - ELOC commitment fee |

|

|

(6,000,000 |

) |

|

|

— |

|

| Gain/(loss)

on warrants and derivative liability revaluation |

|

|

4,503,099 |

|

|

|

(116,256,212 |

) |

| Gain/(loss)

on extinguishment of debt |

|

|

(655,721 |

) |

|

|

(6,246,089 |

) |

| Loss on

financing |

|

|

— |

|

|

|

(8,934,892 |

) |

| Gain/(loss)

on disposal of fixed assets |

|

|

(511,838 |

) |

|

|

386,377 |

|

| Interest

expense |

|

|

(49,377,125 |

) |

|

|

(4,993,140 |

) |

| Other

income, net |

|

|

2,458,578 |

|

|

|

2,407,034 |

|

| Total other

income (expense) |

|

|

(117,888,802 |

) |

|

|

(639,874,960 |

) |

| Net

loss before income tax benefit |

|

$ |

(509,715,251 |

) |

|

$ |

(1,017,647,310 |

) |

| |

|

|

|

|

|

|

| Income tax

benefit/ (provision) |

|

|

3,888,700 |

|

|

|

10,988,482 |

|

| Net

loss |

|

$ |

(505,826,551 |

) |

|

$ |

(1,006,658,828 |

) |

| |

|

|

|

|

|

|

| Net loss

attributable to noncontrolling interest |

|

|

(48,767,650 |

) |

|

|

(34,404,246 |

) |

| Net

loss attributable to stockholders |

|

$ |

(457,058,901 |

) |

|

$ |

(972,254,582 |

) |

| |

|

|

|

|

|

|

|

Waived/(accrued) accumulated preferred dividends and other capital

transactions with Preferred stock owners |

|

|

(13,902,843 |

) |

|

|

7,360,397 |

|

| |

|

|

|

|

|

|

| Net

loss attributable to common stockholders after preferred dividends

and other capital transactions with Preferred stock

owners |

|

$ |

(470,961,744 |

) |

|

$ |

(964,894,185 |

) |

| |

|

|

|

|

|

|

| Net Loss per

Share |

|

$ |

(1,425.61 |

) |

|

$ |

(157,405.25 |

) |

| |

|

|

|

|

|

|

| Weighted

average shares outstanding, basic and diluted |

|

|

330,358 |

|

|

|

6,130 |

|

| |

|

|

|

|

|

|

MULLEN

AUTOMOTIVE INC.CONSOLIDATED STATEMENTS OF

CASH FLOWS

| |

|

|

|

|

|

|

| |

|

Year Ended September 30, |

| |

|

2024 |

|

|

2023 |

|

| Cash

Flows from Operating Activities |

|

|

|

|

|

|

|

Net loss |

|

$ |

(505,826,551 |

) |

|

$ |

(1,006,658,828 |

) |

| Adjustments

to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Stock-based compensation |

|

|

40,432,688 |

|

|

|

85,441,869 |

|

|

Deferred income taxes |

|

|

(3,891,900 |

) |

|

|

(10,990,882 |

) |

|

Depreciation and amortization |

|

|

21,984,312 |

|

|

|

16,388,299 |

|

|

Amortization of debt discount and other non-cash interest

expense |

|

|

48,790,729 |

|

|

|

862,045 |

|

|

Impairment of intangible assets |

|

|

73,447,067 |

|

|

|

5,873,000 |

|

|

Impairment of goodwill |

|

|

30,062,727 |

|

|

|

63,988,000 |

|

|

Impairment of right-of-use assets |

|

|

11,505,001 |

|

|

|

— |

|

|

Impairment of property, plant, and equipment, and other noncurrent

assets |

|

|

4,174,935 |

|

|

|

14,770,000 |

|

|

Write-down of inventory to net realizable value |

|

|

15,578,429 |

|

|

|

1,000,284 |

|

|

Other financing costs - ELOC commitment fee |

|

|

6,000,000 |

|

|

|

— |

|

|

Other financing costs - initial recognition of derivative

liabilities |

|

|

54,653,033 |

|

|

|

506,238,038 |

|

|

Other financing costs - initial recognition of warrants |

|

|

13,652,762 |

|

|

|

6,814,000 |

|

|

Revaluation of derivative liabilities |

|

|

(4,503,099 |

) |

|

|

116,256,212 |

|

|

Loss/(gain) on extinguishment of debt |

|

|

655,721 |

|

|

|

6,246,089 |

|

|

Loss/(gain) on assets disposal |

|

|

511,838 |

|

|

|

(386,377 |

) |

|

Non-cash financing loss on over-exercise of warrants |

|

|

— |

|

|

|

8,934,892 |

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

547,455 |

|

|

|

— |

|

|

Inventories |

|

|

(36,274,528 |

) |

|

|

(17,807,297 |

) |

|

Prepaids and other assets |

|

|

8,420,150 |

|

|

|

(22,687,245 |

) |

|

Accounts payable |

|

|

25,227,125 |

|

|

|

7,784,136 |

|

|

Accrued expenses and other liabilities |

|

|

9,752,481 |

|

|

|

38,500,352 |

|

|

Right-of-use assets and lease liabilities |

|

|

(455,856 |

) |

|

|

261,222 |

|

|

Net cash used in operating activities |

|

|

(185,555,481 |

) |

|

|

(179,172,191 |

) |

| |

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

Purchase of equipment |

|

|

(14,748,055 |

) |

|

|

(14,508,004 |

) |

|

Acquisition of MTI business |

|

|

(1,400,000 |

) |

|

|

— |

|

|

Purchase of intangible assets |

|

|

— |

|

|

|

(498,431 |

) |

|

ELMS assets purchase |

|

|

— |

|

|

|

(92,916,874 |

) |

|

Net cash used in investing activities |

|

|

(16,148,055 |

) |

|

|

(107,923,309 |

) |

| |

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

Proceeds from issuance of notes payable with attached warrants |

|

|

61,701,576 |

|

|

|

170,000,000 |

|

|

Payment of notes payable |

|

|

(4,945,832 |

) |

|

|

(20,694,353 |

) |

|

Proceeds from issuance of common stock and prefunded warrants |

|

|

— |

|

|

|

196,999,970 |

|

|

Reimbursement for over issuance of shares |

|

|

— |

|

|

|

17,721,868 |

|

|

Payments to acquire treasury stock |

|

|

— |

|

|

|

(5,610,600 |

) |

|

Net cash provided by financing activities |

|

|

56,755,744 |

|

|

|

358,416,885 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in cash |

|

|

(144,947,792 |

) |

|

|

71,321,385 |

|

|

Cash and restricted cash (in amount of $429,372), beginning of

period |

|

|

155,696,470 |

|

|

|

84,375,085 |

|

|

Cash and restricted cash (in amount of $426,851), ending of

period |

|

$ |

10,748,678 |

|

|

$ |

155,696,470 |

|

| |

|

|

|

|

|

|

|

Supplemental disclosure of Cash Flow

information: |

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

37,458 |

|

|

$ |

122,501 |

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure for Non-Cash

Activities: |

|

|

|

|

|

|

|

Exercise of warrants recognized earlier as liabilities |

|

$ |

113,837,742 |

|

|

$ |

627,836,463 |

|

|

Convertible notes and interest - conversion to common stock |

|

|

49,894,130 |

|

|

|

167,070,343 |

|

|

Right-of-use assets obtained in exchange of operating lease

liabilities |

|

|

11,867,625 |

|

|

|

2,112,773 |

|

|

Issuance of Series E P/S in exchange for Series C P/S |

|

|

8,605,241 |

|

|

|

— |

|

|

Issuance of Notes and Warrants upon exchange of Series E P/S |

|

|

7,866,592 |

|

|

|

— |

|

|

Common stock issued to settle other derivative liability |

|

|

6,508,995 |

|

|

|

— |

|

|

Fair value of common stock issued to avoid fractional shares on

reverse stock split |

|

|

5,208,383 |

|

|

|

|

|

Extinguishment of accounts payable with recognition of

derivatives |

|

|

4,623,655 |

|

|

|

— |

|

|

Decrease of noncontrolling interest upon additional investments

into subsidiary |

|

|

3,077,774 |

|

|

|

— |

|

|

Common stock issued to extinguish other liabilities |

|

|

639,146 |

|

|

|

5,524,838 |

|

|

Reclassification of derivatives to equity upon authorization of

common shares |

|

|

— |

|

|

|

47,818,882 |

|

|

Notes issued to extinguish liability to issue stock |

|

|

|

|

|

11,597,571 |

|

|

Waiver of dividends by stockholders |

|

|

— |

|

|

|

7,387,808 |

|

|

Extinguishment of operational liabilities by sale of property |

|

|

— |

|

|

|

760,669 |

|

|

Extinguishment of financial liabilities by sale of property |

|

|

— |

|

|

|

238,259 |

|

| |

|

|

|

|

|

|

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based

automotive company building the next generation of commercial

electric vehicles (“EVs”) with two United States-based vehicle

plants located in Tunica, Mississippi, (120,000 square feet) and

Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen

began commercial vehicle production in Tunica. As of January 2024,

both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a

Class 3 EV cab chassis truck, are California Air Resource Board

(“CARB”) and EPA certified and available for sale in the U.S. The

Company has also recently expanded its commercial dealer network to

seven dealers, which includes Papé Kenworth, Pritchard EV, National

Auto Fleet Group, Ziegler Truck Group, Range Truck Group, Eco Auto,

and Randy Marion Auto Group, providing sales and service coverage

in key West Coast, Midwest, Pacific Northwest, New England and

Mid-Atlantic markets.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that are not historical

facts are forward-looking statements within the meaning of Section

27A of the Securities Exchange Act of 1934, as amended. Any

statements contained in this press release that are not statements

of historical fact may be deemed forward-looking statements. Words

such as "continue," "will," "may," "could," "should," "expect,"

"expected," "plans," "intend," "anticipate," "believe," "estimate,"

"predict," "potential" and similar expressions are intended to

identify such forward-looking statements. All forward-looking

statements involve significant risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied in the forward-looking statements, many of which are

generally outside the control of Mullen and are difficult to

predict. Examples of such risks and uncertainties include, but are

not limited to whether sales demand and traction for its vehicles

will continue, how long the Company’s competitive advantage with

its commercial vehicle line up will continue, whether federal,

state and other electric vehicle incentive programs will continue,

the outcome of the Company’s application to DOE for $55 million in

matching DOE funds to support its U.S. manufacturing capabilities

and whether the Company will be successful with its battery

development initiatives or meet its projected battery production,

certification and sales timelines. Additional examples of such

risks and uncertainties include but are not limited to: (i)

Mullen’s ability (or inability) to obtain additional financing in

sufficient amounts or on acceptable terms when needed; (ii)

Mullen's ability to maintain existing, and secure additional,

contracts with manufacturers, parts and other service providers

relating to its business; (iii) Mullen’s ability to successfully

expand in existing markets and enter new markets; (iv) Mullen’s

ability to successfully manage and integrate any acquisitions of

businesses, solutions or technologies; (v) unanticipated operating

costs, transaction costs and actual or contingent liabilities; (vi)

the ability to attract and retain qualified employees and key

personnel; (vii) adverse effects of increased competition on

Mullen’s business; (viii) changes in government licensing and

regulation that may adversely affect Mullen’s business; (ix) the

risk that changes in consumer behavior could adversely affect

Mullen’s business; (x) Mullen’s ability to protect its intellectual

property; and (xi) local, industry and general business and

economic conditions. Additional factors that could cause actual

results to differ materially from those expressed or implied in the

forward-looking statements can be found in the most recent annual

report on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K filed by Mullen with the Securities and

Exchange Commission. Mullen anticipates that subsequent events and

developments may cause its plans, intentions and expectations to

change. Mullen assumes no obligation, and it specifically disclaims

any intention or obligation, to update any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by law. Forward-looking

statements speak only as of the date they are made and should not

be relied upon as representing Mullen’s plans and expectations as

of any subsequent date.

Contact:Mullen Automotive, Inc.+1 (714)

613-1900www.MullenUSA.com

Corporate Communications:InvestorBrandNetwork

(IBN)Los Angeles,

Californiawww.InvestorBrandNetwork.com310.299.1717

OfficeEditor@InvestorBrandNetwork.com

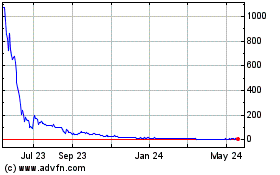

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Dec 2024 to Jan 2025

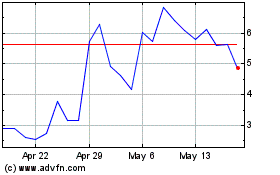

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Jan 2024 to Jan 2025