Papa John’s International, Inc. (Nasdaq: PZZA) (“Papa Johns®”)

(the “Company”) today announced financial results for the third

quarter ended September 29, 2024.

Highlights

- North America comparable sales(a) were down 6% from a year ago

as Domestic Company-owned restaurants were down 7% and North

America franchised restaurants were down 5%; International

comparable sales(a) were down 3% compared with the prior year

period.

- 25 net restaurant openings in the third quarter; North America

remains on track for more than 100 gross restaurant openings in

fiscal year 2024, while International anticipated gross openings

increases to between 170 and 190 restaurants.

- Global system-wide restaurant sales were $1.19 billion, a 3%(b)

decrease compared with the prior year third quarter, driven by

lower comparable sales partially offset by trailing twelve month

net restaurant growth.

- Total revenues of $507 million were down 3% compared with a

year ago driven by lower International revenues resulting from the

refranchising and closure of Company-owned restaurants and lower

sales at our Domestic Company-owned restaurants.

- Operating income increased to $65 million compared with $32

million a year ago, while Adjusted operating income(c) decreased $4

million to $29 million primarily related to lower Domestic

Company-owned restaurant-level margins, as anticipated, in the

third quarter.

- Diluted earnings per common share of $1.27 compared with $0.48

for the third quarter of 2023; Adjusted diluted earnings per common

share(c) was $0.43 compared with $0.53 for the third quarter a year

ago.

“In my first few months at Papa Johns, I have been impressed

with the disciplined execution of our teams. During the third

quarter, we delivered earnings in line with our expectations in

what continues to be a very challenging consumer environment,” said

Todd Penegor, Papa Johns President and CEO.

“I joined Papa Johns because I could see the potential in this

company. With our leadership team, we continue to evaluate the

business and refine our key strategic initiatives. We are

encouraged by the early progress we are making to improve our value

perception along with our digital and loyalty experience.

Reigniting our track record of innovation and prioritizing the

customer experience and franchisee profitability, we’re confident

Papa Johns can return to sustainable, profitable growth,” added

Penegor. “We are excited about the opportunities ahead of us and

look forward to sharing our progress with our investors and other

key stakeholders.”

(a) North America and International

comparable sales are reported on a 13-week basis comparing July 1,

2024 through September 29, 2024 with July 3, 2023 through October

1, 2023.

(b) Excludes the impact of foreign

currency.

(c) Represents a Non-GAAP financial

measure. See “Non-GAAP Financial Measures” for a reconciliation to

the most comparable US GAAP measures.

Financial Highlights

Three Months Ended

Nine Months Ended

(In thousands, except per share

amounts)

September 29,

2024

September 24,

2023

Increase (Decrease)

September 29,

2024

September 24,

2023

Increase (Decrease)

Total revenues

$

506,807

$

522,812

$

(16,005

)

$

1,528,617

$

1,564,391

$

(35,774

)

Operating income

$

65,229

$

31,868

$

33,361

$

127,173

$

104,576

$

22,597

Adjusted operating income (a)

$

29,297

$

33,638

$

(4,341

)

$

110,893

$

109,671

$

1,222

Net income attributable to the Company

$

41,808

$

15,861

$

25,947

$

68,687

$

56,005

$

12,682

Diluted earnings per common share

$

1.27

$

0.48

$

0.79

$

2.09

$

1.68

$

0.41

Adjusted diluted earnings per common share

(a)

$

0.43

$

0.53

$

(0.10

)

$

1.71

$

1.80

$

(0.09

)

Results for the first nine months of 2024 are not directly

comparable with the first nine months of 2023, as year-over-year

comparisons are impacted by the UK franchisee acquisitions that

occurred during the second and third quarters of 2023 and the UK

restaurant closures and refranchising transactions in the second

and third quarters of 2024.

Quarterly Results

Total revenues of $506.8 million decreased $16.0 million, or

3.1%, in the third quarter of 2024 compared with the prior year

period. The lower revenues were largely attributable to: 1) a $9.9

million decrease in International revenues primarily reflecting the

net impact of the UK Company-owned restaurants versus the prior

year period; 2) an $8.5 million decrease in Domestic Company-owned

restaurant sales reflecting lower transaction volumes; and, 3) a

$4.8 million decrease related to Preferred Marketing, our formerly

wholly-owned print and promotions company which was sold in the

fourth quarter of 2023. Partially offsetting these declines was a

$5.5 million increase in North America commissary revenues,

reflecting higher commodity prices, partially offset by lower

transaction volumes.

For the third quarter of 2024, Global system-wide restaurant

sales were $1.19 billion, down 3.0% from the prior year quarter

(excluding the impact of foreign currency). The decrease was due to

lower comparable sales, partially offset by 1.6% global net

restaurant growth on a trailing twelve-month basis.

Third quarter Operating income was $65.2 million, a $33.4

million increase compared with the prior year third quarter,

primarily due to $41.3 million of gains associated with the sale(b)

of two Quality Control Center properties (“QC Centers”) in the

current year third quarter. Adjusted operating income(a) was $29.3

million, a $4.3 million, or 12.9%, decrease from the same period a

year ago. The variance between Operating income and Adjusted

operating income was due to the aforementioned gains from the QC

Center sales, $3.9 million of International restructuring costs in

the UK, and a $1.5 million non-cash impairment charge primarily

related to fixed and intangible assets from the refranchising of 15

Domestic restaurants.

The decrease in Adjusted operating income in the third quarter

of 2024 was primarily due to anticipated lower operating margins at

our Domestic Company-owned restaurants as the Company strategically

reinvested some of its first-half savings into improving its value

perception with consumers.

Diluted earnings per common share was $1.27 for the third

quarter of 2024 compared with $0.48 in the third quarter of 2023.

Adjusted diluted earnings per common share(a) was $0.43 for the

third quarter of 2024 compared with $0.53 in the third quarter of

2023. These changes were driven by the same factors impacting

Operating income and Adjusted operating income as discussed above.

In addition, diluted earnings per common share and Adjusted diluted

earnings per common share reflected lower interest expense and a

higher effective tax rate compared with the third quarter of 2023.

Interest expense decreased largely due to lower average outstanding

debt compared with the prior year third quarter. The higher tax

rate reflects the impairment charges related to the International

Restructuring program as well as the shortfall from the vesting of

long-term equity awards, resulting in an additional tax expense

when compared with the prior year period.

See the Management’s Discussion and Analysis of Financial

Condition and Results of Operations section of our Quarterly Report

on Form 10-Q filed with the SEC for additional information

concerning our operating results for the three and nine months

ended September 29, 2024.

(a) Represents a Non-GAAP financial

measure. See “Non-GAAP Financial Measures” for a reconciliation to

the most comparable US GAAP measures.

(b) Properties were subsequently leased

back by the Company. See “Note 11. Divestitures” in the Company’s

Form 10-Q for the quarter ended September 29, 2024 for additional

information.

Global Restaurant Sales

Information

Global restaurant and comparable sales information for the three

and nine months ended September 29, 2024, compared with the three

and nine months ended September 24, 2023 are as follows (See

“Supplemental Information and Financial Statements” below for

related definitions):

Three Months Ended

Nine Months Ended

Amounts below exclude the impact of

foreign currency

September 29,

2024

September 24,

2023

September 29,

2024

September 24,

2023

Comparable sales growth

(decline):

Domestic Company-owned restaurants

(6.7

)%

5.9

%

(4.6

)%

3.8

%

North America franchised restaurants

(5.3

)%

2.2

%

(3.4

)%

(0.4

)%

North America restaurants

(5.6

)%

2.9

%

(3.6

)%

0.4

%

International restaurants

(2.8

)%

(0.3

)%

(1.8

)%

(2.3

)%

Total comparable sales growth

(decline)

(4.9

)%

2.2

%

(3.2

)%

(0.2

)%

System-wide restaurant sales growth

(decline):

Domestic Company-owned restaurants

(4.8

)%

6.7

%

(2.8

)%

4.7

%

North America franchised restaurants

(3.8

)%

3.2

%

(2.4

)%

1.1

%

North America restaurants

(4.0

)%

3.9

%

(2.5

)%

1.8

%

International restaurants (a)

—

%

8.8

%

2.2

%

6.8

%

Total global system-wide restaurant sales

growth (decline) (a)

(3.0

)%

5.1

%

(1.4

)%

3.0

%

(a) System-wide sales for the nine months ended September 29, 2024

include $7.1 million of International sales related to the first

and second quarters of 2024 that were erroneously omitted in prior

periods.

Global Restaurants

As of September 29, 2024, there were 5,908 Papa Johns

restaurants operating in 49 countries and territories, as

follows:

Third Quarter

Domestic Company Owned

Franchised North

America

Total North America

International Company

Owned

International

Franchised

Total International

System-wide

Beginning - June 30, 2024

537

2,910

3,447

33

2,403

2,436

5,883

Opened

—

18

18

—

36

36

54

Closed

—

(11

)

(11

)

—

(18

)

(18

)

(29

)

Refranchised

—

—

—

(20

)

20

—

—

Ending - September 29, 2024

537

2,917

3,454

13

2,441

2,454

5,908

Net restaurant growth/(decline)

—

7

7

(20

)

38

18

25

Trailing four quarters net restaurant

growth

11

46

57

(105

)

139

34

91

Free Cash Flow

Free cash flow, a non-GAAP financial measure which the Company

defines as net cash provided by operating activities, less

purchases of property and equipment, was $9.0 million for the nine

months ended September 29, 2024, compared with $76.0 million in the

prior year period. The year over year change primarily reflects

unfavorable working capital changes and timing of cash payments for

advertising and income taxes, partially offset by a $4.0 million

decrease in capital expenditures.

Nine Months Ended

(in thousands)

September 29,

2024

September 24,

2023

Net cash provided by operating

activities

$

55,884

$

126,936

Purchases of property and equipment

(46,931

)

(50,905

)

Free cash flow

$

8,953

$

76,031

We view free cash flow as an important financial measure because

it is one factor that management uses in determining the amount of

cash available for discretionary investment. Free cash flow is not

a term defined by GAAP, and as a result, our measure of free cash

flow might not be comparable to similarly titled measures used by

other companies. Free cash flow should not be construed as a

substitute for or a better indicator of the Company’s performance

than the Company’s GAAP measures.

Cash Dividend

The Company paid cash dividends of $15.2 million ($0.46 per

common share) in the third quarter of 2024. On October 29, 2024,

our Board of Directors declared a fourth quarter dividend of $0.46

per common share. The dividend will be paid on November 29, 2024 to

stockholders of record as of the close of business on November 18,

2024.

Conference Call

Papa Johns will host a call with analysts today, November 7,

2024, at 8:00 a.m. Eastern Time. To access the conference call or

webcast, please register online at:

ir.papajohns.com/events-presentations. A replay of the webcast will

be available two hours after the call and archived on the same web

page.

About Papa Johns

Papa John’s International, Inc. (Nasdaq: PZZA) opened its doors

in 1984 with one goal in mind: BETTER INGREDIENTS. BETTER PIZZA.®

Papa Johns believes that using high-quality ingredients leads to

superior quality pizzas. Its original dough is made of only six

ingredients and is fresh, never frozen. Papa Johns tops its pizzas

with real cheese made from mozzarella, pizza sauce made with

vine-ripened tomatoes that go from vine to can in the same day and

meat free of fillers. It was the first national pizza delivery

chain to announce the removal of artificial flavors and synthetic

colors from its entire food menu. Papa Johns is co-headquartered in

Atlanta, Ga. and Louisville, Ky. and is the world’s third-largest

pizza delivery company with more than 5,900 restaurants in

approximately 50 countries and territories. For more information

about the Company or to order pizza online, visit www.papajohns.com

or download the Papa Johns mobile app for iOS or Android.

Forward-Looking

Statements

Certain matters discussed in this press release and other

Company communications that are not statements of historical fact

constitute forward-looking statements within the meaning of the

federal securities laws. Generally, the use of words such as

“expect,” “intend,” “estimate,” “believe,” “anticipate,” “will,”

“forecast,” “outlook”, “plan,” “project,” or similar words identify

forward-looking statements that we intend to be included within the

safe harbor protections provided by the federal securities laws.

Such forward-looking statements include or may relate to

projections or guidance concerning business performance, revenue,

earnings, cash flow, earnings per share, share repurchases, the

current economic environment, commodity and labor costs, currency

fluctuations, profit margins, supply chain operating margin, net

unit growth, unit level performance, capital expenditures,

restaurant and franchise development, restaurant acquisitions,

restaurant closures, labor shortages, labor cost increases, changes

in management, inflation, royalty relief, franchisee support and

incentives, the effectiveness of our menu innovations and other

business initiatives, investments in product and digital

innovation, marketing efforts and investments, liquidity,

compliance with debt covenants, impairments, strategic decisions

and actions, changes to our national marketing fund, changes to our

commissary model, dividends, effective tax rates, regulatory

changes and impacts, investments in and repositioning of the UK

market, International restructuring plans, timing and costs,

International consumer demand, adoption of new accounting

standards, and other financial and operational measures. Such

statements are not guarantees of future performance and involve

certain risks, uncertainties and assumptions, which are difficult

to predict and many of which are beyond our control. Therefore,

actual outcomes and results may differ materially from those

matters expressed or implied in such forward-looking

statements.

Our forward-looking statements are based on our assumptions

which are based on currently available information. Actual outcomes

and results may differ materially from those matters expressed or

implied in our forward-looking statements as a result of various

factors, including but not limited to risks related to:

deteriorating economic conditions in the U.S. and international

markets, including the United Kingdom; labor shortages at Company

and/or franchised restaurants and our quality control centers;

increases in labor costs, changes in commodity costs, supply chain

incentive-based rebates, or sustained higher other operating costs,

including as a result of supply chain disruption, inflation or

climate change; the potential for delayed new restaurant openings,

both domestically and internationally, or lower net unit

development due to changing circumstances outside of our control;

the increased risk of phishing, ransomware and other cyber-attacks;

risks and disruptions to the global economy and our business

related to the conflicts in Ukraine and the Middle East and other

international conflicts and risks related to a possible economic

recession or downturn that could reduce consumer spending or

demand. These and other risks, uncertainties and assumptions that

are involved in our forward-looking statements are discussed in

detail in “Part I. Item 1A. – Risk Factors” in our Annual Report on

Form 10-K for the fiscal year ended December 31, 2023. We undertake

no obligation to update publicly any forward-looking statements,

whether as a result of future events, new information or otherwise,

except as required by law.

For more information about the company, please visit

www.papajohns.com.

Supplemental

Information and Financial Statements

Definitions

“Comparable sales” represents sales for the same base of

restaurants for the same fiscal periods. “Comparable sales growth

(decline)” represents the change in year-over-year comparable

sales. “Global system-wide restaurant sales” represents total

restaurant sales for all Company-owned and franchised restaurants

open during the comparable periods, and “Global system-wide

restaurant sales growth (decline)” represents the change in global

system-wide restaurant sales year-over-year. Comparable sales,

Comparable sales growth (decline), Global system-wide restaurant

sales and Global system-wide sales growth (decline) exclude

franchisees for which we suspended corporate support.

We believe Domestic Company-owned, North America franchised, and

International Comparable sales growth (decline) and Global

system-wide restaurant sales information is useful in analyzing our

results since our franchisees pay royalties and marketing fund

contributions that are based on a percentage of franchise sales.

Comparable sales and Global system-wide restaurant sales results

for restaurants operating outside of the United States are reported

on a constant dollar basis, which excludes the impact of foreign

currency translation. Franchise sales also generate commissary

revenue in the United States and in certain international markets.

Comparable sales growth (decline) and Global system-wide restaurant

sales information is also useful for comparison to industry trends

and evaluating the strength of our brand. Management believes the

presentation of Global system-wide restaurant sales growth,

excluding the impact of foreign currency, provides investors with

useful information regarding underlying sales trends and the impact

of new unit growth without being impacted by swings in the external

factor of foreign currency. Franchise restaurant sales are not

included in the Company’s revenues.

Non-GAAP Financial

Measures

In addition to the results provided in accordance with U.S.

GAAP, we provide certain non-GAAP measures, which present results

on an adjusted basis. These are supplemental measures of

performance that are not required by or presented in accordance

with U.S. GAAP and include the following: Adjusted operating

income, Adjusted net income attributable to common shareholders and

Adjusted diluted earnings per common share. We believe that our

non-GAAP financial measures enable investors to assess the

operating performance of our business relative to our performance

based on U.S. GAAP results and relative to other companies. We

believe that the disclosure of these non-GAAP measures is useful to

investors as they reflect metrics that our management team and

Board utilize to evaluate our operating performance, allocate

resources and administer employee incentive plans. The most

directly comparable U.S. GAAP measures to Adjusted operating

income, Adjusted net income attributable to common shareholders and

Adjusted diluted earnings per common share are Operating income,

net income attributable to common shareholders and diluted earnings

per common share, respectively. These non-GAAP measures should not

be construed as a substitute for or a better indicator of the

Company’s performance than the Company’s U.S. GAAP results. The

table that follows reconciles our GAAP financial results to our

non-GAAP financial measures.

Three Months Ended

Nine Months Ended

(In thousands, except per share

amounts)

September 29,

2024

September 24,

2023

September 29,

2024

September 24,

2023

Operating income

$

65,229

$

31,868

$

127,173

$

104,576

Gain on sale of QC Center properties

(a)

(41,289

)

—

(41,289

)

—

International restructuring costs (b)

3,862

—

19,514

—

UK repositioning and acquisition-related

costs (c)

—

1,193

—

2,501

Legal settlements (d)

—

577

—

577

Other costs (e)

1,495

—

5,495

2,017

Adjusted operating income

$

29,297

$

33,638

$

110,893

$

109,671

Net income attributable to common

shareholders

$

41,808

$

15,861

$

68,687

$

56,005

Gain on sale of QC Center properties

(a)

(41,289

)

—

(41,289

)

—

International restructuring costs (b)

3,862

—

19,514

—

UK repositioning and acquisition-related

costs (c)

—

1,193

—

2,501

Legal settlements (d)

—

577

—

577

Other costs (e)

1,495

—

5,495

2,017

Tax effect of adjustments (f)

8,121

(404

)

3,679

(1,162

)

Adjusted net income attributable to

common shareholders

$

13,997

$

17,227

$

56,086

$

59,938

Diluted earnings per common

share

$

1.27

$

0.48

$

2.09

$

1.68

Gain on sale of QC Center properties

(a)

(1.25

)

—

(1.25

)

—

International restructuring costs (b)

0.12

—

0.59

—

UK repositioning and acquisition-related

costs (c)

—

0.04

—

0.07

Legal settlements (d)

—

0.02

—

0.02

Other costs (e)

0.04

—

0.17

0.06

Tax effect of adjustments (f)

0.25

(0.01

)

0.11

(0.03

)

Adjusted diluted earnings per common

share

$

0.43

$

0.53

$

1.71

$

1.80

Refer to footnotes on following page.

Footnotes to Non-GAAP Financial Measures

(a)

Represents pre-tax gain on sale,

net of transaction costs, realized upon the August 2, 2024

completion of the sale of our Texas and Florida QC Center

properties.

(b)

Represents costs associated with

the Company’s International Restructuring plan. For the three and

nine months ended September 29, 2024, these costs are comprised

primarily of lease and fixed asset impairment charges related to

restaurant closures in the UK, professional services and other

related costs, losses on refranchising Company-owned restaurants,

losses on franchisee notes receivable, lease termination costs, as

well as severance.

(c)

Represents costs associated with

repositioning the UK portfolio as well as transaction costs related

to the acquisition of restaurants from franchisees.

(d)

Represents accruals for certain

legal settlements, recorded in General and administrative

expenses.

(e)

For the three and nine months

ended September 29, 2024, represents non-cash impairment and

remeasurement charges related primarily to fixed and intangible

assets from the refranchising of 15 Domestic Company-owned

restaurants. For the three and nine months ended September 24,

2023, represents severance and related costs associated with the

transition of certain executives, recorded in General and

administrative expenses.

(f)

The tax effect on non-GAAP

adjustments was calculated by applying the marginal tax rates of

22.6% and 22.8% for the three and nine months ended September 29,

2024 and September 24, 2023, respectively.

Papa John’s International,

Inc. and Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands, except per share

amounts)

September 29,

2024

December 31,

2023

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

17,550

$

40,587

Accounts receivable, net

101,804

104,244

Notes receivable, current portion

5,728

5,199

Income tax receivable

2,414

2,577

Inventories

36,488

36,126

Prepaid expenses and other current

assets

51,873

42,285

Total current assets

215,857

231,018

Property and equipment, net

266,508

282,812

Finance lease right-of-use assets, net

25,535

31,740

Operating lease right-of-use assets

191,194

164,158

Notes receivable, less current portion,

net

7,346

12,346

Goodwill

76,460

76,206

Other assets

77,975

76,725

Total assets

$

860,875

$

875,005

Liabilities, Redeemable noncontrolling

interests and Stockholders’ deficit

Current liabilities:

Accounts payable

$

62,800

$

74,949

Income and other taxes payable

10,166

17,948

Accrued expenses and other current

liabilities

139,301

158,167

Current deferred revenue

19,645

20,427

Current finance lease liabilities

6,962

9,029

Current operating lease liabilities

26,001

24,076

Current portion of long-term debt

5,650

—

Total current liabilities

270,525

304,596

Deferred revenue

18,737

20,366

Long-term finance lease liabilities

19,921

24,144

Long-term operating lease liabilities

180,137

151,050

Long-term debt, less current portion,

net

721,355

757,422

Other long-term liabilities

64,882

60,192

Total liabilities

1,275,557

1,317,770

Redeemable noncontrolling

interests

937

851

Stockholders’ deficit:

Common stock ($0.01 par value per share;

issued 49,282 at September 29, 2024 and 49,235 at December 31,

2023)

493

492

Additional paid-in capital

449,141

452,290

Accumulated other comprehensive loss

(6,580

)

(7,803

)

Retained earnings

242,269

219,027

Treasury stock (16,645 shares at September

29, 2024 and 16,747 shares at December 31, 2023, at cost)

(1,116,256

)

(1,123,098

)

Total stockholders’ deficit

(430,933

)

(459,092

)

Noncontrolling interests in

subsidiaries

15,314

15,476

Total Stockholders’ deficit

(415,619

)

(443,616

)

Total Liabilities, Redeemable

noncontrolling interests and Stockholders’ deficit

$

860,875

$

875,005

Papa John’s International,

Inc. and Subsidiaries

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended

Nine Months Ended

(In thousands, except per share

amounts)

September 29,

2024

September 24,

2023

September 29,

2024

September 24,

2023

Revenues:

Domestic Company-owned restaurant

sales

$

168,672

$

177,195

$

518,103

$

532,841

North America franchise royalties and

fees

33,831

35,041

103,937

105,824

North America commissary revenues

210,389

204,887

611,873

624,433

International revenues

33,024

42,927

113,433

108,998

Other revenues

60,891

62,762

181,271

192,295

Total revenues

506,807

522,812

1,528,617

1,564,391

Costs and expenses:

Operating costs (excluding depreciation

and amortization shown separately below):

Domestic Company-owned restaurant

expenses

142,403

145,433

419,189

436,922

North America commissary expenses

193,818

189,551

561,316

576,434

International expenses

19,001

29,796

74,424

67,542

Other expenses

55,543

57,587

164,261

177,661

General and administrative expenses

13,553

52,173

129,726

154,441

Depreciation and amortization

17,260

16,404

52,528

46,815

Total costs and expenses

441,578

490,944

1,401,444

1,459,815

Operating income

65,229

31,868

127,173

104,576

Net interest expense

(10,629

)

(11,378

)

(32,588

)

(31,674

)

Income before income taxes

54,600

20,490

94,585

72,902

Income tax expense

12,812

4,539

25,347

16,546

Net income before attribution to

noncontrolling interests

41,788

15,951

69,238

56,356

Net loss (income) attributable to

noncontrolling interests

20

(90

)

(551

)

(351

)

Net income attributable to the

Company

$

41,808

$

15,861

$

68,687

$

56,005

Basic earnings per common share

$

1.28

$

0.49

$

2.10

$

1.69

Diluted earnings per common share

$

1.27

$

0.48

$

2.09

$

1.68

Basic weighted average common shares

outstanding

32,745

32,564

32,701

33,053

Diluted weighted average common shares

outstanding

32,930

32,800

32,850

33,287

Dividends declared per common share

$

0.46

$

0.46

$

1.38

$

1.30

Papa John’s International,

Inc. and Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Nine Months Ended

(In thousands)

September 29,

2024

September 24,

2023

Operating activities

Net income before attribution to

noncontrolling interests

$

69,238

$

56,356

Adjustments to reconcile net income to net

cash provided by operating activities:

Provision for allowance for credit losses

on accounts and notes receivable

2,936

1,348

Depreciation and amortization

52,528

46,815

Refranchising and impairment loss

17,433

—

Deferred income taxes

3,877

3,481

Stock-based compensation expense

5,903

13,224

Gain on disposal of property and

equipment

(42,034

)

—

Other

614

331

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable

879

(11,643

)

Income tax receivable

232

7,617

Inventories

(207

)

3,875

Prepaid expenses and other current

assets

(1,684

)

(2,104

)

Other assets and liabilities

(5,923

)

2,057

Accounts payable

(12,389

)

15,237

Income and other taxes payable

(7,609

)

1,087

Accrued expenses and other current

liabilities

(25,837

)

(6,579

)

Deferred revenue

(2,073

)

(4,166

)

Net cash provided by operating

activities

55,884

126,936

Investing activities

Purchases of property and equipment

(46,931

)

(50,905

)

Notes issued

(154

)

(7,310

)

Repayments of notes issued

3,148

5,759

Acquisitions, net of cash acquired

—

(5,599

)

Proceeds from dispositions

49,012

—

Other

2,373

401

Net cash provided by (used in) investing

activities

7,448

(57,654

)

Financing activities

Net (repayments) proceeds of revolving

credit facilities

(31,589

)

185,789

Proceeds from exercise of stock

options

1,021

1,816

Acquisition of Company common stock

—

(210,348

)

Dividends paid to common stockholders

(45,381

)

(43,641

)

Tax payments for equity award

issuances

(3,508

)

(6,279

)

Distributions to noncontrolling

interests

(627

)

(651

)

Principal payments on finance leases

(6,778

)

(5,975

)

Other

278

150

Net cash used in financing activities

(86,584

)

(79,139

)

Effect of exchange rate changes on cash

and cash equivalents

215

(24

)

Change in cash and cash equivalents

(23,037

)

(9,881

)

Cash and cash equivalents at beginning of

period

40,587

47,373

Cash and cash equivalents at end of

period

$

17,550

$

37,492

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106937512/en/

Papa Johns Investor Relations

investor_relations@papajohns.com

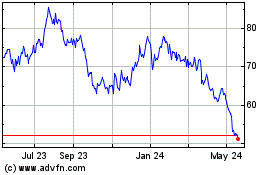

Papa Johns (NASDAQ:PZZA)

Historical Stock Chart

From Oct 2024 to Nov 2024

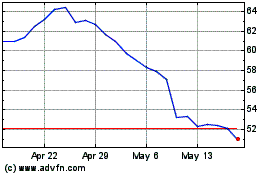

Papa Johns (NASDAQ:PZZA)

Historical Stock Chart

From Nov 2023 to Nov 2024