Net Investment Income of $0.40 Per Share; Declares Fourth

Quarter Dividend of $0.34 Per Share and a Special Dividend of $0.10

Per Share; 50 Consecutive Quarters of Dividend Coverage

BlackRock TCP Capital Corp. (“we,” “us,” “our,” “TCPC” or the

“Company”), a business development company (NASDAQ: TCPC), today

announced its financial results for the third quarter ended

September 30, 2024 and filed its Form 10-Q with the U.S. Securities

and Exchange Commission.

FINANCIAL HIGHLIGHTS

- On a GAAP basis, net investment income for the quarter ended

September 30, 2024 was $33.9 million, or $0.40 per share on a

diluted basis, which exceeded the regular dividend of $0.34 per

share paid on September 30, 2024. Excluding amortization of

purchase discount recorded in connection with the Merger(1),

adjusted net investment income(1) for the quarter ended September

30, 2024 was $30.8 million, or $0.36 per share on a diluted

basis.

- Net asset value per share was $10.11 as of September 30, 2024

compared to $10.20 as of June 30, 2024.

- Net increase in net assets from operations on a GAAP basis for

the quarter ended September 30, 2024 was $21.6 million, or $0.25

per share, compared to a $51.3 million, or $0.60 per share, net

decrease in net assets from operations for the quarter ended June

30, 2024.

- Total acquisitions during the quarter ended September 30, 2024

were approximately $72.8 million and total investment dispositions

were $139.2 million during the three months ended September 30,

2024.

- As of September 30, 2024, net leverage was 1.08x compared to

1.13x at June 30, 2024.

- As of September 30, 2024, debt investments on non-accrual

status represented 3.8% of the portfolio at fair value and 9.3% at

cost, compared to 4.9% of the portfolio at fair value and 10.5% at

cost as of June 30, 2024.

- On August 1, 2024, the Company amended the Operating Facility

to extend the maturity date to August 1, 2029. Additionally, on

August 23, 2024, the Company paid off $250.0 million in aggregate

principal amount of 3.90% notes due 2024 (the “2024 Notes”).

- On November 6, 2024, our Board of Directors declared a fourth

quarter dividend of $0.34 per share and a special dividend of $0.10

per share, both payable on December 31, 2024 to stockholders of

record as of the close of business on December 17, 2024.

“We delivered solid adjusted net investment income of $30.8

million, or $0.36 per share, for the third quarter, resulting in an

adjusted annualized NII return on average equity of 14%, which

continues to be at the high end of historical levels,” said Raj

Vig, Chairman and CEO of BlackRock TCP Capital Corp. “Our dividend

remains well covered at 106%. We are also pleased to report that

our board approved a special dividend of $0.10 per share payable to

our shareholders this quarter and also re-approved our

authorization to repurchase up to $50.0 million of our common

stock.”

“Our portfolio showed signs of improvement since last quarter as

non-accrual investments declined; however, an additional

non-accrual investment and certain markdowns resulted in a slight

reduction in the NAV. We are working diligently with our borrowers,

their lenders, and their sponsors to resolve credit issues with the

goal of achieving positive outcomes for our shareholders.”

“At quarter end, our portfolio remained well diversified with

156 investments primarily in senior secured, first-lien loans. We

have a strong capital and liquidity position to capitalize on a

growing pipeline of attractive investment opportunities to deliver

attractive risk-adjusted returns for our shareholders over the long

term.”

SELECTED FINANCIAL

HIGHLIGHTS(1)

Three months ended September

30,

2024

2023

Amount

Per

Share

Amount

Per

Share

Net investment income

$

33,877,641

0.40

$

28,319,912

0.49

Less: Purchase accounting discount

amortization

3,044,864

0.04

—

—

Adjusted net investment income

$

30,832,777

0.36

$

28,319,912

0.49

Net realized and unrealized gain

(loss)

$

(12,244,681

)

(0.14

)

$

(15,496,980

)

(0.27

)

Less: Realized gain (loss) due to the

allocation of purchase discount

2,727,500

0.03

—

—

Less: Net change in unrealized

appreciation (depreciation) due to the allocation of purchase

discount

(5,772,364

)

(0.07

)

—

—

Adjusted net realized and unrealized

gain (loss)

$

(9,199,817

)

(0.10

)

$

(15,496,980

)

(0.27

)

Net increase (decrease) in net assets

resulting from operations

$

21,632,960

0.25

$

12,822,932

0.22

Less: Purchase accounting discount

amortization

3,044,864

0.04

—

—

Less: Realized gain (loss) due to the

allocation of purchase discount

2,727,500

0.03

—

—

Less: Net change in unrealized

appreciation (depreciation) due to the allocation of purchase

discount

(5,772,364

)

(0.07

)

—

—

Adjusted net increase (decrease) in

assets resulting from operations

$

21,632,960

0.25

$

12,822,932

0.22

(1) On March 18, 2024, the Company completed its previously

announced merger with BlackRock Capital Investment Corporation

("Merger"). The Merger has been accounted for as an asset

acquisition of BlackRock Capital Investment Corporation ("BCIC") by

the Company in accordance with the asset acquisition method of

accounting as detailed in ASC 805-50 ("ASC 805"), Business

Combinations-Related Issues. The Company determined the fair value

of the shares of the Company's common stock that were issued to

former BCIC shareholders pursuant to the Merger Agreement plus

transaction costs to be the consideration paid in connection with

the Merger under ASC 805. The consideration paid to BCIC

shareholders was less than the aggregate fair values of the BCIC

assets acquired and liabilities assumed, which resulted in a

purchase discount (the “purchase discount”). The consideration paid

was allocated to the individual BCIC assets acquired and

liabilities assumed based on the relative fair values of net

identifiable assets acquired other than “non-qualifying” assets and

liabilities (for example, cash) and did not give rise to goodwill.

As a result, the purchase discount was allocated to the cost basis

of the BCIC investments acquired by the Company on a pro-rata basis

based on their relative fair values as of the effective time of the

Merger. Immediately following the Merger, the investments were

marked to their respective fair values in accordance with ASC 820

which resulted in immediate recognition of net unrealized

appreciation in the Consolidated Statement of Operations as a

result of the Merger. The purchase discount allocated to the BCIC

debt investments acquired will amortize over the remaining life of

each respective debt investment through interest income, with a

corresponding adjustment recorded to unrealized appreciation or

depreciation on such investment acquired through its ultimate

disposition. The purchase discount allocated to BCIC equity

investments acquired will not amortize over the life of such

investments through interest income and, assuming no subsequent

change to the fair value of the equity investments acquired and

disposition of such equity investments at fair value, the Company

may recognize a realized gain or loss with a corresponding reversal

of the unrealized appreciation on disposition of such equity

investments acquired.

As a supplement to the Company’s reported GAAP financial

measures, we have provided the following non-GAAP financial

measures that we believe are useful:

- “Adjusted net investment income” – excludes the amortization of

purchase accounting discount from net investment income calculated

in accordance with GAAP;

- “Adjusted net realized and unrealized gain (loss)” – excludes

the unrealized appreciation resulting from the purchase discount

and the corresponding reversal of the unrealized appreciation from

the amortization of the purchase discount from the determination of

net realized and unrealized gain (loss) determined in accordance

with GAAP; and

- “Adjusted net increase (decrease) in net assets resulting from

operations” – calculates net increase (decrease) in net assets

resulting from operations based on Adjusted net investment income

and Adjusted net realized and unrealized gain (loss).

We believe that the adjustment to exclude the full effect of

purchase discount accounting under ASC 805 from these financial

measures is meaningful because of the potential impact on the

comparability of these financial measures that we and investors use

to assess our financial condition and results of operations period

over period. Although these non-GAAP financial measures are

intended to enhance investors’ understanding of our business and

performance, these non-GAAP financial measures should not be

considered an alternative to GAAP. The aforementioned non-GAAP

financial measures may not be comparable to similar non-GAAP

financial measures used by other companies.

PORTFOLIO AND INVESTMENT ACTIVITY

As of September 30, 2024, our consolidated investment portfolio

consisted of debt and equity positions in 156 portfolio companies

with a total fair value of approximately $1.9 billion, of which

90.6% was in senior secured debt. 81.3% of the total portfolio was

first lien. Equity positions, which include equity interests in

diversified portfolios of debt, represented approximately 9.1% of

the portfolio. 92.7% of our debt investments were floating rate,

97.0% of which had interest rate floors.

As of September 30, 2024, the weighted average annual effective

yield of our debt portfolio was approximately 13.4%(1) and the

weighted average annual effective yield of our total portfolio was

approximately 11.9%, compared with 13.7% and 12.4%, respectively,

as of June 30, 2024. Debt investments in ten portfolio companies

were on non-accrual status as of September 30, 2024, representing

3.8% of the consolidated portfolio at fair value and 9.3% at

cost.

During the three months ended September 30, 2024, we invested

approximately $72.8 million, primarily in 9 investments, comprised

of 6 new and 3 existing portfolio companies. Of these investments,

$62.7 million, or 86.2% of total acquisitions, were in senior

secured loans, and $7.6 million, or 10.4% of total acquisitions,

were in senior secured notes. The remaining $2.5 million, or 3.4%

of total acquisitions, were comprised of equity investments.

Additionally, we received approximately $139.2 million in proceeds

from sales or repayments of investments during the three months

ended September 30, 2024. New investments during the quarter had a

weighted average effective yield of 11.3%. Investments we exited

had a weighted average effective yield of 13.4%.

As of September 30, 2024, total assets were $2.0 billion, net

assets were $865.6 million and net asset value per share was

$10.11, as compared to $2.2 billion, $873.1 million, and $10.20 per

share, respectively, as of June 30, 2024.

__________________________

(1) Weighted average annual effective yield includes

amortization of deferred debt origination and accretion of original

issue discount, but excludes market discount and any prepayment and

make-whole fee income. The weighted average effective yield on our

debt portfolio excludes non-accrual and non-income producing

loans.

CONSOLIDATED RESULTS OF OPERATIONS

Total investment income for the three months ended September 30,

2024 was approximately $70.9 million, or $0.83 per share.

Investment income for the three months ended September 30, 2024

included $0.08 per share from prepayment premiums and related

accelerated original issue discount and exit fee amortization,

$0.04 per share from recurring portfolio investment original issue

discount and exit fee amortization, $0.05 per share from interest

income paid in kind and $0.02 per share in dividend income. This

reflects our policy of recording interest income, adjusted for

amortization of portfolio investment premiums and discounts, on an

accrual basis. Origination, structuring, closing, commitment, and

similar upfront fees received in connection with the outlay of

capital are generally amortized into interest income over the life

of the respective debt investment.

Total operating expenses for the three months ended September

30, 2024 were approximately $37.1 million, or $0.43 per share,

including interest and other debt expenses of $21.2 million, or

$0.25 per share, and incentive compensation from net investment

income of $6.5 million, or $0.08 per share. Excluding incentive

compensation, interest and other debt expenses, annualized third

quarter expenses were 4.2% of average net assets.

Net investment income for the three months ended September 30,

2024 was approximately $33.9 million, or $0.40 per share. Net

realized losses for the three months ended September 30, 2024 were

$31.4 million, or $0.37 per share. Net realized losses for the

three months ended September 30, 2024 were comprised primarily of

$24.1 million and $7.4 million in losses from the restructuring of

our investments in Pluralsight and McAfee, respectively. Subsequent

to its restructuring, our debt investment in Pluralsight is back on

accrual status. Net unrealized gains for the three months ended

September 30, 2024 were $19.2 million, or $0.22 per share. Net

unrealized gains for the three months ended September 30, 2024

primarily reflect $24.1 million and $7.6 million reversals of

previous unrealized losses from the restructuring of our

investments in Pluralsight and McAfee, respectively, a $4.2 million

unrealized gain on our investment in Securus, a $3.6 million

unrealized gain on our investment in Domo and other unrealized

gains across the portfolio, partially offset by an $8.0 million

unrealized loss on our investment in Gordon Brothers, a $4.0

million unrealized loss on our investment in Seller-X, a $3.3

million unrealized loss on our investment in InMoment, a $2.8

million unrealized loss on our investment in Edmentum and a $2.2

million unrealized loss on our investment in Alpine. Net increase

in net assets resulting from operations for the three months ended

September 30, 2024 was $21.6 million, or $0.25 per share.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2024, available liquidity was approximately

$581.8 million, comprised of approximately $477.7 million in

available capacity under our leverage program, $104.2 million in

cash and cash equivalents, offset by $0.1 million in payable for

investments purchased.

The combined weighted-average interest rate on debt outstanding

at September 30, 2024 was 5.43%.

Total debt outstanding at September 30, 2024, including debt

assumed as a result of the Merger, was as follows:

Maturity

Rate

Carrying

Value (1)

Available

Total

Capacity

Operating Facility

2029

SOFR+2.00%

(2)

$

121,253,796

$

178,746,204

$

300,000,000

(3)

Funding Facility II

2027

SOFR+2.05%

(4)

51,000,000

149,000,000

200,000,000

(5)

Merger Sub Facility(6)

2028

SOFR+2.00%

(7)

125,000,000

140,000,000

265,000,000

(8)

SBA Debentures

2025−2031

2.45%

(9)

131,500,000

10,000,000

141,500,000

2025 Notes ($92 million par)(6)

2025

Fixed/Variable

(10)

92,000,000

—

92,000,000

2026 Notes ($325 million par)

2026

2.85%

325,497,355

—

325,497,355

2029 Notes ($325 million par)

2029

6.95%

321,590,452

—

321,590,452

Total leverage

1,167,841,603

$

477,746,204

$

1,645,587,807

Unamortized issuance costs

(7,798,616

)

Debt, net of unamortized issuance

costs

$

1,160,042,987

(1)

Except for the 2026 Notes and 2029 Notes,

all carrying values are the same as the principal amounts

outstanding.

(2)

As of September 30, 2024, $113.0 million

of the outstanding amount was subject to a SOFR credit adjustment

of 0.11%. $8.3 million of the outstanding amount bore interest at a

rate of EURIBOR + 2.00%.

(3)

Operating Facility includes a $100.0

million accordion which allows for expansion of the facility to up

to $400.0 million subject to consent from the lender and other

customary conditions.

(4)

Subject to certain funding requirements

and a SOFR credit adjustment of 0.15%.

(5)

Funding Facility II includes a $50.0

million accordion which allows for expansion of the facility to up

to $250.0 million subject to consent from the lender and other

customary conditions.

(6)

Debt assumed by the Company as a result of

the Merger with BCIC.

(7)

The applicable margin for SOFR-based

borrowings could be either 1.75% or 2.00% depending on a ratio of

the borrowing base to certain committed indebtedness, and is also

subject to a credit spread adjustment of 0.10%. If Merger Sub

elects to borrow based on the alternate base rate, the applicable

margin could be either 0.75% or 1.00% depending on a ratio of the

borrowing base to certain committed indebtedness.

(8)

Merger Sub Facility includes a $60.0

million accordion which allows for expansion of the facility to up

to $325.0 million subject to consent from the lender and other

customary conditions.

(9)

Weighted-average interest rate, excluding

fees of 0.35% or 0.36%.

(10)

The 2025 Notes consist of two tranches:

$35.0 million aggregate principal amount with a fixed interest rate

of 6.85% and $57.0 million aggregate principal amount bearing

interest at a rate equal to SOFR plus 3.14%.

On February 27, 2024, the Board of Directors approved a new

dividend reinvestment plan (the “DRIP”) for the Company. The DRIP

was effective as of, and will apply to the reinvestment of cash

distributions with a record date after March 18, 2024. Under the

DRIP, shareholders will automatically receive cash dividends and

distributions unless they “opt in” to the DRIP and elect to have

their dividends and distributions reinvested in additional shares

of the Company’s common stock. Notwithstanding the foregoing, the

former shareholders of BCIC that participated in the BCIC dividend

reinvestment plan at the time of the Merger have been automatically

enrolled in the Company’s DRIP and will have their shares

reinvested in additional shares of the Company’s common stock on

future distributions, unless they “opt out” of the DRIP. For the

three months ended September 30, 2024, approximately $0.7 million

of cash distributions were reinvested for electing Participants

through purchase of shares in the open market in accordance with

the terms of the DRIP.

On August 1, 2024, our Board of Directors re-approved our stock

repurchase plan to acquire up to $50.0 million in the aggregate of

our common stock at prices at certain thresholds below our net

asset value per share, in accordance with the guidelines specified

in Rule 10b-18 and Rule 10b5-1 of the Securities Exchange Act of

1934. During the three months ended September 30, 2024, no shares

were repurchased.

RECENT DEVELOPMENTS

On November 6, 2024, our Board of Directors declared a fourth

quarter dividend of $0.34 per share and a $0.10 per share special

dividend, both payable on December 31, 2024 to stockholders of

record as of the close of business on December 17, 2024.

CONFERENCE CALL AND WEBCAST

BlackRock TCP Capital Corp. will host a conference call on

Wednesday, November 6, 2024 at 1:00 p.m. Eastern Time (10:00 a.m.

Pacific Time) to discuss its financial results. All interested

parties are invited to participate in the conference call by

dialing (833) 470-1428; international callers should dial (404)

975-4839. All participants should reference the access code 846824.

For a slide presentation that we intend to refer to on the earnings

conference call, please visit the Investor Relations section of our

website (www.tcpcapital.com) and click on the Third Quarter 2024

Investor Presentation under Events and Presentations. The

conference call will be webcast simultaneously in the investor

relations section of our website at

http://investors.tcpcapital.com/. An archived replay of the call

will be available approximately two hours after the live call,

through Wednesday, November 13, 2024. For the replay, please visit

https://investors.tcpcapital.com/events-and-presentations or dial

(866) 813-9403. For international replay, please dial (929)

458-6194. For all replays, please reference access code 616523.

BlackRock TCP Capital

Corp.

Consolidated Statements of

Assets and Liabilities

September 30, 2024

December 31, 2023

(unaudited)

Assets

Investments, at fair value:

Non-controlled, non-affiliated investments

(cost of $1,781,311,452 and $1,389,865,889, respectively)

$

1,672,494,110

$

1,317,691,543

Non-controlled, affiliated investments

(cost of $58,628,251 and $63,188,613, respectively)

51,200,328

65,422,375

Controlled investments (cost of

$221,093,292 and $198,335,511, respectively)

185,394,923

171,827,192

Total investments (cost of $2,061,032,995

and $1,651,390,013, respectively)

1,909,089,361

1,554,941,110

Cash and cash equivalents

104,181,765

112,241,946

Interest, dividends and fees

receivable

25,786,624

25,650,684

Deferred debt issuance costs

6,650,857

3,671,727

Due from broker

784,356

—

Prepaid expenses and other assets

1,207,929

2,266,886

Total assets

2,047,700,892

1,698,772,353

Liabilities

Debt (net of deferred issuance costs of

$7,798,616 and $3,355,221, respectively)

1,160,042,987

985,200,609

Interest and debt related payables

11,507,228

10,407,570

Incentive fees payable

6,540,286

5,347,711

Interest Rate Swap, at fair value

652,656

—

Reimbursements due to the Advisor

219,502

844,664

Management fees payable

—

5,690,105

Payable for investments purchased

99,747

960,000

Accrued expenses and other liabilities

3,001,588

2,720,148

Total liabilities

1,182,063,994

1,011,170,807

Net assets

$

865,636,898

$

687,601,546

Composition of net assets applicable to

common shareholders

Common stock, $0.001 par value;

200,000,000 shares authorized, 85,591,134 and 57,767,264 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively

$

85,591

$

57,767

Paid-in capital in excess of par

1,248,080,041

967,643,255

Distributable earnings (loss)

(382,528,734

)

(280,099,476

)

Total net assets

865,636,898

687,601,546

Total liabilities and net assets

$

2,047,700,892

$

1,698,772,353

Net assets per share

$

10.11

$

11.90

BlackRock TCP Capital

Corp.

Consolidated Statements of

Operations

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Investment income

Interest income (excluding PIK):

Non-controlled, non-affiliated

investments

$

61,647,228

$

46,722,801

$

173,856,058

$

138,140,812

Non-controlled, affiliated investments

381,494

48,712

1,113,813

141,950

Controlled investments

2,980,201

2,970,153

8,535,851

7,954,881

PIK interest income:

Non-controlled, non-affiliated

investments

3,827,236

3,511,734

8,267,269

8,728,033

Non-controlled, affiliated investments

—

—

92,675

—

Controlled investments

388,897

—

1,092,618

310,993

Dividend income:

Non-controlled, non-affiliated

investments

141,677

263,420

1,048,373

821,599

Non-controlled, affiliated investments

1,015,415

672,734

2,747,604

1,960,002

Controlled investments

423,031

—

1,301,106

—

Other income:

Non-controlled, non-affiliated

investments

127,308

21,387

132,654

376,209

Non-controlled, affiliated investments

—

—

—

45,650

Total investment income

70,932,487

54,210,941

198,188,021

158,480,129

Operating expenses

Interest and other debt expenses

21,160,551

12,133,863

54,117,604

35,971,338

Incentive fees

6,540,286

6,010,047

19,236,336

17,255,238

Management fees

6,185,025

6,092,673

18,567,719

18,065,948

Professional fees

842,389

745,978

2,443,988

1,519,106

Administrative expenses

547,458

357,921

1,702,669

1,092,268

Director fees

202,500

185,500

616,719

745,319

Insurance expense

214,102

134,212

565,168

426,790

Custody fees

96,574

94,811

285,639

276,727

Other operating expenses

1,265,961

122,860

2,687,733

1,781,273

Total operating expenses

37,054,846

25,877,865

100,223,575

77,134,007

Net investment income before

taxes

33,877,641

28,333,076

97,964,446

81,346,122

Excise tax expense

—

13,164

—

48,604

Net investment income

33,877,641

28,319,912

97,964,446

81,297,518

Realized and unrealized gain (loss) on

investments and foreign currency

Net realized gain (loss):

Non-controlled, non-affiliated

investments

(31,425,777

)

(128,841

)

(54,297,646

)

(31,153,173

)

Non-controlled, affiliated investments

—

—

(12,810,138

)

—

Net realized gain (loss)

(31,425,777

)

(128,841

)

(67,107,784

)

(31,153,173

)

Net change in unrealized appreciation

(depreciation) (1):

Non-controlled, non-affiliated

investments

27,118,840

(9,268,963

)

(36,652,226

)

11,820,648

Non-controlled, affiliated investments

(3,594,328

)

(4,131,670

)

(9,661,686

)

(5,339,736

)

Controlled investments

(4,539,213

)

(1,967,506

)

(9,190,060

)

(4,837,760

)

Interest Rate Swap

195,797

—

60,894

—

Net change in unrealized appreciation

(depreciation)

19,181,096

(15,368,139

)

(55,443,078

)

1,643,152

Net realized and unrealized gain

(loss)

(12,244,681

)

(15,496,980

)

(122,550,862

)

(29,510,021

)

Net increase (decrease) in net assets

resulting from operations

$

21,632,960

$

12,822,932

$

(24,586,416

)

$

51,787,497

Basic and diluted earnings (loss) per

share

$

0.25

$

0.22

$

(0.32

)

$

0.90

Basic and diluted weighted average

common shares outstanding

85,591,134

57,767,264

77,772,017

57,767,264

(1) Includes $21,347,357 change in unrealized appreciation from

application of Merger accounting under ASC 805 for the nine months

ended September 30, 2024.

ABOUT BLACKROCK TCP CAPITAL CORP.

BlackRock TCP Capital Corp. (NASDAQ: TCPC) is a specialty

finance company focused on direct lending to middle-market

companies as well as small businesses. TCPC lends primarily to

companies with established market positions, strong regional or

national operations, differentiated products and services and

sustainable competitive advantages, investing across industries in

which it has significant knowledge and expertise. TCPC’s investment

objective is to achieve high total returns through current income

and capital appreciation, with an emphasis on principal protection.

TCPC is a publicly-traded business development company, or BDC,

regulated under the Investment Company Act of 1940 and is

externally managed by its advisor, a wholly-owned, indirect

subsidiary of BlackRock, Inc. For more information, visit

www.tcpcapital.com.

FORWARD-LOOKING STATEMENTS

Prospective investors considering an investment in BlackRock TCP

Capital Corp. should consider the investment objectives, risks and

expenses of the company carefully before investing. This

information and other information about the company are available

in the company’s filings with the Securities and Exchange

Commission (“SEC”). Copies are available on the SEC’s website at

www.sec.gov and the company’s website at www.tcpcapital.com.

Prospective investors should read these materials carefully before

investing.

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are based on estimates,

projections, beliefs and assumptions of management of the company

at the time of such statements and are not guarantees of future

performance. Forward-looking statements involve risks and

uncertainties in predicting future results and conditions. Actual

results could differ materially from those projected in these

forward-looking statements due to a variety of factors, including,

without limitation, changes in general economic conditions or

changes in the conditions of the industries in which the company

makes investments, risks associated with the availability and terms

of financing, changes in interest rates, availability of

transactions, and regulatory changes. Certain factors that could

cause actual results to differ materially from those contained in

the forward-looking statements are included in the “Risk Factors”

section of the company’s Form 10-K for the year ended December 31,

2023, and the company’s subsequent periodic filings with the SEC.

Certain factors could cause actual results and conditions to differ

materially from those projected, including the uncertainties

associated with (i) the ability to realize the anticipated benefits

of the Merger, including the expected accretion to net investment

income and the elimination or reduction of certain expenses and

costs due to the Merger; (ii) risks related to diverting

management’s attention from ongoing business operations; (iii)

risks related to the retention of the personnel of TCPC’s advisor;

(iv) changes in the economy, financial markets and political

environment, including the impacts of inflation and rising interest

rates; (v) risks associated with possible disruption in the

operations of TCPC or the economy generally due to terrorism, war

or other geopolitical conflict (including the current conflict

between Russia and Ukraine and the conflict in the Middle East),

natural disasters or public health crises and epidemics; (vi)

future changes in laws or regulations (including the interpretation

of these laws and regulations by regulatory authorities); (vii)

conditions in TCPC’s operating areas, particularly with respect to

business development companies or regulated investment companies;

and (viii) other considerations that may be disclosed from time to

time in TCPC’s publicly disseminated documents and filings. Copies

are available on the SEC’s website at www.sec.gov and the Company’s

website at www.tcpcapital.com. Forward-looking statements are made

as of the date of this press release and are subject to change

without notice. The Company has no duty and does not undertake any

obligation to update or revise any forward-looking statements based

on the occurrence of future events, the receipt of new information,

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106872955/en/

BlackRock TCP Capital Corp. Michaela Murray (310) 566-1094

investor.relations@tcpcapital.com

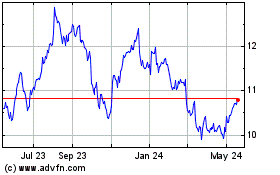

BlackRock TCP Capital (NASDAQ:TCPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

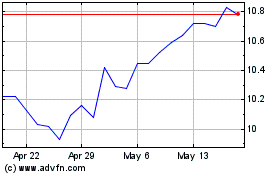

BlackRock TCP Capital (NASDAQ:TCPC)

Historical Stock Chart

From Jan 2024 to Jan 2025