KKR Completes Tender Offer for FUJI SOFT

February 19 2025 - 11:35PM

Business Wire

Becomes largest shareholder with 58% of

ownership; to proceed with privatization

KKR, a leading global investment firm, today announced that in

connection with the two-stage tender offer (the “Tender Offer”) for

the common shares and share options of FUJI SOFT INCORPORATED (TSE

stock code 9749; “FUJI SOFT” or the “Company”) through FK Co., Ltd.

(the “Offeror”), the Offeror, an entity owned by investment funds

managed by KKR, received tenders in excess of 19.25%, the minimum

ownership stake required to conduct a squeeze-out (53.22% in

total), and completed the second stage of its Tender Offer (“Second

Tender Offer”) on February 19, 2025.

Upon settlement of the Second Tender Offer, including the shares

acquired by the Offeror in the First Tender Offer, the Offeror will

hold a total of 35,753,281 common shares and share options (758,400

shares on an as-converted basis) of FUJI SOFT (Total Ownership

Ratio: 57.92%). Settlement of the Second Tender Offer will commence

on February 27, 2025.

In addition to the shares acquired through the Tender Offer, the

Offeror aims to acquire the remaining shares of FUJI SOFT through a

squeeze-out process, which will result in the Offeror owning 100%

of the shares of FUJI SOFT. The Extraordinary General Meeting for

the squeeze-out process is scheduled for late April 2025.

FUJI SOFT is a leading Japanese system integration company

specializing in control systems and embedded software, business

software, and systems. With over 10,000 system engineers, strong

technical capabilities and a long track record, FUJI SOFT provides

IT services to clients across a wide range of industries. In its

“Mid-term Business Plan 2028” announced in February 2024, FUJI SOFT

set a vision of “becoming the leading company providing

systems/software & services in the IT x OT field.” In the

fiscal year ending December 2024, the first year of the plan, FUJI

SOFT achieved a record high revenue and operating income of 317.5

billion yen and 22 billion yen respectively, with an operating

income margin of 6.5%.

Following the Offeror’s announcement of a Tender Offer with the

support from the Board of Directors of FUJI SOFT on August 8, 2024,

an unprecedented situation arose in which the Offeror’s Tender

Offer was followed by Bain Capital’s announcement of a proposed

tender offer. As a result, the Offeror’s Tender Offer was completed

more than four months later than initially anticipated. The Offeror

is grateful for the patience and consistent support it received

from FUJI SOFT’s executive team and Board of Directors during this

period, and now looks forward to focusing on the business growth of

and value creation for FUJI SOFT.

Hiro Hirano, Deputy Executive Chairman of KKR Asia Pacific

and CEO of KKR Japan, said, “We are very pleased with the

outcome of the tender offer and are thankful for the trust and

endorsement shown by FUJI SOFT through this process. We are fully

committed and look forward to supporting FUJI SOFT’s plan to

enhance its corporate value, under a new and simpler ownership by

KKR following the privatization, by leveraging our global network

and expertise and to help FUJI SOFT achieve its next stage of

transformation. As one of Japan’s leading system integrators, FUJI

SOFT plays an important role in enabling Japanese businesses to

deliver better solutions and experiences for their customers in

this new age of digitalization, cloud computing and AI.”

The Tender Offer will be financed predominantly from KKR Asian

Fund IV.

This press release should be read in conjunction with the

release issued by the Offeror today titled “Notice Regarding the

Results of Tender Offer for the Shares of FUJI SOFT INCORPORATED

(Securities Code: 9749) by FK Co., Ltd.”

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219106284/en/

For more information, please contact: KKR Asia Pacific Wei Jun

Ong +65 6922 5813 WeiJun.Ong@kkr.com

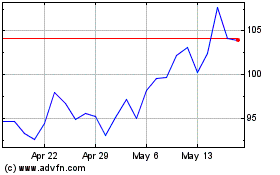

KKR (NYSE:KKR)

Historical Stock Chart

From Jan 2025 to Feb 2025

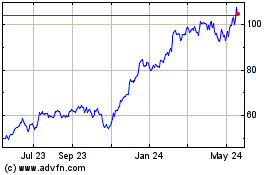

KKR (NYSE:KKR)

Historical Stock Chart

From Feb 2024 to Feb 2025