UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: May 2024

Commission file number: 001-38350

Lithium Americas (Argentina) Corp.

(Translation of Registrant’s name into English)

900 West Hastings Street, Suite 300,

Vancouver, British Columbia,

Canada V6C 1E5

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover:

Form 20-F [ ] Form 40-F [X]

INCORPORATION BY REFERENCE

Exhibit 99.3 to this Form 6-K of Lithium Americas (Argentina) Corp. (formerly Lithium Americas Corp) is hereby incorporated by reference as an exhibit to the Registration Statement on Form F-10 (File No. 333-269649), as amended or supplemented.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Lithium Americas (Argentina) Corp. |

(Registrant) |

|

By: |

“Sam Pigott” |

Name: |

Sam Pigott |

Title: |

President and Chief Executive Officer |

Dated: May 14, 2024

NOTICE OF ANNUAL AND SPECIAL MEETING

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the holders (“Shareholders”) of common shares (“Common Shares”) of Lithium Americas (Argentina) Corp. (the “Company” or “Lithium Argentina”) will be held virtually at https://meetnow.global/MU9LYN5 at 10:00 a.m. (Pacific Time) on June 20, 2024:

At the Meeting, Shareholders will be asked to consider the following matters:

1.To receive the consolidated financial statements of the Company for the year ended December 31, 2023, together with the report of the auditors thereon.

2.To set the number of directors (the “Directors”) of the Company at eight (8).

3.To elect Directors of the Company for the ensuing year.

4.To appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Company for the ensuing year and to authorize the Directors to fix their remuneration.

5.To approve the Company’s amended and restated equity incentive plan.

6.To approve a non-binding advisory resolution on the Company’s executive compensation.

7.To transact such other business as may properly come before the Meeting or any adjournment thereof.

The specific details of these matters to be put before the Meeting are set forth in the management information circular (the “Circular”) accompanying this notice. The board of Directors (the “Board”) has approved the contents of the Circular and the distribution of the Circular to Shareholders. The consolidated financial statements and related management’s discussion and analysis of the Company for the financial year ended December 31, 2023 have been mailed to those Shareholders who have previously requested to receive them. Otherwise, they are available upon request to the Company or they can be found on the Company’s website at www.lithium-argentina.com or on SEDAR+ www.sedarplus.ca. All Shareholders are reminded to review the Circular before voting.

Shareholders have the right to vote if they were a Shareholder of the Company at the close of business on April 30, 2024, the record date set by the Board for determining the Shareholders entitled to receive notice of and vote at the Meeting or any adjournment(s) or postponement(s) thereof.

Shareholders who are unable to attend the virtual Meeting are encouraged to vote their proxy by mail, internet or telephone. Shareholders will need the control number contained in the accompanying form of proxy in order to vote. Further information on how to vote at the virtual Meeting can be found in the section “Voting Information – How to Vote” in the Circular. To be valid, a Shareholders proxy must be received by the Company’s transfer agent, Computershare Investor Services Inc., no later than 10:00 a.m. (Pacific Time) on June 18, 2024 or no later than 48 hours (excluding Saturdays, Sundays and statutory holidays) prior to the date on which the Meeting or any postponement or adjournment thereof is held.

Non-registered Shareholders who receive these materials through their broker or other intermediary are requested to follow the instructions for voting provided by their broker or intermediary, which may include the completion and delivery of a voting instruction form.

If you have any questions relating to the Meeting, please contact the Company at 778-653-8092 or by email at info@lithium-argentina.com.

DATED at Vancouver, British Columbia this 10th day of May, 2024.

|

On behalf of the Board of Directors |

(signed) “John Kanellitsas” |

Executive Chair |

Exhibit 99.2

LITHIUM AMERICAS (ARGENTINA) CORP. Fold Fold Have questions about this notice? Call the Toll Free Number below or scan the QR code to find out more. www.computershare.com/ noticeandaccess Toll Free 1-866-964-0492 Notice of Availability of Proxy Materials for LITHIUM AMERICAS (ARGENTINA) CORP. Annual and Special Meeting Meeting Date and Location: When: June 20, 2024 10:00 am (Pacific Time) Where: Online at https://meetnow.global/MU9LYN5 You are receiving this notice to advise that the proxy materials for the above noted securityholders' meeting are available on the Internet. This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We remind you to access and review all of the important information contained in the information circular and other proxy materials before voting. The information circular and other relevant materials are available at: http://lithium-argentina.com/investor-relations/AGM OR www.sedarplus.ca How to Obtain Paper Copies of the Proxy Materials Securityholders may request to receive paper copies of the current meeting materials by mail at no cost. Requests for paper copies may be made using your Control Number as it appears on your enclosed Voting Instruction Form or Proxy. To ensure you receive the materials in advance of the voting deadline and meeting date, all requests must be received no later than June 10, 2024. If you do request the current materials, please note that another Voting Instruction Form/Proxy will not be sent; please retain your current one for voting purposes. For Registered Shareholders: For registered shareholders or those shareholders without a 16-digit control number or who are dialing from outside of North America, please call Toll Free Number: 1-844-916-0609 or Direct Dial: 1-303-562-9305 (English) or Toll Free Number: 1-844-973-0593 or Direct Dial: 1-303-562-9306 (French). For Non-Registered Shareholders: For non-registered shareholders with a 16-digit control number please call 1-877-907-7643 or visit www.proxyvote.com and enter the 16-digit control number located on your voting instruction form. Dual

Fold Securityholder Meeting Notice The resolutions to be voted on at the meeting are listed below along with the Sections within the Information Circular where disclosure regarding the matter can be found. 1. Number of Directors - Items of Business, Set Number of Directors on the Board 2. Election of Directors - Items of Business, Elect Directors 3. Appointment of Auditors - Items of Business, Appoint the Auditor 4. Approval of the Amended and Restated Incentive Plan - Items of Business, Approval of Amended and Restated Incentive Plan 5. Approach to Executive Compensation - Items of Business, Approach to Executive Compensation Voting PLEASE NOTE - YOU CANNOT VOTE BY RETURNING THIS NOTICE. To vote your securities you must vote using the methods reflected on your enclosed Voting Instruction Form or Proxy. PLEASE VIEW THE INFORMATION CIRCULAR PRIOR TO VOTING Annual Financial statement delivery No Annual Report (or Annual Financial Statements) is (are) included in this mailing

LITHIUM AMERICAS (ARGENTINA) CORP.

(FORMERLY LITHIUM AMERICAS CORP.)

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

to be held June 20, 2024

MANAGEMENT INFORMATION CIRCULAR

Dated: May 10, 2024

LETTER TO SHAREHOLDERS

Dear Fellow Lithium Americas (Argentina) Corp. Shareholders,

On behalf of the board of directors (the “Board”) of Lithium Americas (Argentina) Corp. (“Lithium Argentina” or the “Company”), it is our pleasure to invite you to attend the annual and special meeting of shareholders on June 20, 2024 at 10:00 a.m. (Pacific Time) to be held virtually at https://meetnow.global/MU9LYN5 (the “Meeting”).

This management information circular (the “Circular”) provides you with information for purposes of voting on items of business that will be considered at the Meeting, including the election of directors, appointment of auditors, approval of an amended and restated equity incentive plan and, on an advisory basis, the approval of our approach to executive compensation.

2023 was a transformational year for the Company with the commencement of operations at the Caucharí-Olaroz site in Argentina and the completion on October 3, 2023 of its separation transaction into Lithium Americas (Argentina) Corp. and a new company spun out to our shareholders renamed “Lithium Americas Corp.” to which the Company transferred its previously-held North American business unit. The Company retained its Argentine business unit, enabling it to focus on its activities in Argentina comprised of the 44.8% interest in Caucharí-Olaroz, the 100% interest in Pastos Grandes and the 65% interest in Sal de la Puna which the Company acquired in April, 2023. All of these achievements were the culmination of years of hard work, dedication and determination, and an over US$1 billion investment into northern Argentina. We are proud of the cross-cultural team that came together to diligently progress Caucharí-Olaroz, making it the success it is today. We are confident that the great work that has been done to date, will be the foundation for great achievements for the Company in the future.

As we look to the year 2024, the priority is completing the ramp up of Stage 1 of Caucharí-Olaroz and transitioning from development to operations. The project is well on its way to completing commissioning and is currently producing at approximately 50% capacity, making it already among the largest operations in Argentina. The operation is targeting to reach nameplate capacity on a limited basis by mid-2024 and maintain a level near capacity on steady state basis by the end of the year. The Company looks forward to advancing its role in providing such a critical input to the electric vehicle industry. While, the commissioning of the project has been going very well, we will remain cognizant of the market environment and will make thoughtful decisions to ensure that shareholder value is protected.

The recent agreement to prepare a regional development plan together with Ganfeng for their Pozuelos Pastos Grandes project and the Company’s Pastos Grandes and Sal de la Puna projects is a potentially lucrative opportunity to organize the development of these assets in a logical way while maintaining optionality for offtake. The Company’s strong balance sheet coupled with the high quality and low-cost nature of its brine assets in Argentina, will position it better to navigate the cyclical nature of the lithium market today and in the future.

Your votes are important to us. We encourage you to read the Circular in advance to allow meaningful participation in the voting process.

On behalf of everyone at Lithium Argentina, we appreciate your ongoing support of our Company.

Sincerely,

“John Kanellitsas” “Sam Pigott”

John Kanellitsas Sam Pigott

Executive Chair President and Chief Executive Officer

NOTICE OF ANNUAL AND SPECIAL MEETING

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the holders (“Shareholders”) of common shares (“Common Shares”) of Lithium Americas (Argentina) Corp. (the “Company” or “Lithium Argentina”) will be held virtually at https://meetnow.global/MU9LYN5 at 10:00 a.m. (Pacific Time) on June 20, 2024:

At the Meeting, Shareholders will be asked to consider the following matters:

1. To receive the consolidated financial statements of the Company for the year ended December 31, 2023, together with the report of the auditors thereon.

2. To set the number of directors (the “Directors”) of the Company at eight (8).

3. To elect Directors of the Company for the ensuing year.

4. To appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Company for the ensuing year and to authorize the Directors to fix their remuneration.

5. To approve the Company’s amended and restated equity incentive plan.

6. To approve a non-binding advisory resolution on the Company’s executive compensation.

7. To transact such other business as may properly come before the Meeting or any adjournment thereof.

The specific details of these matters to be put before the Meeting are set forth in the management information circular (the “Circular”) accompanying this notice. The board of Directors (the “Board”) has approved the contents of the Circular and the distribution of the Circular to Shareholders. The consolidated financial statements and related management’s discussion and analysis of the Company for the financial year ended December 31, 2023 have been mailed to those Shareholders who have previously requested to receive them. Otherwise, they are available upon request to the Company or they can be found on the Company’s website at http://lithium-argentina.com/investor-relations/AGM or on SEDAR+ www.sedarplus.ca. All Shareholders are reminded to review the Circular before voting.

Shareholders have the right to vote if they were a Shareholder of the Company at the close of business on April 30, 2024, the record date set by the Board for determining the Shareholders entitled to receive notice of and vote at the Meeting or any adjournment(s) or postponement(s) thereof.

Shareholders who are unable to attend the virtual Meeting are encouraged to vote their proxy by mail, internet or telephone. Shareholders will need the control number contained in the accompanying form of proxy in order to vote. Further information on how to vote at the virtual Meeting can be found in the section “Voting Information – How to Vote” in the Circular. To be valid, a Shareholders proxy must be received by the Company’s transfer agent, Computershare Investor Services Inc., no later than 10:00 a.m. (Pacific Time) on June 18, 2024 or no later than 48 hours (excluding Saturdays, Sundays and statutory holidays) prior to the date on which the Meeting or any postponement or adjournment thereof is held.

Non-registered Shareholders who receive these materials through their broker or other intermediary are requested to follow the instructions for voting provided by their broker or intermediary, which may include the completion and delivery of a voting instruction form.

If you have any questions relating to the Meeting, please contact the Company at 778-653-8092 or by email at info@lithium-argentina.com.

DATED at Vancouver, British Columbia this 10th day of May, 2024.

|

On behalf of the Board of Directors |

(signed) “John Kanellitsas” |

Executive Chair |

TABLE OF CONTENTS

|

|

GENERAL INFORMATION |

1 |

Date of Information |

1 |

Currency |

1 |

Committee Abbreviations |

1 |

Voting Securities and Principal Holders of Voting Securities |

1 |

Meeting Representations |

1 |

Additional Information |

1 |

Separation Transaction |

2 |

FORWARD-LOOKING STATEMENTS |

2 |

VOTING INFORMATION |

3 |

Proxy Solicitation |

3 |

Who can Vote |

4 |

Voter Types |

4 |

How to Vote |

4 |

Voting Changes |

6 |

Exercise of Discretion |

7 |

Technical Requirements |

7 |

Notice to U.S. Shareholders |

8 |

Notice-and-Access |

8 |

ITEMS OF BUSINESS |

9 |

Receive Financial Statements |

9 |

Set Number of Directors on the Board |

9 |

Elect Directors |

9 |

Appoint the Auditor |

9 |

Approval of Amended and Restated Incentive Plan |

9 |

Approach to Executive Compensation |

11 |

Other Business Conduct |

12 |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON |

12 |

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

12 |

AUDIT FEES |

12 |

DIRECTORS DISCLOSURE |

13 |

Advance Notice for Nominations |

13 |

Majority Voting Policy |

13 |

Nominees |

13 |

Corporate Cease Trade Orders, Bankruptcies, Penalties and Sanctions |

18 |

CORPORATE GOVERNANCE |

18 |

Corporate Governance Overview |

18 |

About the Board |

19 |

ESG Approach |

22 |

Diversity |

24 |

Succession Planning |

25 |

Risk Management |

26 |

Position Descriptions for the CEO and CFO |

27 |

Shareholder Engagement |

27 |

In-Camera Meetings |

27 |

Code of Business Conduct and Ethics |

27 |

Serving as a Director |

28 |

Board Education |

30 |

Board Orientation |

31 |

Committees of the Board |

31 |

Director Meeting Attendance |

34 |

Director Compensation |

34 |

Indebtedness of Directors and Executive Officers |

39 |

EXECUTIVE COMPENSATION |

39 |

|

|

Executive Compensation Philosophy |

40 |

Compensation Governance |

41 |

Compensation Advisor and Peer Group Benchmarking Review |

41 |

Performance Evaluation and Compensation Process |

41 |

Compensation Benchmarking |

42 |

Compensation Peer Group |

42 |

Named Executive Officers |

43 |

Elements of Executive Compensation |

43 |

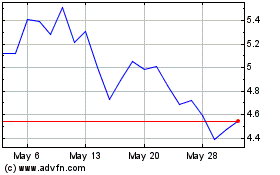

Performance Graph |

47 |

Summary Compensation Table |

48 |

Incentive Plan Awards |

50 |

Other Compensation and Pension Benefits |

53 |

Employment Agreements |

53 |

Termination and Change of Control Benefits |

54 |

Management Contracts |

55 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY INCENTIVE PLANS |

56 |

Annual Burn Rate |

57 |

Summary of the Amended and Restated Incentive Plan |

57 |

Amended and Restated Incentive Plan Grants and Limits |

60 |

DIRECTORS’ APPROVAL |

60 |

SCHEDULES

|

|

Schedule “A” Blackline Amended and Restated Equity Incentive Plan |

A-1 |

Schedule “B” Board Mandate |

B-1 |

GENERAL INFORMATION

Date of Information

All information in this management information circular (the “Circular”) of Lithium Americas (Argentina) Corp. (the “Company” or “Lithium Argentina”) is dated as of May 10, 2024 except as otherwise noted herein.

Currency

This Circular contains references to United States dollars (US$) and Canadian dollars (C$ or $). All dollar amounts referenced, unless otherwise indicated, are expressed in Canadian dollars.

Committee Abbreviations

Committees of our Board are abbreviated in certain tables in this Circular as follows:

Audit and Risk Committee – “ARC”

Sustainable Development Committee – “SDC”

Governance, Nomination, Compensation and Leadership Committee – “GNCLC”.

Voting Securities and Principal Holders of Voting Securities

Holders of Common Shares (as defined below) as of the close of business on April 30, 2024 (the “Record Date”), are entitled to vote at the Meeting (as defined below) as a Shareholder (as defined below). Only Shareholders whose names have been entered in the register of shareholders as of the close of business on the Record Date will be entitled to receive notice of the Meeting and shall have one vote per Common Share (as defined below) at the Meeting. As of the Record Date, the Company had 161,212,995 fully paid and non-assessable Common Shares issued and outstanding. The Company’s authorized capital consists of an unlimited number of common shares without par value (each, a “Common Share”).

To the knowledge of the directors and executive officers of the Company, no person or company, directly or indirectly, beneficially owns or exercises control or direction over, 10% or more of the Common Shares.

Pursuant to an investor rights agreement dated February 16, 2023 as between the Company and General Motors Holdings LLC (“GM”), should GM hold 10% or more of the issued and outstanding Common Shares of the Company, it shall be entitled to designate one nominee for election to the board of directors of the Company (the “Board”). As of the Record Date, GM held 15,002,245 Common Shares, representing approximately 9.30% of the outstanding Common Shares.

Meeting Representations

No person is authorized to give any information or to make any representation concerning the Meeting other than those contained in this Circular and, if given or made, such information or representation should not be relied upon as having been authorized.

Additional Information

Financial information about us is included in our annual financial statements and management’s discussion and analysis (“MD&A”) for our most recently completed financial year. These documents, along with our annual information form, are filed under our profile on SEDAR+ (www.sedarplus.ca). Information concerning the Company, including printed copies of our annual financial statements and MD&A, may be

obtained by any shareholder of the Company (“Shareholder”) free of charge by contacting the Company at 778-653-8092 or by email at info@lithium-argentina.com.

Separation Transaction

On October 3, 2023, the Company completed a reorganization transaction by way of a statutory plan of arrangement under the laws of British Columbia (the “Separation Transaction”), pursuant to which the Company separated its previously-held North American business unit, comprised of a 100% interest in the Thacker Pass lithium project in Humboldt County, Nevada, as well as investments in Green Technology Metals Ltd. and Ascend Elements, Inc., into an independent public company named “Lithium Americas Corp.” (formerly 1397468 B.C. Ltd.) (“Lithium Americas (Newco)”). The Company retained its Argentine business unit, comprised of the 44.8% interest in the Caucharí-Olaroz lithium project, the 100%-owned Pastos Grandes lithium project and the 65% interest in the Sal de la Puna Project.

In connection with the Separation Transaction, the Company’s shareholders exchanged each of their Common Shares for one common share of Lithium Americas (Newco) and one new Common Share in a series of share exchanges.

Holders of all DSUs, RSUs and PSUs of the Company previously held (collectively, the “Old LAC Units”) received, in lieu of such outstanding Old LAC Units, equivalent incentive securities of the Company (collectively, the “Company Units”) and of Lithium Americas (NewCo) (collectively, the “New LAC Units”). In accordance with the Separation Transaction, each Old LAC unit was replaced with one New LAC Unit and 0.87 of a Company Unit (as adjusted pursuant to subsection 7(1.4) of the Income Tax Act (Canada)).

The Old LAC Units exchanged were cancelled. Incentive securities (other than PSUs) of one entity, being either the Company or Lithium Americas (NewCo), held by persons who were not employed as a director, officer, or employee or engaged as a service provider of that entity subsequent to the Separation Transaction, but are employed or engaged with the other entity, immediately vested and the holder of these incentive securities became entitled to receive the underlying share after completion of the Separation Transaction. The replacement PSUs of each of the Company and Lithium Americas (NewCo) continued, but are subject to the same time based vesting period as the old PSUs they replace and upon vesting thereof will be settled by the issuance of one (1) underlying share irrespective of the applicable performance multiplier to which the original old PSU was subject, except with respect to old PSUs that were fully vested prior to the Separation Transaction, in which case the replacement PSUs will be settled for the number of underlying shares determined based on the performance multipliers of the old PSUs they replaced.

References to “the Company” and information about “the Company” contained in this Circular for the period prior and up to October 3, 2023 pertain to the Company prior to the completion of the Separation Transaction, holding both the Argentine and North American business units. References to “the Company” and information about “the Company” contained in this Circular for the period commencing on and following October 3, 2023 pertain to the Company following the completion of the Separation Transaction, holding only the Argentine business unit. The Separation Transaction is described in the Company’s management information circular dated June 16, 2023, which is available under our profile on SEDAR+ (www.sedarplus.ca).

FORWARD-LOOKING STATEMENTS

This Circular (including the letter attached thereto) and documents referred to herein include and incorporate statements that are prospective in nature that constitute forward-looking information and/or forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”). Forward-looking statements include, but are not limited to, statements concerning the Company’s future objectives and strategies to achieve those objectives, the Company’s outlook for 2024 in the letter attached hereto, including, without limitation, with respect to the targeting timing to reach name plate capacity at Caucharí-Olaroz, the Company’s plans with respect to its compensation and governance programs, the expected benefits of approving the Amended and Restated Incentive Plan Resolution and

other business items at the Meeting, as well as other statements with respect to management’s beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans” or “continue”, or similar expressions suggesting future outcomes or events.

Forward-looking statements reflect management’s current beliefs, expectations and assumptions and are based on information currently available to management, management’s historical experience, perception of trends and current business conditions, expected future developments and other factors which management considers appropriate. With respect to the forward-looking statements included in or incorporated into this Circular, we have made certain assumptions with respect to, among other things, that no unforeseen changes in the legislative and operating framework for the business of the Company, that the Company will meet its future objectives and priorities, that the Company will have access to adequate capital to fund its future projects and plans, that the Company’s future projects and plans will proceed as anticipated, as well as assumptions concerning general economic and industry growth rates, commodity prices, currency exchange and interest rates and competitive conditions.

Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. By their nature, forward-looking statements involve known and unknown risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated by such statements. Factors that could cause such differences include, but are not limited to: uncertainties inherent to feasibility studies and mineral resource and reserve estimates; global financial markets, general economic conditions, competitive business environments, and other factors that may negatively impact the Company’s financial condition; the inability of the Company to secure sufficient additional financing to develop the Company’s mineral projects; and all the other risk factors identified in the Company’s latest annual information form.

All forward-looking statements included in this Circular are qualified by these cautionary statements. The forward-looking statements contained herein are made as of the date of this Circular and, except as required by applicable law, the Company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Readers are cautioned that the actual results achieved will vary from the information provided herein and that such variations may be material. Consequently, there are no representations by the Company that actual results achieved will be the same in whole or in part as those set out in the forward-looking statements.

VOTING INFORMATION

Proxy Solicitation

The Company is providing this Circular to Shareholders to solicit proxies for use at the annual general meeting (the “Meeting”) of Shareholders to be held virtually at 10:00 a.m. (Pacific Time) on June 20, 2024.

The Company’s management is primarily soliciting proxies by mail, but may also contact Shareholders by telephone, email, internet or other means of communication. The Company will pay the costs of soliciting proxies. The Company may also pay reasonable costs incurred by intermediaries who are registered owners of Common Shares (such as brokers, dealers, other registrants under applicable securities laws, nominees and/or custodians) to deliver the notice package to beneficial owners of such Common Shares. The Company will provide, without cost to such persons, upon request to the Vice President, Investor Relations and ESG of the Company, additional copies of the foregoing documents required for this purpose.

The cost of solicitation will be borne by the Company. The Company may utilize the Broadridge QuickVoteTM service to assist Shareholders with voting their Common Shares.

Who can Vote

Holders of Common Shares as of the close of business on the Record Date, April 30, 2024, are entitled to vote at the Meeting as a Shareholder. Only Shareholders whose names have been entered in the register of shareholders as of the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting.

The Company’s articles (the “Articles”) provide that the quorum for the transaction of business at the Meeting is at least two (2) Shareholders who hold in aggregate at least 5% of the issued Common Shares entitled to vote at the Meeting. A simple majority of the votes cast at the Meeting, whether virtually, by proxy or otherwise, will constitute approval of any item of business considered at the Meeting.

Voter Types

Voters fall into two (2) categories:

Registered shareholders, meaning Shareholders whose share certificate is in the name of the holder; or

Non-registered Shareholders, meaning beneficial Shareholders whose share certificate is registered in the name of an intermediary such as a brokerage firm, bank, trust company or clearing agency (for example, The Canadian Depository for Securities Limited commonly known as CDS, or Cede & Co.).

How to Vote

Voting occurs in advance of the Meeting by voting a proxy, or at the Meeting by attending online. How a Shareholder votes will vary depending on whether they are a registered Shareholder or a non-registered Shareholder (beneficial Shareholder):

Registered Shareholders

Registered shareholders may wish to vote by proxy whether or not they are able to attend the Meeting online. Voting by proxy means the Shareholder appoints another individual – either the Company’s management or any other person of their choice – to attend the Meeting and vote the Shareholder’s Common Shares based on their instructions to the person. This person does not need to be a shareholder of the Company to be the Shareholder’s proxy. The form of proxy enclosed with this Circular names the senior management of the Company who will vote the Shareholder’s shares as proxy if they do not appoint another person.

Proxies voted by the Company’s management will be voted as follows:

a) FOR setting the number of directors at eight (8) for the ensuing year

b) FOR electing all director nominees

c) FOR appointing PricewaterhouseCoopers LLP, Chartered Professional Accountants (“PwC”) as the Company’s auditors

d) FOR approving the Company’s amended and restated equity incentive plan

e) FOR approving the non-binding advisory vote in support of the Company’s approach to executive compensation as described in this Circular

To exercise the right of appointing a person other than the Company’s management as a proxy, a registered Shareholder must fill in the name of the person to be designated proxy in the space provided on the proxy form and return their proxy. The Shareholder must also register their proxyholder with Computershare Investor Services Inc. (“Computershare”) at http://www.computershare.com/LithiumAmericasArgentina no later than 10:00 a.m. (Pacific Time) on June 18, 2024. Any registered Shareholder exercising this right must register their non-management proxyholder with Computershare to allow that person to receive a control number from Computershare. Failure to register will result in the proxyholder not receiving a control number to attend, participate or vote at the Meeting. Without a control number, the proxyholder will only be able to attend the Meeting online as a guest. Guests are unable to vote or ask questions.

Registered Shareholders electing to submit a proxy may do so by:

a) Mail – complete, sign, date and mail your proxy to Computershare Investor Services Inc., Proxy Department at 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1;

b) Fax – complete, sign, date and fax your proxy to Computershare at (416) 263-9524 or 1-866-249-7775;

c) Internet voting – vote your proxy online at www.investorvote.com using the 15-digit or 16-digit control number located at the bottom of your proxy; or

d) Telephone – vote your proxy by telephone at 1-866-732-VOTE (8683) (toll free within North America) or 1-312-588-4290 (outside North America).

In all cases, the proxy must be received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the proxy is to be used. Proxies received after that time may be accepted by the Chair of the Meeting at such person’s sole discretion. The Chair of the Meeting is under no obligation to accept late proxies.

Registered Shareholders may also choose to attend the Meeting virtually and vote their Common Shares at the Meeting through the online meeting platform, rather than voting by proxy. This means attending the Meeting virtually at the time set out on the Notice of Meeting and voting at that time.

The Company recommends Shareholders consider voting by proxy even if they plan to attend the Meeting virtually, in case they encounter technical difficulties using the online meeting platform.

Registered Shareholders can attend the Meeting virtually by following these steps:

a) At least a few minutes before the Meeting, go to the Computershare meeting platform website, https://meetnow.global/MU9LYN5

b) Login by clicking on “I have a Control Number” and entering the 15-digit control number on the proxy form

A “Virtual AGM User Guide” is available with the meeting materials on SEDAR+ and EDGAR.

Non-Registered Shareholders

The Company sends Meeting materials to intermediaries for delivery to non-registered Shareholders who have not waived the right to receive them and pays for delivery costs to objecting beneficial Shareholders.

If a non-registered Shareholder has not waived the right to receive Meeting materials, their intermediary is required for the delivery of the Meeting materials. The materials will generally include a voting instruction form (“VIF”) that will allow non-registered Shareholders to vote their Common Shares.

The VIF should be completed, signed and returned to the non-registered Shareholder’s intermediary. Non-registered Shareholders can also vote by telephone or online per the VIF instructions.

Should a non-registered Shareholder who received one of the above forms wish to vote at the Meeting (or have another person attend and vote on behalf of the non-registered Shareholder), the non-registered Shareholder must: (1) follow the instructions on the VIF to indicate that they (or such other person) will virtually attend and vote at the Meeting, and (2) register their appointment at http://www.computershare.com/LithiumAmericasArgentina. If the non-registered Shareholder completes these two steps within the required timeframe, then, prior to the Meeting, Computershare will contact the non-registered Shareholder by email with login details to allow login to the live webcast and voting at the Meeting using the Computershare meeting platform, available online at https://meetnow.global/MU9LYN5. Non-registered Shareholders should carefully follow the instructions contained in the VIF of their intermediaries and contact them directly with any questions regarding the voting of Common Shares owned by them. A “Virtual AGM User Guide” is available with the meeting materials on SEDAR+ and EDGAR.

Voting instructions must be received in sufficient time to allow for the VIF to be forwarded by the intermediary to Computershare no later than 10:00 a.m. (Pacific Time) on June 18, 2024.

To attend and vote at the Meeting, U.S. non-registered Shareholders must first obtain a valid legal proxy from their intermediary and then register in advance to attend the Meeting. The U.S. non-registered Shareholder must follow the instructions from their intermediary included with the notice package, or contract their intermediary to request a legal proxy form. After first obtaining a valid legal proxy from their intermediary, to then register to attend the Meeting, U.S. non-registered Shareholders must submit a copy of their valid legal proxy to Computershare. Requests for registration should be directed to Computershare by mail at 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, or by email at USLegalProxy@computershare.com.

Requests for registration must be labeled as “Legal Proxy” and be received no later than 10:00 a.m. (Pacific Time) on June 18, 2024. Non-registered Shareholders will receive a confirmation of registration by email after Computershare receives the registration materials. All U.S. non-registered Shareholders must also register their appointment at the following link: http://www.computershare.com/LithiumAmericasArgentina.

Voting Changes

Shareholders can make changes to how they have voted their Common Shares by proxy in advance of the Meeting.

A registered Shareholder who has given a proxy may revoke it at any time not less than 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting time or, if adjourned, any reconvened meeting time by sending written notice of revocation signed by the registered Shareholder of their authorized attorney (or for corporations who are registered Shareholders, by an authorized officer or attorney under the corporate seal) to the Company’s head office at Lithium Americas (Argentina) Corp., Suite 300, 900 West Hastings Street, Vancouver, British Columbia, V6C 1E5, Attention: Vice President, Investor Relations and ESG. A proxy may also be revoked in any other manner permitted by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the time of the revocation. A Shareholder attending the Meeting has the right to vote virtually and, if he or she does so, his or her proxy is nullified with respect to the matters such person votes upon and any subsequent matters thereafter to be voted upon at the Meeting.

A non-registered Shareholder wishing to change their vote must, at least seven (7) days before the Meeting, contact their intermediary to change their vote and follow their intermediary’s instructions. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

Exercise of Discretion

Common Shares represented by a properly executed proxy given in favour of the persons designated in the printed portion of the accompanying proxy at the Meeting will be voted or withheld from voting in accordance with the instructions contained therein on any ballot that may be called for and, if a Shareholder specifies a choice with respect to any matter to be acted upon at the Meeting, the Common Shares represented by the proxy shall be voted accordingly. Except with respect to broker non-votes described below where no choice is specified, the proxy will confer discretionary authority and will be voted in favour of each matter for which no choice has been specified.

Except with respect to broker non-votes described below, a proxy when properly completed and delivered and not revoked also confers discretionary authority upon the person appointed as proxy thereunder to vote with respect to any amendments or variations of matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of posting this Circular in accordance with Notice-and-Access (as defined below), management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters which are not known to the management of the Company should properly come before the Meeting, the Common Shares represented by proxies given in favour of management nominees will be voted in accordance with the best judgement of the nominee.

Under rules of the New York Stock Exchange (“NYSE”), brokers and other intermediaries holding shares in street name for their customers are generally required to vote these shares in the manner directed by their customers. If their customers do not give any direction, brokers may vote the securities at their discretion on routine matters, but not on non-routine matters. Other than the proposals to set the number of directors and for the appointment of our auditor, we believe all of the other matters to be voted on at the Meeting are non-routine matters and brokers governed by NYSE rules may not vote the securities held in street name for their customers in relation to these items of business without direction from their customers. The absence of a vote on a non-routine matter is referred to as a broker non-vote. Any securities represented at the Meeting but not voted (whether by abstention, broker non-vote or otherwise) will have no impact in the election of directors or any other matter to be voted on at the Meeting, except to the extent that the failure to vote for an individual nominee results in another individual receiving a larger proportion of votes cast for the election of directors. For purposes of the Company’s Majority Voting Policy (as defined below), a broker non-vote is not considered to be a withhold vote.

Technical Requirements

Participants attending the Meeting online to vote, should ensure they are entitled to vote and are connected to the internet at all times to allow them to vote on the resolutions during the polling periods for each matter put before the Meeting. Participants are responsible for ensuring they have internet connectivity at all times during the Meeting. Participants will also need to have the latest version of Chrome, Safari, Edge or Firefox. The platform does not support access using Internet Explorer. As internal network security protocols (such as firewalls or VPN connections) may block access to the Computershare meeting platform, participants should use a network that is not restricted by the security settings of any organization or that has disabled any VPN settings. Logging in at least an hour before the start of the Meeting is recommended to ensure participants are able to access the online platform. Participants who are having technical difficulties with access, can contact 1-888-724-2416 for technical assistance.

Non-registered Shareholders who wish to vote at the Meeting are responsible for appointing themselves or a third party as a proxyholder and submitting their proxy form with third party appointment details complete to Computershare and registering the third party appointment online with Computershare in advance of the Meeting at http://www.computershare.com/LithiumAmericasArgentina.

The Company believes that Shareholder participation at meetings is important, regardless of the online format for the Meeting. As such, the Meeting platform the Company has selected allows for registered Shareholders to ask written questions during the Meeting, and during any subsequent Company presentation. This facilitates a similar level of interaction as would be expected at an in-person meeting. Questions will be answered by the Chair of the Meeting, or by the Company’s senior management in that person’s discretion. The Company may choose not to answer any question that is asked of them if they determine the question is inappropriate for any reason.

Notice to U.S. Shareholders

This Circular is prepared in accordance with applicable disclosure requirements in Canada. As a “foreign private issuer” under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), the Company is exempt from proxy solicitation requirements in the United States. This means that the content of this Circular may be different from proxy circulars prepared by domestic issuers in the United States who follow U.S. Exchange Act requirements.

Notice-and-Access

The Company is using the notice-and-access provisions (“Notice-and-Access”) under National Instrument 54-101 – Communications with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 – Continuous Disclosure Obligations to distribute the proxy-related materials (including this Circular), the audited financial statements of the Company for the year ended December 31, 2023 and related auditor’s report and MD&A to Shareholders. This allows the Company to post electronic versions of the meeting materials on SEDAR+ at www.sedarplus.ca, and on the Company’s website at http://lithium-argentina.com/investor-relations/AGM instead of mailing paper copies to Shareholders. Notice-and-Access is more environmentally friendly, reduces the use of paper and certain physical delivery-related emissions, and more cost effective for the Company, as it reduces print and mailing costs.

Shareholders still have the right to request paper copies of the Meeting materials posted online by the Company under Notice-and-Access if they choose. The Company will not use the “stratification” procedure for Notice-and-Access, where a paper copy of the Meeting materials is provided along with the notice package. Shareholders may ask the Company additional questions about Notice-and-Access by calling 778-653-8092 or emailing info@lithium-argentina.com.

The Meeting materials are available under the Company’s profile on SEDAR+ and on the Company’s website at http://lithium-argentina.com/investor-relations/AGM. The Company will provide paper copies of the Meeting materials including proxy-related materials such as the Circular, the audited financial statements of the Company for the year ended December 31, 2023, the auditor’s report and the related MD&A free of charge, for a period of up to one year from the date the Circular is filed on SEDAR+.

For non-registered Shareholders with a 16-digit control number please call 1-877-907-7643 or visit www.proxyvote.com and enter the 16-digit control number located on your voting instruction form. For registered Shareholders, or those Shareholders without a 16-digit control number or who are dialing from outside North America, please call Toll Free Number: 1-844-916-0609 or Direct Dial: 1-303-562-9305 (English) or Toll Free Number: 1-844-973-0593 or Direct Dial: 1-303-562-9306 (French).

Shareholders who wish to receive a paper copy of the Meeting materials in advance of the Meeting should submit their request to the Company no later than June 10, 2024, to allow themselves sufficient time to receive and review the materials before the proxy submission deadline of 10:00 a.m. (Pacific Time) on June 18, 2024. The Company will send materials within three (3) business days of receiving a request if the request is received before the Meeting date, or within 10 days if received on or after the Meeting date. Shareholders should consider emailing their request to the Company and requesting an electronic copy of the materials to ensure they have sufficient time to review the materials, in which case requests should be sent to the Company by June 10, 2024.

Shareholders will be sent a paper copy of a notice package under Notice-and-Access by pre-paid mail containing: (i) a notification about the Company’s use of Notice-and-Access with instructions about how to access the proxy-related materials online, and (ii) for registered Shareholders, a form of proxy, or for non-registered Shareholders a VIF.

ITEMS OF BUSINESS

At the Meeting, the following items of business will be conducted:

Receive Financial Statements

Shareholders will receive a link to the audited consolidated financial statements and the auditor’s report for the fiscal year ended December 31, 2023. These materials are also available at www.lithium-argentina.com.

Set Number of Directors on the Board

Shareholders will be asked to approve setting the number of directors for the Company at eight (8).

Management recommends a vote FOR setting the number of directors at eight (8).

Elect Directors

Shareholders will be asked to vote on the election of eight (8) directors to the Board, who will serve until the Company’s next annual meeting of shareholders, or until a successor is elected or appointed in accordance with the Articles of the Company and applicable corporate law. All nominees standing for election have confirmed they are eligible and willing to serve. See page for information about each of the nominees and for general information about the Board.

Management recommends a vote FOR each of the nominated directors. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the nominees listed herein. Shareholders may vote ‘for’ or ‘withhold’ for each of the nominees.

Appoint the Auditor

Voting will occur by Shareholders on the appointment of PwC, to serve as auditors of the Company and for their remuneration to be set by the Board. PwC has served as the Company’s auditor since August 2015. See page for details about fees paid to the auditors.

Management recommends a vote FOR the appointment of the Company’s auditors. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the appointment of PwC as auditors of the Company for the ensuing year and the authorization of the directors to fix their remuneration.

The Company’s Audit and Risk Committee currently consists of Robert Doyle (Chair), George Ireland and Calum Morrison. National Instrument 52-110 – Audit Committees provides that a member of an audit committee is “independent” if the member has no direct or indirect material relationship with the Company, which could, in the view of the Board, reasonably interfere with the exercise of the member’s independent judgement. The Board has determined that all members of the Audit and Risk Committee are “independent” directors.

Approval of Amended and Restated Incentive Plan

Shareholders will be asked to consider and, if deemed appropriate, pass the Amended and Restated Incentive Plan Resolution, the full text of which is located below.

The Company is proposing to make certain amendments to the Company’s current amended and restated equity incentive plan (the “Incentive Plan”) that require Shareholder approval in accordance with the amendment provisions of the Incentive Plan in addition to the requirements of the Toronto Stock Exchange (the “TSX”) Company Manual. While the Company is technically the surviving entity of the Separation Transaction, much of the capacity of the Incentive Plan was granted in the Company’s prior iteration, to executives, staff and Board members that are now part of Lithium Americas (NewCo) and are no longer Participants under the existing Incentive Plan. In order to fulfill the Company’s pay-for-performance compensation philosophy and create alignment between the newly reconstituted Board, executive team, staff and shareholders, the Company is seeking additional flexibility in the Incentive Plan by way of certain corporate governance related amendments and an increase to the aggregate number of Common Shares that may be subject to issuance.

Subsequent to the Separation Transaction, the Board made certain corporate governance related amendments to the definition of “Eligible Director” under the current Incentive Plan and the participation limits of non-employee directors that require Shareholder approval pursuant to the TSX Company Manual, as well as certain housekeeping and other non-substantive amendments to the Incentive Plan as it pertains to United States participants. In particular, the definition of “Eligible Director” and the participation limits on non-employee directors in section 7.1 of the Incentive Plan were amended to: (i) clarify that only non-employee directors qualify as Eligible Directors for the purposes of Part 5 of the Incentive Plan (i.e. participate in awards of DSUs), (ii) denominate the non-employee director limits in section 7.1 of the Incentive Plan in United States dollars rather than Canadian dollars, which is more reflective of the Company’s reporting and functional currency, and (iii) expand the exceptions for the calculations of the non-employee director limits to fully discount from such limits initial securities granted under securities-based compensation arrangements to a person who was not previously a director of the Company, upon such person becoming or agreeing to become a director of the Company and to also discount securities-based compensation arrangements held by directors the Company prior to the Separation Transaction completed on October 3, 2023 (collectively, the “Governance Incentive Plan Amendments”). An aggregate of 325,000 DSUs and 600,000 Options at exercise prices of US$5.40 and US$5.56 per Common Share have been granted to Robert Doyle and Calum Morrison, and George Ireland and Diego Lopez Casanello, respectively, who are independent directors of the Company, the settlement or exercise of a portion of such awards that would exceed the non-employee director limits under section 7.1 of the Incentive Plan being conditional upon the non-employee director limitations forming part of the Governance Incentive Plan Amendments being approved by Shareholders. See “Corporate Governance, Director Compensation” below for more information with respect to the compensation, including incentive securities, awarded to our independent directors in 2023.

The Board approved further amendments to the Incentive Plan to transition the Incentive Plan from a “fixed” equity incentive plan to a “rolling” equity incentive plan pursuant to which the aggregate number of Common Shares that may be subject to issuance, together with any other securities-based compensation arrangements of the Company, will not exceed 8% of the issued and outstanding Common Shares from time to time (the “Rolling Plan Amendment” and with the Governance Incentive Plan Amendments, the “Incentive Plan Amendments”). The Rolling Plan Amendment will allow the number of Common Shares available under the Incentive Plan to automatically adjust with changes in the number of issued and outstanding Common Shares. The aggregate number of Common Shares that may be subject to issuance under the current Incentive Plan, together with any other securities-based compensation arrangements of the Company, is fixed at 14,400,737 Common Shares (representing approximately 8.93% of the issued and outstanding Common Shares as of the Record Date). As of the date hereof, there are 2,437,627 RSUs, 542,310 PSUs, 445,620 DSUs and 1,870,000 Options outstanding, (entitling the holders thereof to acquire a maximum of 5,295,557 Common Shares, after giving effect to the maximum performance multipliers applicable to PSUs, representing 3.28% of the Common Shares based on the current number of Common Shares outstanding). If the Rolling Plan Amendment is approved, 7,601,481 Common Shares will be available for the grant of additional future awards under the new Amended and Restated Incentive Plan (as defined below) representing 4.71% of the Common Shares based on the current number of Common Shares issued and outstanding with additional Common Shares being available for grants upon the Company issuing additional Common Shares from time to time (the “Unallocated Entitlements”).

The collective amendments to the Incentive Plan since it was last presented to Shareholders on July 31, 2023 as part of the approval of the plan of arrangement for the Separation Transaction are reflected in the blackline of the amended and restated equity incentive plan (the “Amended and Restated Incentive Plan”), which is attached as Schedule “A” to this Circular. The TSX has approved the Amended and Restated Incentive Plan. For a description of the Amended and Restated Incentive Plan, please refer to “Summary of Amended and Restated Incentive Plan” starting on page 9.

At the Meeting, Shareholders will be asked to consider, and if thought advisable, pass an ordinary resolution by simple majority vote, the text of which is set out below, approving the Incentive Plan Amendments, the Amended and Restated Incentive Plan and the Unallocated Entitlements (the “Amended and Restated Incentive Plan Resolution”). If at the Meeting, Shareholders do not approve the Amended and Restated Incentive Plan Resolution, the current Incentive Plan, with certain housekeeping and other non-substantive amendments to the Incentive Plan as it pertains to United States participants that do not require Shareholder approval under the TSX Company Manual, will remain as the Company’s equity incentive plan.

BE IT RESOLVED THAT:

1. The amended and restated equity incentive plan of Lithium Americas (Argentina) Corp. (the “Company”) as last amended by the board of directors of the Company (the “Board”) dated May 10, 2024 (the “Amended and Restated Incentive Plan”), including, without limitation, the “Incentive Plan Amendments”, substantially as described in the management information circular of the Company dated May 10, 2024 with respect to the Company’s annual general and special meeting of shareholders to be held on June 20, 2024 (the “Meeting”) be and are hereby authorized, approved, ratified and confirmed;

2. The Board be and is hereby authorized to reserve a sufficient number of common shares in the capital of the Company to satisfy the requirements under the Amended and Restated Incentive Plan;

3. All unallocated awards issuable pursuant to the Amended and Restated Incentive Plan be and are hereby authorized and approved;

4. The Company be and is hereby authorized to continue granting awards under the Amended and Restated Incentive Plan until June 20, 2027, being three years from the date of the Meeting; and

5. Any one more of the directors or officers of the Company be and is hereby authorized and directed to perform all such acts, deeds and things, execute or deliver all such documents and other writings, including treasury orders, as may be required to give effect to the intent of the foregoing resolutions.

Management recommends a vote FOR the approval, with or without variation, of the Amended and Restated Incentive Plan Resolution. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the Amended and Restated Incentive Plan Resolution

Approach to Executive Compensation

In line with its past practices, the Company will hold an advisory vote of Shareholders on its approach to executive compensation, as it believes it is important to ascertain Shareholder feedback on its practices in this area. The Company will disclose the results of the vote as part of its report on the voting results for the Meeting. The advisory vote is non-binding on the Company and it remains the duty of the Board to develop and implement appropriate executive compensation policies. However, the Board will take the results into account when considering the executive compensation plans and policies of the Company for future periods, recognizing that 2023 was a very unique transformational year for the Company with the completion of the Separation Transaction, the bringing of Caucharí-Olaroz into production and the significant changes in its human capital composition with the reconstitution of its management team.

For details regarding the Company’s executive compensation program and decisions made by the Board concerning executive pay for 2023, see the disclosure under the heading “Executive Compensation” starting on page .

Management recommends a vote FOR the non-binding advisory resolution on the Company’s approach to executive compensation. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the non-binding advisory resolution on the Company’s approach to executive compensation.

Other Business Conduct

The Company is not aware of any other business that may be raised at the Meeting. If any other matters do arise, management who is named in the proxy intend to vote on any poll using their best judgement. They will exercise discretionary authority when considering any amendments or variations of matters set out in the Notice of Meeting, or other matters that may properly come before the Meeting or any adjournment.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No person who has been a director or executive officer of the Company at any time since the beginning of the Company’s last completed financial year, nor any proposed nominee for director of the Company, nor any associate or affiliate of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting other than the election of directors or the approval of the Amended and Restated Incentive Plan.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as set out in this Circular, or in the Company’s annual information form (including without limitation, with respect to the interest of certain directors and officers of the Company in securities of the Company exchanged in connection with the Separation Transaction), annual financial statements and MD&A for its most recently completed financial year filed pursuant to applicable Canadian provincial securities laws and which are available on SEDAR+, no person who has been a director or executive officer of the Company, nor any proposed nominee for director of the Company, nor any person or company who beneficially owns, directly or indirectly, or who exercises control or direction over (or a combination of both) more than 10% of the issued and outstanding Common Shares, nor any associate or affiliate of those persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any transaction since the beginning of the Company’s last completed financial year which has materially affected or would materially affect the Company or its subsidiaries.

AUDIT FEES

The following table sets forth the fees billed to the Company and its subsidiaries by PwC for services rendered during the years ended December 31, 2023 and 2022:

|

|

|

|

2023 |

2022 |

Audit fees(1) |

$1,600,500 |

$652,543 |

Audit-related fees(2) |

- |

- |

Tax fees(3) |

$170,300 |

$157,330 |

All other fees(4) |

$6,440 |

$1,440 |

|

|

|

|

2023 |

2022 |

Total |

$1,777,240 |

$811,313 |

Notes:

(1) The aggregate audit fees billed by the Company’s auditor.

(2) Audit-related fees refers to the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under audit fees.

(3) The aggregate fees billed (or accrued) for professional services provided by the auditor rendered for tax compliance, tax advice and tax planning.

(4) All other fees represent fees for an audit of the Company’s report prepared pursuant to the Extractive Sector Transparency Measure Act in Canada.

DIRECTORS DISCLOSURE

Advance Notice for Nominations

Further to the Company’s advance notice requirements, any Shareholder who wishes to nominate a candidate to stand for election as a director must provide advance notice to the Vice President, Investor Relations and ESG (In lieu of the Corporate Secretary) by personal delivery or email. Notice must be delivered at least 30 days before the date of the Meeting, resulting in a delivery date no later than May 21, 2024. Additional advance notice requirements are set out in the advance notice provisions in the Company’s Articles available on our website (www.lithium-argentina.com).

Majority Voting Policy

The Company has a majority voting policy that establishes requirements for the election of directors at uncontested meetings of Shareholders (the “Majority Voting Policy”). Under the policy, nominees are required to stand for election individually and not as a slate. Any nominee who receives a majority of “withheld” or “against” votes (50% + 1) is deemed to have tendered their resignation to the Board. The Board has the discretion, on recommendation from the Governance, Nomination, Compensation and Leadership Committee, to decline any deemed resignation within 90 days of the meeting at which the election occurred, but doing so will require the Company to issue a press release pursuant to the Majority Voting Policy. The nominee would be excluded from Board and committee meetings until a decision is made on whether to accept the nominee’s deemed resignation. Any acceptance of a deemed resignation will create a vacancy on the Board that can be filled as permitted by applicable corporate law in British Columbia, including a Board appointment of a new nominee.

Nominees

As a result of the Separation Transaction, our Board was reconstituted in October 2023 to be comprised of John Kanellitsas, George Ireland, Diego Lopez Casanello, Robert Doyle, Franco Mignacco and Calum Morrison. On March 19, 2024, Sam Pigott and Monica Moretto were appointed to the Board. At the Meeting, Shareholders will be asked to elect these eight (8) nominees as directors of the Company. Each director nominee elected will hold office until their successor is elected at the next annual meeting of Shareholders, or any postponement(s) or adjournment(s) thereof, or until their successor is otherwise elected or appointed.

The following tables set out information regarding nominees for election as directors, including, but not limited to, the names, province or state and country of residence, the offices they hold within the Company, their principal occupations, business or employment within the five preceding years, the period or periods during which each director has served as a director, areas of expertise, attendance of meetings during the

2023 fiscal year (if applicable) and the number of securities of the Company that each beneficially owns, directly or indirectly, or over which control or direction is exercised, as of the date of this Circular:

|

|

|

|

|

|

|

|

|

JOHN KANELLITSAS, Executive Chairman Florida, USA |

Mr. Kanellitsas is the Executive Chairman of the Company. He joined the former Lithium Americas Corp. in June 2013 and has been as a director of the Company and has served in various executive roles with the Company since September 2015. He also served as the Interim Chief Executive Officer from October 2023 until March 2024. Mr. Kanellitsas also serves as a director of Largo Physical Vanadium Corp. and Lithium Royalty Corp. He has over 25 years of experience in the investment banking and asset management industries. He co-founded and was a partner of Geologic Resource Partners, LLP, where he served as its Chief Operating Officer from 2004 to 2014. Prior to Geologic, Mr. Kanellitsas was employed by Sun Valley Gold, LLC and Morgan Stanley & Co. in New York and San Francisco. Mr. Kanellitsas has a Bachelor of Science in Mechanical Engineering from Michigan State University and a Master of Business Administration from the University of California in Los Angeles. |

Non-Independent Age: 62 |

2023 AGM Voting Results |

Other Public Company Boards and Committees |

97.24% voted for, 2.58% withheld |

Largo Physical Vanadian Corp. Lithium Royalty Corp. |

2023 Meeting Attendance |

Board SDC |

8 of 8 1 of 1 |

100% 100% |

Securities Ownership Details |

Common Shares |

RSUs |

PSUs |

DSUs |

Options |

Direct 2,116,260 Indirect 88,445(1) |

1,051,579 |

27,870(2) |

- |

250,000 |

(1) Held by Mr. Kanellitsas’ spouse.

(2) PSUs are satisfied in Common Shares on a one-for-one basis.

|

|

|

|

|

|

|

|

|

SAM PIGOTT, President and CEO(1) Ontario, Canada |

Mr. Pigott joined the Company as President and Chief Executive Officer on March 18, 2024 and as a director on March 19, 2024. Prior to this, he served as Head of Business Development, North America of Ganfeng Lithium Co., Ltd. (“Ganfeng”) from October 2018 to March 2024. Before joining Ganfeng in 2018, Mr. Pigott worked in several financial and investment banking institutions in a variety of senior roles. Mr. Pigott holds a Master of Business Administration from Oxford University and a Bachelor of Arts in Economics and History from McGill University. |

Non-Independent Age: 41 |

2023 AGM Voting Results |

Other Public Company Boards and Committees |

N/A |

N/A |

2023 Meeting Attendance |

Board |

N/A |

N/A |

Securities Ownership Details |

Common Shares |

RSUs |

PSUs |

DSUs |

Options |

39,269 |

200,000 |

- |

- |

250,000 |

(1) The Company appointed Sam Pigott as President and Chief Executive Officer effective on March 18, 2024, with Mr. Kanellitsas (the Company’s former President and Interim Chief Executive Officer) continuing in his role as Executive

Chairman. Mr. Pigott was also appointed to the Company’s Board effective March 19, 2024.

|

|

|

|

|

|

|

|

|

GEORGE IRELAND, Lead Director Massachusetts, USA |

Mr. Ireland joined the Company as a director in November 2015. He has over forty years of experience in the mining and metals industry in positions ranging from field geologist and operations, to banking and venture capital. In 2004, Mr. Ireland founded Geologic Resource Partners LLP and serves as Chief Investment Officer and CEO. He previously held various roles as an analyst and partner with investment firms including Knott Partners LP, Cleveland Cliffs Inc., the Chase Manhattan Bank, ASARCO Inc. and Ventures Trident LP. He graduated from the University of Michigan with a BSc degree from the School of Natural Resources and is a Fellow in the Society of Economic Geologists. |

Independent Director Age: 67 |

2023 AGM Voting Results |

Other Public Company Boards and Committees |

97.71% voted for, 2.29% withheld |

Amerigo Resources Ltd. Heliostar Metals Corp. |

2023 Meeting Attendance |

Board ARC GNCLC SDC |

8 of 8 8 of 8 1 of 1 1 of 1 |

100% 100% 100% 100% |

Securities Ownership Guidelines – Independent Directors |

Common Shares |

DSUs |

Options |

Total Securities |

Total Market Value* |

3,256,186 |

212,900 |

150,000 |

3,619,086 |

US$19,114,663.86 |

* Based on the NYSE closing price of US$5.51 per Common Share on May 9, 2024. The total market value amount is in respect of the Common Shares and DSUs held, and excludes Options which are not factored into share ownership calculations under the Share Ownership Policy.

|

|

|

|

|

|

|

|

|

DIEGO LOPEZ CASANELLO, Director(1) North Carolina, USA |

Mr. Casanello joined the Company as a director in October 2023 with the Separation Transaction. He has served as Chief Executive Officer of Farmers Business Network, Inc. (farmer-to-farmer network and e-commerce platform) since March 2024; Managing Partner of Vidavo Ventures (venture capital firm focused on decarbonization technologies) since March 2022; and Executive Advisor to New Mountain Capital LLC (private equity firm) since June 2021. Prior to this he served as Former President and Chief Operating Officer of UPL Limited (global agricultural and specialty chemicals manufacturer) from March 2019 to May 2021 and as the Chief Executive Officer of Arysta LifeScience Corporation (global agricultural chemicals manufacturer) from February 2016 to February 2019, following its sale in July 2018 to UPL. He currently serves on the board of Profile Products LLC since November 2021 (environmental solutions). Mr. Casanello started his career at chemical manufacturer BASF SE and worked in senior executive positions in Europe, Asia, South and North America, including as Managing Director of BASF Argentina S.A. and leading the Oilfield and Mining Chemicals business in North America. He has extensive M&A experience and holds a BA in Business Administration from the University of Hagen. |

Independent Director Age: 50 |

2023 AGM Voting Results |

Other Public Company Boards and Committees |

N/A |

N/A |

2023 Meeting Attendance |

Board SDC |

2 of 2 1 of 1 |

100% 100% |

Securities Ownership Guidelines – Independent Directors |

Common Shares |

DSUs |

Options |

Total Securities |

Total Market Value* |

50,000 |

75,000 |

150,000 |

275,000 |

US$688,750.00 |

(1) Mr. Casanello was appointed to the Company’s Board effective October 3, 2023 with the Separation Transaction.

* Based on the NYSE closing price of US$5.51 per Common Share on May 9, 2024. The total market value amount is in respect of the Common Shares and DSUs held, and excludes Options which are not factored into share ownership calculations under the Share Ownership Policy.

|

|

|

|

|

|

|

|

|

ROBERT DOYLE, Director(1) British Columbia, Canada |

Mr. Doyle joined the Company as a director in October 2023 with the Separation Transaction. He has been a corporate director since June 2016, serving on the boards of Faraday Copper Corp. (development-stage copper company) since April 2022, OreZone Gold Corp. (TSX-listed gold producer) since June 2022 and Maverix Metals Inc. (royalty streaming company) from June 2016 until its acquisition by Triple Flag Precious Metals Corp. in January 2023. He previously served as Chief Financial Officer of Pan American Silver Corp. (TSX and NASDAQ-listed, leading producer of silver) from January 2004 until retiring in March 2022. Mr. Doyle has over 20 years of international experience in corporate finance, functional management and capital markets roles. Mr. Doyle holds a BSc of Finance from the University of Cape Town and is a Chartered Accountant in South Africa and Chartered Financial Analyst in Canada. |

Independent Director Age: 55 |

2023 AGM Voting Results |

Other Public Company Boards and Committees |

N/A |

Faraday Copper Corp. Orezone Gold Corporation |

2023 Meeting Attendance |

Board ARC GNCLC |

2 of 2 2 of 2 1 of 1 |

100% 100% 100% |

Securities Ownership Guidelines – Independent Directors |

Common Shares |

DSUs |

Options |

Total Securities |

Total Market Value* |

4,500 |

75,000 |

150,000 |

229,500 |

US$438,045.00 |

(1) Mr. Doyle was appointed to the Company’s Board effective October 3, 2023 with the Separation Transaction.

* Based on the NYSE closing price of US$5.51 per Common Share on May 9, 2024. The total market value amount is in respect of the Common Shares and DSUs held, and excludes Options which are not factored into share ownership calculations under the Share Ownership Policy.

|

|

|

|

|

|

|

|

|

FRANCO MIGNACCO, President of Minera Exar(3) Jujuy, Argentina |

Mr. Mignacco has been a director of the Company since September 2015 and serves on the board of Full Circle Lithium Corp. since April 21, 2023. He has served as President of Minera Exar S.A. (“Minera Exar”) since June 2013, overseeing operations and development of the Cauchari-Olaroz mineral project. Previously, he was the Vice Chairman of the former Lithium Americas Corp. from June 2013 to September 2015 prior to its merger with Western Lithium USA Corp. Mr. Mignacco holds an MBA from San Andres University in Buenos Aires, Argentina and a mining degree with honours from Universidad Austral, Buenos Aires, Argentina. |

Non-Independent Age: 41 |

2023 AGM Voting Results |

Other Public Company Boards and Committees |

98.18% voted for, 1.82% withheld |

Full Circle Lithium Corp. |