Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is pleased to report its operating and unaudited consolidated

financial results for the three months ended March 31, 2020.

Operations Highlights

- Q1 Production: ~36,550 boe/d including ~28,300

bbl/d in Thermal Oil & ~8,250 boe/d in Light Oil.

- Leismer: Q1 production of ~19,800 bbl/d

supported by strong results at Pad 7.

- Placid Montney: Encouraging initial results

from 10 wells that were placed on production for clean-up in April

with plans to defer new volumes until commodity prices

improve.

- Kaybob Duvernay: Continued strong results in

the oil window with recent pads at Kaybob East IP30s averaging

~1,000 boe/d per well (88% liquids). These results compare

favorably to the East Shale Basin Duvernay due to low capital costs

and higher sustained liquids rates.

Resiliency Measures Taken in Response to

COVID19

- Halted Capital Program: 2020 budget of $85

million reflects a $40 million reduction from the original budget.

Minimal activity planned for the balance of the year ($31.5 million

Q2-Q4 2020).

- Production Curtailments: Shut in production

indefinitely at Hangingstone and planning to curtail production at

Leismer to ~8,000 bbl/d by June and Light Oil to ~7,500 boe/d

starting in May. The duration of curtailments will be dictated by

commodity prices.

- G&A Reductions: Moved to 80% work week for

corporate staff in the Calgary office.

- Contingent Bitumen Royalty: $70 million cash

consideration for an upsized Royalty agreement with Burgess Energy

at a highly attractive cost of capital (the “Royalty”).

- Reduced Future Financial Commitments:

Reassigned 15,000 bbl/d of Keystone XL transportation commitment to

a third party while retaining 10,000 bbl/d of capacity.

- Risk Management: Protection in place to

mitigate near term pricing volatility including 18,000 bbl/d of WTI

hedged for Q2 at ~US$42.50 vs. strip at ~US$20.50 (May 4).

Balance Sheet and Financial

Highlights

- Balance Sheet: Liquidity of $352 million

(cash, cash equivalents and available credit facilities at March

31, 2020 and pro forma the Royalty transaction announced on April

28, 2020).

- Financial Results: Q1 Operating Income of $1.1

million with financial results impacted by realized price declines

related to the onset of the COVID-19 pandemic.

Athabasca remains focused on maximizing

corporate funds flow and maintaining strong corporate liquidity.

Athabasca maintains long-term optionality across a deep inventory

of high-quality Thermal Oil projects and flexible Light Oil

development opportunities. This balanced portfolio provides

shareholders with differentiated exposure to liquids weighted

production and significant long reserve life assets.

Business Environment and the Impact of

COVID19

In March 2020, the COVID-19 outbreak was

declared a pandemic by the World Health Organization. The COVID-19

pandemic has caused a material disruption to global business and a

slowdown of the global economy. Governments and central banks have

reacted with significant monetary and fiscal interventions designed

to stabilize economic conditions.

Global commodity prices have declined

significantly as countries around the world enact emergency

measures to combat the spread of the virus. The decrease in oil

demand has been unprecedented with an estimated 22.5 MMbbl/d off

market in April, 2020 (Goldman Sachs Global Investment Research).

Additionally, Saudi Arabia and Russia could not agree on extending

production cuts in March 2020 resulting in world supply increasing.

Global inventories have reached all-time highs recently, including

in North America. The result has seen WTI prices drop from

~US$57.50 in January to ~US$16.75 in April (monthly average

prices). Physical markets and regional benchmark prices (e.g.

Western Canadian Select “WCS” heavy oil) have also been impacted by

inventory balances and underlying commodity price volatility.

In April, OPEC and non-OPEC countries agreed to

supply cuts amounting to 10 MMbbl/d in response to the over-supply

situation along with other global producer curtailments. Athabasca

expects improving global oil fundamentals through H2 2020 due to

these supply cuts and demand support as countries implement

relaunch programs for businesses and day-to-day life.

Corporate Update and Response to

COVID19

Athabasca’s first priority is the safety of its

employees and contractors and ensuring the Company is doing its

part to flatten the curve. Athabasca’s field operations have been

reduced to essential personnel and the Company is strictly

complying with Alberta Health Guidelines. The Company has

successfully implemented remote work access for its Calgary staff

since mid-March.

The Company has taken swift action in response

to the pandemic and economic crisis. Major initiatives to date

include halting the 2020 capital program, significant production

curtailments, partnering with service companies to reduce operating

costs and reducing future financial commitments on the Keystone XL

pipeline. Finally, the Company recently bolstered its liquidity by

$70 million through an upsized Contingent Bitumen Royalty.

The Company is well positioned to navigate the

current challenging environment with $352 million in liquidity

($270 million cash and cash equivalents, $82 million undrawn credit

capacity as at March 31, 2020 and pro forma the Royalty transaction

announced on April 28). The low decline nature of Athabasca’s

assets allows for minimal capital investment while maintaining its

production base for a crude oil demand recovery. Strong current

liquidity in conjunction with swift operational actions should

allow Athabasca to remain resilient under strip commodity prices

through this cycle with significant upside potential as oil prices

recover. Athabasca is continuing to explore opportunities to

increase liquidity to further insulate from market volatility

including potentially accessing the recently announced Federal

Government support programs.

Athabasca’s 2020 capital program is $85 million

($31.5 million Q2 – Q4 2020), with $40 million cancelled from the

original budget. The Company is suspending its production guidance

given the uncertainty associated with the duration of the announced

curtailments which will be dictated by commodity pricing.

The Company has 18,000 bbl/d of WTI hedged for

Q2 2020 at ~US$42.50 and 9,000 bbl/d for H2 2020 at ~US$41. For the

balance of the year (Q2 – Q4), the Company has 15,000 bbl/d of WCS

differentials hedged at ~US$18.

There have been recent positive developments on

market egress. TC Energy and the Alberta Government announced on

March 31, 2020 that the Alberta Government would provide financial

support in the form of a $1.5 billion equity investment in 2020 and

$6 billion of loan guarantees in 2021, enabling completion of the

Keystone XL pipeline. As a result, the project resumed construction

on April 1, 2020. Despite these encouraging advancements,

overall broader market uncertainty has delayed returns that our

investors expect. Canada is fortunate to have an abundance of

resources and the technical strength for responsible development.

Our Company is firm in its belief that we develop Energy

responsibly to make lives better. The world needs Canadian Energy

and so does Canada.

Financial and Operational Highlights

|

|

Three months

endedMarch 31, |

|

|

($ Thousands, unless otherwise noted) |

2020 |

|

2019 |

|

|

CONSOLIDATED |

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d) |

|

36,557 |

|

|

39,206 |

|

|

Operating Income(1)(2) |

$ |

1,098 |

|

$ |

58,602 |

|

|

Operating Netback(1)(2) ($/boe) |

$ |

0.33 |

|

$ |

16.77 |

|

|

Capital expenditures |

$ |

76,246 |

|

$ |

52,964 |

|

|

Capital Expenditures Net of Capital-Carry(1) |

$ |

53,506 |

|

$ |

31,756 |

|

|

LIGHT OIL DIVISION |

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d) |

|

8,242 |

|

|

11,712 |

|

|

Percentage liquids (%) |

|

59 |

% |

|

54 |

% |

|

Operating Income (Loss)(1) |

$ |

12,783 |

|

$ |

31,280 |

|

|

Operating Netback(1) ($/boe) |

$ |

17.04 |

|

$ |

29.67 |

|

|

Capital expenditures |

$ |

58,527 |

|

$ |

29,855 |

|

|

Capital Expenditures Net of Capital-Carry(1) |

$ |

35,787 |

|

$ |

8,647 |

|

|

THERMAL OIL DIVISION |

|

|

|

|

|

|

|

Bitumen production (bbl/d) |

|

28,315 |

|

|

27,494 |

|

|

Operating Income (Loss)(1) |

$ |

(33,111 |

) |

$ |

45,128 |

|

|

Operating Netback(1) ($/bbl) |

$ |

(12.50 |

) |

$ |

18.50 |

|

|

Capital expenditures |

$ |

17,696 |

|

$ |

23,109 |

|

|

CASH FLOW AND FUNDS FLOW |

|

|

|

|

|

|

|

Cash flow from operating activities |

$ |

(3,021 |

) |

$ |

(18,572 |

) |

|

per share - basic |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

|

Adjusted Funds Flow(1) |

$ |

(27,883 |

) |

$ |

41,619 |

|

|

per share - basic |

$ |

(0.05 |

) |

$ |

0.08 |

|

|

NET INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

Net income (loss) and comprehensive income (loss) |

$ |

(516,481 |

) |

$ |

206,796 |

|

|

per share - basic |

$ |

(0.99 |

) |

$ |

0.40 |

|

|

per share - diluted |

$ |

(0.99 |

) |

$ |

0.39 |

|

|

COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

523,595,977 |

|

|

516,011,483 |

|

|

Weighted average shares outstanding - diluted |

|

523,595,977 |

|

|

524,731,043 |

|

| |

March 31, |

|

December 31, |

|

|

As at ($ Thousands) |

2020 |

|

2019 |

|

|

LIQUIDITY AND BALANCE SHEET |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

199,517 |

|

$ |

254,389 |

|

|

Available credit facilities(3) |

$ |

82,240 |

|

$ |

85,815 |

|

|

Capital-carry receivable (current portion - undiscounted) |

$ |

— |

|

$ |

22,740 |

|

|

Face value of long-term debt(4) |

$ |

638,415 |

|

$ |

583,425 |

|

(1) Refer to the Advisories in this News Release

and the “Advisories and Other Guidance” section within this in the

Company’s Q1 2020 MD&A for additional information on Non-GAAP

Financial Measures. (2) Includes realized commodity risk management

gain of $21.4 million for the three months ended March 31, 2020

(three months ended March 31, 2019 - $17.8 million loss).(3)

Includes available credit under Athabasca's Credit Facility and

Unsecured Letter of Credit Facility.(4) The face value of the 2022

Notes is US$450 million. The 2022 Notes were translated into

Canadian dollars at the March 31, 2020 exchange rate of US$1.00 =

C$1.4187.

Operations Update

Thermal Oil

In Q1 2020, production averaged 28,315 bbl/d

with a strong contribution from Leismer which averaged 19,818

bbl/d. Leismer had a 13% improvement in its steam oil ratio (“SOR”)

to 3.4x compared with Q4 2019. The improvement at Leismer was due

to increased co-injection of non-condensable gas and the impact of

Pad 7’s low SOR.

The Company has recently voluntarily curtailed

Leismer volumes to optimize operating cash flows while conserving

valuable reserves for a more constructive pricing environment. In

the near term, the Company anticipates managing volumes down to

~8,000 bbl/d by June. Operations are focused on maintaining

reservoir integrity through optimizing steam levels and

non-condensable gas co-injection. The duration of curtailments will

be dictated by commodity pricing. Leismer’s operating break-even is

estimated at US$23 WCS (US$35 WTI assuming a US$12.50 WCS

differential) at current production capacity (~19,000 bbl/d).

Overall Thermal Oil financial results in Q1 were

impacted by the severe selloff in commodity prices following the

global COVID-19 outbreak with an Operating Loss of $33.1 million.

Capital expenditures were $17.7 million and were primarily

associated with Leismer and included the completion of the water

disposal project as well as drilling observation wells and

purchasing long-lead items for Pad 8. Minimal capital activity is

budgeted for the balance of 2020 and only includes routine

pump-changes on wells.

Athabasca suspended the Hangingstone SAGD

operation on April 2, 2020. This suspension involved shutting in

the well pairs, halting steam injection to the reservoir, and

taking measures to preserve the processing facility and pipelines

in a safe manner so that it could be re‐started at a future date

when the economy has recovered. The Hangingstone asset has an

operating break‐even of approximately US$37 WCS (US$50 WTI assuming

$12.50/bbl WCS differential) and this action is expected to

significantly improve corporate resiliency in the current

environment.

Light Oil

In Q1 2020, production averaged 8,242 boe/d (59%

liquids). The division generated Operating Income of $12.8 million

($17.04/boe netback). The Company’s Light Oil Netbacks are top tier

when compared to Alberta’s other liquids-rich Montney and Duvernay

resource producers and are supported by a high liquids weighting

and low operating expenses. Capital Expenditures were $35.8

million. The Company has no additional Light Oil activity planned

for the balance of the year.

At Greater Placid, the 10 Montney development

wells from the winter program were all placed on-production by

April for clean-up. Athabasca is pleased with initial production

results and has elected to defer new volumes from the development

wells until commodity prices improve. The Company anticipates

managing base Montney volumes to ~3,500 boe/d through May and June.

Greater Placid is positioned for flexible future development with

no near-term land retention requirements.

In the Greater Kaybob Duvernay, Athabasca

concluded an active winter campaign that included the drilling of 8

wells, 13 completions and a total of 16 tie-ins expected by

mid-year. In the volatile oil window, production results have been

consistently strong. Recent multi-well pads at Kaybob East (10

wells) had IP30s averaging ~1,000 boe/d per well (80% liquids).

Drilling and completion costs have been reduced to ~C$7.5 million

on recent wells (2-well pads) with line of sight to further

improvements with multi-well pad development. These results compare

favorably to the East Shale Basin Duvernay due to low capital costs

and higher sustained liquids rates.

Annual General Meeting

Athabasca will hold its 2020 Annual General

Meeting on Thursday, May 7, 2020 at 9:00am (MDT). The Meeting will

be held at Athabasca’s Calgary office located at Suite 1200, 215 -

9 Avenue SW.

Due to restrictions on gatherings

implemented by the Government of Alberta in response COVID-19,

guidelines issued with respect to social distancing and out of

concern for the wellbeing of all participants, we strongly

recommend that shareholders not attend the meeting

in-person.

Shareholders can listen to the Meeting via live

webcast at https://www.atha.com/investors/presentation-events.html.

An archived recording of the webcast will be available on the

Company’s website for those unable to listen live.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:Matthew TaylorChief

Financial Officer1-403-817-9104mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “believe”, “view”, ”contemplate”,

“target”, “potential” and similar expressions are intended to

identify forward-looking information. The forward-looking

information is not historical fact, but rather is based on the

Company’s current plans, objectives, goals, strategies, estimates,

assumptions and projections about the Company’s industry, business

and future operating and financial results. This information

involves known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking information. No assurance

can be given that these expectations will prove to be correct and

such forward-looking information included in this News Release

should not be unduly relied upon. This information speaks only as

of the date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans and growth strategies; plans

to curtail production; the Company’s 2020 capital budget;

expectations on global oil fundamentals; and other matters.

With respect to forward-looking information

contained in this News Release, assumptions have been made

regarding, among other things: commodity outlook; the regulatory

framework in the jurisdictions in which the Company conducts

business; the Company’s financial and operational flexibility; the

Company’s, capital expenditure outlook, financial sustainability

and ability to access sources of funding; geological and

engineering estimates in respect of Athabasca’s reserves and

resources; and other matters.

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 4, 2020 available on SEDAR at

www.sedar.com, including, but not limited to: fluctuations in

commodity prices, foreign exchange and interest rates; political

and general economic, market and business conditions in Alberta,

Canada, the United States and globally; changes to royalty regimes,

environmental risks and hazards; the potential for management

estimates and assumptions to be inaccurate; the dependence on

Murphy as the operator of the Company’s Duvernay assets; the

capital requirements of Athabasca’s projects and the ability to

obtain financing; operational and business interruption risks,

including those that may be related to the COVID pandemic; failure

by counterparties to make payments or perform their operational or

other obligations to Athabasca in compliance with the terms of

contractual arrangements; aboriginal claims; failure to obtain

regulatory approvals or maintain compliance with regulatory

requirements; uncertainties inherent in estimating quantities of

reserves and resources; litigation risk; environmental risks and

hazards; reliance on third party infrastructure; hedging risks;

insurance risks; claims made in respect of Athabasca’s operations,

properties or assets; risks related to Athabasca’s amended

credit facilities and senior secured notes; and risks related

to Athabasca’s common shares.

The risks and uncertainties referred to above

are described in more detail in Athabasca’s most recent AIF, which

is available on the Company’s SEDAR profile at www.sedar.com.

Readers are cautioned that the foregoing list of risk factors

should not be construed as exhaustive. The forward-looking

information included in this News Release is expressly qualified by

this cautionary statement and is made as of the date of this News

Release. The Company does not undertake any obligation to publicly

update or revise any forward-looking information except as required

by applicable securities laws.

Oil and Gas Information

“BOEs" may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Operating break‐even reflects the estimated WCS

oil price per barrel required to generate an asset level operating

income of Cdn $0. Break‐even is used to assess the impact of

changes in WCS oil prices on operating income of an asset and could

impact future investment decisions. Break‐even does not have any

standardized meaning and therefore should not be used to make

comparisons to similar measures presented by other issuers.

Initial Production Rates

The initial production rates provided in this

News Release should be considered to be preliminary. Initial

production rates disclosed herein may not necessarily be indicative

of long-term performance or of ultimate recovery.

Non-GAAP Financial Measures

The "Adjusted Funds Flow”, "Light Oil Operating

Income", “Light Oil Operating Netback”, “Light Oil Capital

Expenditures Net of Capital‐Carry”, "Thermal Oil Operating Income

(Loss)", "Thermal Oil Operating Netback", “Consolidated Operating

Income”, “Consolidated Operating Netback”, and “Consolidated

Capital Expenditures Net of Capital‐Carry” financial measures

contained in this News Release do not have standardized meanings

which are prescribed by IFRS and they are considered to be non‐GAAP

measures. These measures may not be comparable to similar measures

presented by other issuers and should not be considered in

isolation with measures that are prepared in accordance with

IFRS.

Adjusted Funds Flow is not intended to represent

cash flow from operating activities, net earnings or other measures

of financial performance calculated in accordance with IFRS.

Adjusted Funds Flow is calculated by adding certain non-cash

changes to working capital and settlement of provisions to cash

flow from operating activities. The Adjusted Funds Flow measure

allows management and others to evaluate the Company’s ability to

fund its capital programs and meet its ongoing financial

obligations using cash flow internally generated from ongoing

operating related activities. Adjusted Funds Flow per share is

calculated as Adjusted Funds Flow divided by the applicable number

of weighted average shares outstanding.

The Light Oil Operating Income measure in this

News Release is calculated by subtracting royalties, operating

expenses and transportation & marketing expenses from petroleum

and natural gas sales. The Light Oil Operating Netback measure is

calculated by dividing the Light Oil Operating Income (Loss) by the

Light Oil production and is presented on a per boe basis. The Light

Oil Operating Income and the Light Oil Operating Netback measures

allow management and others to evaluate the production results from

the Company’s Light Oil assets.

The Thermal Oil Operating Income (Loss) measure

in this News Release with respect to the Leismer Project and

Hangingstone Project is calculated by subtracting the cost of

diluent blending, royalties, operating expenses and transportation

& marketing expenses from blended bitumen sales and adjusting

for the impacts of inventory write-downs. The Thermal Oil Operating

Netback measure is calculated by dividing the respective projects

Operating Income (Loss) by its respective bitumen sales volumes and

is presented on a per barrel basis. The Thermal Oil Operating

Income (Loss) and the Thermal Oil Operating Netback measures allow

management and others to evaluate the production results from the

Company’s Thermal Oil assets.

The Consolidated Operating Income (Loss) measure

in this News Release is calculated by adding or subtracting

realized gains (losses) on commodity risk management contracts,

royalties, the cost of diluent blending, operating expenses and

transportation & marketing expenses from petroleum and natural

gas sales and adjusting for the impacts of inventory write-downs.

The Consolidated Operating Netback measure is calculated by

dividing Consolidated Operating Income (Loss) by the total sales

volumes and is presented on a per boe basis. The Consolidated

Operating Income (Loss) and the Consolidated Operating Netback

measures allow management and others to evaluate the production

results from the Company’s Light Oil and Thermal Oil assets

combined together including the impact of realized commodity risk

management gains or losses.

The Consolidated Capital Expenditures Net of

Capital-Carry and Light Oil Capital Expenditures Net of

Capital-Carry measures in this News Release are outlined in the

Company’s Q1 2020 MD&A. These measures allow management and

others to evaluate the true net cash outflow related to Athabasca's

capital expenditures.

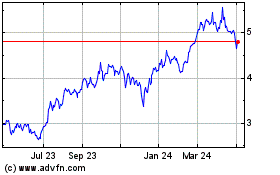

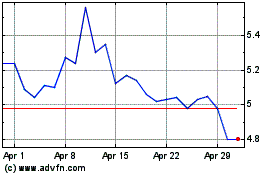

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2023 to Nov 2024