TIDMCRPR

RNS Number : 2692K

Cropper(James) PLC

24 August 2023

24 August 2023

James Cropper plc

('James Cropper', the 'Company' or the 'Group')

Full Year Results

Transformational Year with Good Progress Achieved

James Cropper plc (AIM: CRPR), a global market leader in

advanced materials, luxury packaging and paper products, today

announces its results for the year ended 1 April 2023.

Headlines:

Financial

-- Strong recovery in a transformational year, with a 24%

increase in revenue to GBP129.7m (2022: GBP104.9m) driven by high

demand and retained contracts

-- Despite the significant inflationary cost headwinds, adjusted

operating profit increased 4% to GBP4.8m (APM1*) (2022:

GBP4.6m)

-- GBP3.2m adjusted profit before tax, 21% lower (2022: GBP4.0m)

(APM2**) due to an increase in net finance costs

-- Exceptional costs of GBP1.1m which reflects outperformance at

TFP Hydrogen and consequent reassessment of the value of contingent

consideration (2022: GBP0.4m)

-- Profit before tax of GBP1.3m, 53% lower (2022: GBP2.8m) due

to an increase in net finance costs and exceptional costs

-- Net debt of GBP16.6m up 35% (2022: GBP12.3m)

-- Earnings per share 5.4p down 62% (2022: 14.2p)

-- Full year dividend proposal 6.0p per share in line with expectations (2022: 10.0p)

*APM1 "Adjusted operating profit" refers to operating profit

before interest and prior to the impact of IAS 19

and exceptional items

**APM2 "Adjusted profit before tax" refers to profit before tax

prior to the impact of IAS 19 and exceptional items

Operational

-- Strong global pipeline in Future Energy sector

-- TFP Hydrogen exceeded our expectations

-- Well advanced in the transformation of the Paper division post year end

-- Significantly tighter scope around decarbonisation project:

40% lower capital investment requirement

-- Ongoing energy saving actions contributed to 8% annualised reduction in site fuel consumption

-- Strengthened the Board and Executive leadership team

-- Strengthened broader organisational leadership to drive strategy

Outlook

-- Future Energy and Luxury Packaging to deliver high market growth and value, respectively

-- Integration of Colourform with Paper to drive a unique and

compelling Luxury Packaging proposition

-- Consolidation across the organisation and estate to reduce costs and improve efficiency

-- Streamlined Paper Product offer to drive margin improvements and productivity

-- Continued technological leaders in recycled content and responsible sourcing

-- Strengthen our sector leadership in carbon reduction

-- Sharper focus with better clarity and assessment of our climate risks

-- Strong leadership team to reposition James Cropper

-- Drive brand value, recognition and preference in each market focused segment

Commenting on the full year results, James Cropper CEO Steve

Adams said:

"We achieved a good performance for the year with 24% revenue

growth in spite of unprecedented market headwinds. In FY2023,

significant progress was made in repositioning James Cropper t o

capitalise on growth opportunities within its core and emerging

end-markets, such as the fast-growing renewable energy and

decarbonisation markets which are in need of novel high-performance

materials and sustainable fibres.

We will aim to drive increased value for our shareholders

through accelerated growth in each of our market focused segments;

Creative Papers, Luxury Packaging, Technical Fibres and Future

Energy by leveraging our potential as one Company under the James

Cropper name.

I am excited by the many opportunities and have confidence in

our strategy to accelerate growth and in our exceptional team

worldwide to make a real difference. The foundations are in place

to create a greater global presence for James Cropper, by

repositioning ourselves to better serve our existing and target

customers."

Enquiries:

James Cropper plc

Rosina Merrett

Mob: +44 (0) 7500 083559

rosina.merrett@cropper.com

Shore Capital - NOMAD and Broker

Robert Finlay, Henry Willcocks, Lucy Bowden

Tel: +44 (0) 207601 6100

Buchanan Communications - Financial PR

Chris Lane, Charles Ryland, Jamie Hooper, Verity Parker

jamescropper@buchanancomms.co.uk

Tel: +44 (0) 207 466 5000

Notes for editors:

James Cropper is a market leader in advanced materials and paper

products. Led by the Cropper family for six generations, the

business has an international workforce and an operational reach in

over 50 countries.

Established in 1845, the Group manufactures paper, packaging and

advanced materials incorporating pioneering non-wovens and

electrochemical coatings.

James Cropper is a specialist provider of niche solutions

tailored to a unique customer specification, ranging from

substrates and components in hydrogen electrolysis and fuel cells

to bespoke colours and textures in paper and moulded fibre

packaging designed to replace single use plastics.

The Group operates across multiple markets from luxury retail to

renewable energy. It is renowned globally for service, capability,

pioneering and multi award-winning commitment to the highest

standards of sustainability.

James Cropper's goal is to be operationally carbon neutral by

2030 and to reduce carbon through its entire supply chain to net

zero by 2050.

Chairman's Letter

Dear Shareholders

As I look back over the last year what stands out is less the

circumstances, which were challenging as ever in some quarters, but

more the broad range of positive actions we have taken to

reposition the Company over this period. These actions have

strengthened our foundations for sustained growth in every

corner.

I must thank all our customers for their support in the year.

Even then, at times it was challenging to keep up with the

inflationary environment.

The resulting impact was lessened by outperformance in Technical

Fibre Products and its Hydrogen business unit. Overall, however,

significant credit is due to our workforce who addressed the

unfolding situation with exceptional urgency and dedication.

Adapting to circumstance always leads to change and accordingly

within the year we have comprehensively reviewed our growth plans

and the foundations required to ensure we maximise opportunities

and minimise risks as these roll forwards.

This has enabled us to bring to life our strategy in realigning

the business to be centred around our customers.

Our products and markets will remain broadly the same, but we

will start the journey to reposition ourselves operating as one

Company. To move from three separate divisions (James Cropper

Paper, Technical Fibre Products and Colourform(TM)) into four

market-facing segments, all unified under the Group name, James

Cropper:

-- Creative Papers

-- Luxury Packaging

-- Technical Fibres

-- Future Energy

My greatest desire for James Cropper is that while we remain

proud of our great heritage, we always feel young, and achieve this

balance by seamlessly combining generations of know-how with a

relentless appetite for renewal.

The reorganisation truly encapsulates this blend from our

historic roots in papermaking to cutting edge materials and

components in renewable energy.

Importantly, across this range it is no longer accurate to refer

to us as a paper-mill or paper business, as has been the norm since

our outset in 1845. Today, James Cropper is successfully

transitioning to an advanced materials and paper products group

across everything it does, committed to pioneering innovation in

traditional markets alongside breakthrough areas.

We are determined to stay modern and relevant, which will lead

us to spend more over the coming years as we invest in our

processes and systems. This will enable smarter access to data,

leaner working practices and cost savings.

In the same vein, we will also look to invest further in

innovation to meet the anticipated demands of future markets and

customers, whether technical, environmental or economic.

We have ambitious plans to decarbonise the Group's operations,

the first phase will be to cut natural gas use by 25% by 2025,

keeping us on track to achieve net zero across our entire supply

chain by 2050. This includes novel approaches to heat generation

that we hope can blaze the way for other energy intensive

manufacturers.

We are also investing to enhance our position in hydrogen

electrolysis, fuel cells, carbon capture and other fast-growing

markets. The growth potential is significant, but we will only earn

a share through step changes in performance and cost reduction.

This will involve both technology advances and operational

investments. For example, we have recently commissioned a hydrogen

component line in the United States, taking production closer to a

large share of our customer base whilst at the same time cutting

freight and duty costs.

Our paper and packaging partnerships within luxury and premium

retail sectors remain strong, whether designing new tailor-made

papers or Colourform(TM) products or offering customers more

sustainable options and recycled fibres.

On this note, we are proud to have been involved in the recent

creation of the first-ever 100% plastic-free remembrance poppy for

the British Legion, whom we have proudly partnered with since

1978.

We have also launched our FibreBlend Upcycled Technology

programme, offering a choice of different recovered fibre

categories. This builds on our award-winning CupCycling proposition

which gives used coffee cups a second life as a valuable fibre

source for high quality paper. At present, over 75% of our

custom-made paper products contain a blended fibre source. Our

plans in this area include developing a unique technique to

separate cotton, recyclable into paper, from artificial fibres.

Dividend

In financial terms, the Group reported a profit before tax of

GBP1.3m for the period ended 1 April 2023. This was down by 53%

versus the prior period with the Group revenue rising by 24% split

between Paper (+25%), Colourform(TM) (+29%) and Technical Fibre

Products (+19%).

In line with expectations, the Board is proposing a final

dividend of 4.0 pence per share, making a total dividend for the

year of 6.0 pence per share.

Board changes

This year has seen several changes to our leadership team. In

August 2022, Steve Adams was appointed CEO, following the departure

of Phil Wild.

Since the year end, we have also seen the departure of Isabelle

Maddock, our CFO, who resigned in June 2023. I would like to

personally thank both Phil and Isabelle for their dedicated service

to James Cropper.

Transitioning to a brighter future

As ever, James Cropper continues to earn its future by building

a diversified business across multiple markets and geographies and

by adapting with pace, when required. I am very conscious that this

has included the hard choice to restructure our Paper division from

four machines to three with associated headcount reductions.

The decision was not taken lightly but has been essential to

address years of headwinds and margin pressures and create a more

resilient, profitable business.

Overall, we are blessed with a talented team and a range of

materials and products that have never been more relevant in a

world that rapidly needs to learn to live in greater balance with

nature. Common to all our activities is the opportunity to

accelerate the transition to greener economies and societies, and

grow a vibrant group around this. I am hopeful these actions will

position us better than ever to truly deliver on this.

Everyone in the Company is playing a part in this journey and I

would like to thank all who work for us and with us for their

continued commitment to James Cropper.

Mark Cropper

Chairman

23 August 2023

Chief Executive Officer's Review

I am delighted to report our financial results in my first year

as CEO. Despite a year of unprecedented economic turbulence and

market volatility with high energy and raw material costs still

being prevalent, we have continued to show resilience.

All parts of our business responded with conviction and pace to

implement actions to offset as much of the cost headwinds as

possible. The Group also experienced strong demand and retained

contracts throughout the period across all divisions, with 24%

revenue growth in the year to 1 April 2023, which is ahead of

previous market expectations.

I wish to express my sincerest thanks to all our customers for

their continued loyalty and support and to our employees who have

remained focused on delivering the best outcome possible.

Over this last year, we have made significant progress in our

journey to reposition James Cropper to an advanced materials and

paper products group.

We have defined and introduced our six strategic priorities,

building a solid foundation to drive a strategy for accelerated

growth.

Our customer base is changing and we are putting the right

measures in place to improve both the customer and employee

experience and to truly deliver on our purpose of 'pioneering

materials to safeguard our future'.

We have strengthened our commercial leadership teams to expand

in markets that we currently already operate in, whilst being

constantly curious to explore new opportunities. We are also in the

process of further strengthening our Executive Leadership team with

the skills and knowledge to support our ambitious growth plans.

The fast-growing renewable energy and decarbonisation markets

are creating an ever-greater need for novel and high-performance

materials, while sustainable fibres, and low, or zero, carbon

processing are driving growth within paper and packaging.

After 12 months of planning, I am also pleased to share that the

installation of our new energy-efficient boiler has taken place.

This will dramatically improve our energy efficiency and resilience

as we drive forward with our net zero carbon ambition.

These energy saving investments in upgrades to our paper

machines, along with a small decrease in gross paper production

over the last 12 months, have contributed to an 8% annualised

reduction in site fuel consumption and

we are on track to build our Low Carbon Energy Centre with the

necessary planning application attained and grant application

awarded.

A strategy for accelerated growth:

1. Profitable growth through new customer acquisition:

Opportunities to expand in new and existing markets

2. World class execution: Investment in global systems and functions

3. Technology and Innovation: Centre for Innovation will include

decarbonisation and waste fibres as well as exploring new ideas

4. Leaders in sustainability: Recognising our responsibility to

reduce and ultimately eliminate our emissions

5. Inspiring our people: Building a culture of trust, cooperation and involvement

6. Build the brand: Presenting a more meaningful and relevant

face to our increasingly global customer base

Financial Review

Revenue and adjusted operating profit

Group revenue for the financial period is GBP129.7m, up 24% on

the prior period (2022: GBP104.9m) driven by organic volume growth,

price increases and the energy surcharge applied to counter energy

and raw material cost increases.

Revenue for the Paper division increased by 25% in the period to

GBP88.2m generating an adjusted operating loss of GBP2.8m, compared

to GBP2.3m in the prior period.

Revenue for the TFP division increased by 19% in the period to

GBP37.2m generating an adjusted operating profit of GBP9.2m,

compared to GBP8.7m in the prior period.

Revenue for Colourform(TM) grew by 29% in the period to GBP4.3m,

generating an adjusted operating loss of GBP1.1m, compared to

GBP0.8m in the prior period.

Summary table of results

2023 2022 Change

GBP'000 GBP'000 %

========================================= ===== ====================== ============ ======

Group Revenue 129,664 104,922 24%

================================================ ====================== ============ ======

Adjusted EBITDA APM4 9,045 8,636 5%

========================================= ===== ====================== ============ ======

Profit summary

Paper Products (2,847) (2,338) 22%

Technical Fibre Products (TFP) 9,244 8,684 6%

Colourform (TM) (1,057) (754) 40%

Other Group expenses (573) (1,007) -43%

================================================ ====================== ============ ======

Adjusted operating profit APM1 4,767 4,585 4%

Fair value movement on derivatives (330) - 0%

Net finance costs (excluding exceptional

items and IAS 19 impact) (1,242) (540) 130%

================================================ ====================== ============ ======

Adjusted profit before tax APM2 3,195 4,045 - 21%

========================================= ===== ====================== ============ ======

Exceptional costs (986) (354) 179%

Exceptional finance costs (109) - 0%

================================================ ====================== ============ ======

Adjusted profit before tax after

exceptional items APM3 2,100 3,691 -43%

========================================= ===== ====================== ============ ======

Net IAS 19 pension adjustments

Net current service charge required (442) (547) - 19%

Net interest (345) (367) -6%

================================================ ====================== ============ ======

Net IAS 19 pension impact (787) (914) - 14%

================================================ ====================== ============ ======

Profit before tax 1,313 2,777 -53%

================================================ ====================== ============ ======

The Group monitors adjusted EBITDA as it provides a measure of

the cash generating ability of the Group that is comparable

year-on-year. Despite demand increasing, inflationary pressures on

raw materials, distribution and energy costs have dampened margins,

with an adjusted EBITDA increasing by 5% on the prior year.

Energy costs proved a significant headwind and the unprecedented

price rises saw costs increase 104% year-on-year, from GBP7.4m in

FY2022 to GBP15.2m in FY2023.

Similarly, with inflationary pressures in the pulp, recycled

pulp, chemicals and dyes markets, material costs increased 23%

year-on-year. During the year, the Group also paid a one-off cost

of living payment to employees totalling GBP0.6m in recognition of

the escalating costs that employees were facing.

Depreciation and amortisation charges increased by 6%

year-on-year, mainly due to the timings of capital investment

programmes.

Divisional highlights

While operating under the Group's combined Purpose and Values,

currently each business division acts independently, focusing on

niche markets and growth areas:

Technical Fibre Products

Within Technical Fibre Products demand remains strong with

contracts returning to pre-Covid levels in aerospace, defence and

the industrial sectors.

TFP Hydrogen continues to exceed our expectations and our new

coating line within our Schenectady, New York hub, became

operational, building on our successful UK Hydrogen plant in

Launceston and bringing capability even closer to our US

customers.

This significant investment will provide a more attractive offer

to our existing and potential customers across North America, as

well as providing a blueprint for future James Cropper hydrogen

coating lines worldwide, supporting the electrolyser manufacturing

hubs being established globally as the technology adoption

accelerates.

James Cropper Paper

Within the Paper division, demand in many of our traditional

volume areas such as files and folders, commercial print and

stationery papers has declined as those sectors continued to move

away from paper to digital or they prove to no longer be

economically viable. We are taking this opportunity to right-size

our business, streamlining our portfolio and service offer to be

much more aligned on high value partnerships. In particular, we are

focussing our offer on luxury packaging and premium creative papers

where our customers really value our innovation, expertise and

quality.

This year the Embossing Centre of Excellence was opened. The

installation of an embosser varnisher includes smart eye production

technology for precision-made textured paper.

This multi-million pound investment will allow James Cropper to

meet growing demand for surface aesthetics in luxury packaging and

creative papers, as well as best in class service for bespoke

textural effects alongside the development of individual

colour.

Colourform(TM)

Colourform(TM) continues to disrupt the luxury packaging market,

maintaining a strong pipeline of sales with 29% revenue growth

throughout the year. This was driven by innovative new market

launches in the luxury drinks

and cosmetics sectors.

We celebrated being the overall category winners for the Dieline

award as well as receiving both the Yellow and Wood pencil D&AD

awards. Receiving international acclaim for our creativity and

sustainability in a way that no other product in the global

packaging market has ever been able to achieve.

Overall, while margins are relatively strong, profits were

nevertheless impacted by inflationary pressures in raw materials

and energy prices. Moving forward, the division is expected to

drive ongoing revenue growth in profitable long-term packaging

rebrands, coupled with an improved focus on operational performance

to increase margins and manage costs. The integration of

Colourform(TM) into James Cropper Luxury Packaging will create

greater synergies, build better efficiencies in our operating model

as well as increase relevance and scale in key markets.

Expenses and profit

Other expenses have increased from GBP20,960k in 2022 to

GBP25,471k in the year to 1 April 2023. The business has

experienced widespread cost inflation across an array of overhead

expenditure, with distribution costs and consultancy expenses

increasing materially.

In the first half of the year the Paper division suffered

considerable machine downtime, which resulted in a significant

increase in repairs and maintenance expenditure in the year.

TFP Hydrogen continued to perform above management expectations

in the year to April 2023. Business outlook continues to improve

and at the year end this required the value of the contingent

consideration on the business acquisition to be reassessed. An

exceptional cost of GBP1,095k (2022: GBP354k) has been posted to

the Statement of Comprehensive Income in this regard.

Management considers this adjustment a positive indication on

the future value of the business and the profit that TFP Hydrogen

will deliver.

With strong revenue growth, adjusted operating profit (see APM1

Alternative Performance Measures) was GBP4,767k in the year, up 4%

on prior period, despite the challenging economic environment,

which saw unprecedented raw material and energy prices.

Net finance costs have increased by GBP702k in the year, as the

Group has continued to draw down on its external borrowing

facilities and interest rates have increased notably.

The Group has hedged the first GBP15m drawn down of the external

financing across UKEF and Commercial Facility at a rate of 1.5%

plus margin, which provides assurances and visibility over future

interest payments and limits exposure to increasing interest

rates.

Adjusted profit before tax (see APM 2 Alternative Performance

Measures) was GBP3,195k in the year and ahead of market

expectations, partly due to stronger trading in TFP and the

accounting adjustments of provisions relating to TFP.

After the impact of IAS 19 the Group reports a profit before tax

of GBP1,313k, a 53% decrease on prior year (2022: GBP2,777k).

The Group's profit after tax for the period is GBP516k (2022:

GBP1,358k) which calculates to earnings per share of 5.4p (2022:

14.2p).

Alternative performance measures

These accounts contain two main adjusting factors being the

impact of IAS 19 pension adjustments which is separated out and

exceptional items. These APM measures are used internally to

evaluate business performance and are used in this report;

APM 1 "Adjusted operating profit"

Adjusted operating profit refers to operating profit before

interest and prior to the impact of IAS 19 and exceptional

items.

APM2 "Adjusted profit before tax"

Adjusted profit before tax refers to profit before tax prior to

the impact of IAS 19 and exceptional items.

APM3 "Adjusted profit before tax after exceptional items"

Adjusted profit before tax refers to profit before tax prior to

the impact of IAS 19.

APM4 "Adjusted EBITDA"

EBITDA is a common term that refers to operating profit before

interest, tax, depreciation and amortisation. Adjusted EBITDA is

EBITDA prior to the impact of IAS 19 and exceptional items. The

impact of IAS 19 and exceptional items are presented in the summary

tables of results.

IAS 19 pension adjustment is separated out from operating profit

measures as the impact of IAS 19 varies from one reporting period

to another which makes year-on-year comparison of performance

challenging. Over the last 12 years, the average impact is a charge

to profit before tax of GBP1,052k. This year the charge is GBP787k

(2022: charge of GBP914k).

Currency

US$ EUR

===================== ====================== =============

Opening Rate v. GBP 1.3165 1.1998

Closing Rate v. GBP 1.2333 1.1370

GBP weakened against

currency (%) (6.32%) (5.23%)

===================== ====================== =============

This table compares the opening and closing exchange rates for

the financial period. Sterling weakened against the Dollar and Euro

over the year. 59% of the Group's revenue is earned from customers

outside of the UK (2022: 61%) bringing in Dollars and Euros to the

Group. Euros are used to purchase Euro priced pulp and raw

materials and Dollar receipts are used to fund the purchase of

Dollar priced pulp, creating a natural hedge across the Group.

Potential exposure to any foreign currency surpluses, or deficits,

are dealt with via foreign currency trades using forward selling or

forward purchasing contracts. Currency movements had a 3% impact on

revenue increasing revenues by GBP3,884k for the period.

Statement of financial position (SFP)

Non-pension assets have increased largely due to capital

expenditure, an increase in trade debtors and the recognition of

the interest rate cap in other financial assets.

Capital investment in the period was GBP5,779k (2022:

GBP6,761k). Investments are driven largely to enable growth in the

form of increasing capacity, improving capability or generating

cost savings.

We have concluded the build of additional embossing varnishing

capability in the Paper division and new energy technologies have

been introduced in Paper to facilitate the path towards the Group's

net zero goals.

The Group experienced a greater level of revenue in the period

compared to the prior period, and, inevitably with this, an

increase within trade and other receivables of GBP2,857k and

inventory of GBP711k.

After deferred tax the Net IAS 19 deficit has increased by

GBP2,258k to GBP12,105k (2022: GBP9,847k), the reasons for which

are detailed in the Pension Report in the 2023 Annual Report.

As a result of these movements on the pension scheme deficits,

shareholders' funds show an overall decrease of GBP2,449k to

GBP32,065k.

2023 2022

SFP Restated*

GBP'000 GBP'000

======================== ========= ============

Non-pension assets

- excluding cash 86,754 81,568

Non-pension liabilities

- excluding borrowings (25,990) (24,913)

======================== ========= ============

60,764 56,655

Net IAS 19 pension

deficit (after

deferred tax) (12,105) (9,847)

======================== ========= ============

48,659 46,808

Net debt (16,594) (12,294)

======================== ========= ============

Equity shareholders'

funds 32,065 34,514

======================== ========= ============

Gearing % - before

IAS 19 deficit 38% 28%

Gearing % - after

IAS 19 deficit 52% 36%

Capital expenditure

GBP'000 5,779 6,761

* see note 11 for details of the restatements.

2023 2022

Restated*

Cash Flow GBP'000 GBP'000

====================================== ======= ==========

Net cash inflow from operating

activities 5,550 4,029

Net cash outflow from investing

activities (6,643) (6,598)

====================================== ======= ==========

(1,093) (2,569)

Net cash inflow from financing

activities 622 3,436

====================================== ======= ==========

Net (decrease) / increase in

cash and cash equivalents (471) 867

Effects of exchange rate fluctuations

on cash held 400 118

====================================== ======= ==========

Net (decrease) / increase in

cash and cash equivalents (71) 985

Opening cash and cash equivalents 7,750 6,765

====================================== ======= ==========

Closing cash and cash equivalents 7,679 7,750

====================================== ======= ==========

* see note 11 for details of the restatements.

In the period the Group's net cash outflow was GBP71k (2022:

inflow GBP985k).

The Group continued to invest in capital expenditure throughout

the year in order to facilitate future revenue growth by building

capacity and capability.

There was also an increased demand for working capital following

the improved demand in the year.

Net debt

The Group incorporates GBP3,791k (2022: GBP3,949k) of

right-of-use leases in its 2023 borrowings figure. The Group's

banking arrangements monitor net debt excluding IFRS 16.

On this basis net debt has increased over the year from

GBP8,345k to GBP12,803k, an increase of GBP4,458k. Net debt

including right of use lease liabilities is GBP16,594k, an increase

of GBP4,300k on the prior period.

2023 2022

Net debt before RoU leases Restated*

GBP'000 GBP'000

===================================== ============= ============

Cash and cash equivalents 7,679 7,750

All borrowings excluding RoU

leases (20,482) (16,095)

===================================== ============= ============

Net debt on an equivalent comparison

basis (12,803) (8,345)

===================================== ============= ============

* see note 11 for details of the restatements.

Funding and facilities

The Group funds its operations and investments from operating

cash flow and from borrowings and leases.

The Group has a core banking facility in the UK and further loan

support in the US, along with some lease arrangements, all with

high street banks. The Group has a core GBP25m banking facility

under UKEF's Export Development Guarantee scheme which is aimed at

enabling additional bank liquidity to support exporters.

This finance arrangement is available for general corporate

purposes and will be used to support strategic growth and

innovation, capital expenditure and decarbonisation programmes. The

facility has an availability period of a further 2 years and an

overall tenure of 8 years from inception, repayments are on a

straight line basis from years 4 to 8. The Group's key financial

covenants are EBITDA: net Interest 4x, and the Net Debt: EBITDA

3.5x. The Group is in compliance with all its banking covenants at

the period end.

Cash and cash equivalents decreased marginally from GBP7,750k to

GBP7,679k in the year. Long term borrowings (falling due after more

than a year) increased by GBP4,066k to GBP22,515k. Facilities

comprise of unused overdraft facilities of GBP3,500k plus the total

unused credit facilities of GBP12,000k, this means a total of

GBP15,500k remains unutilised at the year-end date. Having taken

account of current borrowings to be paid within 12 months of the

reporting period the Group has GBP21,421k available to the Group

beyond 12 months.

Funding 2023 2022

GBP'000 Restated*

GBP'000

--------------------------------- --------- -----------

Facilities 39,773 40,544

Less: Undrawn facilities (15,500) (20,500)

--------------------------------- --------- -----------

Total Borrowings 24,273 20,044

Less: Cash and cash equivalents (7,679) (7,750)

--------------------------------- --------- -----------

Net debt 16,594 12,294

Cash and cash equivalents 7,679 7,750

Undrawn facilities 15,500 20,500

--------------------------------- --------- -----------

Funds available at year

end 23,179 28,250

Borrowings: repayable

within one year (1,758) (1,595)

--------------------------------- --------- -----------

Funds available at year

end 21,421 26,655

--------------------------------- --------- -----------

* see note 11 for details of the restatements.

Inspiring our people

We recognise that it is the passionate, committed and talented

people we employ that will help us navigate through the business

changes and opportunities we have before us to deliver long term

sustainable business growth.

Our online employee opinion survey is in its second year and saw

a marked increase in employee participation as well as increased

engagement.

Whilst this is pleasing to see, we will work even harder to

deliver an improved proposition for our employees with continued

focus on upgrading our policies, updating our working practices and

reviewing our remuneration and career opportunities for all.

We have concluded the first year of our LEAP leadership

development programme with 50 leaders - from first line leaders to

Executive Committee members - having benefited from the course. A

further cohort of approximately 40 employees will be invited to

participate in the coming year.

We have committed to invest in creating a great place to work

and will continue with our pledge across all our sites to improve

the workplace environment, providing more facilities and amenities

for our employees.

Over the next three years it is our intention to invest in a

multi-million pound programme to update our IT systems and

infrastructure. This will drive significant efficiency and

productivity improvements as well as improving resilience. The

investment will equip our teams to make smarter, data driven

decisions and improve our response times and agility in dealing

with our customers.

Looking forward with confidence

I am excited by the many opportunities we have in front of us as

a Company but certainly do not underestimate the external

challenges that we continue to face.

I have confidence in our strategy to accelerate growth and in

our exceptional team worldwide to make a real difference.

We will create a greater global presence for James Cropper, by

repositioning ourselves to better serve our existing and target

customers.

We will also drive increased value for our shareholders through

accelerated growth in each of our market focused segments; Creative

Papers, Luxury Packaging, Technical Fibres and Future Energy by

leveraging our potential as one Company under the James Cropper

name.

Building on our foundations, we aim to redefine ourselves and

become - what we believe - will be a different organisation with a

very bright future.

Steve Adams

Chief Executive Of cer

23 August 2023

James Cropper PLC

Group Statement of Comprehensive Income

53 week period 52 week period

to to

Note 1 April 2023 26 March 2022

GBP'000 GBP'000

------------------------------------------- ------ -------------- --------------

Revenue 6 129,664 104,922

Provision for impairment reversal 134 184

Other income 650 744

Changes in inventories of finished

goods and work in progress 817 385

Raw materials and consumables used (48,556) (39,577)

Energy costs (15,162) (7,428)

Employee benefit costs (34,459) (30,535)

Depreciation and amortisation (4,278) (4,051)

Other expenses (25,471) (20,960)

------------------------------------------- ------ -------------- --------------

Operating Profit 9 3,339 3,684

Fair value movement on derivatives (330) -

Interest payable and similar charges (1,697) (924)

Interest receivable and similar income 1 17

------------------------------------------- ------ -------------- --------------

Profit before taxation 9 1,313 2,777

Tax expense (797) (1,419)

------------------------------------------- ------ -------------- --------------

Profit for the period 516 1,358

------------------------------------------- ------ -------------- --------------

Earnings per share - basic and diluted 5.4p 14.2p

------------------------------------------- ------ -------------- --------------

Other comprehensive income

Profit for the period 516 1,358

------------------------------------------- ------ -------------- --------------

Items that are or may be reclassified

to profit or loss

Exchange differences on translation

of foreign operations 222 49

Pulp hedge fair value adjustment - (501)

Cash flow hedges - effective portion

of changes in fair value 1,040 10

Cash flow hedges - cost of hedging (355) -

Foreign tax adjustment - (13)

Items that will never be reclassified

to profit or loss

Retirement benefit liabilities - actuarial

(losses) / gains (3,888) 4,777

Deferred tax on actuarial losses /

(gains) on retirement benefit liabilities 972 (179)

------------------------------------------- ------ -------------- --------------

Other comprehensive (expense) / income

for the period (2,009) 4,143

------------------------------------------- ------ -------------- --------------

Total comprehensive (expense) / income

for the period attributable to equity

holders of the Company (1,493) 5,501

------------------------------------------- ------ -------------- --------------

James Cropper PLC

Statement of Financial Position

Group as Company

at as at

Group as at 26 March Company as 26 March

2022 at 2022

1 April 2023 Restated 1 April 2023 Restated

Note GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------------------------------------------------------------- -------- ------------ --------

Assets

Goodwill 1,264 1,264 - -

Intangible assets 1,524 1,584 788 769

Property, plant and equipment 32,717 30,551 1,758 1,630

Right-of-use assets 6,765 7,358 402 343

Investments in subsidiary

undertakings - - 7,350 7,350

Other financial assets 654 - 654 -

Deferred tax assets 4,198 3,534 4,118 3,459

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total non-current assets 47,122 44,291 15,070 13,551

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Inventories 18,304 17,593 - -

Trade and other receivables 24,763 21,906 53,991 54,749

Provision for impairment (643) (777) - -

Other financial assets 428 - 428 -

Cash and cash equivalents 7,679 7,750 3,506 4,011

Corporation tax 815 1,838 582 968

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total current assets 51,346 48,310 58,507 59,728

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total assets 98,468 92,601 73,577 73,279

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Liabilities

Trade and other payables 21,106 20,936 7,465 16,324

Other financial liabilities 58 6 58 6

Loans and borrowings 1,758 1,595 217 133

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total current liabilities 22,922 22,537 7,740 16,463

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Long-term borrowings 22,515 18,449 13,019 7,904

Retirement benefit liabilities 8 16,140 13,130 16,140 13,130

Contingent consideration

on business acquisition 1,423 578 - -

Deferred tax liabilities 3,403 3,393 112 123

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total non-current liabilities 43,481 35,550 29,271 21,157

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total liabilities 66,403 58,087 37,011 37,620

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Equity

Share capital 2,389 2,389 2,389 2,389

Share premium 1,588 1,588 1,588 1,588

Translation reserve 775 553 - -

Reserve for own shares (1,407) (1,407) (1,407) (1,407)

Cash flow hedging reserve 1,040 - 1,092 -

Cost of hedging reserve (355) - (355) -

Retained earnings 28,035 31,391 33,259 33,089

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total shareholders' equity 32,065 34,514 36,566 35,659

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

Total equity and liabilities 98,468 92,601 73,577 73,279

---------------------------------------------------------------- -------- ------------------------ -------- ------------ --------

The Parent Company reported a profit for the period ended 1

April 2023 of GBP4,042k (2022: GBP4,554k).

James Cropper PLC

Statement of Cash Flows

For the period ended 1 April 2023 (2022:

for the period ended 26 March 2022)

Group 2022

Group 2023 Restated

GBP'000 GBP'000

------------------------------------------------- ------------ ----------

Cash flows from operating activities

Profit for the period 516 1,358

Adjustments for:

Tax expense 797 1,419

Depreciation and amortisation 4,278 4,051

Earn out adjustment on contingent consideration

on business acquisition 986 -

Net IAS 19 pension adjustments within profit 442 914

Past service pension deficit payments (1,665) (1,443)

Foreign exchange differences (136) -

Profit on disposal of property, plant and

equipment and intangible assets (589) -

Interest receivable and similar income (1) (17)

Interest payable and similar charges 1,697 926

Share based payments (59) (107)

Fair value movements on derivatives 330 -

Changes in working capital:

Increase in inventories (696) (2,103)

Increase in trade and other receivables (3,614) (5,942)

Increase in trade and other payables 2,396 5,945

Tax received 868 (972)

-------------------------------------------------- ------------ ----------

Net cash generated from operating activities 5,550 4,029

-------------------------------------------------- ------------ ----------

Cash flows from investing activities

Purchase of intangible assets (1,126) (56)

Purchase of property, plant and equipment (5,267) (6,142)

Deferred consideration on business acquisition

paid - (400)

Contingent consideration on business acquisition

paid (250) -

-------------------------------------------------- ------------ ----------

Net cash used in investing activities (6,643) (6,598)

-------------------------------------------------- ------------ ----------

Cash flows from financing activities

Proceeds from issue of new loans 5,050 9,191

Repayment of borrowings (288) (3,123)

Fees paid on raising finance - (278)

Repayment of lease liabilities (1,561) (1,170)

Interest received 1 17

Interest paid (858) (709)

Non-deliverable forward contract payment (330) -

Payments on interest rate cap (495) -

Purchase of own shares - (256)

Dividends paid to shareholders (897) (236)

-------------------------------------------------- ------------ ----------

Net cash generated from financing activities 622 3,436

-------------------------------------------------- ------------ ----------

Net (decrease) / increase in cash and cash

equivalents (471) 867

Effects of exchange rate fluctuations on

cash held 400 118

-------------------------------------------------- ------------ ----------

Net (decrease) / increase in cash and cash

equivalents (71) 985

Cash and cash equivalents at the start of

the period 7,750 6,765

-------------------------------------------------- ------------ ----------

Cash and cash equivalents at the end of

the period 7,679 7,750

-------------------------------------------------- ------------ ----------

Cash and cash equivalents consists of:

Cash at bank and in hand 7,679 7,750

-------------------------------------------------- ------------ ----------

Cash and cash equivalents at the end of

the period 7,679 7,750

-------------------------------------------------- ------------ ----------

James Cropper PLC

Statement of Changes in Equity

- Group

Reserve Cost of Cash flow

Share Share Translation for Own Hedging Hedging Retained

All figures in GBP'000 capital reserve Shares reserve reserve earnings Total

premium

======================================== ============= ======== ========= ========= ========== =======

At 27 March 2021 - As

previously reported 2,389

1,588 504 (1,151) - 501 26,070 29,901

Restatement - note 11 - - - - - - (300) (300)

At 27 March 2021 - Restated

2,389 1,588 504 (1,151) - 501 25,770 29,601

Comprehensive income - - - - - - 1,358 1,358

for the period

Total other comprehensive

income - - 49 - - (501) 4,595 4,143

Dividends paid - - - - - - (236) (236)

Purchase of own shares - - - (256) - - - (256)

Share based payment charge

- - - - - - (96) (96)

======================================== ============= ======== ========= ========= ========== =======

Total contributions

by and - - - (256) - - (332) (588)

distributions to

owners of the Group

========================== ===== ===== ============= ======== ========= ========= ========== =======

At 26 March 2022

- Restated 2,389 1,588 553 (1,407) - - 31,391 34,514

Comprehensive income - - - - - - 516 516

for the period

Total other comprehensive

income - - 222 - (355) 1,040 (2,916) (2,009)

Dividends paid - - - - - - (897) (897)

Share based payment

charge - - - - - - (59) (59)

-------------------------- ----- ----- ------------- -------- --------- --------- ---------- -------

Total contributions

by and - - - - - - (956) (956)

distributions to

owners of the Group

-------------------------- ----- ----- ------------- -------- --------- --------- ---------- -------

At 1 April 2023 2,389 1,588 775 (1,407) (355) 1,040 28,035 32,065

-------------------------- ----- ----- ------------- -------- --------- --------- ---------- -------

James Cropper PLC

Statement of Changes in Equity - Company

Reserve Cost of Cash flow

All figures in GBP'000 Share Share for Own Hedging Hedging Retained Total

capital premium Shares reserve reserve earnings

========================== ========== ============= ======== ======== ========= ============== =======

At 27 March 2021 2,389 1,588 (1,151) - - 24,253 27,079

Comprehensive income

for the period - - - - - 4,554 4,554

Total other comprehensive

income - - - - - 4,614 4,614

Dividends paid - - - - - (236) (236)

Share based payment

charge - - - - - (96) (96)

Purchase of own shares - - (256) - - - (256)

========================== ========== ============= ======== ======== ========= ============== =======

Total contributions

by and distributions

to owners of the Group - - (256) - - (332) (588)

========================== ========== ============= ======== ======== ========= ============== =======

At 26 March 2022 2,389 1,588 (1,407) - - 33,089 35,659

Comprehensive income

for the period - - - - - 4,042 4,042

Total other comprehensive

income - - - (355) 1,092 (2,916) (2,179)

Dividends paid - - - - - (897) (897)

Share based payment

charge - - - - - (59) (59)

-------------------------- ---------- ------------- -------- -------- --------- -------------- -------

Total contributions

by and distributions

to owners of the Group - - - - - (956) (956)

-------------------------- ---------- ------------- -------- -------- --------- -------------- -------

At 1 April 2023 2,389 1,588 (1,407) (355) 1,092 33,259 36,566

-------------------------- ---------- ------------- -------- -------- --------- -------------- -------

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1 BASIS OF PREPARATION

James Cropper Plc (the Company) is a public limited company

incorporated and domiciled in the United Kingdom and listed on the

Alternative Investment Market (AIM). The condensed consolidated

financial statements of the Company for the 53 weeks ended 1 April

2023, comprise the Company and its subsidiaries (together referred

to as the Group).

Statement of compliance

The condensed consolidated financial statements have been

prepared in accordance with UK adopted international accounting

standards and with those parts of the Companies Act 2006 applicable

to companies reporting under IFRS. As required by the Disclosure

and Transparency Rules of the Financial Services Authority, the

condensed consolidated set of financial statements have been

prepared applying the accounting policies and presentation that

were applied in the preparation of the Group's published

consolidated financial statements for the 53 week period ended 1

April 2023. They do not include all the information required for

full annual financial statements, and should be read in conjunction

with the consolidated financial statements of the Group for the 53

week period ended 1 April 2023.

The consolidated financial statements of the Group for the 53

week period ended 1 April 2023 are available upon request from the

Company's registered office Burneside Mills, Kendal, Cumbria, LA9

6PZ or at www.jamescropper.com .

The financial information is presented in Sterling and all

values are rounded to the nearest thousand pounds (GBP'000) except

where otherwise indicated.

Going concern

The Directors have performed a rigorous assessment of the

financial forecasts for the 2-year period ending 31 March 2025,

including consideration of the principal risks faced by the Group

and the Company, as detailed in the 2023 Annual Report. Following

this review the Directors are satisfied that the Company and the

Group have adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the condensed consolidated

financial statements.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the 53 week period ended 1 April 2023.

2 Accounting estimates and judgements

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses. Actual results may

differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the 53 week period ended 1 April

2023.

3 Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance are disclosed in the 2023 Annual Report and

are namely:

Pandemic risk; fire; net zero emissions; pension; cyber risk;

flood; water abstraction; energy price volatility and pulp price

volatility.

The Board considers that the principal risks and uncertainties

set out in the 2023 Annual Report remain relevant for the current

financial year.

4 Alternative performance measures

The Company uses alternative performance measures to allow users

of the financial statements to gain a clearer understanding of the

underlying performance of the business.

Profit before tax represents the Group's overall performance and

financial position, however it contains significant non-operational

items relating to IAS 19 that the Directors believe make

year-on-year comparison of performance challenging.

Measures used to evaluate business performance are 'Adjusted

operating profit' (operating profit excluding the impact of IAS 19

and exceptional costs), and 'Adjusted profit before tax' (profit

before tax excluding the impact of IAS 19 and exceptional costs).

The alternative performance measures are reconciled in note 9.

5 Earnings per share

The calculation of basic earnings per share is based on earnings

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the year. The calculation

of diluted earnings per share is based on the basic earnings per

share adjusted to assume conversion of all dilutive options.

6 Segmental information

IFRS 8 Operating Segments requires that entities adopt the

'management approach' to reporting the financial performance of its

operating segments. Management has determined the segments that are

reported in a manner consistent with the internal reporting

provided to the chief operating decision maker, identified as the

Executive Committee that makes strategic decisions. The committee

considers the business principally via the four main operating

segments, principally based in the UK:

-- James Cropper Paper Products (Paper): comprising James

Cropper Speciality Papers, a manufacturer of specialist paper and

boards, and James Cropper Converting , a converter of paper.

-- James Cropper 3D Products (Colourform(TM) ) - a manufacturer

of moulded fibre products.

-- Technical Fibre Products (TFP) - a manufacturer of advanced

materials.

-- Group Services - comprises central functions providing

services to the subsidiary companies.

Adjusted operating

Revenue profit / (loss)

2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000

Paper 88,151 70,350 (2,847) (2,338)

Colourform(TM) 4,326 3,363 (1,057) (754)

TFP 37,187 31,209 9,244 8,684

Group services and

other - - (573) (1,007)

-------------------- -------- -------- ---------- ---------

129,664 104,922 4,767 4,585

-------------------- -------- -------- ---------- ---------

7 Dividend

An interim dividend of 2.0p per share was paid in the period.

The Board is proposing a final dividend of 4.0p per share, making a

total declared dividend for the period of 6.0p per share. (2022:

10.0p per ordinary share).

If approved by members at the Annual General Meeting, the final

dividend will be paid to all shareholders on the register on or

before 20 October 2023.

8 Retirement benefit obligations

Movements during the period in the Group's defined benefit

pension schemes are set out below:

2023 2022

----------------------------------- ------------ ------------

GBP'000 GBP'000

Net obligation brought forward (13,130) (18,436)

Expense recognised in the

income statement (1,319) (1,570)

Contributions paid to the

schemes 2,197 2,099

Actuarial (losses) and gains (3,888) 4,777

----------------------------------- ------------ ------------

Net obligation carried forward (16,140) (13,130)

----------------------------------- ------------ ------------

9 Alternative performance measures

2023 2022

GBP'000 GBP'000

Adjusted operating profit 4,767 4,585

Net IAS 19 pension adjustments:

current service costs (974) (1,203)

future service contributions

paid 532 656

Exceptional Items:

Increase in earn out provisions (986) (354)

Operating profit 3,339 3,684

------------------------------------ ----------- -----------

2023 2022

GBP'000 GBP'000

Adjusted profit before tax 3,195 4,045

Net IAS 19 pension adjustments:

current service costs (974) (1,203)

future service contributions

paid 532 656

finance costs (345) (367)

Exceptional items:

Increase in earn out provisions (1,095) (354)

Profit before tax 1,313 2,777

--------------------------------------------------------- ----------- -----------

10 Related parties

There have been no significant changes in the nature of related

party transactions in the period ended April 2023 from that

disclosed in the 2022 Annual report.

11 Prior period restatement

The comparatives detailed below have been restated. No

adjustment impacts prior year profit. Net assets have reduced by

GBP300k.

Statement of Financial Position

- Group

As previously Restatement Restated

reported

All figures in GBP'000 2022 2022 2022

-------------- ------------ ---------

Trade and other receivables(1) 22,184 (278) 21,906

Long-term borrowings(1) 18,727 (278) 18,449

Deferred tax liability(2) 3,093 300 3,393

Retained earnings(2) 31,691 (300) 31,391

================================== ============== ============ =========

Statement of Financial Position

- Company

As previously Restatement Restated

reported

All figures in GBP'000 2022 2022 2022

-------------- ------------ ---------

Trade and other receivables(1) 55,027 (278) 54,749

Long-term borrowings(1) 8,182 (278) 7,904

Statement of Cashflows - Group

As previously Restatement Restated

reported

All figures in GBP'000 2022 2022 2022

-------------- ------------ ---------

Increase in trade and other

receivables(1) (6,220) 278 (5,942)

Increase in trade and other

payables(3) 5,545 400 5,945

Net cash generated from operating

activities 3,351 678 4,029

------------------------------------- -------------- ------------ ---------

Purchase of property, plant

and equipment(4) (6,705) 563 (6,142)

Deferred consideration on business

acquisition paid(3) - (400) (400)

Net cash used in investing

activities (6,761) 163 (6,598)

------------------------------------- -------------- ------------ ---------

Proceeds from issue of new loans(4) 9,754 (563) 9,191

Fees paid on raising finance(1) - (278) (278)

Net cash used in financing

activities 4,277 (841) 3,436

===================================== ============== ============ =========

1 Fees paid on raising finance previously allocated to

prepayments within trade and other receivables have been

reallocated against borrowings in the statement of financial

position and the related cash flow has been separately disclosed

under financing activities. There is no impact on net assets or

cash and cash equivalents.

2 The opening balance of the deferred tax liability for FY2022,

has been increased by GBP300k, following the finalisation of

previous years computations due to errors identified at the tax

provisioning stage. This results in a corresponding reduction in

retained earnings.

3 The deferred consideration on business acquisition paid

previously disclosed within increase in trade and other payables

has been separately disclosed under investing activities to more

appropriately reflect the nature of the cash flow. There is no

impact on net assets or cash and cash equivalents.

4 The cash flow relating to additions to property, plant and

equipment previously included additions to right-of-use assets

which are financed via lease and are therefore non-cash. The

correction has resulted in a decrease in purchase of property,

plant and equipment and a decrease in proceeds from issue of new

loans.

Retirement benefit liabilities

The gross amount of the Works scheme fair value of assets has

been increased by GBP521k to account for the annuities held but not

previously recognised. The defined benefit obligation has been

increased by the corresponding amount resulting in a nil impact on

the retirement benefit liabilities disclosed.

Group and Company

As previously Restatement Restated

reported

All figures in GBP'000 2022 2022 2022

-------------- ------------ ---------

Fair value assets 109,388 521 109,909

Defined benefit obligation 121,130 521 121,651

================================ ============== ============ =========

Retirement benefit liabilities (11,742) - (11,742)

Effect of limit on recoverable

surplus (1,388) - (1,388)

-------------------------------- -------------- ------------ ---------

Retirement benefit liabilities (13,130) - (13,130)

================================ -------------- ------------ ---------

Statement of Directors' responsibilities

The Directors confirm that these condensed consolidated

financial statements have been prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union and that the preliminary report includes a fair

review of the information required by DTR 4.2.7 and DTR 4.2.8,

namely:

(i) An indication of important events that have occurred during

the period and their impact on the condensed set of financial

statements, and a description of the principal risks and

uncertainties for the financial period; and

(ii) Material related party transactions in the period and any

material changes in the related party transactions described in the

last Annual Report.

The Directors of James Cropper Plc are detailed on our Group

website www.jamescropper.com

Forward-looking statements

Sections of this financial report may contain forward-looking

statements with respect to the Group's plans and expectations

relating to its future performance, results, strategic initiatives,

objectives and financial position, including liquidity and capital

resources. These forward-looking statements are not guarantees of

future performance. By their very nature, all forward-looking

statements involve risks and uncertainties because they relate to

events that may or may not occur in the future and are or may be

beyond the Group's control. Accordingly, the Group's actual results

and financial condition may differ materially from those expressed

or implied in any forward-looking statements. Forward-looking

statements in this financial report are current only as of the date

on which such statements are made. The Group undertakes no

obligation to update any forward-looking statements, save in

respect of any requirement under applicable law or regulation.

Nothing in this announcement shall be construed as a profit

forecast.

Annual General Meeting

The Annual General Meeting will be held on 26 September 2023.

The notice of Annual General Meeting will be mailed to shareholders

on or around 4 September 2023 together with a copy of the 2023

Annual Report.

Content of this report

The financial information set out above does not constitute the

Group's statutory accounts for the 12 months ended 1 April 2023 or

26 March 2022 but is derived from those accounts.

Statutory accounts for the 12 months ended 26 March 2022 have

been delivered to the Registrar of Companies. The auditor, BDO LLP,

has reported on the 2022 accounts; the report (i) was unqualified,

(ii) did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying their

report, and (iii) did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006.

The statutory accounts for the 12 month period ended 1 April

2023 will be delivered to the Registrar of Companies following the

Annual General Meeting. The auditor, Grant Thornton UK LLP, has

reported on these accounts; their report (i) is unqualified, (ii)

does not include a reference to any matters to which the auditor

drew attention by way of emphasis without qualifying their report,

and (iii) does not include a statement under either section 498 (2)

or (3) of the Companies act 2006.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR VXLFLXVLLBBX

(END) Dow Jones Newswires

August 24, 2023 02:00 ET (06:00 GMT)

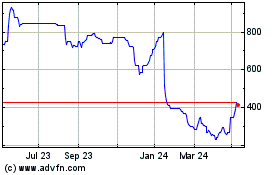

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

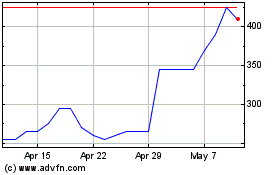

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Nov 2023 to Nov 2024