false

0001471727

Better Choice Co Inc.

0001471727

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 30,

2024

Better

Choice Company, Inc.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

|

001-40477 |

|

83-4284557 |

(State

or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

12400

Race Track Road

Tampa,

Florida 33626

(Address

of Principal Executive Offices) (Zip Code)

(Registrant’s

Telephone Number, Including Area Code): (212) 896-1254

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value share |

|

BTTR |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure

On

October 30, 2024, the Company posted an updated presentation (the “Presentation”) which is available in the Investors

– Events and Presentations section of the Company’s website at https://www.betterchoicecompany.com. A copy of the Presentation

is included as Exhibit 99.1 to this Current Report.

The

Company intends to use the Presentation in presentations to investors and analysts from time to time in the future. The furnishing of

the information in this Current Report is not intended to, and does not, constitute a determination by the Company that the information

in this Current Report is material or complete, or that investors should consider this information before making an investment decision

with respect to any security of the Company. The information in the materials is presented as of October 30, 2024, and the Company does

not assume any obligation to update such information in the future.

The

information in Item 7.01 of this Current Report shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall

such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as shall be expressly set forth by specific reference in such a filing.

Forward-Looking

Statements

This

current report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the “safe harbor” created by

those sections. All statements in this current report that are not based on historical fact are “forward looking statements.”

These statements may be identified by words such as “estimates,” “anticipates,” “projects,” “plans,”

“strategy,” “goal,” or “planned,” “seeks,” “may,” “might”, “will,”

“expects,” “intends,” “believes,” “should,” and similar expressions, or the negative

versions thereof, and which also may be identified by their context. All statements that address operating performance or events or developments

the Company expects or anticipates will occur in the future, such as stated objectives or goals, refinement of strategy, attempts to

secure additional financing, exploring possible business alternatives, or that are not otherwise historical facts, are forward-looking

statements. While management has based any forward-looking statements included in this current report on its current expectations, the

information on which such expectations were based may change. Forward-looking statements involve inherent risks and uncertainties which

could cause actual results to differ materially from those in the forward-looking statements as a result of various factors, including

risks associated with the Company’s ability to obtain additional capital in the future, the proposed transaction with SRx, general

economic factors, competition in the industry and other factors that could cause actual results to be materially different from those

described herein as anticipated, believed, estimated or expected. Additional risks and uncertainties are described in or implied by the

Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of the Company’s

2023 Annual Report on Form 10-K, filed on April 12, 2024 and other reports filed from time to time with the Securities and Exchange Commission

(“SEC”). The Company urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Readers

are cautioned to not place undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise

required by the federal securities laws, the Company disclaims any obligation or undertaking to publicly release any updates or revisions

to any forward-looking statement contained herein (or elsewhere) to reflect any change in its expectations with regard thereto, or any

change in events, conditions, or circumstances on which any such statement is based.

Additional

Information and Where to Find It

The

Company will prepare a proxy statement for the Company’s stockholders to be filed with the SEC. The proxy statement will be mailed

to the Company’s stockholders. The Company urges investors, stockholders and other interested persons to read, when available,

the proxy statement, as well as other documents filed with the SEC, because these documents will contain important information about

the proposed transaction. Such persons can also read the Company’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023, for a description of the security holdings of its officers and directors and their respective interests as security holders

in the consummation of the transactions described herein. The Company’s definitive proxy statement will be mailed to stockholders

of the Company as of a record date to be established for voting on the transactions described in this report. The Company’s stockholders

will also be able to obtain a copy of such documents, without charge, by directing a request to: Carolina Martinez, Chief Financial Officer

of Better Choice Company, Inc., 12400 Race Track Road, Tampa, FL 33626; e-mail: nmartinez@bttrco.com. These documents, once available,

can also be obtained, without charge, at the SEC’s web site (http://www.sec.gov).

Participants

in Solicitation

The

Company and its respective directors, executive officers and other members of their management and employees, under SEC rules, may be

deemed to be participants in the solicitation of proxies of the Company’s stockholders in connection with the proposed transaction.

Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of the Company’s

directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 12, 2024.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Company’s

stockholders in connection with the proposed transaction will be set forth in the proxy statement for the proposed business combination

when available. Information concerning the interests of the Company’s participants in the solicitation, which may, in some cases,

be different than those of the Company’s equity holders generally, will be set forth in the proxy statement relating to the proposed

business combination when it becomes available.

Item

9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Better

Choice Company Inc. |

| |

|

|

| |

By: |

/s/

Carolina Martinez |

| |

Name: |

Carolina

Martinez |

| |

Title: |

Chief

Financial Officer |

| |

|

|

November

4, 2024

|

|

|

Exhibit

99.1

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

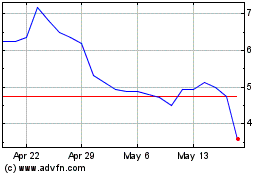

Better Choice (AMEX:BTTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Better Choice (AMEX:BTTR)

Historical Stock Chart

From Nov 2023 to Nov 2024