false

0001374328

0001374328

2024-11-14

2024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 14, 2024

Commission File Number: 000-52369

FitLife Brands, Inc.

(Exact name of registrant as specified in its charter.)

|

Nevada

|

20-3464383

|

|

(State or other jurisdiction of incorporation

or organization)

|

(IRS Employer Identification No.)

|

5214 S. 136th Street, Omaha, Nebraska 68137

(Address of principal executive offices)

402-884-1894

(Registrant's Telephone number)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

FTLF

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 14, 2024, FitLife Brands, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended September 30, 2024. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure

See Item 2.02.

Disclaimer.

The information furnished pursuant to Item 2.02 and 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by referenced.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits Index

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

FitLife Brands, Inc.

|

| |

|

|

|

Date: November 14, 2024

|

By:

|

/s/ Dayton Judd

|

| |

|

Dayton Judd

|

| |

|

Chief Executive Officer

|

Exhibit 99.1

FitLife Brands Announces Third Quarter 2024 Results

OMAHA, NE – November 14, 2024 – FitLife Brands, Inc. (“FitLife” or the “Company”) (NASDAQ: FTLF), a provider of innovative and proprietary nutritional supplements and wellness products, today announced financial results for the third quarter ended September 30, 2024.

Highlights for the third quarter ended September 30, 2024 include:

| |

●

|

Total revenue was $16.0 million, an increase of 15% compared to the third quarter of 2023.

|

| |

●

|

Online sales were $10.8 million, representing 68% of total revenue and an increase of 14% compared to the third quarter of 2023.

|

| |

●

|

Gross margin was 43.8% compared to 41.0% during the third quarter of 2023.

|

| |

●

|

Net income was $2.1 million compared to $1.7 million during the third quarter of 2023.

|

| |

●

|

Basic earnings per share and diluted earnings per share were $0.46 and $0.43, respectively, compared to $0.38 and $0.35 during the third quarter of 2023.

|

| |

●

|

Adjusted EBITDA was $3.6 million, a 41% increase compared to the third quarter of 2023.

|

| |

●

|

The Company ended the quarter with $14.3 million outstanding on its term loans and cash of $4.7 million, or total net debt of $9.5 million.

|

For the third quarter ended September 30, 2024, total revenue was $16.0 million, an increase of 15% compared to $13.9 million during the same period last year. Online revenue for the quarter was $10.8 million, an increase of 14% compared to the quarter ended September 30, 2023. Online revenue accounted for 68% of the Company’s total revenue during the quarters ended September 30, 2024 and 2023.

Wholesale revenue for the quarter ended September 30, 2024 was $5.2 million, an increase of 16% compared to the same period last year. The Company’s recent acquisitions of Mimi’s Rock Corp (“MRC”) and the MusclePharm assets contributed $1.3 million of wholesale revenue during the third quarter of 2024, while Legacy FitLife wholesale revenue was down $0.5 million, or 12%, compared to the same period last year.

Gross margin for the quarter ended September 30, 2024 was 43.8% compared to 41.0% during the same period in the prior year.

Net income for the third quarter of 2024 was $2.1 million compared to $1.7 million during the quarter ended September 30, 2023. Basic and diluted earnings per share were $0.46 and $0.43 respectively, compared to $0.38 and $0.35 during the third quarter of 2023.

Adjusted EBITDA for the quarter ended September 30, 2024 was $3.6 million, an increase of 41% compared to the same period in 2023. Adjusted EBITDA for the last twelve months, which includes four full quarters of MRC’s financial performance but approximately only three and a half quarters of MusclePharm, was $13.4 million.

As of September 30, 2024, the Company had $14.3 million outstanding on its term loans and cash of $4.7 million, or total net debt of approximately $9.5 million. The Company’s $3.5 million revolving line of credit remains undrawn.

Performance of Acquired Brands

Management frequently receives questions from investors regarding the performance of brands subsequent to their acquisition by the Company. In an effort to be responsive to these questions, the Company has provided additional disclosure in this press release and in the Management’s Discussion and Analysis section of the Company’s Form 10-Q filed with the SEC. The Company currently intends to provide this level of disclosure for no more than two years following a transaction, after which the performance of acquired brands will be reported as part of Legacy FitLife results.

One of the primary metrics used by management to evaluate the performance of the Company’s brands is contribution, a non-GAAP financial measure which management defines as gross profit less advertising and marketing expenditures. Other companies may also report contribution as a performance metric, but their definition or calculation of contribution may differ from the Company’s. Management believes that contribution, as defined by the Company, is a particularly relevant performance metric since it incorporates the gross profit associated with a specific brand or collection of brands as well as the advertising and marketing expenditures associated with the same brand or brands. With limited exceptions, other operating expenses incurred by the Company are generally not allocable to a specific brand or collection of brands.

Other than for MusclePharm, the numbers in the contribution tables presented below in the body of the press release represent the performance of a collection of brands. Legacy FitLife consists of nine brands and MRC consists of three brands. These collections of brands do not meet the definition of operating segments and are not managed as such.

|

Legacy FitLife

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

| |

|

2023

|

|

|

2024

|

|

| |

|

Q3

|

|

|

Q4

|

|

|

Q1

|

|

|

Q2

|

|

|

Q3

|

|

|

Wholesale revenue

|

|

|

4,361 |

|

|

|

4,011 |

|

|

|

4,506 |

|

|

|

4,224 |

|

|

|

3,859 |

|

|

Online revenue

|

|

|

2,339 |

|

|

|

2,134 |

|

|

|

2,455 |

|

|

|

2,578 |

|

|

|

2,443 |

|

|

Total revenue

|

|

|

6,700 |

|

|

|

6,145 |

|

|

|

6,961 |

|

|

|

6,802 |

|

|

|

6,302 |

|

|

Gross profit

|

|

|

2,490 |

|

|

|

2,480 |

|

|

|

2,928 |

|

|

|

3,006 |

|

|

|

2,684 |

|

|

Gross margin

|

|

|

37.2 |

% |

|

|

40.4 |

% |

|

|

42.1 |

% |

|

|

44.2 |

% |

|

|

42.6 |

% |

|

Advertising and marketing

|

|

|

79 |

|

|

|

71 |

|

|

|

80 |

|

|

|

94 |

|

|

|

70 |

|

|

Contribution

|

|

|

2,411 |

|

|

|

2,409 |

|

|

|

2,848 |

|

|

|

2,912 |

|

|

|

2,614 |

|

|

Contribution as a % of revenue

|

|

|

36.0 |

% |

|

|

39.2 |

% |

|

|

40.9 |

% |

|

|

42.8 |

% |

|

|

41.5 |

% |

For the third quarter of 2024, Legacy FitLife revenue declined 6% compared to the same period last year, driven by a 12% decline in wholesale revenue partially offset by 4% increase in online revenue.

Despite the revenue decline, gross profit and contribution for Legacy FitLife increased by 8% compared to the same period last year. Gross margin increased from 37.2% during the third quarter of 2023 to 42.6% during the third quarter of 2024. Contribution as a percentage of revenue increased from 36.0% to 41.5% over the same time period.

The Company’s wholesale revenue continues to be challenged by declining customer counts in the brick-and-mortar stores of our wholesale partners. However, at least some of the customers choosing to no longer shop in brick-and-mortar locations continue to purchase Legacy FitLife products online, and when a customer buys online the Company earns higher gross profit and contribution.

|

Mimi's Rock (MRC)

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

| |

|

2023

|

|

|

2024

|

|

| |

|

Q3

|

|

|

Q4

|

|

|

Q1

|

|

|

Q2

|

|

|

Q3

|

|

|

Wholesale revenue

|

|

|

85 |

|

|

|

91 |

|

|

|

94 |

|

|

|

90 |

|

|

|

71 |

|

|

Online revenue

|

|

|

7,117 |

|

|

|

6,811 |

|

|

|

7,399 |

|

|

|

7,371 |

|

|

|

7,139 |

|

|

Total revenue

|

|

|

7,202 |

|

|

|

6,902 |

|

|

|

7,493 |

|

|

|

7,461 |

|

|

|

7,210 |

|

|

Gross profit

|

|

|

3,206 |

|

|

|

2,790 |

|

|

|

3,520 |

|

|

|

3,597 |

|

|

|

3,441 |

|

|

Gross margin

|

|

|

44.5 |

% |

|

|

40.4 |

% |

|

|

47.0 |

% |

|

|

48.2 |

% |

|

|

47.7 |

% |

|

Advertising and marketing

|

|

|

1,196 |

|

|

|

846 |

|

|

|

1,062 |

|

|

|

1,071 |

|

|

|

929 |

|

|

Contribution

|

|

|

2,010 |

|

|

|

1,944 |

|

|

|

2,458 |

|

|

|

2,526 |

|

|

|

2,512 |

|

|

Contribution as % of revenue

|

|

|

27.9 |

% |

|

|

28.2 |

% |

|

|

32.8 |

% |

|

|

33.9 |

% |

|

|

34.8 |

% |

For the third quarter of 2024, MRC revenue was approximately flat compared to the same period in 2023. Over the same time period, despite minimal growth in total revenue, gross profit increased 7% and contribution increased 25%. For the third quarter of 2024, gross margin increased to 47.7% from 44.5% last year.

Revenue for the largest MRC brand—Dr. Tobias—increased 6% while revenue for the skin care brands—Maritime Naturals and All Natural Advice—declined 33% in the third quarter of 2024 compared to the same period in 2023.

At the time of the MRC acquisition in 2023, the skin care brands were sold in a number of countries. Analysis subsequent to the acquisition determined that—in almost all countries other than Canada and the US—the products were being sold at levels resulting in negative contribution. Even worse, in many of those countries, the products were being sold at negative gross margins.

To optimize performance of the skin care brands, management exited a number of countries and raised prices in other countries. As a result of these changes, a substantial amount of unprofitable revenue was eliminated.

The substantial year-over-year increase in contribution for the MRC brands is a function of the optimization of the skin care brands, beneficial product mix within the Dr. Tobias brand, as well as the optimization of advertising spend across all MRC brands.

| |

|

2023

|

|

|

2024

|

|

|

|

|

|

| |

|

Q3

|

|

|

Q4

|

|

|

Q1

|

|

|

Q2

|

|

|

Q3

|

|

|

Wholesale revenue

|

|

|

- |

|

|

|

180 |

|

|

|

1,117 |

|

|

|

1,388 |

|

|

|

1,231 |

|

|

Online revenue

|

|

|

- |

|

|

|

73 |

|

|

|

978 |

|

|

|

1,279 |

|

|

|

1,234 |

|

|

Total revenue

|

|

|

- |

|

|

|

253 |

|

|

|

2,095 |

|

|

|

2,667 |

|

|

|

2,465 |

|

|

Gross profit

|

|

|

- |

|

|

|

93 |

|

|

|

839 |

|

|

|

977 |

|

|

|

876 |

|

|

Gross margin

|

|

|

- |

|

|

|

36.8 |

% |

|

|

40.0 |

% |

|

|

36.6 |

% |

|

|

35.5 |

% |

|

Advertising and marketing

|

|

|

- |

|

|

|

- |

|

|

|

86 |

|

|

|

161 |

|

|

|

94 |

|

|

Contribution

|

|

|

- |

|

|

|

93 |

|

|

|

753 |

|

|

|

816 |

|

|

|

782 |

|

|

Contribution as % of revenue

|

|

|

- |

|

|

|

36.8 |

% |

|

|

35.9 |

% |

|

|

30.6 |

% |

|

|

31.7 |

% |

MusclePharm revenue decreased 8% sequentially from the second quarter of 2024 to the third quarter of 2024, with wholesale revenue decreasing 11% and online revenue decreasing 4%. Lower revenue during the quarter is partially due to the normal seasonality of sales in the second half of the year. In addition, some significant wholesale orders slipped into October and, as a result, monthly revenue for MusclePharm in October was the highest it has been since the Company acquired the MusclePharm assets.

The Company has also made significant progress with new wholesale partners. Subsequent to the end of the third quarter, the Company secured placement for MusclePharm’s Combat Sport protein bars in several regional grocery and convenience chains. The Company also signed an agreement to license the MusclePharm brand to a manufacturer in Israel.

Additionally, the Company is in the process of launching the new MusclePharm Pro Series, a collection of premium sports nutrition products. The Pro Series, consisting initially of 9 SKUs, will be launched in a two-month pilot in high-volume Vitamin Shoppe stores (consisting of approximately 60% of Vitamin Shoppe’s nationwide store base) during the first quarter of 2025. If the pilot effort is successful, the Pro Series is anticipated to be added to the assortment in all Vitamin Shoppe stores and will be exclusive to Vitamin Shoppe for a period of 12 months.

As part of these and other efforts to drive revenue growth, the Company is making targeted investments in advertising and promotion for the MusclePharm brand in both the wholesale and online channels. As a result of these investments, gross margin and contribution margin as a percent of revenue may fluctuate from quarter to quarter.

|

FitLife Consolidated

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

| |

|

2023

|

|

|

2024

|

|

| |

|

Q3

|

|

|

Q4

|

|

|

Q1

|

|

|

Q2

|

|

|

Q3

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale revenue

|

|

|

4,446 |

|

|

|

4,282 |

|

|

|

5,717 |

|

|

|

5,702 |

|

|

|

5,161 |

|

|

Online revenue

|

|

|

9,456 |

|

|

|

9,018 |

|

|

|

10,832 |

|

|

|

11,228 |

|

|

|

10,816 |

|

|

Total revenue

|

|

|

13,902 |

|

|

|

13,300 |

|

|

|

16,549 |

|

|

|

16,930 |

|

|

|

15,977 |

|

|

Gross profit

|

|

|

5,696 |

|

|

|

5,363 |

|

|

|

7,287 |

|

|

|

7,580 |

|

|

|

7,001 |

|

|

Gross margin

|

|

|

41.0 |

% |

|

|

40.3 |

% |

|

|

44.0 |

% |

|

|

44.8 |

% |

|

|

43.8 |

% |

|

Advertising and marketing

|

|

|

1,275 |

|

|

|

917 |

|

|

|

1,228 |

|

|

|

1,326 |

|

|

|

1,093 |

|

|

Contribution

|

|

|

4,421 |

|

|

|

4,446 |

|

|

|

6,059 |

|

|

|

6,254 |

|

|

|

5,908 |

|

|

Contribution as % of revenue

|

|

|

31.8 |

% |

|

|

33.4 |

% |

|

|

36.6 |

% |

|

|

36.9 |

% |

|

|

37.0 |

% |

For the Company overall, revenue increased 15%, gross profit increased 23%, and contribution increased 34% compared to the third quarter of 2023. Gross margin increased to 43.8% compared to 41.0% during the third quarter of last year. Contribution as a percentage of revenue increased to 37.0% compared to 31.8% during the third quarter of last year.

Management Commentary

Dayton Judd, the Company’s Chairman and CEO commented, “I am pleased with the Company’s continued strong performance. At MRC, the Dr. Tobias brand—which represents just over 90% of the MRC business—continued to grow despite significant year-over-year reductions in advertising and marketing spend. And although revenue for MRC’s skin care brands has declined significantly due to our decision to exit unprofitable markets and raise prices in others, the brands are substantially more profitable. The MRC brands’ collective contribution of approximately $9.4 million over the last twelve months compares very favorably to the $17.1 million acquisition price the Company paid for MRC.

“For the past couple of years following the COVID pandemic, we have experienced declining sales of our products through brick-and-mortar retailers, primarily due to store closures and declining foot traffic. For the first eight months of 2024, the year-over-year percentage declines in retail sales of FitLife products were in the low double digits. We are encouraged that the rate of decline has improved sequentially in each month over the past four months, with year-over-year declines now in the single digits. Also, as a reminder, the profit impact of wholesale declines for our Legacy FitLife brands are largely offset by the continued growth in high-margin online sales of those products.

“With regard to MusclePharm, we are encouraged by the recent wins we have had for the MusclePharm Combat Sport bars and the new MusclePharm Pro Series, and we remain engaged with a number of other prospective customers as we seek to continue to grow the brand.

“Overall, I am pleased with the strong performance of our brands, which would not be possible without the continued dedication of each FitLife team member. The Company’s balance sheet is strong, with net debt now representing approximately only 0.7x adjusted LTM EBITDA. During 2023, we borrowed $22.5 million to help fund the purchase of MRC and the MusclePharm assets. As of the end of the third quarter of 2024, we had repaid $8.25 million of those borrowings, and on a net debt basis only $9.5 million remains outstanding. The Company continues to evaluate potential M&A opportunities with a specific focus on accretive, non-dilutive transactions.”

Earnings Conference Call

The Company will hold an investor conference call on Thursday, November 14, 2024 at 4:30 pm ET. Investors interested in participating in the live call can dial (833) 492-0064 from the U.S. and provide the conference identification code of 683771. International participants can dial (973) 528-0163 and provide the same code.

About FitLife Brands

FitLife Brands is a developer and marketer of innovative and proprietary nutritional supplements and wellness products for health-conscious consumers. FitLife markets more than 250 different products primarily online, but also through domestic and international GNC® franchise locations as well as through various other retail locations. FitLife is headquartered in Omaha, Nebraska. For more information, please visit our website at www.fitlifebrands.com.

Forward-Looking Statements

Statements in this release that are forward looking involve known and unknown risks and uncertainties, which may cause the Company's actual results in future periods to be materially different from any future performance that may be suggested in this news release. Such factors may include, but are not limited to, the ability of the Company to continue to grow revenue, and the Company's ability to continue to achieve positive cash flow given the Company's existing and anticipated operating and other costs. Many of these risks and uncertainties are beyond the Company's control. Reference is made to the discussion of risk factors detailed in the Company's filings with the Securities and Exchange Commission including its reports on Form 10-K and 10-Q. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

FITLIFE BRANDS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

| |

|

September

30, 2024

|

|

|

December

31, 2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS:

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,664 |

|

|

$ |

1,139 |

|

|

Restricted cash

|

|

|

56 |

|

|

|

759 |

|

|

Accounts receivable, net of allowance of doubtful accounts of $19 and $17, respectively

|

|

|

2,008 |

|

|

|

2,046 |

|

|

Inventories, net of allowance for obsolescence of $86 and $162, respectively

|

|

|

10,371 |

|

|

|

9,091 |

|

|

Sales tax receivable

|

|

|

58 |

|

|

|

1,019 |

|

|

Prepaid expense and other current assets

|

|

|

942 |

|

|

|

639 |

|

|

Total current assets

|

|

|

18,099 |

|

|

|

14,693 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

91 |

|

|

|

137 |

|

|

Right of use asset

|

|

|

431 |

|

|

|

121 |

|

|

Intangibles, net of amortization of $143 and $113, respectively

|

|

|

26,314 |

|

|

|

26,309 |

|

|

Goodwill

|

|

|

13,130 |

|

|

|

13,294 |

|

|

Deferred tax asset

|

|

|

522 |

|

|

|

792 |

|

|

TOTAL ASSETS

|

|

$ |

58,587 |

|

|

$ |

55,346 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY:

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

4,078 |

|

|

$ |

3,261 |

|

|

Accrued expense and other liabilities

|

|

|

957 |

|

|

|

1,026 |

|

|

Income taxes payable

|

|

|

1,861 |

|

|

|

892 |

|

|

Product returns

|

|

|

570 |

|

|

|

571 |

|

|

Term loan – current portion

|

|

|

4,500 |

|

|

|

4,500 |

|

|

Lease liability - current portion

|

|

|

89 |

|

|

|

87 |

|

|

Total current liabilities

|

|

|

12,055 |

|

|

|

10,337 |

|

| |

|

|

|

|

|

|

|

|

|

Term loan, net of current portion and unamortized deferred finance costs

|

|

|

9,664 |

|

|

|

15,509 |

|

|

Long-term lease liability, net of current portion

|

|

|

352 |

|

|

|

51 |

|

|

Deferred tax liability

|

|

|

2,358 |

|

|

|

2,413 |

|

|

TOTAL LIABILITIES

|

|

|

24,429 |

|

|

|

28,310 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000 shares authorized, none outstanding as of September 30, 2024 and December 31, 2023

|

|

|

- |

|

|

|

- |

|

|

Common stock, $0.01 par value, 60,000 shares authorized; 4,598 issued and outstanding as of September 30, 2024 and December 31, 2023

|

|

|

46 |

|

|

|

46 |

|

|

Additional paid-in capital

|

|

|

31,043 |

|

|

|

30,699 |

|

|

Retained earnings (accumulated deficit)

|

|

|

3,497 |

|

|

|

(3,417 |

) |

|

Foreign currency translation adjustment

|

|

|

(428 |

) |

|

|

(292 |

) |

|

TOTAL STOCKHOLDERS' EQUITY

|

|

|

34,158 |

|

|

|

27,036 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

58,587 |

|

|

$ |

55,346 |

|

FITLIFE BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

(In thousands, except per share data)

(Unaudited)

| |

|

Three months ended

September 30

|

|

|

Nine months ended

September 30

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

15,977 |

|

|

$ |

13,902 |

|

|

$ |

49,456 |

|

|

$ |

39,401 |

|

|

Cost of goods sold

|

|

|

8,976 |

|

|

|

8,206 |

|

|

|

27,588 |

|

|

|

23,332 |

|

|

Gross profit

|

|

|

7,001 |

|

|

|

5,696 |

|

|

|

21,868 |

|

|

|

16,069 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSE:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertising and marketing

|

|

|

1,093 |

|

|

|

1,275 |

|

|

|

3,647 |

|

|

|

3,359 |

|

|

Selling, general and administrative

|

|

|

2,645 |

|

|

|

1,897 |

|

|

|

7,681 |

|

|

|

5,399 |

|

|

Merger and acquisition related

|

|

|

59 |

|

|

|

32 |

|

|

|

217 |

|

|

|

1,519 |

|

|

Depreciation and amortization

|

|

|

22 |

|

|

|

22 |

|

|

|

85 |

|

|

|

64 |

|

|

Total operating expense

|

|

|

3,819 |

|

|

|

3,226 |

|

|

|

11,630 |

|

|

|

10,341 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING INCOME

|

|

|

3,182 |

|

|

|

2,470 |

|

|

|

10,238 |

|

|

|

5,728 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER EXPENSE (INCOME)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

(19 |

) |

|

|

(119 |

) |

|

|

(41 |

) |

|

|

(269 |

) |

|

Interest expense

|

|

|

326 |

|

|

|

249 |

|

|

|

1,085 |

|

|

|

598 |

|

|

Foreign exchange (gain) loss

|

|

|

(21 |

) |

|

|

210 |

|

|

|

(26 |

) |

|

|

93 |

|

|

Total other expense (income)

|

|

|

286 |

|

|

|

340 |

|

|

|

1,018 |

|

|

|

422 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX PROVISION

|

|

|

2,896 |

|

|

|

2,130 |

|

|

|

9,220 |

|

|

|

5,306 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAXES

|

|

|

770 |

|

|

|

434 |

|

|

|

2,306 |

|

|

|

1,490 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME

|

|

$ |

2,126 |

|

|

$ |

1,696 |

|

|

$ |

6,914 |

|

|

$ |

3,816 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.46 |

|

|

$ |

0.38 |

|

|

$ |

1.50 |

|

|

$ |

0.86 |

|

|

Diluted

|

|

$ |

0.43 |

|

|

$ |

0.35 |

|

|

$ |

1.40 |

|

|

$ |

0.78 |

|

|

Basic weighted average common shares

|

|

|

4,598 |

|

|

|

4,446 |

|

|

|

4,598 |

|

|

|

4,458 |

|

|

Diluted weighted average common shares

|

|

|

4,965 |

|

|

|

4,891 |

|

|

|

4,943 |

|

|

|

4,901 |

|

FITLIFE BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

(In thousands)

(Unaudited)

| |

|

Nine months ended

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

6,914 |

|

|

$ |

3,816 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

85 |

|

|

|

64 |

|

|

Allowance for doubtful accounts

|

|

|

2 |

|

|

|

(17 |

) |

|

Allowance for inventory obsolescence

|

|

|

(76 |

) |

|

|

35 |

|

|

Stock-based compensation

|

|

|

344 |

|

|

|

94 |

|

|

Amortization of deferred financing costs

|

|

|

31 |

|

|

|

8 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable - trade

|

|

|

18 |

|

|

|

(498 |

) |

|

Inventories

|

|

|

(1,223 |

) |

|

|

2,534 |

|

|

Deferred tax asset

|

|

|

270 |

|

|

|

709 |

|

|

Prepaid expense, other current assets and sales tax receivable

|

|

|

793 |

|

|

|

(471 |

) |

|

Right-of-use assets

|

|

|

72 |

|

|

|

60 |

|

|

Accounts payable

|

|

|

827 |

|

|

|

(3,570 |

) |

|

Lease liability

|

|

|

(82 |

) |

|

|

(60 |

) |

|

Accrued expense, other liabilities and income taxes payable

|

|

|

680 |

|

|

|

71 |

|

|

Product returns

|

|

|

(2 |

) |

|

|

(3 |

) |

|

Net cash provided by operating activities

|

|

|

8,653 |

|

|

|

2,772 |

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(10 |

) |

|

|

(60 |

) |

|

Cash paid for acquisition of Mimi’s Rock Corp.

|

|

|

- |

|

|

|

(17,099 |

) |

|

Cash deposit paid for the acquisition of assets

|

|

|

- |

|

|

|

(1,825 |

) |

|

Net cash used in investing activities

|

|

|

(10 |

) |

|

|

(18,984 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Borrowings on term loans

|

|

|

- |

|

|

|

12,500 |

|

|

Payments on term loans

|

|

|

(5,875 |

) |

|

|

(1,250 |

) |

|

Net cash provided by (used in) financing activities

|

|

|

(5,875 |

) |

|

|

11,250 |

|

| |

|

|

|

|

|

|

|

|

|

Foreign currency impact on cash

|

|

|

54 |

|

|

|

(3 |

) |

| |

|

|

|

|

|

|

|

|

|

CHANGE IN CASH AND RESTRICTED CASH

|

|

|

2,822 |

|

|

|

(4,965 |

) |

|

CASH AND RESTRICTED CASH, BEGINNING OF PERIOD

|

|

|

1,898 |

|

|

|

13,277 |

|

|

CASH AND RESTRICTED CASH, END OF PERIOD

|

|

$ |

4,720 |

|

|

$ |

8,312 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental cash flow disclosure

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes

|

|

$ |

1,105 |

|

|

$ |

593 |

|

|

Cash paid for interest, net of amounts capitalized

|

|

$ |

1,083 |

|

|

$ |

475 |

|

Non-GAAP Financial Measures

The financial information included in this release and the presentation below contain certain financial measures defined as “non-GAAP financial measures” by the SEC, including non-GAAP EBITDA and non-GAAP adjusted EBITDA. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

As presented below, non-GAAP EBITDA excludes interest, foreign currency gain/loss, income taxes, depreciation and amortization. Adjusted non-GAAP EBITDA excludes, in addition to interest, foreign currency gain/loss, taxes, depreciation and amortization, equity-based compensation, M&A/integration expense, restructuring and non-recurring gains or losses. The Company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expense and other items that may not be indicative of its core operating results and business outlook. The Company believes that the inclusion of non-GAAP measures in the financial presentation below allows investors to compare the Company’s financial results with the Company’s historical financial results and is an important measure of the Company’s comparative financial performance.

The Company’s calculation of Adjusted EBITDA for the three and nine months ended September 30, 2024 and 2023 is as follows:

| |

|

For the three months

ended

September 30,

|

|

|

For the nine months

ended

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Net income

|

|

$ |

2,126 |

|

|

$ |

1,696 |

|

|

$ |

6,914 |

|

|

$ |

3,816 |

|

|

Interest expense

|

|

|

326 |

|

|

|

249 |

|

|

|

1,085 |

|

|

|

598 |

|

|

Interest income

|

|

|

(19 |

) |

|

|

(119 |

) |

|

|

(41 |

) |

|

|

(269 |

) |

|

Foreign exchange (gain) loss

|

|

|

(21 |

) |

|

|

210 |

|

|

|

(26 |

) |

|

|

93 |

|

|

Provision for income taxes

|

|

|

770 |

|

|

|

434 |

|

|

|

2,306 |

|

|

|

1,490 |

|

|

Depreciation and amortization

|

|

|

22 |

|

|

|

22 |

|

|

|

85 |

|

|

|

64 |

|

|

EBITDA

|

|

|

3,204 |

|

|

|

2,492 |

|

|

|

10,323 |

|

|

|

5,792 |

|

|

Non-cash and non-recurring adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

141 |

|

|

|

21 |

|

|

|

344 |

|

|

|

94 |

|

|

Merger and acquisition related

|

|

|

59 |

|

|

|

32 |

|

|

|

217 |

|

|

|

1,519 |

|

|

Restructuring costs

|

|

|

184 |

|

|

|

- |

|

|

|

184 |

|

|

|

- |

|

|

Amortization of inventory step-up

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

323 |

|

|

Non-recurring loss on foreign currency forward contract

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

112 |

|

|

Adjusted EBITDA

|

|

$ |

3,588 |

|

|

$ |

2,545 |

|

|

$ |

11,068 |

|

|

$ |

7,840 |

|

v3.24.3

Document And Entity Information

|

Nov. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FitLife Brands, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 14, 2024

|

| Entity, File Number |

000-52369

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, Tax Identification Number |

20-3464383

|

| Entity, Address, Address Line One |

5214 S. 136th Street

|

| Entity, Address, City or Town |

Omaha

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68137

|

| City Area Code |

402

|

| Local Phone Number |

884-1894

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FTLF

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001374328

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

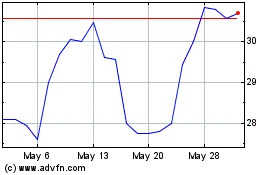

FitLife Brands (NASDAQ:FTLF)

Historical Stock Chart

From Feb 2025 to Mar 2025

FitLife Brands (NASDAQ:FTLF)

Historical Stock Chart

From Mar 2024 to Mar 2025