Travere Therapeutics, Inc. (NASDAQ: TVTX) today reported its fourth

quarter and full year 2024 financial results and provided a

corporate update.

“Our strong execution in 2024 made it a

remarkable year for Travere and the patients we serve. The ongoing

commercial launch of FILSPARI outperformed benchmarks and the

recent full approval has reinforced physicians’ confidence in

choosing FILSPARI as a foundational therapy for IgAN,” said Eric

Dube, Ph.D., president and chief executive officer of Travere

Therapeutics. “We enter 2025 with strong momentum and a clear

focus. With FILSPARI’s differentiated profile as the only medicine

that has been shown to provide superior preservation of kidney

function in a head-to-head trial and can replace historical

foundational therapy, we remain committed to reaching more patients

at risk of IgAN progression. Following our recent FDA engagement

for FILSPARI in FSGS, we are on track to complete our sNDA

submission around the end of the first quarter and are preparing to

be ready for a successful launch, if approved. Additionally, we

continue to optimize our manufacturing for pegtibatinase and will

be preparing to restart enrollment in the pivotal program next

year. These strategic priorities will position us to drive a

lasting positive impact for our patients and stakeholders.”

Financial Results for Continuing

Operations for the Quarter and Year Ended December 31,

2024

The following financial results discussion

compares Travere’s continuing operations. All periods unless

otherwise specified have been adjusted to exclude discontinued

operations related to the divestiture of the bile acid product

portfolio completed on August 31, 2023.

Net product sales for the fourth quarter of 2024

were $73.5 million, compared to $39.9 million for the same period

in 2023. For the full year 2024, net product sales were $226.7

million, compared to $127.5 million for the same period in 2023.

The increase is attributable to growth in sales of FILSPARI,

including a full twelve months of sales in 2024, following the

February 2023 launch.

Research and development (R&D) expenses for

the fourth quarter of 2024 were $62.1 million, compared to $59.7

million for the same period in 2023. For the full year 2024,

R&D expenses were $217.5 million, compared to $245.0 million

for the same period in 2023. The decrease is largely attributable

to previously announced restructuring initiatives and lower costs

associated with the development of sparsentan as our Phase 3

programs advance towards completion, offset by an increase in costs

associated with the development of pegtibatinase following the

December 2023 initiation of the Phase 3 HARMONY Study. On a

non-GAAP adjusted basis, R&D expenses were $58.6 million for

the fourth quarter and $203.3 million for the full year 2024,

compared to $55.3 million and $220.4 million for the same periods

in 2023.

Selling, general, and administrative (SG&A)

expenses for the fourth quarter of 2024 were $69.5 million,

compared to $63.6 million for the same period in 2023. For the full

year 2024, SG&A expenses were $264.1 million, compared to

$265.5 million for the same period in 2023. On a non-GAAP adjusted

basis, SG&A expenses were $51.6 million for the fourth quarter

and $197.8 million for the full year 2024, compared to $49.7

million and $199.5 million for the same periods in 2023.

Total other income, net for the fourth quarter

of 2024 was $0.4 million, compared to $5.7 million for the same

period in 2023. Total other income, net for the full year 2024 was

$3.3 million, compared to $12.0 million in the same period in 2023.

The difference is largely attributable to a non-cash charge to

other expense during the second quarter related to the Renalys

Pharma collaboration entered into in 2024, and a decrease in

interest income.

As of December 31, 2024, the Company had cash,

cash equivalents, and marketable securities of $370.7 million. This

includes net proceeds of $134.7 million from a common stock

offering completed in November 2024.

Program Updates

FILSPARI®

(sparsentan) – IgAN

- On September 5, 2024, the U.S. Food

and Drug Administration (FDA) granted full approval to FILSPARI to

slow kidney function decline in adults with primary IgAN who are at

risk of disease progression.

- In the fourth quarter of 2024, the

Company received 693 new patient start forms (PSFs) driven by

growth amongst both new and repeat prescribers following full

approval.

- Fourth quarter 2024 net product

sales of FILSPARI totaled $49.6 million; full year 2024 net product

sales of FILSPARI totaled $132.2 million.

- The FDA assigned a PDUFA target

action date of August 28, 2025, to the Company’s supplemental New

Drug Application (sNDA) requesting modification of liver monitoring

for FILSPARI in IgAN.

- In 2025, the Company anticipates

final publication of the updated Kidney Disease Improving Global

Outcomes (KDIGO) clinical guidelines for IgAN. The draft guidelines

published in August 2024 recommended FILSPARI as a foundational

kidney-targeted therapy and lowered the targeted proteinuria level

for all IgAN patients to under 0.5 g/day or ideally complete

remission (under 0.3 g/day).

- In 2025, the Company expects the

ongoing SPARTAN Study to be expanded to include post-kidney

transplant patients with recurring IgAN and has plans to initiate a

new open label study of FILSPARI in post kidney-transplant patients

with recurrent IgAN or FSGS.

- In 2025, the Company anticipates

presenting additional data from its ongoing clinical studies to

further support FILSPARI as foundational therapy in treating

patients with IgAN.

- The Company’s collaborator, CSL

Vifor, has launched FILSPARI for the treatment of IgAN in Germany,

Austria and Switzerland.

- In 2025, the Company and CSL Vifor

anticipate the current conditional marketing authorization (CMA)

for FILSPARI for the treatment of IgAN in Europe will be converted

to full approval. The Company expects to receive a $17.5 million

milestone payment from CSL Vifor upon conversion of the CMA to full

approval, and the Company remains eligible to receive additional

milestone payments related to market access and sales-based

achievements.

- The Company’s partner, Renalys

Pharma, Inc., recently completed enrollment in its registrational

Phase 3 clinical trial of sparsentan for the treatment of IgAN in

Japan and expects topline results in the second half of 2025.

FILSPARI®

(sparsentan) – FSGS

- Following its Type C meeting with

the FDA, the Company is on track to submit an sNDA for an FSGS

indication around the end of the first quarter of 2025.

- The sNDA submission will be based

on the results from Phase 3 DUPLEX and Phase 2 DUET studies of

FILSPARI in FSGS, two of the largest interventional clinical trials

conducted in FSGS to-date.

- If approved, FILSPARI would be the

first and only approved medicine indicated for FSGS, a rare kidney

disorder and a leading cause of kidney failure.

Pegtibatinase (TVT-058) – Classical

HCU

- The Company is continuing to make

progress on the necessary process improvements in manufacturing

scale-up and is on track to restart enrollment in the Phase 3

HARMONY Study in 2026.

Conference Call Information

Travere Therapeutics will host a conference call

and webcast today, February 20, 2025, at 4:30 p.m. ET to discuss

company updates as well as fourth quarter and full year 2024

financial results. To participate in the conference call, dial +1

(800) 549-8228 (U.S.) or +1 (646) 564-2877 (International),

conference ID 25215 shortly before 4:30 p.m. ET. The webcast can be

accessed on the Investor page of Travere’s website at

ir.travere.com/events-presentations. Following the live webcast, an

archived version of the call will be available for 30 days on the

Company’s website.

Use of Non-GAAP Financial

Measures

To supplement Travere’s financial results and

guidance presented in accordance with U.S. generally accepted

accounting principles (GAAP), the Company uses certain non-GAAP

adjusted financial measures in this press release and the

accompanying tables. The Company believes that these non-GAAP

financial measures are helpful in understanding its past financial

performance and potential future results. They are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures and should be read in conjunction with the consolidated

financial statements prepared in accordance with GAAP. Travere’s

management regularly uses these supplemental non-GAAP financial

measures internally to understand, manage and evaluate its business

and make operating decisions. In addition, Travere believes that

the use of these non-GAAP measures enhances the ability of

investors to compare its results from period to period and allows

for greater transparency with respect to key financial metrics the

Company uses in making operating decisions.

Investors should note that these non-GAAP

financial measures are not prepared under any comprehensive set of

accounting rules or principles and do not reflect all of the

amounts associated with the Company’s results of operations as

determined in accordance with GAAP. Investors should also note that

these non-GAAP financial measures have no standardized meaning

prescribed by GAAP and, therefore, have limits in their usefulness

to investors. In addition, from time to time in the future the

Company may exclude other items, or cease to exclude items that it

has historically excluded, for purposes of its non-GAAP financial

measures; because of the non-standardized definitions, the non-GAAP

financial measures as used by the Company in this press release and

the accompanying tables may be calculated differently from, and

therefore may not be directly comparable to, similarly titled

measures used by the Company’s competitors and other companies.

As used in this press release, (i) the

historical non-GAAP net loss measures exclude from GAAP net loss,

as applicable, stock-based compensation expense, amortization and

depreciation expense, and income tax; (ii) the historical non-GAAP

SG&A expense measures exclude from GAAP SG&A expenses, as

applicable, stock-based compensation expense, and amortization and

depreciation expense; (iii) the historical non-GAAP R&D expense

measures exclude from GAAP R&D expenses, as applicable,

stock-based compensation expense, and amortization and depreciation

expense.

About Travere

Therapeutics

At Travere Therapeutics, we are in rare for

life. We are a biopharmaceutical company that comes together every

day to help patients, families and caregivers of all backgrounds as

they navigate life with a rare disease. On this path, we know the

need for treatment options is urgent – that is why our global team

works with the rare disease community to identify, develop and

deliver life-changing therapies. In pursuit of this mission, we

continuously seek to understand the diverse perspectives of rare

patients and to courageously forge new paths to make a difference

in their lives and provide hope – today and tomorrow. For more

information, visit travere.com.

FILSPARI®

(sparsentan) U.S. Indication

FILSPARI (sparsentan) is indicated to slow

kidney function decline in adults with primary immunoglobulin A

nephropathy (IgAN) who are at risk for disease progression.

IMPORTANT SAFETY

INFORMATION

BOXED WARNING: HEPATOTOXICITY AND

EMBRYO-FETAL TOXICITY

Because of the risks of hepatotoxicity

and birth defects, FILSPARI is available only through a restricted

program called the FILSPARI REMS. Under the FILSPARI REMS,

prescribers, patients and pharmacies must enroll in the

program.

Hepatotoxicity

Some Endothelin Receptor Antagonists

(ERAs) have caused elevations of aminotransferases, hepatotoxicity,

and liver failure. In clinical studies, elevations in

aminotransferases (ALT or AST) of at least 3-times the Upper Limit

of Normal (ULN) have been observed in up to 3.5% of

FILSPARI-treated patients, including cases confirmed with

rechallenge.

Measure transaminases and bilirubin

before initiating treatment and monthly for the first 12 months,

and then every 3 months during treatment. Interrupt treatment and

closely monitor patients who develop aminotransferase elevations

more than 3x ULN.

FILSPARI should generally be avoided in

patients with elevated aminotransferases (>3x ULN) at baseline

because monitoring for hepatotoxicity may be more difficult and

these patients may be at increased risk for serious

hepatotoxicity.

Embryo-Fetal Toxicity

FILSPARI can cause major birth defects

if used by pregnant patients based on animal data. Therefore,

pregnancy testing is required before the initiation of treatment,

during treatment and one month after discontinuation of treatment

with FILSPARI. Patients who can become pregnant must use effective

contraception before the initiation of treatment, during treatment,

and for one month after discontinuation of treatment with

FILSPARI.

Contraindications

FILSPARI is contraindicated in patients who are

pregnant. Do not coadminister FILSPARI with angiotensin receptor

blockers (ARBs), ERAs, or aliskiren.

Warnings and Precautions

-

Hepatotoxicity: Elevations in ALT or AST of

at least 3-fold ULN have been observed in up to 3.5% of

FILSPARI-treated patients, including cases confirmed with

rechallenge. While no concurrent elevations in bilirubin

>2-times ULN or cases of liver failure were observed in

FILSPARI-treated patients, some ERAs have caused elevations of

aminotransferases, hepatotoxicity, and liver failure. To reduce the

risk of potential serious hepatotoxicity, measure serum

aminotransferase levels and total bilirubin prior to initiation of

treatment and monthly for the first 12 months, then

every 3 months during treatment.

Advise patients with symptoms suggesting

hepatotoxicity (nausea, vomiting, right upper quadrant pain,

fatigue, anorexia, jaundice, dark urine, fever, or itching) to

immediately stop treatment with FILSPARI and seek medical

attention. If aminotransferase levels are abnormal at any time

during treatment, interrupt FILSPARI and monitor as

recommended.

Consider re-initiation of FILSPARI only when

hepatic enzyme levels and bilirubin return to pretreatment values

and only in patients who have not experienced clinical symptoms of

hepatotoxicity. Avoid initiation of FILSPARI in patients with

elevated aminotransferases (>3x ULN) prior to drug initiation

because monitoring hepatotoxicity in these patients may be more

difficult and these patients may be at increased risk for serious

hepatotoxicity.

- Embryo-Fetal

Toxicity: FILSPARI can cause fetal harm when

administered to a pregnant patient and is contraindicated during

pregnancy. Advise patients who can become pregnant of the potential

risk to a fetus. Obtain a pregnancy test prior to initiation of

treatment with FILSPARI, monthly during treatment, and one month

after discontinuation of treatment. Advise patients who can become

pregnant to use effective contraception prior to initiation of

treatment, during treatment, and for one month after

discontinuation of treatment with FILSPARI.

- FILSPARI

REMS: Due to the risk of hepatotoxicity and

embryo-fetal toxicity, FILSPARI is available only through a

restricted program called the FILSPARI REMS. Prescribers, patients,

and pharmacies must be enrolled in the REMS program and comply with

all requirements (www.filsparirems.com).

-

Hypotension: Hypotension has been observed in

patients treated with ARBs and ERAs. There was a greater incidence

of hypotension-associated adverse events, some serious, including

dizziness, in patients treated with FILSPARI compared to

irbesartan. In patients at risk for hypotension, consider

eliminating or adjusting other antihypertensive medications and

maintaining appropriate volume status. If hypotension develops,

despite elimination or reduction of other antihypertensive

medications, consider a dose reduction or dose interruption of

FILSPARI. A transient hypotensive response is not a

contraindication to further dosing of FILSPARI, which can be given

once blood pressure has stabilized.

- Acute Kidney

Injury: Monitor kidney function periodically. Drugs

that inhibit the renin-angiotensin system (RAS) can cause kidney

injury. Patients whose kidney function may depend in part on the

activity of the RAS (e.g., patients with renal artery stenosis,

chronic kidney disease, severe congestive heart failure, or volume

depletion) may be at particular risk of developing acute kidney

injury on FILSPARI. Consider withholding or discontinuing therapy

in patients who develop a clinically significant decrease in kidney

function while on FILSPARI.

-

Hyperkalemia: Monitor serum potassium

periodically and treat appropriately. Patients with advanced kidney

disease, taking concomitant potassium-increasing drugs (e.g.,

potassium supplements, potassium-sparing diuretics), or using

potassium-containing salt substitutes are at increased risk for

developing hyperkalemia. Dosage reduction or discontinuation of

FILSPARI may be required.

- Fluid

Retention: Fluid retention may occur with ERAs, and

has been observed in clinical studies with FILSPARI. FILSPARI has

not been evaluated in patients with heart failure. If clinically

significant fluid retention develops, evaluate the patient to

determine the cause and the potential need to initiate or modify

the dose of diuretic treatment then consider modifying the dose of

FILSPARI.

Most common adverse reactions

The most common adverse reactions (≥5%) are

hyperkalemia, hypotension (including orthostatic hypotension),

peripheral edema, dizziness, anemia, and acute kidney injury.

Drug interactions

- Renin-Angiotensin System

(RAS) Inhibitors and ERAs: Do not coadminister

FILSPARI with ARBs, ERAs, or aliskiren due to increased risks of

hypotension, syncope, hyperkalemia, and changes in renal function

(including acute renal failure).

- Strong and Moderate CYP3A

Inhibitors: Avoid concomitant use of FILSPARI with

strong CYP3A inhibitors. If a strong CYP3A inhibitor cannot be

avoided, interrupt FILSPARI treatment. When resuming treatment with

FILSPARI, consider dose titration. Monitor blood pressure, serum

potassium, edema, and kidney function regularly when used

concomitantly with moderate CYP3A inhibitors. Concomitant use with

a strong CYP3A inhibitor increases sparsentan exposure which may

increase the risk of FILSPARI adverse reactions.

- Strong CYP3A

Inducers: Avoid concomitant use with a strong CYP3A

inducer. Concomitant use with a strong CYP3A inducer decreases

sparsentan exposure which may reduce FILSPARI efficacy.

- Antacids and Acid Reducing

Agents: Administer FILSPARI 2 hours before or after

administration of antacids. Avoid concomitant use of acid reducing

agents (histamine H2 receptor antagonist and PPI proton pump

inhibitor) with FILSPARI. Sparsentan exhibits pH-dependent

solubility. Antacids or acid reducing agents may decrease

sparsentan exposure which may reduce FILSPARI efficacy.

- Non-Steroidal

Anti-Inflammatory Agents (NSAIDs), Including Selective

Cyclooxygenase-2 (COX-2) Inhibitors: Monitor for

signs of worsening renal function with concomitant use with NSAIDs

(including selective COX-2 inhibitors). In patients with volume

depletion (including those on diuretic therapy) or with impaired

kidney function, concomitant use of NSAIDs (including selective

COX-2 inhibitors) with drugs that antagonize the angiotensin II

receptor may result in deterioration of kidney function, including

possible kidney failure.

- CYP2B6, 2C9, and 2C19

Substrates: Monitor for efficacy of concurrently

administered CYP2B6, 2C9, and 2C19 substrates and consider dosage

adjustment in accordance with the Prescribing Information.

Sparsentan decreases exposure of these substrates, which may reduce

efficacy related to these substrates.

- P-gp and BCRP

Substrates: Avoid concomitant use of sensitive

substrates of P-gp and BCRP with FILSPARI. Sparsentan may increase

exposure of these transporter substrates, which may increase the

risk of adverse reactions related to these substrates.

- Agents Increasing Serum

Potassium: Monitor serum potassium frequently in

patients treated with FILSPARI and other agents that increase serum

potassium. Concomitant use of FILSPARI with potassium-sparing

diuretics, potassium supplements, potassium-containing salt

substitutes, or other drugs that raise serum potassium levels may

result in hyperkalemia.

Please see the

full Prescribing

Information, including BOXED WARNING, for

additional Important Safety Information.

Forward-Looking Statements

This press release contains “forward-looking

statements” as that term is defined in the Private Securities

Litigation Reform Act of 1995. Without limiting the foregoing,

these statements are often identified by the words “on-track,”

“positioned,” “look forward to,” “will,” “would,” “may,” “might,”

“believes,” “anticipates,” “plans,” “expects,” “intends,”

“potential,” or similar expressions. In addition, expressions of

strategies, intentions or plans are also forward-looking

statements. Such forward-looking statements include, but are not

limited to, references to: continued progress with the FILSPARI

launch in IgAN; plans and expectations regarding the submission of

an sNDA for FILSPARI in FSGS, expectations regarding the timing and

outcome thereof, and statements regarding preparations for a

successful launch in FSGS, if approved; statements regarding the

potential for FILSPARI to be the first and only approved medicine

indicated for FSGS; statements regarding FILSPARI’s potential to

replace the historical standard of care in IgAN as a new

foundational therapy and to reach more patients at risk of IgAN

progression; statements regarding manufacturing for pegtibatinase

and the Company’s ability to restart enrollment in the Phase 3

HARMONY Study in 2026; statements regarding the Company’s sNDA

requesting modification of liver monitoring for FILSPARI in IgAN

and expectations regarding the timing and outcome thereof;

expectations regarding the conversion of the current conditional

marketing authorization (CMA) for FILSPARI for the treatment of

IgAN in Europe to full approval; expectations regarding milestone

payments and the potential achievement and timing thereof;

expectations regarding the SPARTAN Study and the other studies

described herein; expectations regarding Renalys Pharma’s

registrational Phase 3 clinical trial of sparsentan for the

treatment of IgAN in Japan; expectations regarding the KDIGO

guidelines; and statements regarding financial metrics and

expectations related thereto. Such forward-looking statements are

based on current expectations and involve inherent risks and

uncertainties, including factors that could delay, divert or change

any of them, and could cause actual outcomes and results to differ

materially from current expectations. No forward-looking statement

can be guaranteed. Among the factors that could cause actual

results to differ materially from those indicated in the

forward-looking statements are risks and uncertainties related to

the Company’s planned submission of an sNDA for FILSPARI in FSGS,

including the timing and outcome thereof. There is no guarantee

that the FDA will accept the sNDA for filing, grant priority review

of the sNDA or grant approval of FILSPARI for FSGS. The Company

also faces risks related to its business and finances in general,

the success of its commercial products, risks and uncertainties

associated with its preclinical and clinical stage pipeline, risks

and uncertainties associated with the regulatory review and

approval process, risks and uncertainties associated with

enrollment of clinical trials for rare diseases, and risks that

ongoing or planned clinical trials may not succeed or may be

delayed for safety, regulatory or other reasons. Specifically, the

Company faces risks associated with the ongoing commercial launch

of FILSPARI in IgAN, the timing and potential outcome of its and

its partners’ clinical studies, market acceptance of its commercial

products including efficacy, safety, price, reimbursement, and

benefit over competing therapies, risks related to the challenges

of manufacturing scale-up, risks associated with the successful

development and execution of commercial strategies for such

products, including FILSPARI, and risks and uncertainties related

to the new administration and matters related to the funding and

staffing of government agencies including the FDA. The Company also

faces the risk that it will be unable to raise additional funding

that may be required to complete development of any or all of its

product candidates, including as a result of macroeconomic

conditions; risks relating to the Company’s dependence on

contractors for clinical drug supply and commercial manufacturing;

uncertainties relating to patent protection and exclusivity periods

and intellectual property rights of third parties; risks associated

with regulatory interactions; and risks and uncertainties relating

to competitive products, including current and potential future

generic competition with certain of the Company’s products, and

technological changes that may limit demand for the Company’s

products. The Company also faces additional risks associated with

global and macroeconomic conditions, including health epidemics and

pandemics, including risks related to potential disruptions to

clinical trials, commercialization activity, supply chain, and

manufacturing operations. You are cautioned not to place undue

reliance on these forward-looking statements as there are important

factors that could cause actual results to differ materially from

those in forward-looking statements, many of which are beyond our

control. The Company undertakes no obligation to publicly update

any forward-looking statement, whether as a result of new

information, future events, or otherwise. Investors are referred to

the full discussion of risks and uncertainties, including under the

heading “Risk Factors”, as included in the Company’s most recent

Form 10-K, Form 10-Q and other filings with the Securities and

Exchange Commission.

|

|

|

TRAVERE THERAPEUTICS, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except share amounts) |

| |

|

|

|

|

| |

|

December 31, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

58,535 |

|

|

$ |

58,176 |

|

|

Marketable debt securities, at fair value |

|

|

312,166 |

|

|

|

508,675 |

|

|

Accounts receivable, net |

|

|

27,116 |

|

|

|

21,179 |

|

|

Inventory |

|

|

6,200 |

|

|

|

9,410 |

|

|

Prepaid expenses and other current assets |

|

|

12,685 |

|

|

|

19,335 |

|

|

Total current assets |

|

|

416,702 |

|

|

|

616,775 |

|

| Long-term inventory |

|

|

35,656 |

|

|

|

31,494 |

|

| Property and equipment,

net |

|

|

5,336 |

|

|

|

7,479 |

|

| Operating lease right-of-use

assets |

|

|

14,295 |

|

|

|

18,061 |

|

| Intangible assets, net |

|

|

103,974 |

|

|

|

104,443 |

|

| Other assets |

|

|

18,162 |

|

|

|

10,661 |

|

|

Total assets |

|

$ |

594,125 |

|

|

$ |

788,913 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

23,534 |

|

|

$ |

41,675 |

|

|

Accrued expenses |

|

|

86,028 |

|

|

|

118,991 |

|

|

Convertible debt, current portion |

|

|

68,678 |

|

|

|

— |

|

|

Deferred revenue, current portion |

|

|

2,815 |

|

|

|

7,096 |

|

|

Operating lease liabilities, current portion |

|

|

5,405 |

|

|

|

4,909 |

|

|

Other current liabilities |

|

|

14,291 |

|

|

|

5,237 |

|

|

Total current liabilities |

|

|

200,751 |

|

|

|

177,908 |

|

|

Convertible debt, less current portion |

|

|

310,310 |

|

|

|

377,263 |

|

|

Operating lease liabilities, less current portion |

|

|

17,191 |

|

|

|

22,612 |

|

|

Other non-current liabilities |

|

|

6,796 |

|

|

|

10,320 |

|

|

Total liabilities |

|

|

535,048 |

|

|

|

588,103 |

|

| |

|

|

|

|

| Stockholders'

Equity: |

|

|

|

|

|

Preferred stock $0.0001 par value; 20,000,000 shares authorized; no

shares issued and outstanding as of December 31, 2024 and 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock $0.0001 par value; 200,000,000 and 200,000,000 shares

authorized; 87,452,835 and 75,367,117 issued and outstanding as of

December 31, 2024 and 2023, respectively |

|

|

9 |

|

|

|

7 |

|

|

Additional paid-in capital |

|

|

1,506,315 |

|

|

|

1,327,881 |

|

|

Accumulated deficit |

|

|

(1,447,167 |

) |

|

|

(1,125,622 |

) |

|

Accumulated other comprehensive loss |

|

|

(80 |

) |

|

|

(1,456 |

) |

|

Total stockholders' equity |

|

|

59,077 |

|

|

|

200,810 |

|

|

Total liabilities and stockholders' equity |

|

$ |

594,125 |

|

|

$ |

788,913 |

|

|

Note: Certain adjustments / reclassifications have been

made to prior periods to conform to current year

presentation. |

|

TRAVERE THERAPEUTICS, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENT OF OPERATIONS |

|

(in thousands, except share and per share

data) |

| |

| |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

(unaudited) |

|

|

|

|

| Net product sales: |

|

|

|

|

|

|

|

|

|

FILSPARI |

|

$ |

49,644 |

|

|

$ |

14,699 |

|

|

$ |

132,222 |

|

|

$ |

29,208 |

|

|

Tiopronin products |

|

|

23,902 |

|

|

|

25,217 |

|

|

|

94,485 |

|

|

|

98,329 |

|

|

Total net product sales |

|

|

73,546 |

|

|

|

39,916 |

|

|

|

226,707 |

|

|

|

127,537 |

|

| License and collaboration

revenue |

|

|

1,241 |

|

|

|

5,143 |

|

|

|

6,468 |

|

|

|

17,701 |

|

|

Total revenue |

|

|

74,787 |

|

|

|

45,059 |

|

|

|

233,175 |

|

|

|

145,238 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

2,553 |

|

|

|

4,564 |

|

|

|

7,744 |

|

|

|

11,450 |

|

|

Research and development |

|

|

62,067 |

|

|

|

59,746 |

|

|

|

217,496 |

|

|

|

244,990 |

|

|

Selling, general and administrative |

|

|

69,501 |

|

|

|

63,588 |

|

|

|

264,119 |

|

|

|

265,542 |

|

|

In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

65,205 |

|

|

|

— |

|

|

Restructuring |

|

|

1,403 |

|

|

|

11,394 |

|

|

|

2,438 |

|

|

|

11,394 |

|

|

Total operating expenses |

|

|

135,524 |

|

|

|

139,292 |

|

|

|

557,002 |

|

|

|

533,376 |

|

| |

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(60,737 |

) |

|

|

(94,233 |

) |

|

|

(323,827 |

) |

|

|

(388,138 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

3,795 |

|

|

|

7,152 |

|

|

|

17,817 |

|

|

|

21,768 |

|

|

Interest expense |

|

|

(2,817 |

) |

|

|

(2,821 |

) |

|

|

(11,182 |

) |

|

|

(11,334 |

) |

|

Other (expense) income, net |

|

|

(581 |

) |

|

|

1,374 |

|

|

|

(3,318 |

) |

|

|

1,594 |

|

|

Total other income, net |

|

|

397 |

|

|

|

5,705 |

|

|

|

3,317 |

|

|

|

12,028 |

|

| |

|

|

|

|

|

|

|

|

| Loss from continuing

operations before income tax provision |

|

|

(60,340 |

) |

|

|

(88,528 |

) |

|

|

(320,510 |

) |

|

|

(376,110 |

) |

| Income tax benefit (provision)

on continuing operations |

|

|

72 |

|

|

|

(68 |

) |

|

|

(120 |

) |

|

|

(223 |

) |

| |

|

|

|

|

|

|

|

|

| Loss from continuing

operations, net of tax |

|

|

(60,268 |

) |

|

|

(88,596 |

) |

|

|

(320,630 |

) |

|

|

(376,333 |

) |

| Income (loss) from

discontinued operations, net of tax |

|

|

4 |

|

|

|

(1,577 |

) |

|

|

(915 |

) |

|

|

264,934 |

|

| Net loss |

|

$ |

(60,264 |

) |

|

$ |

(90,173 |

) |

|

$ |

(321,545 |

) |

|

$ |

(111,399 |

) |

| |

|

|

|

|

|

|

|

|

| Per share

data |

|

|

|

|

|

|

|

|

| Basic and diluted: |

|

|

|

|

|

|

|

|

|

Net loss per common share |

|

$ |

(0.73 |

) |

|

$ |

(1.18 |

) |

|

$ |

(4.08 |

) |

|

$ |

(1.50 |

) |

|

Weighted average common shares outstanding |

|

|

83,105,184 |

|

|

|

76,474,560 |

|

|

|

78,888,861 |

|

|

|

74,267,418 |

|

|

Note: Certain adjustments / reclassifications have been

made to prior periods to conform to current year

presentation. |

|

TRAVERE THERAPEUTICS, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF GAAP REPORTED TO NON-GAAP ADJUSTED

INFORMATION |

|

(in thousands, except share and per share

data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP operating

loss |

|

$ |

(60,737 |

) |

|

$ |

(94,233 |

) |

|

$ |

(323,827 |

) |

|

$ |

(388,138 |

) |

| |

|

|

|

|

|

|

|

|

| R&D operating expense |

|

|

(62,067 |

) |

|

|

(59,746 |

) |

|

|

(217,496 |

) |

|

|

(244,990 |

) |

| |

|

|

|

|

|

|

|

|

| Stock compensation |

|

|

3,426 |

|

|

|

3,426 |

|

|

|

14,178 |

|

|

|

17,284 |

|

| Amortization &

depreciation |

|

|

— |

|

|

|

997 |

|

|

|

— |

|

|

|

7,261 |

|

|

Subtotal non-GAAP items |

|

|

3,426 |

|

|

|

4,423 |

|

|

|

14,178 |

|

|

|

24,545 |

|

| Non-GAAP R&D expense |

|

|

(58,641 |

) |

|

|

(55,323 |

) |

|

|

(203,318 |

) |

|

|

(220,445 |

) |

| |

|

|

|

|

|

|

|

|

| SG&A operating

expense |

|

|

(69,501 |

) |

|

|

(63,588 |

) |

|

|

(264,119 |

) |

|

|

(265,542 |

) |

| |

|

|

|

|

|

|

|

|

| Stock compensation |

|

|

5,789 |

|

|

|

3,070 |

|

|

|

22,735 |

|

|

|

28,389 |

|

| Amortization &

depreciation |

|

|

12,093 |

|

|

|

10,855 |

|

|

|

43,555 |

|

|

|

37,671 |

|

|

Subtotal non-GAAP items |

|

|

17,882 |

|

|

|

13,925 |

|

|

|

66,290 |

|

|

|

66,060 |

|

| Non-GAAP SG&A expense |

|

|

(51,619 |

) |

|

|

(49,663 |

) |

|

|

(197,829 |

) |

|

|

(199,482 |

) |

| |

|

|

|

|

|

|

|

|

|

Subtotal non-GAAP items |

|

|

21,308 |

|

|

|

18,348 |

|

|

|

80,468 |

|

|

|

90,605 |

|

| Non-GAAP operating

loss |

|

$ |

(39,429 |

) |

|

$ |

(75,885 |

) |

|

$ |

(243,359 |

) |

|

$ |

(297,533 |

) |

| |

|

|

|

|

|

|

|

|

| GAAP net

loss |

|

$ |

(60,264 |

) |

|

$ |

(90,173 |

) |

|

$ |

(321,545 |

) |

|

$ |

(111,399 |

) |

|

Non-GAAP operating loss adjustments |

|

|

21,308 |

|

|

|

18,348 |

|

|

|

80,468 |

|

|

|

90,605 |

|

|

Income tax (benefit) provision |

|

|

(72 |

) |

|

|

68 |

|

|

|

120 |

|

|

|

223 |

|

| Non-GAAP net

loss(1) |

|

$ |

(39,028 |

) |

|

$ |

(71,757 |

) |

|

$ |

(240,957 |

) |

|

$ |

(20,571 |

) |

| |

|

|

|

|

|

|

|

|

| Per share

data |

|

|

|

|

|

|

|

|

| Basic and diluted: |

|

|

|

|

|

|

|

|

| Non-GAAP net loss per common

share |

|

$ |

(0.47 |

) |

|

$ |

(0.94 |

) |

|

$ |

(3.05 |

) |

|

$ |

(0.28 |

) |

| Weighted average common shares

outstanding |

|

|

83,105,184 |

|

|

|

76,474,560 |

|

|

|

78,888,861 |

|

|

|

74,267,418 |

|

|

(1) Non-GAAP net loss includes income from discontinued

operations but excludes non-GAAP adjustments for the effect of

discontinued operations. |

|

Note: Certain adjustments / reclassifications have been

made to prior periods to conform to current year

presentation. |

|

Contact:Investors:888-969-7879ir@travere.com |

Media:888-969-7879mediarelations@travere.com |

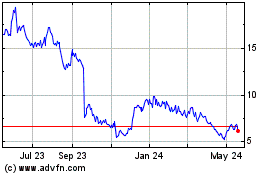

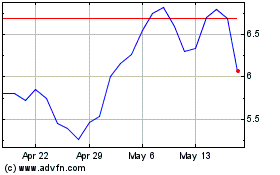

Travere Therapeutics (NASDAQ:TVTX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Travere Therapeutics (NASDAQ:TVTX)

Historical Stock Chart

From Feb 2024 to Feb 2025