- Record Housing and Infrastructure Products (HIP) annual income

from operations of $807 million and EBITDA of $1.1 billion

- Fifth consecutive quarter of year-over-year growth in

company-wide sales volume

Westlake Corporation (NYSE: WLK) (the "Company" or "Westlake")

today announced fourth quarter and full year 2024 results.

SUMMARY FINANCIAL HIGHLIGHTS ($ in

millions except per share data and percentages)

Three Months Ended

Twelve Months Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2023

2024

2023

Westlake Corporation

Net sales

$

2,843

$

3,117

$

2,826

$

12,142

$

12,548

Income (loss) from operations

$

66

$

180

$

(552)

$

875

$

729

Net income (loss) attributable to Westlake

Corporation (1)

$

7

$

108

$

(497)

$

602

$

479

Diluted earnings (loss) per common share

(1)

$

0.06

$

0.83

$

(3.86)

$

4.64

$

3.70

EBITDA

$

416

$

505

$

(235)

$

2,211

$

1,962

Identified Items (2)

$

—

$

75

$

625

$

75

$

625

EBITDA excl. Identified Items

$

416

$

580

$

390

$

2,286

$

2,587

EBITDA margin (3)

15%

19%

14%

19%

21%

Housing and Infrastructure Products

("HIP") Segment

Net sales

$

981

$

1,098

$

946

$

4,317

$

4,212

Income from operations

$

129

$

202

$

121

$

807

$

710

EBITDA

$

188

$

262

$

173

$

1,050

$

949

EBITDA margin

19%

24%

18%

24%

23%

Performance and Essential Materials

("PEM") Segment

Net sales

$

1,862

$

2,019

$

1,880

$

7,825

$

8,336

Income (loss) from operations

$

(41)

$

(9)

$

(664)

$

129

$

59

EBITDA

$

220

$

222

$

(424)

$

1,086

$

965

Identified Items (2)

$

—

$

75

$

625

$

75

$

625

EBITDA excl. Identified Items

$

220

$

297

$

201

$

1,161

$

1,590

EBITDA margin (3)

12%

15%

11%

15%

19%

__________________________

(1)

Includes $45 million ($0.35 per

share) one-time non-cash charge related to changes in Louisiana tax

law in the fourth quarter and full year 2024

(2)

"Identified Items" for 2024

represents $75 million accrued expense to temporarily cease

operations ("mothball") of the allyl chloride (AC) and

epichlorohydrin (ECH) units at the Company's site in Pernis, the

Netherlands, and for 2023 are a $475 million non-cash impairment

charge and a $150 million charge to fully resolve certain liability

claims

(3)

Excludes Identified Items

BUSINESS HIGHLIGHTS

In the fourth quarter of 2024, Westlake reported net sales of

$2.8 billion and net income of $7 million, or $0.06 per share

including $0.35 per share from a one-time non-cash tax charge.

Fourth quarter EBITDA (earnings before interest expense, income

taxes, depreciation and amortization) of $416 million was higher

than EBITDA of $390 million (excluding "Identified Items") in the

prior-year period driven by higher sales volume in each

segment.

For the full year of 2024, Westlake reported net sales of $12.1

billion, net income of $677 million (excluding "Identified Items")

and EBITDA of $2.3 billion (excluding "Identified Items"). Compared

to the prior-year financial results, the Company's 2024 results

benefitted from higher sales volume, particularly in HIP, which was

offset by lower product pricing and margins, particularly in

PEM.

Westlake's fourth quarter of 2024 sales increased 1%

year-over-year, driven by 3% sales volume growth, representing the

fifth consecutive quarter of year-over-year sales volume growth,

and a 2% decline in average sales price. Housing and Infrastructure

Products sales increased 4%, driven by 7% sales volume growth that

more than offset a 3% decline in average sales price. Performance

and Essential Materials sales decreased 1% over the same period of

time, as 1% sales volume growth was slightly less than a 2% decline

in average sales price.

EXECUTIVE COMMENTARY

"Westlake generated solid sales volume growth in 2024, in part

due to innovative new product introductions, export opportunities

enabled by our globally-advantaged feedstock & energy cost

position in our Performance and Essential Materials segment in

spite of globally weak macroeconomic conditions the industry is

experiencing, and our position as a leading supplier to

faster-growing national homebuilders in our Housing and

Infrastructure Products segment. HIP segment EBITDA increased more

than 10% compared to 2023 as our sales volume growth outperformed

the growth in the overall market while our cost-saving actions

improved profitability. While earnings in our PEM segment were

lower compared to 2023 due to lower average sales price as a result

of weak global industrial and manufacturing activity, we made

important progress during 2024 to improve our cost structure

through productivity enhancements and the decision to mothball the

AC and ECH units at our epoxy site in Pernis, The Netherlands,"

said Jean-Marc Gilson, President and Chief Executive Officer.

"Compared to the prior-year period our fourth quarter sales

volume grew in each segment, highlighted by 7% sales volume growth

in our HIP segment, which was solid compared to a challenging

macroeconomic backdrop that impacted the industry. However, during

the fourth quarter sales volume growth was largely offset by lower

average sales price in each segment. While company-wide sales were

relatively flat with the prior-year period, Westlake was able to

increase EBITDA by 7% in the fourth quarter through targeted

cost-reduction actions," continued Mr. Gilson.

"Looking ahead to 2025, we are optimistic on the outlook for our

HIP segment, underpinned by the need to expand the supply of

residential housing in the U.S. after over 15 years of

under-building to support population growth and resulting housing

demand. While global macroeconomic conditions remain challenging to

start the year, our PEM segment is well-positioned to capitalize on

an eventual recovery in global industrial and manufacturing

activity. Our focus for 2025 will be on improving the components of

earnings growth that are within our control, including executing on

our cost-saving plans, increasing the value that we provide to our

customers, ensuring the safety and reliability of our plants, and

commercializing new product innovations," concluded Mr. Gilson.

RESULTS

Consolidated Results

(Unless otherwise noted the financial numbers below exclude the

Identified Items)

For the three months ended December 31, 2024, the Company

reported net income of $7 million, or $0.06 per share, on net sales

of $2.8 billion. The year-over-year decrease in net income of $86

million was primarily due to a one-time non-cash charge of

approximately $45 million in the fourth quarter of 2024 for the

revaluation of state deferred tax assets and deferred tax

liabilities caused by recent legislative changes in Louisiana.

Fourth quarter 2024 net income of $7 million decreased by $176

million sequentially as compared to the third quarter of 2024. The

decrease in net income compared to the prior quarter was primarily

due to lower sales prices in Performance Materials and seasonally

lower Housing and Infrastructure Products sales volume.

EBITDA of $416 million for the fourth quarter of 2024 increased

by $26 million compared to fourth quarter 2023 EBITDA of $390

million. Fourth quarter 2024 EBITDA decreased by $164 million

compared to third quarter 2024 EBITDA of $580 million.

For the full year of 2024, net income of $677 million decreased

by $392 million as compared to 2023 net income of $1.1 billion.

Income from operations of $1.0 billion for the full year of 2024

decreased by $0.4 billion as compared to income from operations of

$1.4 billion for the full year of 2023. The decreases in net income

and income from operations were primarily due to lower average

selling price, particularly in Performance and Essential

Materials.

A reconciliation of EBITDA and net income to EBITDA excluding

Identified Items and net income excluding Identified Items as well

as a reconciliation of EBITDA to net income, income from operations

(including and excluding Identified Items) and net cash provided by

operating activities as well as a reconciliation of free cash flow

to net cash flow provided by operating activities can be found in

the financial schedules at the end of this press release.

Cash and Debt

Net cash provided by operating activities was $434 million for

the fourth quarter of 2024 and $1.3 billion for the full year of

2024. Capital expenditures for the fourth quarter and full year of

2024 were $285 million and $1.0 billion, respectively. For the

fourth quarter and full year of 2024, free cash flow (net cash

provided by operating activities less capital expenditures) was

$149 million and $306 million, respectively. As of December 31,

2024, the Company's cash and cash equivalents balance was $2.9

billion and total debt was $4.6 billion.

Housing and Infrastructure Products Segment

For the fourth quarter of 2024, Housing and Infrastructure

Products income from operations of $129 million increased by $8

million as compared to the fourth quarter of 2023. The

year-over-year increase was the result of higher sales volume,

particularly for pipe and fittings.

Sequentially, Housing and Infrastructure Products income from

operations decreased by $73 million as compared to the third

quarter of 2024. This decrease in income from operations versus the

prior quarter was primarily driven by lower sales volume as a

result of the typical seasonality of customer demand.

For the full year of 2024, Housing and Infrastructure Products

net sales of $4.3 billion increased by $0.1 billion as compared to

2023. Housing Products net sales of $3.6 billion increased by $0.1

billion due to solid sales volume growth, particularly in siding

& trim and roofing. Infrastructure Products net sales of $0.7

billion was in line with 2023 as higher sales volume offset lower

average sales price. Housing and Infrastructure Products income

from operations of $807 million increased by $97 million as

compared to the full year of 2023 primarily due to growth in

Housing Products net sales and cost-saving initiatives.

Performance and Essential Materials Segment

(Unless otherwise noted the financial numbers below exclude the

Identified Items)

For the fourth quarter of 2024, Performance and Essential

Materials loss from operations was $41 million as compared to the

fourth quarter of 2023's loss from operations of $39 million due to

lower selling prices for most of our major products, particularly

for chlorine, PVC resin and polyethylene. This negative impact was

partially offset by higher sales volume, particularly for

polyethylene and PVC resin.

Sequentially, Performance and Essential Materials income from

operations for the fourth quarter of 2024 decreased by $107 million

as compared to the third quarter of 2024 (excluding "Identified

Items"). This decrease in income from operations versus the prior

quarter was primarily driven by lower average sales price.

For the full year of 2024, Performance and Essential Materials

net sales of $7.8 billion decreased by $0.5 billion as compared to

2023. Performance Materials net sales of $4.6 billion in 2024 were

relatively in line with 2023 net sales of $4.7 billion as higher

sales volume, particularly for PVC resin and epoxy resin, offset

lower average sales price, particularly for PVC resin and epoxy

resin. Essential Materials net sales of $3.2 billion decreased by

$0.5 billion from 2023 primarily due to lower caustic soda average

sales price. Performance and Essential Materials income from

operations of $204 million decreased by $480 million as compared to

2023. This decrease in income from operations versus the prior-year

was primarily driven by lower average sales price and margins.

Forward-Looking Statements

The statements in this release and the related teleconference

relating to matters that are not historical facts, including

statements regarding our outlook for the performance of our

business segments (such as our optimistic outlook for our HIP

segment), global macroeconomic conditions (including an eventual

recovery in global industrial and manufacturing activity), housing

demand, impacts of tariffs and duties, continuing stabilization of

sales prices and volumes in both domestic and export markets for

most of our products, our market position, our ability to improve

safety, reliability and efficiency of our plants, further

commercialization of new product innovations, our cost savings

initiatives, including the effect of our decision to mothball part

of our epoxy operations, global demand for our products, and our

ability to deliver greater value to customers are forward-looking

statements.

These forward-looking statements are subject to significant

risks and uncertainties. Actual results could differ materially,

based on factors including, but not limited to: general economic

and business conditions; the cyclical nature of the industry; the

availability, cost and volatility of raw materials and energy;

uncertainties associated with the United States, European and

worldwide economies, including those due to political tensions and

conflict in the Middle East, Russia and Ukraine and elsewhere;

uncertainties associated with barriers to international trade,

including the imposition of tariffs and duties or trade disputes;

uncertainties associated with climate change; the potential impact

on demand for ethylene, polyethylene and polyvinyl chloride due to

initiatives such as recycling and customers seeking alternatives to

polymers; current and potential governmental regulatory actions in

the United States and other countries; industry production capacity

and operating rates; the supply/demand balance for Westlake's

products; competitive products and pricing pressures, including

from global competitors; instability in the credit and financial

markets; access to capital markets; terrorist acts; operating

interruptions; changes in laws and regulations, including trade

policies; technological developments; information systems failures

and cyberattacks; foreign currency exchange risks; our ability to

implement our business strategies; creditworthiness of our

customers; the effect and results of litigation and settlements of

litigation; and other risk factors. For more detailed information

about the factors that could cause actual results to differ

materially, please refer to Westlake's Annual Report on Form 10-K

for the year ended December 31, 2023, which was filed with the SEC

in February 2024, and Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024, which was filed with the SEC in November

2024.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial

measures, such as EBITDA, free cash flow and other measures that

exclude the effects of the Identified Items, as defined in

Regulation G of the U.S. Securities Exchange Act of 1934, as

amended. For this purpose, a non-GAAP financial measure is

generally defined by the Securities and Exchange Commission ("SEC")

as a numerical measure of a registrant's historical or future

financial performance, financial position or cash flows that (1)

excludes amounts, or is subject to adjustments that have the effect

of excluding amounts, that are included in the most directly

comparable measure calculated and presented in accordance with GAAP

in the statement of income, balance sheet or statement of cash

flows (or equivalent statements) of the registrant; or (2) includes

amounts, or is subject to adjustments that have the effect of

including amounts, that are excluded from the most directly

comparable measure so calculated and presented. We report our

financial results in accordance with U.S. generally accepted

accounting principles ("U.S. GAAP"), but believe that certain

non-GAAP financial measures, such as EBITDA, free cash flow and

measures that exclude the effects of the Identified Items, provide

useful supplemental information to investors regarding the

underlying business trends and performance of the Company's ongoing

operations and are useful for period-over-period comparisons of

such operations. These non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the financial measures prepared in accordance with

U.S. GAAP. A reconciliation of (i) EBITDA to net income, income

from operations and net cash provided by operating activities, (ii)

free cash flow to net cash provided by operating activities, and

(iii) other measures reflecting adjustments for the effects of the

Identified Items can be found in the financial schedules at the end

of this press release.

About Westlake

Westlake is a global manufacturer and supplier of materials and

innovative products that enhance life every day. Headquartered in

Houston, with operations in Asia, Europe and North America, we

provide the building blocks for vital solutions — from housing and

construction, to packaging and healthcare, to automotive and

consumer. For more information, visit the Company's web site at

www.westlake.com.

Westlake Corporation Conference Call Information:

A conference call to discuss Westlake Corporation's fourth

quarter and full year 2024 results will be held Monday, February

24, 2025 at 11:00 AM Eastern Time (10:00 AM Central Time). To

access the conference call, it is necessary to pre-register at

https://register.vevent.com/register/BI72061c1352d74b3482abead232a4bf93.

Once registered, you will receive a phone number and unique PIN

number.

A replay of the conference call will be available beginning two

hours after its conclusion. The conference call and replay will be

available via webcast at

https://edge.media-server.com/mmc/p/9nttceuz.

WESTLAKE CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

(In millions of dollars,

except per share data and share amounts)

Net sales

$

2,843

$

2,826

$

12,142

$

12,548

Cost of sales

2,515

2,627

10,185

10,329

Gross profit

328

199

1,957

2,219

Selling, general and administrative

expenses

226

224

874

865

Impairment of goodwill and long-lived

assets

—

475

—

475

Amortization of intangibles

28

30

117

122

Restructuring, transaction and

integration-related costs

8

22

91

28

Income (loss) from operations

66

(552

)

875

729

Interest expense

(39

)

(41

)

(159

)

(165

)

Other income, net

69

35

222

136

Income (loss) before income taxes

96

(558

)

938

700

Provision for (benefit from) income

taxes

77

(71

)

291

178

Net income (loss)

19

(487

)

647

522

Net income attributable to noncontrolling

interests

12

10

45

43

Net income (loss) attributable to

Westlake Corporation

$

7

$

(497

)

$

602

$

479

Earnings (loss) per common share

attributable to Westlake Corporation:

Basic

$

0.06

$

(3.86

)

$

4.66

$

3.73

Diluted

$

0.06

$

(3.86

)

$

4.64

$

3.70

Weighted average common shares

outstanding:

Basic

128,564,101

128,165,690

128,535,226

127,806,317

Diluted

129,115,674

128,165,690

129,206,922

128,598,441

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

December 31,

2024

2023

(In millions of

dollars)

ASSETS

Current assets

Cash and cash equivalents

$

2,919

$

3,304

Accounts receivable, net

1,483

1,601

Inventories

1,697

1,622

Prepaid expenses and other current

assets

115

82

Total current assets

6,214

6,609

Property, plant and equipment, net

8,633

8,519

Other assets, net

5,903

5,907

Total assets

$

20,750

$

21,035

LIABILITIES AND EQUITY

Current liabilities (accounts payable and

accrued and other liabilities)

$

2,213

$

2,491

Current portion of long-term debt, net

6

299

Long-term debt, net

4,556

4,607

Other liabilities

2,932

2,874

Total liabilities

9,707

10,271

Total Westlake Corporation stockholders'

equity

10,527

10,241

Noncontrolling interests

516

523

Total equity

11,043

10,764

Total liabilities and equity

$

20,750

$

21,035

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Twelve Months Ended December

31,

2024

2023

(In millions of

dollars)

Cash flows from operating

activities

Net income

$

647

$

522

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

1,114

1,097

Impairment of goodwill and long-lived

assets

—

475

Deferred income taxes

(35

)

(175

)

Net loss on disposition and others

57

85

Other balance sheet changes

(469

)

332

Net cash provided by operating

activities

1,314

2,336

Cash flows from investing

activities

Acquisition of business, net of cash

acquired

—

—

Additions to investments in unconsolidated

subsidiaries

(26

)

(25

)

Additions to property, plant and

equipment

(1,008

)

(1,034

)

Other, net

33

22

Net cash used for investing activities

(1,001

)

(1,037

)

Cash flows from financing

activities

Distributions to noncontrolling

interests

(49

)

(54

)

Dividends paid

(264

)

(221

)

Proceeds from exercise of stock

options

13

44

Repayment of senior notes

(300

)

—

Repurchase of common stock for

treasury

(60

)

(23

)

Other, net

10

9

Net cash used for financing activities

(650

)

(245

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(47

)

19

Net increase (decrease) in cash, cash

equivalents and restricted cash

(384

)

1,073

Cash, cash equivalents and restricted cash

at beginning of period

3,319

2,246

Cash, cash equivalents and restricted cash

at end of period

$

2,935

$

3,319

WESTLAKE CORPORATION

SEGMENT INFORMATION

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

(In millions of

dollars)

Net external sales

Housing and Infrastructure Products

Housing Products

$

818

$

795

$

3,644

$

3,494

Infrastructure Products

163

151

673

718

Total Housing and Infrastructure

Products

981

946

4,317

4,212

Performance and Essential Materials

Performance Materials

1,121

1,107

4,626

4,656

Essential Materials

741

773

3,199

3,680

Total Performance and Essential

Materials

1,862

1,880

7,825

8,336

Total reportable segments and

consolidated

$

2,843

$

2,826

$

12,142

$

12,548

Income (loss) from operations

Housing and Infrastructure Products

$

129

$

121

$

807

$

710

Performance and Essential Materials

(41

)

(664

)

129

59

Total reportable segments

88

(543

)

936

769

Corporate and other

(22

)

(9

)

(61

)

(40

)

Consolidated

$

66

$

(552

)

$

875

$

729

Depreciation and amortization

Housing and Infrastructure Products

$

56

$

50

$

213

$

207

Performance and Essential Materials

223

229

892

881

Total reportable segments

279

279

1,105

1,088

Corporate and other

2

3

9

9

Consolidated

$

281

$

282

$

1,114

$

1,097

Other income, net

Housing and Infrastructure Products

$

3

$

2

$

30

$

32

Performance and Essential Materials

38

11

65

25

Total reportable segments

41

13

95

57

Corporate and other

28

22

127

79

Consolidated

$

69

$

35

$

222

$

136

WESTLAKE CORPORATION

RECONCILIATION OF EBITDA TO

NET INCOME AND INCOME FROM OPERATIONS AND

NET CASH PROVIDED BY OPERATING

ACTIVITIES (INCLUDING AND EXCLUDING IDENTIFIED ITEMS)

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(In millions of dollars,

except percentages)

Net cash provided by operating

activities

$

474

$

434

$

573

$

1,314

$

2,336

Changes in operating assets and

liabilities and other

(354

)

(392

)

(1,168

)

(702

)

(1,989

)

Deferred income taxes

—

(23

)

108

35

175

Net income (loss)

120

19

(487

)

647

522

Add:

Mothball expenses in 2024 / Impairment

charge in 2023

75

—

475

75

475

Litigation settlement charge,

after-tax

—

—

115

—

115

Net income excl. Identified

Items

$

195

$

19

$

103

$

722

$

1,112

Net income (loss)

$

120

$

19

$

(487

)

$

647

$

522

Less:

Other income, net

44

69

35

222

136

Interest expense

(39

)

(39

)

(41

)

(159

)

(165

)

Benefit from (provision for) income

taxes

(65

)

(77

)

71

(291

)

(178

)

Income (loss) from operations

180

66

(552

)

875

729

Add:

Mothball expenses in 2024 / Impairment

charge in 2023

75

—

475

75

475

Litigation settlement charge, pre-tax

—

—

150

—

150

Income from operations excl. Identified

Items

255

66

73

950

1,354

Add:

Depreciation and amortization

281

281

282

1,114

1,097

Other income, net

44

69

35

222

136

EBITDA excl. Identified Items

580

416

390

2,286

2,587

Less:

Mothball expenses in 2024 / Impairment

charge in 2023

75

—

475

75

475

Litigation settlement charge, pre-tax

—

—

150

—

150

EBITDA

$

505

$

416

$

(235

)

$

2,211

$

1,962

Net external sales

$

3,117

$

2,843

$

2,826

$

12,142

$

12,548

Operating income (loss) margin

6%

2%

(20)%

7%

6%

Operating income margin excl.

Identified Items

8%

2%

3%

8%

11%

EBITDA margin

16%

15%

(8)%

18%

16%

EBITDA margin excl. Identified

Items

19%

15%

14%

19%

21%

WESTLAKE CORPORATION

RECONCILIATION OF DILUTED

EARNINGS PER COMMON SHARE TO DILUTED EARNINGS PER COMMON SHARE

EXCLUDING IDENTIFIED ITEMS

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(per share data)

Diluted earnings (loss) per common

share attributable to Westlake Corporation

$

0.83

$

0.06

$

(3.86

)

$

4.64

$

3.70

Add:

Mothball expenses in 2024 / Impairment

charge in 2023

0.58

—

3.69

0.58

3.68

Litigation settlement charge

—

—

0.89

—

0.89

Diluted earnings per common share

attributable to Westlake Corporation excl. Identified Items

$

1.41

$

0.06

$

0.72

$

5.22

$

8.27

WESTLAKE CORPORATION

RECONCILIATION OF FREE CASH

FLOW TO NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(In millions of

dollars)

Net cash provided by operating

activities

$

474

$

434

$

573

$

1,314

$

2,336

Less:

Additions to property, plant and

equipment

220

285

282

1,008

1,034

Free cash flow

$

254

$

149

$

291

$

306

$

1,302

WESTLAKE CORPORATION

RECONCILIATION OF HIP SEGMENT

EBITDA TO INCOME FROM OPERATIONS

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(In millions of dollars,

except percentages)

Housing and Infrastructure Products

Segment

Income from operations

$

202

$

129

$

121

$

807

$

710

Add:

Depreciation and amortization

54

56

50

213

207

Other income, net

6

3

2

30

32

EBITDA

$

262

$

188

$

173

$

1,050

$

949

Net external sales

$

1,098

$

981

$

946

$

4,317

$

4,212

Operating income margin

18%

13%

13%

19%

17%

EBITDA margin

24%

19%

18%

24%

23%

WESTLAKE CORPORATION

RECONCILIATION OF PEM SEGMENT

EBITDA TO INCOME FROM OPERATIONS (INCLUDING AND EXCLUDING

IDENTIFIED ITEMS)

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(In millions of dollars,

except percentages)

Performance and Essential Materials

Segment

Income (loss) from operations

$

(9

)

$

(41

)

$

(664

)

$

129

$

59

Add:

Mothball expenses in 2024 / Impairment

charge in 2023

75

—

475

75

475

Litigation settlement charge

—

—

150

—

150

Income (loss) from operations excl.

Identified Items

66

(41

)

(39

)

204

684

Add:

Depreciation and amortization

225

223

229

892

881

Other income, net

6

38

11

65

25

EBITDA excl. Identified Items

297

220

201

1,161

1,590

Less:

Mothball expenses in 2024 / Impairment

charge in 2023

75

—

475

75

475

Litigation settlement charge

—

—

150

—

150

EBITDA

$

222

$

220

$

(424

)

$

1,086

$

965

Net external sales

$

2,019

$

1,862

$

1,880

$

7,825

$

8,336

Operating income (loss) margin

—%

(2)%

(35)%

2%

1%

Operating income (loss) margin excl.

Identified Items

3%

(2)%

(2)%

3%

8%

EBITDA margin

11%

12%

(23)%

14%

12%

EBITDA margin excl. Identified

Items

15%

12%

11%

15%

19%

WESTLAKE CORPORATION

SUPPLEMENTAL

INFORMATION

Product Sales Price and Volume

Variance by Operating Segments

Fourth Quarter 2024 vs. Fourth

Quarter 2023

Fourth Quarter 2024 vs. Third

Quarter 2024

Average

Sales Price

Volume

Average

Sales Price

Volume

Housing and Infrastructure Products

-3%

+7%

-1%

-9%

Performance and Essential Materials

-2%

+1%

-7%

-1%

Company

-2%

+3%

-5%

-4%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218855957/en/

Contact—(713) 960-9111 Investors—Steve Bender Media—L. Benjamin

Ederington

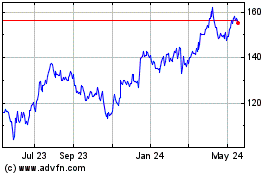

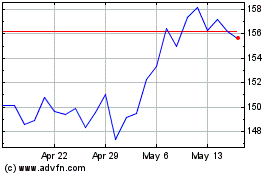

Westlake (NYSE:WLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Westlake (NYSE:WLK)

Historical Stock Chart

From Feb 2024 to Feb 2025