false000126282300012628232025-02-242025-02-240001262823us-gaap:CommonStockMember2025-02-242025-02-240001262823wlk:OnePointSixTwoFivePercentageSeniorNotesDueTwentyTwentyNineMemberDomain2025-02-242025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 24, 2025

Westlake Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-32260 | | 76-0346924 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 2801 Post Oak Boulevard, | | Suite 600 | | |

| Houston, | | Texas | | 77056 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (713) 960-9111

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | WLK | The New York Stock Exchange |

| 1.625% Senior Notes due 2029 | WLK29 | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Item 2.02. Results of Operations and Financial Condition.

On February 24, 2025, Westlake Corporation (the "Company") issued a press release announcing its 2024 fourth quarter and full year results. A copy of the press release is furnished with this Current Report as Exhibit 99.1.

The information furnished pursuant to this Current Report, including Exhibit 99.1, shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed by Westlake Corporation under the Securities Act of 1933, as amended, unless specifically identified as being incorporated therein.

Item 7.01. Regulation FD Disclosure.

The Company is holding a conference call on February 24, 2025 to discuss its 2024 fourth quarter and full year results. Information about the call can be found in the press release furnished with this Current Report as Exhibit 99.1. In addition, the Company made available an investor presentation regarding its 2024 fourth quarter and full year results, which is furnished with this Current Report as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished herewith:

104 The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | WESTLAKE CORPORATION |

| Date: | February 24, 2025 | | By: | /S/ JEAN-MARC GILSON |

| | | | Jean-Marc Gilson President and Chief Executive Officer |

EXHIBIT 99.1

WESTLAKE CORPORATION

Contact—(713) 960-9111

Investors—Steve Bender

Media—L. Benjamin Ederington

Westlake Corporation Reports Fourth Quarter and Full Year 2024 Results

•Record Housing and Infrastructure Products (HIP) annual income from operations of $807 million and EBITDA of $1.1 billion

•Fifth consecutive quarter of year-over-year growth in company-wide sales volume

HOUSTON--(BUSINESS WIRE)--Westlake Corporation (NYSE: WLK) (the "Company" or "Westlake") today announced fourth quarter and full year 2024 results.

SUMMARY FINANCIAL HIGHLIGHTS ($ in millions except per share data and percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended | | | | |

| | | December 31, | | September 30, | | December 31, | | December 31, | | | | |

| | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | | | | | |

| Westlake Corporation | | | | | | | | | | | | | | | |

| Net sales | | | $ | 2,843 | | $ | 3,117 | | $ | 2,826 | | $ | 12,142 | | $ | 12,548 | | | | |

Income (loss) from operations | | | $ | 66 | | $ | 180 | | $ | (552) | | $ | 875 | | $ | 729 | | | | |

Net income (loss) attributable to Westlake Corporation (1) | | | $ | 7 | | $ | 108 | | $ | (497) | | $ | 602 | | $ | 479 | | | | |

Diluted earnings (loss) per common share (1) | | | $ | 0.06 | | $ | 0.83 | | $ | (3.86) | | $ | 4.64 | | $ | 3.70 | | | | |

EBITDA | | | $ | 416 | | $ | 505 | | $ | (235) | | $ | 2,211 | | $ | 1,962 | | | | |

| | | | | | | | | | | | | | | |

Identified Items (2) | | | $ | — | | $ | 75 | | $ | 625 | | $ | 75 | | $ | 625 | | | | |

EBITDA excl. Identified Items | | | $ | 416 | | $ | 580 | | $ | 390 | | $ | 2,286 | | $ | 2,587 | | | | |

EBITDA margin (3) | | | 15% | | 19% | | 14% | | 19% | | 21% | | | | |

| | | | | | | | | | | | | | | |

| Housing and Infrastructure Products ("HIP") Segment | | | | | | | | | | | | | | | |

| Net sales | | | $ | 981 | | $ | 1,098 | | $ | 946 | | $ | 4,317 | | $ | 4,212 | | | | |

| Income from operations | | | $ | 129 | | $ | 202 | | $ | 121 | | $ | 807 | | $ | 710 | | | | |

| | | | | | | | | | | | | | | |

EBITDA | | | $ | 188 | | $ | 262 | | $ | 173 | | $ | 1,050 | | $ | 949 | | | | |

| EBITDA margin | | | 19% | | 24% | | 18% | | 24% | | 23% | | | | |

| | | | | | | | | | | | | | | |

| Performance and Essential Materials ("PEM") Segment | | | | | | | | | | | | | | | |

| Net sales | | | $ | 1,862 | | $ | 2,019 | | $ | 1,880 | | $ | 7,825 | | $ | 8,336 | | | | |

Income (loss) from operations | | | $ | (41) | | $ | (9) | | $ | (664) | | $ | 129 | | $ | 59 | | | | |

| | | | | | | | | | | | | | | |

EBITDA | | | $ | 220 | | $ | 222 | | $ | (424) | | $ | 1,086 | | $ | 965 | | | | |

| | | | | | | | | | | | | | | |

Identified Items (2) | | | $ | — | | $ | 75 | | $ | 625 | | $ | 75 | | $ | 625 | | | | |

EBITDA excl. Identified Items | | | $ | 220 | | $ | 297 | | $ | 201 | | $ | 1,161 | | $ | 1,590 | | | | |

EBITDA margin (3) | | | 12% | | 15% | | 11% | | 15% | | 19% | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

______________________________

(1)Includes $45 million ($0.35 per share) one-time non-cash charge related to changes in Louisiana tax law in the fourth quarter and full year 2024

(2)"Identified Items" for 2024 represents $75 million accrued expense to temporarily cease operations ("mothball") of the allyl chloride (AC) and epichlorohydrin (ECH) units at the Company's site in Pernis, the Netherlands, and for 2023 are a $475 million non-cash impairment charge and a $150 million charge to fully resolve certain liability claims

(3)Excludes Identified Items

BUSINESS HIGHLIGHTS

In the fourth quarter of 2024, Westlake reported net sales of $2.8 billion and net income of $7 million, or $0.06 per share including $0.35 per share from a one-time non-cash tax charge. Fourth quarter EBITDA (earnings before interest expense, income taxes, depreciation and amortization) of $416 million was higher than EBITDA of $390 million (excluding "Identified Items") in the prior-year period driven by higher sales volume in each segment.

For the full year of 2024, Westlake reported net sales of $12.1 billion, net income of $677 million (excluding "Identified Items") and EBITDA of $2.3 billion (excluding "Identified Items"). Compared to the prior-year financial results, the Company's 2024 results benefitted from higher sales volume, particularly in HIP, which was offset by lower product pricing and margins, particularly in PEM.

Westlake's fourth quarter of 2024 sales increased 1% year-over-year, driven by 3% sales volume growth, representing the fifth consecutive quarter of year-over-year sales volume growth, and a 2% decline in average sales price. Housing and Infrastructure Products sales increased 4%, driven by 7% sales volume growth that more than offset a 3% decline in average sales price. Performance and Essential Materials sales decreased 1% over the same period of time, as 1% sales volume growth was slightly less than a 2% decline in average sales price.

EXECUTIVE COMMENTARY

"Westlake generated solid sales volume growth in 2024, in part due to innovative new product introductions, export opportunities enabled by our globally-advantaged feedstock & energy cost position in our Performance and Essential Materials segment in spite of globally weak macroeconomic conditions the industry is experiencing, and our position as a leading supplier to faster-growing national homebuilders in our Housing and Infrastructure Products segment. HIP segment EBITDA increased more than 10% compared to 2023 as our sales volume growth outperformed the growth in the overall market while our cost-saving actions improved profitability. While earnings in our PEM segment were lower compared to 2023 due to lower average sales price as a result of weak global industrial and manufacturing activity, we made important progress during 2024 to improve our cost structure through productivity enhancements and the decision to mothball the AC and ECH units at our epoxy site in Pernis, The Netherlands," said Jean-Marc Gilson, President and Chief Executive Officer.

"Compared to the prior-year period our fourth quarter sales volume grew in each segment, highlighted by 7% sales volume growth in our HIP segment, which was solid compared to a challenging macroeconomic backdrop that impacted the industry. However, during the fourth quarter sales volume growth was largely offset by lower average sales price in each segment. While company-wide sales were relatively flat with the prior-year period, Westlake was able to increase EBITDA by 7% in the fourth quarter through targeted cost-reduction actions," continued Mr. Gilson.

"Looking ahead to 2025, we are optimistic on the outlook for our HIP segment, underpinned by the need to expand the supply of residential housing in the U.S. after over 15 years of under-building to support population growth and resulting housing demand. While global macroeconomic conditions remain challenging to start the year, our PEM segment is well-positioned to capitalize on an eventual recovery in global industrial and manufacturing activity. Our focus for 2025 will be on improving the components of earnings growth that are within our control, including executing on our cost-saving plans, increasing the value that we provide to our customers, ensuring the safety and reliability of our plants, and commercializing new product innovations," concluded Mr. Gilson.

RESULTS

Consolidated Results

(Unless otherwise noted the financial numbers below exclude the Identified Items)

For the three months ended December 31, 2024, the Company reported net income of $7 million, or $0.06 per share, on net sales of $2.8 billion. The year-over-year decrease in net income of $86 million was primarily due to a one-time non-cash charge of approximately $45 million in the fourth quarter of 2024 for the revaluation of state deferred tax assets and deferred tax liabilities caused by recent legislative changes in Louisiana.

Fourth quarter 2024 net income of $7 million decreased by $176 million sequentially as compared to the third quarter of 2024. The decrease in net income compared to the prior quarter was primarily due to lower sales prices in Performance Materials and seasonally lower Housing and Infrastructure Products sales volume.

EBITDA of $416 million for the fourth quarter of 2024 increased by $26 million compared to fourth quarter 2023 EBITDA of $390 million. Fourth quarter 2024 EBITDA decreased by $164 million compared to third quarter 2024 EBITDA of $580 million.

For the full year of 2024, net income of $677 million decreased by $392 million as compared to 2023 net income of $1.1 billion. Income from operations of $1.0 billion for the full year of 2024 decreased by $0.4 billion as compared to income from operations of $1.4 billion for the full year of 2023. The decreases in net income and income from operations were primarily due to lower average selling price, particularly in Performance and Essential Materials.

A reconciliation of EBITDA and net income to EBITDA excluding Identified Items and net income excluding Identified Items as well as a reconciliation of EBITDA to net income, income from operations (including and excluding Identified Items) and net cash provided by operating activities as well as a reconciliation of free cash flow to net cash flow provided by operating activities can be found in the financial schedules at the end of this press release.

Cash and Debt

Net cash provided by operating activities was $434 million for the fourth quarter of 2024 and $1.3 billion for the full year of 2024. Capital expenditures for the fourth quarter and full year of 2024 were $285 million and $1.0 billion, respectively. For the fourth quarter and full year of 2024, free cash flow (net cash provided by operating activities less capital expenditures) was $149 million and $306 million, respectively. As of December 31, 2024, the Company's cash and cash equivalents balance was $2.9 billion and total debt was $4.6 billion.

Housing and Infrastructure Products Segment

For the fourth quarter of 2024, Housing and Infrastructure Products income from operations of $129 million increased by $8 million as compared to the fourth quarter of 2023. The year-over-year increase was the result of higher sales volume, particularly for pipe and fittings.

Sequentially, Housing and Infrastructure Products income from operations decreased by $73 million as compared to the third quarter of 2024. This decrease in income from operations versus the prior quarter was primarily driven by lower sales volume as a result of the typical seasonality of customer demand.

For the full year of 2024, Housing and Infrastructure Products net sales of $4.3 billion increased by $0.1 billion as compared to 2023. Housing Products net sales of $3.6 billion increased by $0.1 billion due to solid sales volume growth, particularly in siding & trim and roofing. Infrastructure Products net sales of $0.7 billion was in line with 2023 as higher sales volume offset lower average sales price. Housing and Infrastructure Products income from operations of $807 million increased by $97 million as compared to the full year of 2023 primarily due to growth in Housing Products net sales and cost-saving initiatives.

Performance and Essential Materials Segment

(Unless otherwise noted the financial numbers below exclude the Identified Items)

For the fourth quarter of 2024, Performance and Essential Materials loss from operations was $41 million as compared to the fourth quarter of 2023's loss from operations of $39 million due to lower selling prices for most of our major products, particularly for chlorine, PVC resin and polyethylene. This negative impact was partially offset by higher sales volume, particularly for polyethylene and PVC resin.

Sequentially, Performance and Essential Materials income from operations for the fourth quarter of 2024 decreased by $107 million as compared to the third quarter of 2024 (excluding "Identified Items"). This decrease in income from operations versus the prior quarter was primarily driven by lower average sales price.

For the full year of 2024, Performance and Essential Materials net sales of $7.8 billion decreased by $0.5 billion as compared to 2023. Performance Materials net sales of $4.6 billion in 2024 were relatively in line with 2023 net sales of $4.7 billion as higher sales volume, particularly for PVC resin and epoxy resin, offset lower average sales price, particularly for PVC resin and epoxy resin. Essential Materials net sales of $3.2 billion decreased by $0.5 billion from 2023 primarily due to lower caustic soda average sales price. Performance and Essential Materials income from operations of $204 million decreased by $480 million as compared to 2023. This decrease in income from operations versus the prior-year was primarily driven by lower average sales price and margins.

Forward-Looking Statements

The statements in this release and the related teleconference relating to matters that are not historical facts, including statements regarding our outlook for the performance of our business segments (such as our optimistic outlook for our HIP segment), global macroeconomic conditions (including an eventual recovery in global industrial and manufacturing activity), housing demand, impacts of tariffs and duties, continuing stabilization of sales prices and volumes in both domestic and export markets for most of our products, our market position, our ability to improve safety, reliability and efficiency of our plants, further commercialization of new product innovations, our cost savings initiatives, including the effect of our decision to mothball part of our epoxy operations, global demand for our products, and our ability to deliver greater value to customers are forward-looking statements.

These forward-looking statements are subject to significant risks and uncertainties. Actual results could differ materially, based on factors including, but not limited to: general economic and business conditions; the cyclical nature of the industry; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, European and worldwide economies, including those due to political tensions and conflict in the Middle East, Russia and Ukraine and elsewhere; uncertainties associated with barriers to international trade, including the imposition of tariffs and duties or trade disputes; uncertainties associated with climate change; the potential impact on demand for ethylene, polyethylene and polyvinyl chloride due to initiatives such as recycling and customers seeking alternatives to polymers; current and potential governmental regulatory actions in the United States and other countries; industry production capacity and operating rates; the supply/demand balance for Westlake's products; competitive products and pricing pressures, including from global competitors; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions; changes in laws and regulations, including trade policies; technological developments; information systems failures and cyberattacks; foreign currency exchange risks; our ability to implement our business strategies; creditworthiness of our customers; the effect and results of litigation and settlements of litigation; and other risk factors. For more detailed information about the factors that could cause actual results to differ materially, please refer to Westlake's Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC in February 2024, and Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which was filed with the SEC in November 2024.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial measures, such as EBITDA, free cash flow and other measures that exclude the effects of the Identified Items, as defined in Regulation G of the U.S. Securities Exchange Act of 1934, as amended. For this purpose, a non-GAAP financial measure is generally defined by the Securities and Exchange Commission ("SEC") as a numerical measure of a registrant's historical or future financial performance, financial position or cash flows that (1) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or (2) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. We report our financial results in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"), but believe that certain non-GAAP financial measures, such as EBITDA, free cash flow and measures that exclude the effects of the Identified Items, provide useful supplemental information to investors regarding the underlying business trends and performance of the Company's ongoing operations and are useful for period-over-period comparisons of such operations. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with U.S. GAAP. A reconciliation of (i) EBITDA to net income, income from operations and net cash provided by operating activities, (ii) free cash flow to net cash provided by operating activities, and (iii) other measures reflecting adjustments for the effects of the Identified Items can be found in the financial schedules at the end of this press release.

About Westlake

Westlake is a global manufacturer and supplier of materials and innovative products that enhance life every day. Headquartered in Houston, with operations in Asia, Europe and North America, we provide the building blocks for vital solutions — from housing and construction, to packaging and healthcare, to automotive and consumer. For more information, visit the Company's web site at www.westlake.com.

Westlake Corporation Conference Call Information:

A conference call to discuss Westlake Corporation's fourth quarter and full year 2024 results will be held Monday, February 24, 2025 at 11:00 AM Eastern Time (10:00 AM Central Time). To access the conference call, it is necessary to pre-register at https://register.vevent.com/register/BI72061c1352d74b3482abead232a4bf93. Once registered, you will receive a phone number and unique PIN number.

A replay of the conference call will be available beginning two hours after its conclusion. The conference call and replay will be available via webcast at https://edge.media-server.com/mmc/p/9nttceuz.

WESTLAKE CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| | (In millions of dollars, except per share data and share amounts) |

| Net sales | | $ | 2,843 | | | $ | 2,826 | | | $ | 12,142 | | | $ | 12,548 | |

| Cost of sales | | 2,515 | | | 2,627 | | | 10,185 | | | 10,329 | |

| Gross profit | | 328 | | | 199 | | | 1,957 | | | 2,219 | |

| Selling, general and administrative expenses | | 226 | | | 224 | | | 874 | | | 865 | |

Impairment of goodwill and long-lived assets | | — | | | 475 | | | — | | | 475 | |

| Amortization of intangibles | | 28 | | | 30 | | | 117 | | | 122 | |

| Restructuring, transaction and integration-related costs | | 8 | | | 22 | | | 91 | | | 28 | |

Income (loss) from operations | | 66 | | | (552) | | | 875 | | | 729 | |

| Interest expense | | (39) | | | (41) | | | (159) | | | (165) | |

| Other income, net | | 69 | | | 35 | | | 222 | | | 136 | |

Income (loss) before income taxes | | 96 | | | (558) | | | 938 | | | 700 | |

Provision for (benefit from) income taxes | | 77 | | | (71) | | | 291 | | | 178 | |

Net income (loss) | | 19 | | | (487) | | | 647 | | | 522 | |

| Net income attributable to noncontrolling interests | | 12 | | | 10 | | | 45 | | | 43 | |

Net income (loss) attributable to Westlake Corporation | | $ | 7 | | | $ | (497) | | | $ | 602 | | | $ | 479 | |

Earnings (loss) per common share attributable to Westlake Corporation: | | | | | | | | |

| Basic | | $ | 0.06 | | | $ | (3.86) | | | $ | 4.66 | | | $ | 3.73 | |

| Diluted | | $ | 0.06 | | | $ | (3.86) | | | $ | 4.64 | | | $ | 3.70 | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | 128,564,101 | | | 128,165,690 | | | 128,535,226 | | | 127,806,317 | |

| Diluted | | 129,115,674 | | | 128,165,690 | | | 129,206,922 | | | 128,598,441 | |

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | |

| | December 31, |

| | 2024 | | 2023 |

| | | | |

| | (In millions of dollars) |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 2,919 | | | $ | 3,304 | |

| Accounts receivable, net | | 1,483 | | | 1,601 | |

| Inventories | | 1,697 | | | 1,622 | |

| Prepaid expenses and other current assets | | 115 | | | 82 | |

| | | | |

| Total current assets | | 6,214 | | | 6,609 | |

| Property, plant and equipment, net | | 8,633 | | | 8,519 | |

| | | | |

| Other assets, net | | 5,903 | | | 5,907 | |

| Total assets | | $ | 20,750 | | | $ | 21,035 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities (accounts payable and accrued and other liabilities) | | $ | 2,213 | | | $ | 2,491 | |

| Current portion of long-term debt, net | | 6 | | | 299 | |

| | | | |

| Long-term debt, net | | 4,556 | | | 4,607 | |

| | | | |

| Other liabilities | | 2,932 | | | 2,874 | |

| Total liabilities | | 9,707 | | | 10,271 | |

| Total Westlake Corporation stockholders' equity | | 10,527 | | | 10,241 | |

| Noncontrolling interests | | 516 | | | 523 | |

| Total equity | | 11,043 | | | 10,764 | |

| Total liabilities and equity | | $ | 20,750 | | | $ | 21,035 | |

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2024 | | 2023 |

| | | | |

| | (In millions of dollars) |

| Cash flows from operating activities | | | | |

| Net income | | $ | 647 | | | $ | 522 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 1,114 | | | 1,097 | |

| Impairment of goodwill and long-lived assets | | — | | | 475 | |

| Deferred income taxes | | (35) | | | (175) | |

| Net loss on disposition and others | | 57 | | | 85 | |

| Other balance sheet changes | | (469) | | | 332 | |

| Net cash provided by operating activities | | 1,314 | | | 2,336 | |

| Cash flows from investing activities | | | | |

| Acquisition of business, net of cash acquired | | — | | | — | |

| Additions to investments in unconsolidated subsidiaries | | (26) | | | (25) | |

| Additions to property, plant and equipment | | (1,008) | | | (1,034) | |

| | | | |

| Other, net | | 33 | | | 22 | |

| Net cash used for investing activities | | (1,001) | | | (1,037) | |

| Cash flows from financing activities | | | | |

| | | | |

| Distributions to noncontrolling interests | | (49) | | | (54) | |

| Dividends paid | | (264) | | | (221) | |

Proceeds from exercise of stock options | | 13 | | | 44 | |

| | | | |

| | | | |

| | | | |

| Repayment of senior notes | | (300) | | | — | |

| Repurchase of common stock for treasury | | (60) | | | (23) | |

| Other, net | | 10 | | | 9 | |

Net cash used for financing activities | | (650) | | | (245) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | | (47) | | | 19 | |

Net increase (decrease) in cash, cash equivalents and restricted cash | | (384) | | | 1,073 | |

| Cash, cash equivalents and restricted cash at beginning of period | | 3,319 | | | 2,246 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 2,935 | | | $ | 3,319 | |

| | | | |

WESTLAKE CORPORATION

SEGMENT INFORMATION

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| | (In millions of dollars) |

| Net external sales | | | | | | | | |

| Housing and Infrastructure Products | | | | | | | | |

| Housing Products | | $ | 818 | | | $ | 795 | | | $ | 3,644 | | | $ | 3,494 | |

| Infrastructure Products | | 163 | | | 151 | | | 673 | | | 718 | |

| Total Housing and Infrastructure Products | | 981 | | | 946 | | | 4,317 | | | 4,212 | |

| Performance and Essential Materials | | | | | | | | |

| Performance Materials | | 1,121 | | | 1,107 | | | 4,626 | | | 4,656 | |

| Essential Materials | | 741 | | | 773 | | | 3,199 | | | 3,680 | |

| Total Performance and Essential Materials | | 1,862 | | | 1,880 | | | 7,825 | | | 8,336 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total reportable segments and consolidated | | $ | 2,843 | | | $ | 2,826 | | | $ | 12,142 | | | $ | 12,548 | |

| | | | | | | | |

| Income (loss) from operations | | | | | | | | |

| | | | | | | | |

| Housing and Infrastructure Products | | $ | 129 | | | $ | 121 | | | $ | 807 | | | $ | 710 | |

| Performance and Essential Materials | | (41) | | | (664) | | | 129 | | | 59 | |

Total reportable segments | | 88 | | | (543) | | | 936 | | | 769 | |

| Corporate and other | | (22) | | | (9) | | | (61) | | | (40) | |

Consolidated | | $ | 66 | | | $ | (552) | | | $ | 875 | | | $ | 729 | |

| | | | | | | | |

| Depreciation and amortization | | | | | | | | |

| Housing and Infrastructure Products | | $ | 56 | | | $ | 50 | | | $ | 213 | | | $ | 207 | |

| Performance and Essential Materials | | 223 | | | 229 | | | 892 | | | 881 | |

| | | | | | | | |

Total reportable segments | | 279 | | | 279 | | | 1,105 | | | 1,088 | |

| Corporate and other | | 2 | | | 3 | | | 9 | | | 9 | |

Consolidated | | $ | 281 | | | $ | 282 | | | $ | 1,114 | | | $ | 1,097 | |

| | | | | | | | |

| Other income, net | | | | | | | | |

| Housing and Infrastructure Products | | $ | 3 | | | $ | 2 | | | $ | 30 | | | $ | 32 | |

| Performance and Essential Materials | | 38 | | | 11 | | | 65 | | | 25 | |

| | | | | | | | |

| Total reportable segments | | 41 | | | 13 | | | 95 | | | 57 | |

| Corporate and other | | 28 | | | 22 | | | 127 | | | 79 | |

Consolidated | | $ | 69 | | | $ | 35 | | | $ | 222 | | | $ | 136 | |

WESTLAKE CORPORATION

RECONCILIATION OF EBITDA TO NET INCOME AND INCOME FROM OPERATIONS AND

NET CASH PROVIDED BY OPERATING ACTIVITIES (INCLUDING AND EXCLUDING IDENTIFIED ITEMS)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended December 31, | | Twelve Months Ended December 31, | |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 | |

| | | | | | | | | | | |

| | (In millions of dollars, except percentages) | |

Net cash provided by operating activities | | $ | 474 | | | $ | 434 | | | $ | 573 | | | $ | 1,314 | | | $ | 2,336 | | |

| Changes in operating assets and liabilities and other | | (354) | | | (392) | | | (1,168) | | | (702) | | | (1,989) | | |

| Deferred income taxes | | — | | | (23) | | | 108 | | | 35 | | | 175 | | |

Net income (loss) | | 120 | | | 19 | | | (487) | | | 647 | | | 522 | | |

| Add: | | | | | | | | | | | |

Mothball expenses in 2024 / Impairment charge in 2023 | | 75 | | | — | | | 475 | | | 75 | | | 475 | | |

Litigation settlement charge, after-tax | | — | | | — | | | 115 | | | — | | | 115 | | |

Net income excl. Identified Items | | $ | 195 | | | $ | 19 | | | $ | 103 | | | $ | 722 | | | $ | 1,112 | | |

| | | | | | | | | | | |

| Net income (loss) | | $ | 120 | | | $ | 19 | | | $ | (487) | | | $ | 647 | | | $ | 522 | | |

| Less: | | | | | | | | | | | |

| Other income, net | | 44 | | | 69 | | | 35 | | | 222 | | | 136 | | |

| Interest expense | | (39) | | | (39) | | | (41) | | | (159) | | | (165) | | |

Benefit from (provision for) income taxes | | (65) | | | (77) | | | 71 | | | (291) | | | (178) | | |

Income (loss) from operations | | 180 | | | 66 | | | (552) | | | 875 | | | 729 | | |

| Add: | | | | | | | | | | | |

Mothball expenses in 2024 / Impairment charge in 2023 | | 75 | | | — | | | 475 | | | 75 | | | 475 | | |

Litigation settlement charge, pre-tax | | — | | | — | | | 150 | | | — | | | 150 | | |

Income from operations excl. Identified Items | | 255 | | | 66 | | | 73 | | | 950 | | | 1,354 | | |

| Add: | | | | | | | | | | | |

| Depreciation and amortization | | 281 | | | 281 | | | 282 | | | 1,114 | | | 1,097 | | |

| Other income, net | | 44 | | | 69 | | | 35 | | | 222 | | | 136 | | |

EBITDA excl. Identified Items | | 580 | | | 416 | | | 390 | | | 2,286 | | | 2,587 | | |

| Less: | | | | | | | | | | | |

Mothball expenses in 2024 / Impairment charge in 2023 | | 75 | | | — | | | 475 | | | 75 | | | 475 | | |

Litigation settlement charge, pre-tax | | — | | | — | | | 150 | | | — | | | 150 | | |

EBITDA | | $ | 505 | | | $ | 416 | | | $ | (235) | | | $ | 2,211 | | | $ | 1,962 | | |

| Net external sales | | $ | 3,117 | | | $ | 2,843 | | | $ | 2,826 | | | $ | 12,142 | | | $ | 12,548 | | |

Operating income (loss) margin | | 6% | | 2% | | (20)% | | 7% | | 6% | |

Operating income margin excl. Identified Items | | 8% | | 2% | | 3% | | 8% | | 11% | |

EBITDA margin | | 16% | | 15% | | (8)% | | 18% | | 16% | |

EBITDA margin excl. Identified Items | | 19% | | 15% | | 14% | | 19% | | 21% | |

WESTLAKE CORPORATION

RECONCILIATION OF DILUTED EARNINGS PER COMMON SHARE TO DILUTED EARNINGS PER COMMON SHARE EXCLUDING IDENTIFIED ITEMS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| | (per share data) |

Diluted earnings (loss) per common share attributable to Westlake Corporation | | $ | 0.83 | | $ | 0.06 | | $ | (3.86) | | $ | 4.64 | | $ | 3.70 |

| Add: | | | | | | | | | | |

Mothball expenses in 2024 / Impairment charge in 2023 | | 0.58 | | — | | 3.69 | | 0.58 | | 3.68 |

Litigation settlement charge | | — | | — | | 0.89 | | — | | 0.89 |

Diluted earnings per common share attributable to Westlake Corporation excl. Identified Items | | $ | 1.41 | | $ | 0.06 | | $ | 0.72 | | $ | 5.22 | | $ | 8.27 |

WESTLAKE CORPORATION

RECONCILIATION OF FREE CASH FLOW TO NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| | (In millions of dollars) |

Net cash provided by operating activities | | $ | 474 | | | $ | 434 | | | $ | 573 | | | $ | 1,314 | | | $ | 2,336 | |

| Less: | | | | | | | | | | |

| Additions to property, plant and equipment | | 220 | | | 285 | | | 282 | | | 1,008 | | | 1,034 | |

Free cash flow | | $ | 254 | | | $ | 149 | | | $ | 291 | | | $ | 306 | | | $ | 1,302 | |

WESTLAKE CORPORATION

RECONCILIATION OF HIP SEGMENT EBITDA TO INCOME FROM OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| | (In millions of dollars, except percentages) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Housing and Infrastructure Products Segment | | | | | | | | | | |

| Income from operations | | $ | 202 | | | $ | 129 | | | $ | 121 | | | $ | 807 | | | $ | 710 | |

| Add: | | | | | | | | | | |

| Depreciation and amortization | | 54 | | | 56 | | | 50 | | | 213 | | | 207 | |

| Other income, net | | 6 | | | 3 | | | 2 | | | 30 | | | 32 | |

| EBITDA | | $ | 262 | | | $ | 188 | | | $ | 173 | | | $ | 1,050 | | | $ | 949 | |

| Net external sales | | $ | 1,098 | | | $ | 981 | | | $ | 946 | | | $ | 4,317 | | | $ | 4,212 | |

Operating income margin | | 18% | | 13% | | 13% | | 19% | | 17% |

EBITDA margin | | 24% | | 19% | | 18% | | 24% | | 23% |

WESTLAKE CORPORATION

RECONCILIATION OF PEM SEGMENT EBITDA TO INCOME FROM OPERATIONS (INCLUDING AND EXCLUDING IDENTIFIED ITEMS)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | |

| | (In millions of dollars, except percentages) |

| Performance and Essential Materials Segment | | | | | | | | | | |

Income (loss) from operations | | $ | (9) | | | $ | (41) | | | $ | (664) | | | $ | 129 | | | $ | 59 | |

| Add: | | | | | | | | | | |

Mothball expenses in 2024 / Impairment charge in 2023 | | 75 | | | — | | | 475 | | | 75 | | | 475 | |

Litigation settlement charge | | — | | | — | | | 150 | | | — | | | 150 | |

Income (loss) from operations excl. Identified Items | | 66 | | | (41) | | | (39) | | | 204 | | | 684 | |

| Add: | | | | | | | | | | |

| Depreciation and amortization | | 225 | | | 223 | | | 229 | | | 892 | | | 881 | |

| Other income, net | | 6 | | | 38 | | | 11 | | | 65 | | | 25 | |

EBITDA excl. Identified Items | | 297 | | | 220 | | | 201 | | | 1,161 | | | 1,590 | |

| Less: | | | | | | | | | | |

Mothball expenses in 2024 / Impairment charge in 2023 | | 75 | | | — | | | 475 | | | 75 | | | 475 | |

Litigation settlement charge | | — | | | — | | | 150 | | | — | | | 150 | |

EBITDA | | $ | 222 | | | $ | 220 | | | $ | (424) | | | $ | 1,086 | | | $ | 965 | |

| Net external sales | | $ | 2,019 | | | $ | 1,862 | | | $ | 1,880 | | | $ | 7,825 | | | $ | 8,336 | |

Operating income (loss) margin | | —% | | (2)% | | (35)% | | 2% | | 1% |

Operating income (loss) margin excl. Identified Items | | 3% | | (2)% | | (2)% | | 3% | | 8% |

EBITDA margin | | 11% | | 12% | | (23)% | | 14% | | 12% |

EBITDA margin excl. Identified Items | | 15% | | 12% | | 11% | | 15% | | 19% |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

WESTLAKE CORPORATION

SUPPLEMENTAL INFORMATION

Product Sales Price and Volume Variance by Operating Segments

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter 2024 vs. Fourth Quarter 2023 | | Fourth Quarter 2024 vs. Third Quarter 2024 |

| | Average

Sales Price | | Volume | | Average

Sales Price | | Volume |

| | | | | | | | |

| Housing and Infrastructure Products | | -3 | % | | +7 | % | | -1 | % | | -9 | % |

| Performance and Essential Materials | | -2 | % | | +1 | % | | -7 | % | | -1 | % |

| Company | | -2 | % | | +3 | % | | -5 | % | | -4 | % |

1 Earnings Presentation 4Q and Full Year 2024

2 Fourth Quarter and Full Year 2024 Highlights Fifth consecutive quarter of YoY sales volume growth with momentum into 2025 • Record Housing and Infrastructure Products (HIP) 2024 income from operations of $807 million driven by our position as a key supplier to faster-growing national homebuilders • Record HIP 2024 EBITDA of $1.1 billion and 2024 EBITDA margin of 24% • Strong HIP YoY sales volume growth of 7% in 4Q’24 and 8% in FY’24 driven by strong demand for siding & trim and pipe & fittings • $170 million of cost savings in FY’24, including $50 million in 4Q’24, exceeding target • Net Income includes ~$45 million ($0.35/share) impact from a one-time non-cash charge related to changes in Louisiana tax law • Investment-grade credit rating with $2.9 billion of cash and equivalents $2.8B Net Sales 1% increase YoY $416M EBITDA(1) 7% increase YoY (2) $434M Net Cash Provided by Operating Activities (1) Reconciliation of EBITDA excl. Identified Item to Net Income, Income from Operations and Net Cash Provided by Operating Activities can be found on page 12 (2) Excludes “Identified Items” consisting of $75 million accrued mothball expenses in 3Q’24 and FY’24 as well as a $475 million non-cash impairment charge and a $150 million charge to fully resolve certain liability claims in 4Q’23 and FY’23 $12.1B Net Sales 3% decrease YoY $2.3B EBITDA(1,2) 12% decrease YoY(2) $1.3B Net Cash Provided by Operating Activities 4Q 2024 Financial Results FY 2024 Financial Results

3 Westlake Corporation 4Q and FY 2024(1) Strong YoY EBITDA growth of 7% in 4Q’24 driven by sales volume growth and cost reduction efforts Exceeded our FY’24 cost reduction target by achieving $170 million of cost savings, including $50 million in 4Q’24 Westlake 4Q 2024 vs. 3Q 2024 Average Sales Price -5.0% Volume -3.8% Westlake 4Q 2024 vs. 4Q 2023 Average Sales Price -2.4% Volume +3.0% (1) Excludes “Identified Items” consisting of $75 million accrued mothball expenses in 3Q’24 and FY’24 as well as a $475 million non-cash impairment charge and a $150 million charge to fully resolve certain liability claims in 4Q’23 and FY’23 (2) Reconciliations of EBITDA excl. Identified Item, Performance and Essential Materials EBITDA excl. Identified Item, Housing and Infrastructure Products EBITDA and Corporate EBITDA to the applicable GAAP measures can be found on pages 12 and 13 (3) EBITDA margin is calculated by dividing EBITDA by Total Sales Solid YoY sales volume growth of 3% driven by stronger seasonal demand in our HIP segment Lower average sales price as the cumulative impact of weak global industrial and manufacturing activity pressured prices, particularly for chlorovinyls 4Q'24 3Q'24 QoQ% 4Q'23 YoY% FY'24 FY'23 YoY% $2,843 $3,117 (9%) $2,826 1% $12,142 $12,548 (3%) $66 $255 (74%) $73 (10%) $950 $1,354 (30%) Housing and Infrastructure Products $188 $262 (28%) $173 9% $1,050 $949 11% Performance and Essential Materials $220 $297 (26%) $201 9% $1,161 $1,590 (27%) Corporate $8 $21 - $16 - $75 $48 - $416 $580 (28%) $390 7% $2,286 $2,587 (12%) EBITDA Margin (1,3) 15% 19% - 14% - 19% 21% - Operating Income(1) Sales EBITDA(1,2) ($ in millions)

4 Housing and Infrastructure Products (“HIP”) Segment Performance HIP Segment 4Q 2024 vs. 3Q 2024 Average Sales Price -1.3% Volume -9.4% HIP Segment 4Q 2024 vs. 4Q 2023 Average Sales Price -3.4% Volume +6.9% Strong 7% YoY sales volume growth driven by continuing strong demand for pipe & fittings and siding & trim Record annual Operating Income of $807 million, EBITDA of $1.1 billion and EBITDA margin of 24%(2) Competitive market pressures lowered average sales price YoY in pipe & fittings (1) Reconciliations of HIP EBITDA to the applicable GAAP measure can be found on page 13 (2) HIP EBITDA margin is calculated by dividing HIP EBITDA by Total HIP Sales 4Q'24 3Q'24 QoQ% 4Q'23 YoY% FY'24 FY'23 YoY% Housing Products Sales $818 $937 (13%) $795 3% $3,644 $3,494 4% Infrastructure Products Sales $163 $161 1% $151 8% $673 $718 (6%) Total HIP Sales $981 $1,098 (11%) $946 4% $4,317 $4,212 2% Operating Income $129 $202 (36%) $121 7% $807 $710 14% EBITDA(1) $188 $262 (28%) $173 9% $1,050 $949 11% EBITDA Margin (2) 19% 24% - 18% - 24% 23% - ($ in millions) Solid YoY EBITDA margin improvement driven by efficiencies created by strong sales volume growth and cost cutting actions

5 Historical HIP Performance $260 $388 $534 $955 $949 $1,050 13.5% 18.5% 17.2% 20.0% 22.5% 24.3% 2019 2020 2021 2022 2023 2024 EBITDA EBITDA Margin⁽¹⁾ HIP EBITDA ($M) AND EBITDA MARGIN (%) • Strong end market demand • Partnerships with nationwide homebuilders who are gaining market share • Coast-to-coast footprint • Product mix and product innovation • Cost controls • Pricing • Automation and efficiency • Synergies from acquisitions and cross-selling (1) HIP EBITDA margin is calculated by dividing HIP EBITDA by Total HIP Sales

6 Housing and Infrastructure Products Update 2 Expecting another year of solid sales growth for Westlake Royal Building Products in 2025, consistent with its 5%-7% long-term sales growth target, and HIP’s sales volume and order books are solid to start the year 3 New PVCO pipe plant under construction to support the strong growth and market adoption for this innovative product that streamlines the installation process reducing labor costs with a sustainable footprint 4 Strong presence in repair & remodel provides stability and steady growth driven by large number of homes in prime remodel age, healthy home equity levels, and significant backlog of projects 1 Longer-term housing fundamentals remain strong due to decade-plus of under-building, increasingly favorable demographics and popularity of remote work

7 PEM Segment 4Q 2024 vs. 3Q 2024 Average Sales Price -7.0% Volume -0.7% PEM Segment 4Q 2024 vs. 4Q 2023 Average Sales Price -1.9% Volume +1.0% Lower average sales price, both QoQ and YoY, driven by lower prices for PVC resin and polyethylene, partially offset by higher prices for caustic soda 4Q’24 EBITDA impacted by an unfavorable FIFO impact (1) Excludes “Identified Items” consisting of $75 million accrued mothball expenses in 3Q’24 and FY’24 as well as a $475 million non-cash impairment charge and a $150 million charge to fully resolve certain liability claims in 4Q’23 and FY’23 (2) Reconciliations of PEM EBITDA excl. Identified Item to the applicable GAAP measure can be found on page 13 (3) PEM EBITDA margin is calculated by dividing PEM EBITDA excl. Identified Item by Total PEM Sales Performance and Essential Materials (“PEM”) Segment Performance(1) Sales volume grew 1% YoY driven by strong demand for polyethylene into export markets 4Q'24 3Q'24 QoQ% 4Q'23 YoY% FY'24 FY'23 YoY% Performance Materials Sales $1,121 $1,164 (4%) $1,107 1% $4,626 $4,656 (1%) Essential Materials Sales $741 $855 (13%) $773 (4%) $3,199 $3,680 (13%) Total PEM Sales $1,862 $2,019 (8%) $1,880 (1%) $7,825 $8,336 (6%) Operating Income(1) ($41) $66 N.M. ($39) N.M. $204 $684 (70%) EBITDA(1,2) $220 $297 (26%) $201 9% $ 1,161 $1,590 (27%) EBITDA Margin (1,3) 12% 15% - 11% - 15% 19% - ($ in millions)

8 Performance and Essential Materials Update 2 Continued energy and feedstock advantage in North America (~85% of our production capacity) with a high degree of vertical integration relative to the global industry, which supports our ability to profitably run our plants at high operating rates 3 Relatively stable North American demand as global macroeconomic conditions remain sluggish in Europe and Asia, but Westlake’s high degree of product integration and large offtake of PVC resin to the HIP segment provide less exposure to weaker economies outside North America 4 Long-term growth fundamentals remain in place, supported by the global need for clean water, housing, transportation, renewable energy, packaging and consumer goods 1 Early 2025 price increase initiatives are gaining traction in a number of products, supported by stable-to-improving global demand and feedstock & energy cost inflation

99 Financial Reconciliations

10 Consolidated Statements of Operations Housing and Infrastructure Products Sales $ 981 $ 946 $ 1,098 $ 4,317 $ 4,212 Performance and Essential Materials Sales 1,862 1,880 2,019 7,825 8,336 Net sales 2,843 2,826 3,117 12,142 12,548 Cost of sales Gross profit Selling, general and administrative expenses Impairment of goodwill and long-lived assets Amortization of intangibles Restructuring, transaction and integration-related costs Income (loss) from operations Interest expense Other income, net Income (loss) before income taxes Provision for (benefit from) income taxes Net income (loss) Net income attributable to noncontrolling interests Net income (loss) attributable to Westlake Corporation $ 7 $ (497) $ 108 $ 602 $ 479 Earnings (loss) per common share attributable to Westlake Corporation: Basic $ 0.06 $ (3.86) $ 0.84 $ 4.66 $ 3.73 Diluted $ 0.06 $ (3.86) $ 0.83 $ 4.64 $ 3.70 10 45 43 12 12 120 (71) 291 178 75 180 (39) 44 2023 2024 2023 (In millions of dollars, except per share data) 185 65 77 (39) (41) (159) (165) (487) 647 522 96 (558) 938 700 69 35 222 136 19 8 22 91 28 66 (552) 875 729 - 475 - - 475 28 30 117 122 29 226 224 874 865 215 Three months ended December 31, Twelve months ended December 31, Three months ended September 30, 328 199 1,957 2,219 2024 2,618 499 2,515 2,627 10,185 10,329 2024

11 Reconciliation of Net Income Attributable to Westlake Corporation and Earnings Per Diluted Share to Net Income and Diluted Earnings Per Share excl. Identified Items Net income (loss) $ 19 $ (487) $ 120 $ 647 $ 522 Less: Net income attributable to noncontrolling interests Net income (loss) attributable to Westlake Corporation 7 (497) 108 602 479 Add: Mothball expense accrual, after-tax Impairment charge, after-tax - 475 - - 475 Litigation settlement charge of $150 million, after-tax - 115 - - 115 Net income attributable to Westlake Corporation excl. Identified Items $ 7 $ 93 $ 183 $ 677 $ 1,069 Diluted earnings (loss) per common share attributable to Westlake Corporation $ 0.06 $ (3.86) $ 0.83 $ 4.64 $ 3.70 Add: Mothball expense accrual per share Impairment charge per share - 3.69 - - 3.68 Litigation settlement charge per share - 0.89 - - 0.89 Diluted earnings per common share attributable to Westlake Corporation excl. Identified Items $ 0.06 $ 0.72 $ 1.41 $ 5.22 $ 8.27 - 0.58 - - - 75 75 - - 0.58 12 10 12 45 43 (In millions of dollars, except per share data) Three months ended December 31, Three months ended September 30, Twelve months ended December 31, 2024 2023 2024 2024 2023

12 Net cash provided by operating activities $ 434 $ 573 $ 474 $ 1,314 $ 2,336 Changes in operating assets and liabilities and other Deferred income taxes Net income Less: Other income, net Interest expense Provision for income taxes Income from operations Add: Depreciation and amortization Other income, net EBITDA 416 (235) 505 2,211 1,962 Add: Mothball expense accrual Impairment charge - 475 - - 475 Litigation settlement charge EBITDA excl. Identified Items $ 416 $ 390 $ 580 $ 2,286 $ 2,587 Income from operations margin 2% (20%) 6% 7% 6% EBITDA excl. Identified Items margin 15% 14% 19% 19% 21% - 150 - - 150 - - 75 75 - Three months ended December 31, Twelve months ended December 31, 20242024 2023 2024 2023 Three months ended September 30, (In millions of dollars) 175 (354)(392) (1,168) (702) (1,989) 0 (23) 108 35 120 19 (487) 647 522 (39)(39) (41) (159) (165) 44 69 35 222 136 180 66 (552) 875 729 (65)(77) 71 (291) (178) 44 69 35 222 136 281 281 282 1,114 1,097 Reconciliation of EBITDA excl. Identified Items to EBITDA, Net Income, Income from Operations and Net Cash Provided by Operating Activities

13 Three months ended December 31, Three months ended September 30, Twelve months ended December 31, 2024 2023 2024 2024 2023 Housing and Infrastructure Products EBITDA $ 188 $ 173 $ 262 $ 1,050 $ 949 Less: Depreciation and Amortization 56 50 54 213 207 Other income, net 3 2 6 30 32 Housing and Infrastructure Products Operating Income 129 121 202 807 710 Performance and Essential Materials EBITDA excl. Identified Items 220 201 297 1,161 1,590 Less: Identified Items - 625 75 75 625 Depreciation and Amortization 223 229 225 892 881 Other income, net 38 11 6 65 25 Performance and Essential Materials Operating Income (Loss) (41) (664) (9) 129 59 Corporate EBITDA 8 16 21 75 48 Less: Depreciation and Amortization 2 3 2 9 9 Other income, net 28 22 32 127 79 Corporate Operating Income (Loss) (22) (9) (13) (61) (40) Housing and Infrastructure Products Operating Income 129 121 202 807 710 Performance and Essential Materials Operating Income (Loss) (41) (664) (9) 129 59 Corporate Operating Income (Loss) (22) (9) (13) (61) (40) Total Operating Income (Loss) 66$ (552)$ 180$ 875$ 729$ (In millions of dollars) Reconciliation of HIP EBITDA, PEM EBITDA excl. Identified Items and Corporate EBITDA to Operating Income (Loss)

14 Reconciliation of Free Cash Flow to Net Cash Provided by Operating Activities Net cash provided by operating activities $ 434 $ 573 $ 474 $ 1,314 $ 2,336 Less: Additions to property, plant and equipment Free Cash Flow $ 149 $ 291 $ 254 $ 306 $ 1,302 285 282 220 1,008 1,034 (In millions of dollars) Three months ended December 31, Three months ended September 30, Twelve months ended December 31, 2024 2023 2024 2024 2023

15 Safe Harbor Language This presentation contains certain forward-looking statements including statements regarding our cost savings objectives and our ability to maintain synergies, pricing and demand for our products and across the industrial and manufacturing sectors, global macroeconomic conditions, anticipated sales volumes, anticipated long-term sales growth target for Westlake Royal Building Product, industry outlook for both of our segments, stability of demand in North America for PEM, our ability to execute our integrated strategy, our future operating rates, our cost control and efficiency efforts, the effects of changing demographics in the markets that we serve, anticipated residential construction, repair and remodel activities and infrastructure growth, long-term housing market fundamentals, expectations regarding mortgage rates and their effects on the affordability of homes, expectations regarding homebuilder confidence, our energy and feedstock cost advantages in the North American chemicals market, benefits from construction of our new PVCO plant. Actual results may differ materially depending on factors, including, but not limited to, the following: general economic and business conditions; the cyclical nature of the chemical and building products industries; the results of acquisitions and our integration efforts; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, European and worldwide economies, including those due to political tensions and conflict in the Middle East, Russia, Ukraine and elsewhere; uncertainties associated with pandemic infectious diseases; uncertainties associated with climate change; the potential impact on the demand for ethylene, polyethylene and polyvinyl chloride due to initiatives such as recycling and customers seeking alternatives to polymers; current and potential governmental regulatory actions in the United States and other countries; industry production capacity and operating rates; the supply/demand balance for our products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions; changes in laws or regulations, including trade policies; technological developments; information systems failures and cyber attacks; foreign currency exchange risks; our ability to implement our business strategies; creditworthiness of our customers; the effect and results of litigation and settlements of litigation; and other factors described in our reports filed with the Securities and Exchange Commission. Many of these factors are beyond our ability to control or predict. Any of these factors, or a combination of these factors, could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. These forward-looking statements are not guarantees of our future performance, and our actual results and future developments may differ materially from those projected in the forward-looking statements. Management cautions against putting undue reliance on forward-looking statements. Every forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements. Investor Relations Contacts Steve Bender Executive Vice President & Chief Financial Officer John Zoeller Vice President & Treasurer Westlake Corporation 2801 Post Oak Boulevard, Suite 600, Houston, Texas 77056 | 713-960-9111

v3.25.0.1

Cover Page Cover Page

|

Feb. 24, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 24, 2025

|

| Entity Registrant Name |

Westlake Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32260

|

| Entity Tax Identification Number |

76-0346924

|

| Entity Address, Address Line One |

2801 Post Oak Boulevard,

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77056

|

| City Area Code |

713

|

| Local Phone Number |

960-9111

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001262823

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

WLK

|

| Security Exchange Name |

NYSE

|

| One Point Six Two Five Percentage Senior Notes Due Twenty Twenty Nine [Member] [Domain] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Senior Notes due 2029

|

| Trading Symbol |

WLK29

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wlk_OnePointSixTwoFivePercentageSeniorNotesDueTwentyTwentyNineMemberDomain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

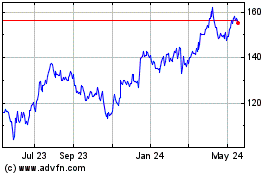

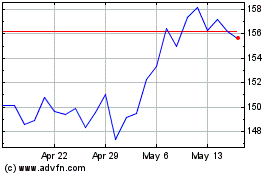

Westlake (NYSE:WLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Westlake (NYSE:WLK)

Historical Stock Chart

From Feb 2024 to Feb 2025