Andrew Peller Limited (TSX: ADW.A / ADW.B) (“APL” or the “Company”)

announced today results for the three and six months ended

September 30, 2024. All amounts are expressed in Canadian dollars

unless otherwise stated.

SECOND QUARTER 2025

HIGHLIGHTS

- Revenue was $109.2 million, up from

$100.2 million in the prior year;

- Gross margin of 42.4%, compared

with 41.2% in the prior year;

- EBITA increased to $18.0 million,

from $15.1 million in Q2 2024; and

- Net earnings of $4.6 million ($0.11

per Class A Share), compared to $5.4 million ($0.13 per Class A

Share) in Q2 2024.

YTD 2025 HIGHLIGHTS

- Revenue was $208.7 million,

compared with $200.7 million in the prior year;

- Gross margin of 40.5%, consistent

with the prior year;

- EBITA increased to $30.8 million,

from $27.8 million in the prior year; and

- Net earnings of $4.2 million ($0.10

per Class A Share), compared to $4.5 million ($0.11 per Class A

Share) in prior year; and

- Dividend of $0.123 per Class A

Share and $0.107 per Class B Share.

“Our Q2 results were highlighted by solid

year-over-year growth in revenue and EBITA, led by robust retail

store sales and contributions from other key trade channels in the

period, which speaks to the breadth of our distribution and the

benefits of our diversified operations,” said Paul Dubkowski, Chief

Executive Officer. “This allowed us to navigate softness in other

channels due largely to reduced consumer discretionary spending in

this economic environment. We continue to focus on above-category

sales performance by growing our key brands while introducing new

products both in our core wine segment and other growth categories.

As an example, our healthier-for-you offerings are among the

fastest-growing in our lineup. In addition to further innovation,

margin expansion and disciplined cash management remain key areas

of focus for the team going forward.”

Financial Highlights(Financial

Statements and the Company’s Management Discussion and Analysis for

the period can be obtained on the Company’s web site at

ir.andrewpeller.com)

|

For the three and six months ended September

30, |

Three months |

Six months |

|

(in $000, except per share amounts) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Revenue |

|

109,238 |

|

100,175 |

$ 208,703 |

$200,656 |

|

| Gross margin (1) |

|

46,327 |

|

41,267 |

|

84,506 |

|

80,295 |

|

| Gross margin (% of

revenue) |

|

42.4% |

|

41.2% |

|

40.5% |

|

40.0% |

|

| Selling and administrative

expenses |

|

28,348 |

|

26,157 |

|

53,668 |

|

52,485 |

|

| EBITA (1) |

|

17,979 |

|

15,110 |

|

30,838 |

|

27,810 |

|

| Interest |

|

4,319 |

|

3,886 |

|

8,899 |

|

8,170 |

|

| Net unrealized loss (gain) on

derivative financial instruments |

|

1,513 |

|

(1,827) |

|

1,731 |

|

(1,196) |

|

| Loss on debt extinguishment

and financing fees |

|

- |

|

- |

|

- |

|

2,172 |

|

| Other expenses (income) |

|

912 |

|

(102) |

|

1,208 |

|

1,115 |

|

| Net earnings |

|

4,560 |

|

5,391 |

|

4,185 |

|

4,460 |

|

| Earnings per share – Class A

basic |

$0.11 |

$0.13 |

$0.10 |

$0.11 |

|

| Earnings per share – Class B

basic |

$0.10 |

$0.11 |

$0.09 |

$0.09 |

|

| Dividend per share – Class

A |

|

|

$0.123 |

$0.123 |

|

|

Dividend per share – Class B |

|

|

$0.107 |

$0.107 |

|

(1) Please refer to the Company’s MD&A concerning “Non-IFRS

Measures”

Financial Review

Revenue for the three months ended September 30,

2024, increased 9.0% over the prior year period due primarily to an

increase in the Company’s retail store sales due to the July strike

at the LCBO. Several of the Company’s other well-established trade

channels also performed well, particularly restaurants and

hospitality locations. This was offset by softness in sales from

the estates and wine clubs due to lower guest traffic and reduced

consumer discretionary spending due to economic conditions. In the

second quarter of fiscal 2025, the Company recognized $2.9 million

relating to the revised Ontario VQA Support Program announced in

December 2023.

For the six months ended September 30, 2024,

revenue was $208.7 million, up 4.0% from the prior year. The

majority of the Company’s well-established trade channels have

performed well on a year-to-date basis, particularly provincial

liquor stores, restaurants and hospitality and the Company’s retail

stores. This strong performance is offset by softness in sales from

the estate wineries and wine clubs. In the six months ending

September 30, 2024, the Company recognized $6.1 million relating to

the revised Ontario VQA Support Program.

Gross margin as a percentage of revenue

increased to 42.4% and 40.5% for the three and six months ended

September 30, 2024 respectively from 41.2% and 40.0% in the prior

year. Gross margin continues to be impacted by channel mix and

inflationary cost pressures in imported wine, glass bottles,

packaging materials, and international freight and shipping

charges. In response to these margin pressures, the Company has

executed numerous production efficiency and cost savings programs

including the renegotiation of inbound and outbound freight rates

and alternate sourcing for glass bottles.

As a percentage of revenue, selling and

administrative expenses improved to 26.0% and 25.7% for the three

and six months ended September 30, 2024, respectively, compared to

26.1% and 26.2% in the prior year. Selling and administrative

expenses increased due to higher labour and other store related

charges incurred by the Company’s retail stores to support

increased sales in the second quarter of fiscal 2025.

Earnings before interest, amortization, loss on

debt extinguishment and financing fees, net unrealized gains and

losses on derivative financial instruments, other (income)

expenses, and income taxes (“EBITA”) (see “Non-IFRS Measures”

section of this MD&A) was $18.0 million in the second quarter

of fiscal 2025 compared to $15.1 million in the same prior year

period. EBITA increased to $30.8 million for the six months ended

September 30, 2024 from $27.8 million in the prior year.

Interest expense for the three and six months

ended September 30, 2024 increased from the prior year due to a

higher average debt balance and higher interest expense on the

Company’s leases.

The Company recorded a net unrealized non-cash

loss in the first six months of fiscal 2025 of $1.7 million related

to mark-to-market adjustments on interest rate swaps and foreign

exchange contracts compared to a gain of $1.2 million in the prior

year. The Company has elected not to apply hedge accounting and

accordingly the change in fair value of these financial instruments

is reflected in the Company’s consolidated statement of earnings

each reporting period. These instruments are considered to be

effective economic hedges and are expected to mitigate the

short-term volatility of changing foreign exchange and interest

rates.

In the first six months of fiscal 2025, the

Company undertook certain tax planning initiatives as it relates to

capital gains with respect to the Port Moody lands. This included

transferring the beneficial interest in the land to a newly

registered limited partnership. All parties associated with the

limited partner are within the consolidated APL group and there has

been no legal ownership change. This transaction resulted in an

additional current tax expense of $4,000, with an offsetting

deferred tax recovery, recorded for the six months ended September

30, 2024.

The Company generated net income of $4.6 million

($0.11 per Class A share) for the second quarter of fiscal 2025

compared to net income of $5.4 million ($0.13 per Class A share) in

the prior year and net income of $4.2 million ($0.10 per Class A

share) for the six months ended September 30, 2024 compared to net

income of $4.5 million ($0.11 per Class A Share) in the prior

year.

On July 15, 2024, the Company announced its

normal course issuer bid (“NCIB”) had been approved by the Toronto

Stock Exchange. Under the issuer bid the Company can purchase for

cancellation up to 1,000,000 of its outstanding Class A non-voting

shares, representing 2.8% of the Class A shares outstanding at the

time, over the ensuing 12 months. The total number of common shares

repurchased for cancellation under the NCIB for the six-month

period ended September 30, 2024 amounted to 56,800 common shares,

at a weighted average price of $3.99 per common share, for a total

cash consideration of $0.2 million.

Investor Conference CallThe

Company will hold conference call to discuss the results on

Thursday, November 7, 2024 at 10:00 a.m. ET. Paul Dubkowski, CEO,

Patrick O’Brien, President and CCO, and Renee Cauchi, VP, Finance

and Interim CFO, will host the call, with a question and answer

period following management’s presentation.

|

|

|

| Conference

Call Dial In Details: |

| Date: |

Thursday, November 7, 2024 |

| Time: |

10:00 a.m. (ET) |

| Dial-in

numbers: |

Local Toronto / International:

(437) 900-0527North American Toll Free: (888) 510-2154 |

| Webcast: |

A live webcast will be available

at ir.andrewpeller.com / https://app.webinar.net/2Bz9QWm5Xxo |

| Replay: |

Following the live call, a

recording will be available on the Company’s investor relations

website at ir.andrewpeller.com |

| |

|

About Andrew Peller

LimitedAndrew Peller Limited is one of Canada’s leading

producers and marketers of quality wines and craft beverage alcohol

products. The Company’s award-winning premium and ultra-premium

Vintners’ Quality Alliance brands include Peller Estates, Trius,

Thirty Bench, Wayne Gretzky, Sandhill, Red Rooster, Black Hills

Estate Winery, Tinhorn Creek Vineyards, Gray Monk Estate Winery,

Raven Conspiracy, and Conviction. Complementing these premium

brands are a number of popularly priced varietal offerings,

wine-based liqueurs, craft ciders, and craft spirits. The Company

owns and operates 101 well-positioned independent retail locations

in Ontario under The Wine Shop, Wine Country Vintners, and Wine

Country Merchants store names. The Company also operates Andrew

Peller Import Agency and The Small Winemaker’s Collection Inc.,

importers and marketing agents of premium wines from around the

world. With a focus on serving the needs of all wine consumers, the

Company produces and markets premium personal winemaking products

through its wholly owned subsidiary, Global Vintners Inc., the

recognized leader in personal winemaking products. More information

about the Company can be found at www.ir.andrewpeller.com.

The Company utilizes EBITA (defined as earnings

before interest, amortization, loss on debt extinguishment and

financing fees, net unrealized gains and losses on derivative

financial instruments, other (income) expenses, and income taxes)

to measure its financial performance. EBITA is not a recognized

measure under IFRS. Management believes that EBITA is a useful

supplemental measure to net earnings, as it provides readers with

an indication of earnings available for investment prior to debt

service, capital expenditures, and income taxes, as well as

provides an indication of recurring earnings compared to prior

periods. Readers are cautioned that EBITA should not be construed

as an alternative to net earnings determined in accordance with

IFRS as indicators of the Company’s performance or to cash flows

from operating, investing, and financing activities as a measure of

liquidity and cash flows. The Company also utilizes gross margin

(defined as sales less cost of goods sold, excluding amortization).

The Company’s method of calculating EBITA and gross margin may

differ from the methods used by other companies and, accordingly,

may not be comparable to measures used by other companies.

Andrew Peller Limited common shares trade on the

Toronto Stock Exchange (symbols ADW.A and ADW.B).

FORWARD-LOOKING

INFORMATIONCertain statements in this news release may

contain “forward-looking statements” within the meaning of

applicable securities laws including the “safe harbour provisions”

of the Securities Act (Ontario) with respect to APL and its

subsidiaries. Such statements include, but are not limited to,

statements about the growth of the business; its launch of new

premium wines and craft beverage alcohol products; sales trends in

foreign markets; its supply of domestically grown grapes; and

current economic conditions. These statements are subject to

certain risks, assumptions, and uncertainties that could cause

actual results to differ materially from those included in the

forward-looking statements. The words “believe”, “plan”, “intend”,

“estimate”, “expect”, or “anticipate”, and similar expressions, as

well as future or conditional verbs such as “will”, “should”,

“would”, “could”, and similar verbs often identify forward-looking

statements. We have based these forward-looking statements on our

current views with respect to future events and financial

performance. With respect to forward-looking statements contained

in this news release, the Company has made assumptions and applied

certain factors regarding, among other things: future grape, glass

bottle, and wine and spirit prices; its ability to obtain grapes,

imported wine, glass, and other raw materials; fluctuations in

foreign currency exchange rates; its ability to market products

successfully to its anticipated customers; the trade balance within

the domestic Canadian and international wine markets; market

trends; reliance on key personnel; protection of its intellectual

property rights; the economic environment; the regulatory

requirements regarding producing, marketing, advertising, and

labelling of its products; the regulation of liquor distribution

and retailing in Ontario; the application of federal and provincial

environmental laws; and the impact of increasing competition.

These forward-looking statements are also

subject to the risks and uncertainties discussed in this news

release, in the “Risks and Uncertainties” section and elsewhere in

the Company’s MD&A and other risks detailed from time to time

in the publicly filed disclosure documents of Andrew Peller Limited

which are available at www.sedar.com. Forward-looking statements

are not guarantees of future performance and involve risks,

uncertainties, and assumptions which could cause actual results to

differ materially from those conclusions, forecasts, or projections

anticipated in these forward-looking statements. Because of these

risks, uncertainties and assumptions, you should not place undue

reliance on these forward-looking statements. The Company’s

forward-looking statements are made only as of the date of this

news release, and except as required by applicable law, the Company

undertakes no obligation to update or revise these forward-looking

statements to reflect new information, future events or

circumstances or otherwise.

For more information, please contact:Craig

Armitage and Jennifer Smithir@andrewpeller.com

Source: Andrew Peller Limited

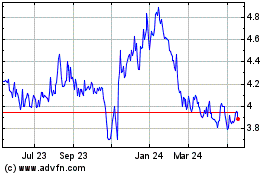

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Feb 2025 to Mar 2025

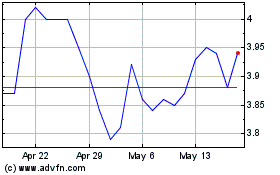

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Mar 2024 to Mar 2025