Montero Receives Second Instalment of US$8 million from Tanzania

February 10 2025 - 10:56AM

Montero Mining and Exploration Ltd. (TSX-V: MON)

(“

Montero” or the “

Company”) is

pleased to confirm that US$8,000,000 in cash (the “

Second

Instalment Funds”) have been received by the Company’s

legal representatives from the United Republic of Tanzania

(“

Tanzania”). The Second Instalment represents the

second instalment of the US$27,000,000 settlement between the

Company and Tanzania in connection with Tanzania’s expropriation of

Montero’s Wigu Hill rare earth element project (the

“

Expropriation”), as previously announced on 20th

November 2024.

The final instalment of US$7,000,000 (the

“Final Instalment”) is due to be paid on or before

28th February 2025. The final net proceeds to be received by the

Company is not certain at this time as final legal costs and other

expenses Montero incurred in connection with defence and settlement

of the Expropriation will be determined following receipt of the

Final Instalment. After receipt of the Final Instalment, it is

expected that the Company will finalize its analysis with respect

to the distribution of funds including any potential distribution

to shareholders of the Company. The Company expects to announce an

update on its distribution plans during Q2 2025.

Dr Tony Harwood, President and CEO of Montero

commented: “I am pleased Montero has received the second payment of

US$8,000,000 from Tanzania with a final payment of US$7,000,000 to

be paid on or before 28th February 2025. Further notice of payments

received will be forthcoming.”

ICSID ArbitrationMontero and

Tanzania jointly requested the arbitral tribunal to suspend the

ICSID arbitration proceedings after receiving the first settlement

payment. Upon receipt of the Final Instalment as scheduled, the

parties expect to formally request the tribunal to discontinue the

ICSID arbitration in its entirety.

Distribution of FundsMontero is

considering all options with respect to the distribution of the

settlement proceeds, including but not limited to a return of

capital distribution to shareholders. The exact amount of any

distribution and the method of such distribution is yet to be

determined and will be subject to accounting review and board

approval. In addition, Montero will retain funds to cover legal,

taxation, and administrative expenses, including potential costs

for arbitral proceedings, or enforcement actions in the event of

delays or non-payment of the Final Instalment. The latter will now

be the sole responsibility of Montero. Further announcements will

be made in due course.

DisclaimerThe conclusion of the

ICSID arbitration and payment of the remaining instalment is

conditional on Tanzania’s compliance with the settlement agreement.

The agreement does not provide for any security for the benefit of

Montero in case Tanzania would not pay any instalment, in which

case Montero can either resume the ICSID arbitration or seek

enforcement of the settlement agreement.

About MonteroMontero has agreed

to a US$27,000,000 settlement amount to end its dispute with the

United Republic of Tanzania for the expropriation of the Wigu Hill

rare earth element project. The Company is also advancing the

Avispa copper-molybdenum project in Chile and is seeking a joint

venture partner. Montero’s board of directors and management have

an impressive track record of successfully discovering and

advancing precious metal and copper projects. Montero trades on the

TSX Venture Exchange under the symbol MON and has 50,122,975 shares

outstanding.

For more information,

contact:Montero Mining and Exploration

Ltd. Dr. Tony Harwood, President, and

Chief Executive OfficerE-mail: ir@monteromining.comTel: +1 604 428

7050www.monteromining.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain "forward-looking

information" within the meaning of applicable Canadian securities

laws. Forward looking information includes, but is not limited to,

statements, projections and estimates with respect to the receipt

of the total settlement sum of US$27,000,000 and the timing thereof

and with respect to the distribution of the settlement funds, the

amount and timing of receipt of the Final Instalment, that after

receipt of the Final Instalment, it is expected that the Company

will finalize its analysis with respect to the distribution of

funds including any potential distribution to shareholders of the

Company, in the form of a return or capital or otherwise, the

expected announcement of an update to the Company’s funds

distribution plans and that the expectation that the ICSID

arbitration will be discontinued following receipt of the Final

Instalment. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. Such information is based on information currently

available to Montero and Montero provides no assurance that actual

results will meet management's expectations. Forward-looking

information by its very nature involves inherent risks and

uncertainties that may cause the actual results, level of activity,

performance, or achievements of Montero to be materially different

from those expressed or implied by such forward-looking

information. Actual results relating to, among other things,

completion of the required instalments pursuant to the settlement

agreement with Tanzania, satisfactory arrangements for the payment

of the arbitration funder and legal expenses, the ability of the

Company to find suitable exploration projects, results of

exploration, project development, reclamation and capital costs of

Montero’s mineral properties, and financial condition and

prospects, all of which could differ materially from those

currently anticipated in such statements for many reasons such as:

an inability to obtain payment of the remaining instalment amounts

from Tanzania on the terms as announced or at all; unanticipated

expenses associated with the settlement; accounting review and

other factors that may not be known to management of the Company at

this time suggest an alternative strategy for the use of the

settlement proceeds; changes in general economic conditions and

conditions in the financial markets; changes in demand and prices

for minerals; litigation, legislative, environmental and other

judicial, regulatory, political and competitive developments;

technological and operational difficulties encountered in

connection with Montero’s activities; and other matters discussed

in this news release and in filings made with securities

regulators. This list is not exhaustive of the factors that may

affect any of Montero’s forward-looking statements. These and other

factors should be considered carefully and accordingly, readers

should not place undue reliance on forward-looking information.

Montero does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

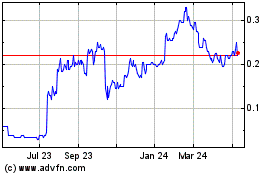

Montero Mining and Explo... (TSXV:MON)

Historical Stock Chart

From Jan 2025 to Feb 2025

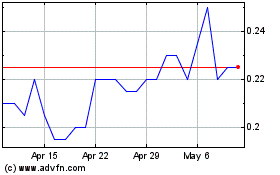

Montero Mining and Explo... (TSXV:MON)

Historical Stock Chart

From Feb 2024 to Feb 2025